Key Takeaways

- The best bank accounts for small businesses in Canada include Loop, Tangerine Business Account, Wise Business, Caary, Vault, PayPal for Business, Alterna, RBC, Scotiabank, CIBC, and TD.

- A small business bank account is a type of account that lets you manage your business transactions, from deposits to bill payments and customer payments.

Opening a business account is the first step to setting up your small business and keeping it legally compliant.

Financial technology companies offer various options, such as Loop Global Banking, Tangerine Business Account and Wise Business. Banks also provide a range of business savings account choices like Scotiabank Unlimited Account and TD Basic Business Plan.

Below, I cover how to choose the best business bank account for your needs.

Overall Best Small Business Account in Canada

1. Loop Corporate Banking

Loop is a Toronto-based financial technology platform specifically built for growing businesses and entrepreneurs who want to explore global markets.

It offers multiple global business banking accounts in one platform, providing Canadian businesses access to US, EU, and UK accounts in just a few clicks. With these accounts, your business can skip conversion fees and cross-border delays when receiving or sending international payments.

Loop also provides a no-FX, cross-border corporate credit card that holds four currencies: CAD, USD, GBP, and EUR. Despite having no annual fees and minimum spend requirement, this card allows you to earn points that you can redeem at brands such as Amazon and Air Canada.

The Loop Corporate credit card’s credit limit is based on the user’s revenue and can reach up to $1 million. Apart from an actual card, Loop can also provide virtual cards for your business team members with flexible spending and freezing rules.

Fees: Free to start an account (the Free Loop account includes free CAD, USD, GBP, and EUR accounts, free international payments, 20 virtual cards, unlimited team members, 0.50% FX fee – a saving of 2%, 0.5% ACH/EFT billing); $49/month if you upgrade to Loop Plus, $199/month to have a Loop Power account.

Top Unlimited Small Business Bank Accounts

2. RBC Digital Choice Business Account

The RBC Digital Choice Business Account is for small to mid-sized businesses that mostly operate online and use online and mobile banking for most of their transactions.

The RBC business account features unlimited electronic debit and credit transactions, electronic cheque deposits, and Moneris deposits (no limit on credit and debit card transactions).

Fees: $6 monthly fee; $1.50 per transfer for sending Interac e-Transfer (after the ten included); $4.00 for paper statement without images; $5.00 for paper statement with images.

3. Alterna Small Business eChequing Account

Alterna is an online-only bank offering a business-specific chequing account. It requires no monthly fees if you maintain a $3,000 minimum balance. It features unlimited transactions, unlimited monthly deposits, and access to over 3,000 ATMs.

It also offers free unlimited electronic debit and credit transactions, free incoming Interac e-Transfers, and six free Interac e-Transfer Send or Request Money transactions per month.

Fees: $5 monthly for accounts under the daily closing balance; $5 monthly fee; Interac transfers for $1.50 per transfer (after six free transfers) per month; $2 per $1,000 deposit for in-branch cash deposit.

4. Scotiabank Unlimited Account

The Unlimited Account is Scotiabank’s fourth plan type in the Select Account for Business product options. It features no fees with a minimum account balance, unlimited transactions and deposit items, and access to ScotiaConnect Digital Banking.

Fees: $120 monthly fee (free with a balance of $75,000); $2.50 for additional cash deposit fee (for every $1,000).

5. CIBC Unlimited Business Operating Account

The CIBC Unlimited Business Operating Account is for medium to large businesses. It offers a comprehensive deposit package each month at no extra cost, which includes: a $15,000 cash deposit; a $1,000 coin deposit; and 100 cheques.

The premium operating account features unlimited transactions, including Interac e-Transfers, withdrawals, account transfers, bill payments, etc. The monthly fee is waived if you maintain the minimum daily balance of $45,000.

Fees: $65 monthly fee; $2 for ATM withdrawal; $0.22 for cheque deposit; $1.50 for Interac e-Transfer.

6. TD Unlimited Business Account

The TD Unlimited Business Account offers unlimited transactions and additional banking benefits like an annual rebate of the $149 annual fee, waiver of set-up fees, a $10 monthly fee rebate on Business Overdraft Protection, and free Interac e-Transfer.

It features unlimited deposit items and transactions per month, and a fee rebate if you maintain the minimum monthly balance of $65,000.

Fees: $125 monthly plan fee; $2.50 per $1,000 additional cash deposit fee.

Related: 35 Best Franchises to Open in Canada

Best Business Accounts for Smaller Businesses

7. TD Basic Business Plan

The TD Basic Business Plan is for business owners who are just starting and have minimal monthly transactions. The account includes five free transactions per month and five free deposit items per month.

With this account, you can bank anywhere and make deposits through TD Mobile Deposit. All Point-of-Sale Terminal deposits are electronically credited to a TD Canada Trust business chequing account. Also included are free online statements with cheque images.

Fees: $5 monthly plan fee; $1.25 fee for each additional transaction (the first 5 are free each month); $0.22 for each additional deposit fee (after five free deposits); cash deposit fee of $2.50 per $1,000. The complete list of fees is here.

8. RBC Flex Choice Business Account

The RBC Flex Choice Business Account is for business owners who want to bank online and in-branch. It is ideal if you have a maximum of 75 monthly paper transactions.

This account offers other benefits such as Instant Fuel Savings at Petro-Canada and exclusive access to offers and support from various services. It also provides personalized offers, bonus Avion points, and cash savings from certain brands.

Fees: $7 monthly fee; $0.75 for each electronic deposit; $1.25 for each paper transaction; $1.50 for each Interac e-Transfer you send; $2.25-$2.50 for cash deposits; $4.00 for Paper statement without images; and $5.00 for paper statement with images.

9. Scotiabank Right Size Account

The Right Size Account for Business is a product that lets you manage funds easily using a flexible and budget-friendly solution that offers convenience, lower costs, and better cash flow.

It lets you bank whenever you want using online access. You pay only for the transactions you make. There are no deposit fees for payment processing.

Fees: $6.00 monthly fee; $1.25 per 1-15 transactions per month; $1.15 per 16-50 transactions per month; $1 for over 51 transactions done monthly.

10. BMO Business Builder Account

The BMO Business Builder Account is for businesses with a moderate number of monthly transactions. It offers advanced digital banking solutions that assist the growth of your business.

The BMO small business account requires no minimum balance and provides access to BMO’s online platform. It includes two free Interac e-Transfer transactions per month, 35 free monthly transactions, unlimited Moneris transactions, and free monthly eStatements.

Fees: $22.50 monthly fee

11. CIBC Everyday Business Operating Account

The CIBC Everyday Business Operating Account is for small business owners who want a cost-effective business operating account that reduces fees when banking electronically. It includes 30 transactions and a monthly fee waiver.

The account also includes free CIBC Online Banking, free CIBC SmartBanking for Business, and a deposit package with up to $3,000 in cash, $300 in coins, and 25 cheques deposited per month.

Fees: $20-$25 self- or full-service access; $1.00-$1.25 for each additional full-service; $3.50 for a printed statement; $5.00 for a monthly statement reprint plus printed statement fee; $4.50 for an interim statement plus printed statement fee.

Best Online Small Business Bank Accounts

12. Tangerine Business Account

The Tangerine Business Account from Tangerine Bank (formerly ING Bank and now a division of Scotiabank) is an online-only business savings account for small business owners and entrepreneurs. It works as a complement to your existing business chequing account.

It requires no minimum balance and has no monthly fees or hidden charges. One drawback to the Tangerine business account is that it is an online-only product, so there is no physical branch you can visit.

13. Wise Business

The Wise Business account in Canada is an online multi-currency international business account that lets you transfer money from your account or between banks, receive and add money, hold over 40 currencies in your Wise account, or send money to over 160 countries.

With a Wise account, you get low and transparent fees cheaper than PayPal and traditional banks, no monthly fees, and cheap conversion rates. One disadvantage to using the Wise Business account in Canada is that it does not offer a chequing account.

Fees: 42 CAD for registering a Wise account; from 0.43% for sending and converting money; 1.75% (+ 1.50 CAD per withdrawal) for ATM fees (over 350 CAD per month per account); 2% for account funding transactions.

14. Caary

Caary is a corporate credit card powered by Mastercard and a financial platform designed for small- and medium-sized businesses that need easy and accessible credit with no personal credit checks, automated expense management, and no-fee cards, and no personal liability.

It lets you keep control of your business spending in real-time and offers physical and virtual cards. It is free to use and has no annual fees and foreign exchange fees for purchases outside Canada. A disadvantage to Caary is that you have to hold an average of $35,000 in a business bank account. It also does not have as many perks as some other business credit cards.

15. Vault

Vault is an online banking platform that lets small to medium-sized businesses hold local accounts in different currencies (USD, CAD, GBP, and EUR), and send and receive money at real-time exchange rates that are multiple times cheaper than at the big banks.

Vault customers do not need to carry minimum balances or pay monthly or annual fees. Deposits and withdrawals, incoming and outgoing transfers/wires are all free. As with online-only banking platforms, it may be a challenging experience if there is no branch to visit and no personnel to talk to.

16. PayPal for Business

A PayPal for Business account lets small and medium-sized businesses send and receive payments online and in person. It is one of the most widely used payment processing platforms because it is easy to use and integrates easily with shopping carts.

Some advantages of using Paypal for Business include ease of use, instant payment, easy-to-set-up recurring payments and multiple currencies accepted. The cons include high chargeback fees and fees higher than those at a typical merchant.

Fees: The list of fees can be found here.

What is a Small Business Bank Account?

A small business bank account is a type of account that lets you manage your business transactions, from deposits to bill payments and customer payments.

Opening a small business bank account is crucial due to the following reasons:

- To give your small business a separate entity

- To give your business a professional appearance

- To make it easy for a small business owner come tax time

- To conduct banking in your company name

- To keep records of all your business transactions

- To prove separate transactions for tax reasons

- To avoid mixing your personal and business funds

Best Bank Accounts for Small Businesses in Canada

Choosing the best business bank account or business savings account is a fundamental step, but it can be time-consuming to go through all the available options to find the ideal one that fits your needs.

This guide will help you make an informed choice to ensure your business operates as smoothly as possible. With that, here are the best bank accounts for small businesses in Canada.

Do You Need a Business Bank Account?

Technically speaking, if you are running a sole proprietorship business and your business is not incorporated, you need not use a business bank account. But here are some instances when opening a business bank account is beneficial for you and your small business:

- Business records. When you need to provide detailed business records (such as when applying for a business loan), having a business bank account will enable you to show your expenses, cash flow, and revenue.

- Taxes. Having a business bank account makes it easy to separate your personal from your business expenses. This makes it easier when filing taxes at the end of the year.

- Payroll solutions. Business chequing accounts often come with direct deposit and payroll features. This makes it simpler for you to pay your employees and suppliers or contractors.

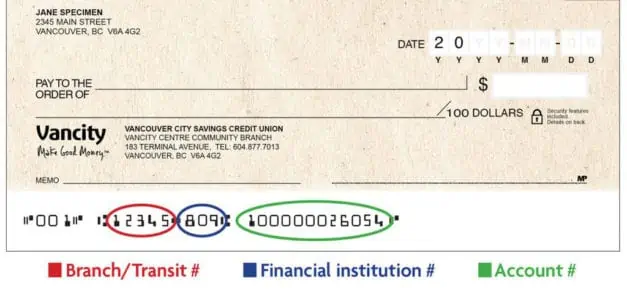

How to Open a Small Business Bank Account

Depending on your business setup, you can apply online or by visiting a local branch to finish the process.

Submit the required documents for the application process. Information that banks will require you to provide includes the following:

- Personal information

- Name, address, birthdate, phone number, email address

- Business information

- Business name, business address, business registration number, date of operation, basic financial information, a summary of the business

- Two forms of identification, one a photo ID

- A document with your business address on it

- Business documents (depending on your business type)

Small Business vs Personal Bank Account

The primary difference between a small business bank account and a personal bank account is that a personal bank account is for handling your personal expenses while a business bank account is used to manage business transactions.

| Personal Bank Account | Small Business Bank Account |

| For your use as a consumer | For business-related transactions |

| Used for day-to-day transactions | Separate from personal assets |

| Holds and manages personal funds | Requires a higher daily average balance than a personal account |

| Used to pay personal bills or make purchases | Accepts payments for the business |

| Remains in the name of the individual | Can have several signatories |

| Manages personal expenses | Separate from personal assets |

| Higher fees for opening and managing an account | |

| Conveys confidence and professionalism |

Pros and Cons of a Small Business Bank Account

Pros

- Separates your personal and business expenses

- Helps you to easily track your business expenses

- Typically comes with payroll solutions you can use in your business

- Provides bank statements that you may use in your business dealings

- Simplifies CRA audits

- Helps you keep abreast with your business accounting

Cons

- Limited monthly transactions

- Generally comes with extra fees

- Do not earn much interest

Should You Open a Small Business Bank Account?

Yes, it is recommended that you open a small business bank account. As you can see from the list of pros and cons, opening a business bank account has more advantages than disadvantages, which makes it a sensible business move on your part.

There are numerous banking options available to your small business. When choosing what small business bank account to go with, take time to review the details and determine if these are beneficial for your business.

Check if the features of a business bank account meet what you need. If your business is just starting, avoid selecting an account that comes with monthly fees for multiple transactions. The gist is to do your due diligence and find out what the banks offer.

FAQs

A non-resident can open a business bank account since residency is not a requirement for the said procedure. To ensure a smooth process, prepare all the required documents and records and present them when asked.

Both TD Bank and RBC offer affordable online banking solutions for small businesses, but RBC offers more options for business bank accounts. TD offers three plans (TD Basic Business Plan, TD Everyday Business Plan, and TD Unlimited Business Plan). RBC, on the other hand, offers several, including Digital Choice Business Account, Flex Choice Business Account, Ultimate Business Account, and US Dollar Business Account.

You can use your personal bank account for your small business; however, this will make it difficult for you to separate your personal from your business expenses. But having a business bank account can make the process of accounting and filing taxes a lot easier.

The best small business bank in Canada is the one that can provide your business banking needs at the most reasonable price. Thus, doing research about small business bank accounts prior to opening an account is a vital step to choosing the bank that can meet your needs.

Related: Money Making Business Ideas