Canada has one of the safest banking systems in the world.

The Royal Bank of Canada, TD Bank, Bank of Nova Scotia (Scotiabank), Bank of Montreal, and the Canadian Imperial Bank of Commerce all rank within the top 35 most stable banks in the world.

I often get questions about the best bank in Canada for newcomers, students, seniors, or online banking.

The short answer is that your choice of a bank depends on your financial needs and preferences. And in many cases, you can also be well served through a credit union.

This post covers Canada’s best and largest banks, a list of the best online banks, what they offer, and how to choose the best bank for you.

The Best Banks in Canada for 2024

1. Scotiabank: Best Big Bank in Canada

Operating under the legal name of the Bank of Nova Scotia, Scotiabank is the third-largest bank in Canada based on asset size and market capitalization. It is also one of the best banks in Canada.

Its personal banking channel offers various chequing, savings, and credit card options.

Scotiabank Chequing Accounts

Scotiabank offers five chequing accounts that are designed to cater to different needs.

Its most basic chequing account offers 12 free transactions every month. On the other end of the spectrum, you can opt for Scotiabank’s Ultimate Package chequing account and enjoy premium perks, including:

- Unlimited transactions (debits and Interac e-transfers)

- Up to $150 fee waivers on a credit card

- Unlimited free Global withdrawals (non-Scotiabank ATMs)

- Extra 0.10% on a MomentumPLUS Saving Account

- Free personalized cheques and drafts

- Free stocks trading on Scotia iTRADE, and several more

All Scotia Chequing Accounts offer rewards points on everyday purchases in the form of SCENE or Scotia Rewards. You can redeem your points for free movies, food, travel, and gift cards.

Scotia’s Ultimate Package and Preferred Package accounts offer up to a $350 cash bonus when you open an account.

| Ultimate Package | Preferred Package | Basic Plus | Basic Account | Student Banking | |

| Monthly fee | $30.95 | $16.95 | $11.95 | $3.95 | $0 |

| Minimum balance to waive the monthly fee | $5,000 | $4,000 | $3,000 | N/A | N/A |

| # of debit transactions | Unlimited | Unlimited | 25/month | 12/month | Unlimited |

| # of eTransfers | Unlimited | Unlimited | 10/month | 2/month | Unlimited |

| Senior’s discount | -$4.00 | -$4.00 | -$4.00 | -$3.95 | N/A |

| Special features | $350 welcome bonus; Earn Scene+ points; Up to $150 waived on credit card fees annually; 0.10% interest rate boost on savings; Unlimited free non-Scotiabank ATM withdrawals globally; No monthly overdraft protection fee; Up to 10 free equity trades on Scotia iTrade; Free personalized cheques and drafts | $350 welcome bonus; Earn Scene+ points; Up to $150 waived on credit card fees (1st year only); 0.05% interest rate boost on savings; 1 free non-Scotiabank ATM withdrawal/month; International money transfer at $1.99 | Earn Scene+ points; International money transfer at $1.99 | Earn Scene+ points | Earn Scene+ points; $100 welcome bonus |

| Learn more | Read review | Read review | Read review | – | – |

| Application | Apply | Apply | Apply | Apply | Apply |

Scotiabank Savings Account

Scotiabank has five savings accounts you can choose from:

- MomentumPLUS Savings Account

- Savings Accelerator Account

- Money Master Savings Account

- Scotia U.S. Dollar Daily Interest Account

- Scotia Euro Daily Interest Account

The MomentumPLUS Savings Account is Scotiabank’s high-interest savings account and offers a base rate of 1.40% (up to 6.05% with offers).

Depending on how long you keep the funds untouched and whether you pair it with a premium chequing account, you can earn up to 6.05% on your savings (includes limited-time bonuses).

Get more details about Scotiabank’s savings accounts.

Scotiabank Credit Card

Scotiabank has a long list of Visa, Mastercard, and American Express credit cards, including some of the best credit cards in Canada.

One of their credit cards worth noting here is the Scotiabank Passport Visa Infinite Card.

This premium card waves the FX markup on foreign currency purchases, offers a complimentary Priority Pass membership (includes six free visits) and complimentary travel insurance.

Learn more about the card here.

2. Bank of Montreal

Bank of Montreal is the fourth largest bank in Canada and the oldest, having been founded in 1817.

BMO Chequing Accounts

BMO has 5 chequing accounts ranging from an entry-level “Practical” account to a “Premium” chequing account.

The five accounts are:

- Premium chequing Account

- Performance chequing account (Get up to a $450 welcome bonus when you open an account)

- Plus chequing account

- AIR MILES chequing account

- Practical chequing account

BMO Premium chequing offers unlimited transactions, free non-BMO ATM withdrawals, a $150 annual fee rebate on the BMO World Elite Mastercard, and free identity theft protection.

Similar to the other big banks, Newcomers to Canada can save on fees for a period when they open an account through BMO’s NewStart Program.

BMO Savings Accounts

For your savings needs, BMO offers four savings accounts, including:

- BMO Smart Saver

- BMO Savings Builder

- BMO Premium Rate Savings

- BMO U.S. Dollar Premium Rate

The Savings Builder is the bank’s high-interest savings account, and it offers bonus interest when you increase your balance by at least $200 each month.

BMO Credit Cards

BMO has a credit card fitting most of the categories you can think of, including cash back rewards, AIR Miles, travel, low-interest and no-fee cards.

Here are some of the best BMO credit cards.

The BMO CashBack Mastercard is one of the top credit cards for students and newcomers to Canada.

BMO was the first Big Five bank to offer a digital investment service. You can learn more about BMO Smartfolio.

3. Royal Bank of Canada

The Royal Bank of Canada (RBC) is the largest bank in Canada.

RBC sponsors many cultural and sporting events, including The Canadian Open, one of the oldest golf tournaments in the world.

RBC Chequing Accounts

RBC offers four main chequing bank accounts:

- RBC Day to Day Banking

- RBC No Limit Banking

- RBC Signature No Limit Banking

- RBC VIP Banking

Its most basic chequing account offers 12 free transactions per month. Its Premium VIP option comes with unlimited debits, Interac e-transfer, free drafts, discounts on safe deposit box rentals, and up to a $120 fee rebate on select credit cards.

All RBC chequing accounts offer a saving of 3 cents per litre of gas purchased at Petro-Canada. You can also earn 20% more Petro-Points when you link your RBC debit card.

When you open a Signature No Limit Banking or VIP Banking chequing account and meet the requirements, you get a free iPad.

RBC Savings Accounts

RBC has 4 savings accounts you can choose from, including the following:

- RBC High Interest eSavings

- RBC Enhanced Savings

- RBC Day to Day Savings

- RBC U.S. High Interest eSavings

You can turn on the NOMI Find & Save feature to automate transfers and increase your savings rate.

RBC Credit Cards

RBC offers credit cards in various categories, including cash back, travel, low-interest, and no-annual fees.

Here’s a review of the best RBC student credit cards.

If you are looking for a robo-advisor service from a big bank, check out this RBC Investease review.

4. Toronto-Dominion Bank

TD is the second-largest bank in Canada by market capitalization. It also ranks as one of the best banks in Canada based on several metrics.

TD Bank also has a significant presence in the United States, making it one of the largest banks in North America.

TD Chequing Accounts

TD has 6 chequing accounts, including two that are specific for students and youths. The bank accounts are:

- TD All-Inclusive Banking Plan

- TD Every Day Chequing Account

- TD Unlimited Chequing Account

- TD Minimum Chequing Account

- TD Student Chequing Account

- TD Youth Account

Its All-Inclusive Banking is the most expensive and offers unlimited transactions, free non-TD ATM withdrawal, certified cheques, money orders, personalized cheques, and up to a $120 fee rebate on eligible TD credit cards.

TD Savings Accounts

The bank has three savings account packages, including:

- TD ePremium Savings

- TD Every Day Savings

- TD High-Interest Savings account

The interest rates on these accounts vary. TD’s youth bank account pays a 0.01% interest rate on your balance.

TD Credit Cards

TD has credit cards offering cash back, Aeroplan Miles, low rates, no annual fees, and TD travel rewards.

Some of the ones we have reviewed are:

5. Canadian Imperial Bank of Commerce

CIBC is one of the biggest banks in Canada. It also operates in the U.S., Europe, and Asia.

CIBC Chequing Accounts

CIBC offers three main chequing bank accounts: CIBC Smart, Smart Plus, and Everyday chequing accounts.

The Everyday Chequing is its entry-level account and offers 12 free transactions per month.

The CIBC Smart Account is flexible and costs $6.95 to $16.95, depending on how many transactions you make during the month.

Lastly, the CIBC Smart Plus Account offers unlimited transactions, free non-CIBC ATM withdrawals, fee rebates on select credit cards, and more.

Here are more details about CIBC’s Chequing Account.

CIBC Savings Accounts

CIBC has four savings accounts, including:

- CIBC Bonus Savings Account

- CIBC eAdvantage Savings Account

- CIBC Premium Growth Account

- CIBC US$ Personal Account

The eAdvantage savings account has one of CIBC’s highest interest rates.

Related: Best U.S. Dollar Business Savings Accounts

CIBC Credit Cards

CIBC has 21 Visa credit cards you can choose from, including the popular CIBC Aventura Visa Infinite.

You can also check out the AC Conversion Visa prepaid if you want to save on currency exchange fees.

CIBC’s brokerage platform offers the lowest trading fees among the big 5 banks. Learn about it in this CIBC Investor’s Edge review.

6. National Bank of Canada

National Bank is the sixth-largest bank in Canada (Big Six) and has its headquarters in Montreal.

National Bank Chequing Accounts

National Bank has 4 chequing accounts, including:

- The Minimalist

- The Modest

- The Connected, and

- The Total account packages

The Total chequing account offers unlimited transactions, free cheques (100/year), overdraft protection, up to a $150 fee rebate for a National Bank Mastercard credit card, and an integrated line of credit.

The entry-level Minimalist package offers only 12 free transactions per month.

National Bank Savings Account

It offers a high-interest savings account.

For registered accounts, it also has a Cash Advantage Solution account which is available as a TFSA, RRSP, or RRIF plan.

The Biggest Banks in Canada

The five largest banks in Canada all date back to the 19th century and have branches and ATMs across the country.

They offer a full suite of financial services, including chequing accounts, savings, investments, brokerage services, mutual funds, insurance, business banking, mortgage loans, and more.

Here’s a list of the top 5 banks in Canada:

- RBC

- TD Bank

- Scotiabank

- BMO

- CIBC

Other Schedule I banks in Canada with significant asset sizes and market capitalization include the National Bank of Canada, Laurentian Bank of Canada, Equitable Bank, and the Canadian Western Bank.

| RBC | Scotiabank | TD | BMO | CIBC | National Bank | |

|---|---|---|---|---|---|---|

| Year Founded | 1864 | 1832 | 1855 | 1817 | 1867 | 1859 |

| Market Cap^ | $167.51B | $87.22B | $142.93B | $80.18B | $53.58B | $28.10B |

| Stock Symbol | RY | BNS | TD | BMO | CM | NA |

| Head Office | Toronto | Toronto | Toronto | Montreal | Toronto | Montreal |

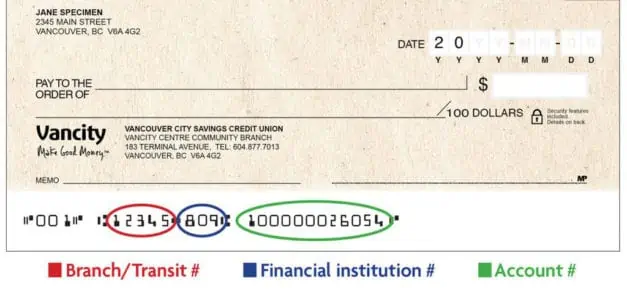

| Institution Number | 003 | 002 | 004 | 001 | 010 | 006 |

| SWIFT Code | ROYCCAT2 | NOSCCATT | TDOMCATTTOR | BOFMCAM2 | CIBCCATT | BNDCCAMMXXX |

| Branches | 1,210 | 953 | 1,091 | 900 | 1,024 | 422 |

| ATMs | 4,200 | 3,600 | 2,800 | 2,200 | 3,075 | 939 |

^ Market Capitalization as of July 15, 2022.

Benefits of Banking With the Big Banks

The biggest banks in Canada have their pros and cons. Here are some of the advantages of banking with them:

Branch Coverage: With thousands of Branch locations, you enjoy easy access to in-person support in all areas of the country.

ATM Coverage: The big banks have thousands of free ATMs across Canada which means you can avoid paying fees that accrue when you use out-of-network ATMs owned by other banks.

One-Stop Banking: You can easily open accounts to suit your varying financial needs with one bank instead of spreading them around. For example, you can open your chequing, savings, mortgage, investment, personal loan, and insurance accounts with the same bank.

Technology and Innovation: Big banks have a hefty budget dedicated to improving users’ experience and interface designs, and they pioneer technology that gives them an edge against their competitors.

International Reach: If you travel abroad frequently, a big bank with operations internationally can save you money through free ATMs or branch locations at your destinations.

Stability: A bank that has been around for 150 years is unlikely to disappear overnight. In fact, some of the biggest banks are classified as Systemically Important Financial Institutions (SIFI) or “too big to fail”.

These banks face extra scrutiny from regulators, providing an extra layer of security for their customers.

Related: Best Banks for Seniors in Canada

Downsides of Banking With a Big Bank

In exchange for convenience and perceived stability, here are some of the cons of a big bank:

Higher Fees: Big banks charge you a fee for everything. If the fee is not obvious, check the small print.

Poor rates: From extremely low savings interest rates to high mortgage and personal loan rates, a big bank is hardly the place to find the most competitive rate possible. There’s also limited room to negotiate better rates.

Less Personalized Service: Unless you have a huge bank balance, you shouldn’t expect top-level customer service. Community-based financial institutions such as credit unions are better in this regard.

Watch out for Shady Practices: It’s no secret that many big banks have been mired in controversies in recent times, from misleading tactics in selling credit card insurance to pushing expensive add-ons people don’t need. Your banking could get a lot more expensive than planned.

Related: Best Business Credit Cards in Canada

Best Online Banks in Canada for 2024

While the Big Five banks typically get most of the attention, several digital banks continue to gain traction as more people become comfortable with online banking.

These branchless virtual banks are best known for providing free chequing accounts and some of the best savings rates available. Your deposits are also protected by the Canada Deposit Insurance Corporation (CDIC).

Some of the ones mentioned below are also wholly owned by Schedule I banks:

- EQ Bank

- Simplii Financial

- Tangerine Bank

- Neo Financial

- Motive Financial

- Alterna Bank

1. EQ Bank: Best Online Bank for Savings

EQ Bank is a subsidiary of Equitable Bank, a Schedule I bank with over $61 billion in assets under management. It is one of the best banks in Canada.

EQ Bank offers high-interest savings and Guaranteed Investment Certificate Investments through its website and innovative mobile app.

EQ Bank Savings Account

The EQ Bank-Savings Plus Account offers one of the best non-promotional rates in Canada. It also functions as a hybrid account (chequing + savings) with features including:

- Unlimited free bill payments and electronic fund transfers

- Unlimited Interac e-Transfers

- No monthly banking fees

- Free mobile cheque deposits

- No minimum account balance

- CDIC insurance up to $100,000 per insured category

- Joint accounts

- Debit card with no ATM or FX fees

This account pays a consistently high-interest rate on every dollar in your account and is one of the best savings interest rates in Canada right now. You can sign up for it here.

In addition to the hybrid Savings Plus Account, you can open an EQ Bank TFSA or RSP account and earn high interest rates of up to 5.20%* using savings products or GICs.

EQ Bank GICs

It offers GICs with terms ranging from 3 months to 5 years. The minimum amount you can invest in an EQ Bank GIC is $100.

EQ Bank also offers joint accounts, and you can send cheap international money transfers directly from your account using Wise.

2. Simplii Financial: Best Bank for No-Fee Chequing Account

Simplii Financial is the direct banking arm of CIBC.

It used to be known as President’s Choice Financial when it was under the banner of both Loblaws and CIBC until 2017.

Simplii Chequing Account

Simplii Financial’s No-Fee Chequing Account has no monthly account fees and offers:

- $400 cash bonus when you sign-up and meet the eligibility requirements

- $0 monthly account fees

- Unlimited debits, bill payments, and Interac e-Transfers

- Free access to more than 3,400 CIBC ATMs

- Interest on your balance up to 0.10%

- No monthly or minimum balance required

It also has a global money transfer service that gives you a bonus when you send your first eligible international money transfer.

Simplii Savings Account

This savings account pays a standard tiered 0.40% to 5.50% interest (6.00% promotional interest rate) and has no monthly fees.

In addition to saving and chequing accounts, Simplii Financial has other banking products, such as investment funds and GICs you can hold inside non-registered and registered accounts.

Simplii Credit Card

Simplii has one credit card – the Simplii Financial Cash Back Visa. This credit card is great for gas, groceries, and restaurant purchases.

Its features include 4% cash back at restaurants and bars, 1.5% on gas, groceries and drugstore purchases, and 0.50% on all other purchases.

3. Tangerine Bank: Top Digital Bank in Canada

Tangerine Bank is the direct banking arm of Scotiabank. It was formerly known as ING Direct Canada.

Apart from a few kiosks and cafes in Toronto, Montreal, Vancouver, and Calgary, Tangerine is a full-fledged online bank.

Tangerine Chequing Account

The Tangerine No-Fee Chequing account offers all the necessities, including:

- $0 monthly account fee

- Unlimited free debits, Interac, e-Transfer transactions, and Tangerine email money transfers

- Free access to 3,500 Scotiabank ATMs in Canada and 44,000 worldwide

- Interest up to 0.10% on your balance

- Mobile cheque deposits

Your first chequebook order (including 50 cheques) is free.

Tangerine Savings Account

Tangerine’s Savings Account is available under six different plans: high-interest savings (general), RRSP, TFSA, US$ savings, RRIF, and a children’s account.

Tangerine also offers GICs for TFSA, RRSP, and other accounts.

Tangerine Credit Cards

Two of the best cash back credit cards in Canada are offered by Tangerine.

Tangerine Money-Back Card: Earn up to 2% cash back on your purchases while paying $0 in annual fees. Cardholders get an unlimited 2% back up to 3 categories of spending and 0.50% on everything else.

Get more details about the card or apply here (10% cash back for a limited time).

Tangerine World Mastercard: This card has a similar cash back offer plus some premium perks, including:

- Rental car insurance

- Mobile device insurance

- Complimentary Mastercard Airport Experiences membership

- Free Wi-Fi at one million+ hotspots around the world

Even better, the Tangerine World Mastercard has no annual fee. Read our review of the card.

Tangerine has other banking products, including HELOCs, investments, and mortgages.

4. Neo Financial

Neo Financial is a fintech company that serves as a virtual bank. It has four main products: Neo Money, Neo Card, Neo Invest, and Neo Mortgage.

Neo Money

Neo Money is a combined spending and savings account that pays a high interest rate on your balance. There are no monthly or annual fees with unlimited free transactions.

Neo does not require a minimum deposit or balance to keep your account free. You can set up a direct deposit of your paycheque in your Neo Money account.

Unlike traditional savings accounts, a Neo Money account also comes with unlimited debits and Interac e-Transfer transactions. Learn more about how it works.

Neo Credit Card

The Neo Financial Mastercard is a fee-free cash back credit card that pays you unlimited instant cash back on all purchases. Plus, you get an average of 5% cash back at Neo partners, and up to 15% cash back on many of your first purchases.

You can apply for the Neo Secured Mastercard if you have poor credit. It has all the same features and benefits as the regular Neo Card. Both cards come with a $25 sign up bonus.

Neo Financial also has a mobile app to view your balance, get transaction alerts, and view your cash back rewards.

Other Neo Products

Neo Invest helps you invest your money with customized, professionally managed investment portfolios. You can open an RRSP, TFSA, or personal investment account. You can start investing with as little as $1.

Neo Mortgage helps you find a mortgage by scanning the market for the best rates. You can start the application process online with the guidance of an advisor.

5. Motive Financial

Motive Financial is a division of the Canadian Western Bank, a Schedule I bank based in Edmonton. It offers chequing high interest savings and GICs.

Motive Financial Chequing Accounts

Motive has two chequing accounts. The Motive Cha-Ching Chequing Account offers:

- No monthly account fee

- Unlimited free transactions and Interac e-Transfer

- Interest on your balance

- Access to thousands of ding-free ATMs

The Motive Chequing also offers unlimited free transactions; however, it is not available to new clients.

Motive Savings Accounts

Motive has two savings accounts: Motive Savings and Motive Savvy Savings. Its features include:

- No minimum balance

- 2 free transactions per month

Motive customers can also access GICs for TFSA, RRSP, and other investment accounts.

6. Alterna Bank

Alterna Bank is a wholly-owned subsidiary of the Ontario-based credit union Alterna Savings. They have one chequing account and 3 eSavings accounts, along with homebuying and investing services.

Alterna Chequing Account

Alterna Bank’s No Fee eChequing Account includes free, unlimited everyday transactions and Interac e-Transfers.

There is no minimum balance required, and you get a 0.05% annual interest rate. You have the option to add Overdraft Protection for $2.50 per month.

Alterna Savings Accounts

Alterna offers 3 savings accounts:

- High Interest eSavings Account

- TFSA eSavings Account

- RRSP eSavings Account

The High Interest eSavings Account currently pays an interest rate of 2.00% on your balance. It offers free, unlimited bill payments, Interac e-Transfers, debits, and bill payments, and there is no minimum balance required.

Alterna Bank also offers mortgages, direct investments, guided portfolios, small business loans, and a small business eChequing Account.

Here’s a detailed Alterna Bank overview.

Methodology:

Savvy New Canadians assesses the best banks in Canada based on their product offerings, monthly and service fees, mobile apps, branch and ATM coverage, transaction limits and minimum balance requirements, savings rates, the bank’s stability, personal experience, and many other features. We carefully evaluate each bank account’s offerings, and our scoring methodology places more weight on each account’s overall value. Based on our research, these are some of the best bank accounts, but they may not be right for you. Visit each bank’s website to learn more about their services.

Pros of Banking With an Online Bank

Better Rates: Most digital banks offer higher savings interest rates, rewards, and welcome bonus offers.

Lower Fees: Online banks are less likely to charge fees if you have a low balance, make debit transactions, or transfer money between accounts.

Better Websites and Mobile Apps: As they’re fully online, digital banks generally have better-designed and more functional mobile apps or websites. You cannot bank in person, so they need everything to be done online.

Cons of Banking With an Online Bank

No Specific ATMs: They may not have their own ATMs, so when you withdraw money, you could be paying a service fee at non-partner ATMs.

Limited Services: Some online banks offer fewer services than in-person banks. For example, they might not offer investment services or mortgages, while most other big banks do.

No In-Person Service: Since there are no physical branches, you cannot walk in and talk to an advisor in person. You’ll need to use the online chat function, email the bank, or schedule a phone appointment.

Types of Banks in Canada

There are three broad categories for banks operating in Canada as per the Bank Act.

Schedule I: These are domestic banks that are not subsidiaries of a foreign bank. They are authorized to accept deposits and may be eligible for deposit insurance through CDIC.

Examples include RBC, TD, CIBC, BMO, Scotiabank, Tangerine, National Bank of Canada, Equitable Bank, etc.

Schedule II: These banks are subsidiaries of eligible foreign banks and are also authorized to accept deposits. Examples include HSBC Bank Canada, ICICI Bank Canada, Citibank Canada, and Bank of China (Canada).

Schedule III: This category includes branches of foreign banks that operate in Canada and are authorized under the Bank Act to carry on banking business in Canada. Examples include Bank of America, Capital One Bank, Deutsche Bank AG, Citibank N.A., and BNP Paribas.

Schedule III banks operate under some restrictions. For example, they are generally limited from accepting deposits of less than $150,000.

How To Choose The Best Bank For You

While we have covered some of the best bank options in Canada, the best bank for you boils down to your specific needs.

Here are some of the factors you should consider:

1. Fees: How much are you willing to pay for your money to sit in a bank account? For convenience? Are you maximizing the features of the account?

If you do most of your banking online, a no-fee chequing account may be all you need. If you need to visit a branch every now and then or want premium perks, it may make sense to keep the minimum balance to waive the account fee at your bank.

2. ATM and Branch Network: Find out whether the account offers access to free ATMs at convenient locations. You don’t want to skimp on the monthly fees only to pay them back in transaction costs.

3. Safety: All the banks listed here are members of the Canada Deposit Insurance Corporation (CDIC). This means your deposit accounts are protected for up to $100,000 per category.

4. Interest Rates: How much is the bank paying you to save money? Compared to a big bank savings account, you could potentially earn 10-30 x more in interest on your savings when you choose an online bank.

5. Perks: Depending on your needs, a package offering free cheques, drafts, safe deposit box rental, credit card fee rebates, loyalty rewards, etc., may influence your choice.

6. Promotion: Banks often advertise juicy offers to attract new customers. While these sign-up bonuses are short-term, they may be worth your time.

Here are the bank promotions available in Canada.

Best Banks Canada FAQs

Overall, our top choice for the best bank in Canada is Scotiabank. The best bank for you depends on your financial needs, including the number of transactions you typically conduct monthly, your location, the need for in-person assistance, and whether you require premium perks.

The biggest bank in Canada right now is the Royal Bank of Canada. It surpasses the others by asset size and market capitalization. The second biggest bank based on these same metrics is Toronto-Dominion Bank (TD Bank).

The top five biggest banks in Canada are RBC, TD, Scotiabank, BMO, and CIBC.

The best online bank in Canada for savings is EQ Bank. The best online bank in Canada for free chequing accounts is Simplii Financial.

If you are looking for a no-fee bank, your best bet is to choose an online bank. Online banks have their pros and cons. You pay minimal fees for day-to-day banking transactions; however, most transactions can only be conducted online as they lack branches.

All major Canadian banks are considered safe. TD, CIBC, RBC, Scotiabank, and BMO all rank within the top 35 most stable banks worldwide.

When choosing a bank, you need to consider the interest rates, fees, top rewards, and products offered. For example, if you need a lower-cost online savings account, you can try Alterna or HSBC. As everyone is different, the best bank will vary.

The bank with the highest non-promotional interest rates on savings accounts on this list is EQ Bank.

Hi Enoch,

Very comprehensive piece, thank you. What would be some options for keeping US cash that would be needed in a 4-5 year period?

Thanks

@Charlie: The options for a short timeframe are very limited. You could try a USD savings account or GIC.

Examples of USD savings for business are in the link below:

https://www.savvynewcanadians.com/best-us-dollar-business-savings-account-canada/

For personal USD savings, the banks on the list also have decent personal USD rates. Some of the accounts are a pain to open though. For example, it took me more than 6 months to open a Tangerine USD account for business…it should be easier for a personal account.

There are also some Cash ETFs, however, I’m not familiar with any that is denominated in USD.

We have dealt with BNS for about 30 years and until recently have been happy with the service. In the past two years however we’ve been increasingly disappointed with the financial advice and frequent changeover of advisors. Since covid hit the management and atmosphere there have become disagreeable and we’ve talked about changing banks. What do you suggest?

CHANGE ->Been with bns since 1995 but the time has come…

I hold personal bank account in TD since 2002 and I was quite happy with their service until the beginning of 2020. But now I see a lot of changes in their performance. Customer service has become utterly hopeless since the beginning of covid pandemic. They screwed up my RESP investments in September 2020 and I incurred losses because of that. I had requested for mutual fund investment of my RESP for maturing GIC but they kept my fund in GIC after maturity without my consent. Since the beginning of 2021, I realize that they have hidden discriminatory policy for people with certain names when they attempt to conduct global transfer of funds. There were more than one instance in 2021 when my attempt for global transfer of fund to my relative or service provider were blocked citing security reasons. I never faced this problem when I made similar transactions through Scotiabank. I suspect they even blocked wire transfer to my account from US because of this discriminatory policy in the month of August. Finally I received money through check after several days. I’m now actively considering to close all my TD accounts because I don’t want to support institutions who promote hidden discrimination of this sort. Could you suggest any other banking institution?

@Mohammed: Sorry to hear about your concerns. I think any of the financial institutions on this list could work. That said, customer service appears to have taken a hit across the board since the start of the pandemic. It appears that many banks haven’t increased their customer service support capacity to the level required for the surge in online banking needs.

I went to open an account with CIBC twice the same day at different branches. The first one was almost empty, but the response I received was to come over another day cause there was nobody who could provide information or assist me that time, it was a Friday around 11 am. I decided to skip it and try later. In the second attempt I received all the information and good attention until the lady was unable to open my account since I was a newcomer and there was some kind of problem with the system. She promised to make a follow-up call by the end of the day up to Monday, the whole week passed and never received a call. To me it’s a no-no for this bank as they seem careless for new customers.

Being a customer of TD bank since 2006. 2020 there service went down hill and so annoying including dealing with everyday banking at the till, insurance claim, TD Autoclub tow service, they made it very hard even you cannot win the claims.

Recently my car was stalled and TD autoclub told me they cannot send help u till 4 hours and it was -35C. They told me to tow by your own and they will reimburse me upto 250 dollars and they only need a receipt from tow company.

I towed it for nearly 200 dollars and they refuse to reimburse and asking me to submit mechanic repair bill.

For hail damage they did not covered anything destroyed by the hail in my back yard.

Like TD Autoclub there service inside the bank is worse too.

I wish I couldn’t stay that muchlonger with Home and Auto insurance.

BMO bank also deny me credit and for no reason being customer for more than 12 years.

Don’t know which bank to choose and trust as I’m still with TD bank.

Good morning!

I didn’t find Koho in your list. I’ve been using it for a few months now and I’m really happy with what it has to offer. Is there a reason why you didn’t talk about it?

Thank you

@Patrick: KOHO is not a “bank” in the strict sense of the word, which is why it is not on this list. We have several other content about KOHO, including those relating to cash back rewards, high interest savings, and more.

Hi,

Which of the above banks assist international students with grants or scholarships towards their tuition?

@Caroline: I’m not aware of any grants or scholarships from any of the banks on this list.

Given events of this year in the U.S., from a safety perspective, I wonder if you have thoughts on this somewhat contrarian article by Safer Banking Research (SBR), which argues that the big Canadian banks have become over-leveraged and at risk, notably due to heavy investments in fossil fuels and real estate.

https://www.saferbankingresearch.com/article/Big-Banks-Have-Massive-Exposure-A-Look-At-Canadian-Banks-202306081011.html

Full disclosure, their actual detailed research and recommendations for safe Canadian banks are behind a paywall, but the author Avi Gilburt, is quite credible in my experience over several years of following his writing online, and SBR actually *predicted* weakness in US banks before this year’s major collapses when it wasn’t really on anyone’s radar.

@Patrick: Compared to the rest of the world, Ièd say Canadian banks are much safer using many of the important metrics. If we see widespread failure here (very unlikely), the banking system will be the least of our worries.