A mortgage is the single largest debt the average Canadian or American will ever have to pay off. How about paying off your mortgage in 5 years…or 10 years? Well, that’s a goal many a homeowner has…mostly in their dreams.

The fact is that a majority of people with mortgages will still carry some level of mortgage debt into retirement, and the reason for this is not far-fetched. Average mortgage debts are simply too high at a whopping $201,811 in the U.S. and $198,781 in Canada.

Compare this to the average household income of $59,039 in the U.S. and $70,336 in Canada, and you can see why mortgage debt is often a lifelong burden. No wonder the most common mortgage amortization chosen by home buyers is the 30 years (U.S.) or 25 years (Canada) mortgage.

So, what options do you have as a homeowner if you’d like to pay off your mortgage early? There are actually a few, and they are now particularly attractive as mortgage rates start to rise.

For the sake of simplicity, let’s start by assuming that you have a $400,000 mortgage. This amount is below the average price of single-family homes in Canada ($568,000) and more than the average price of $304,500 in the U.S.

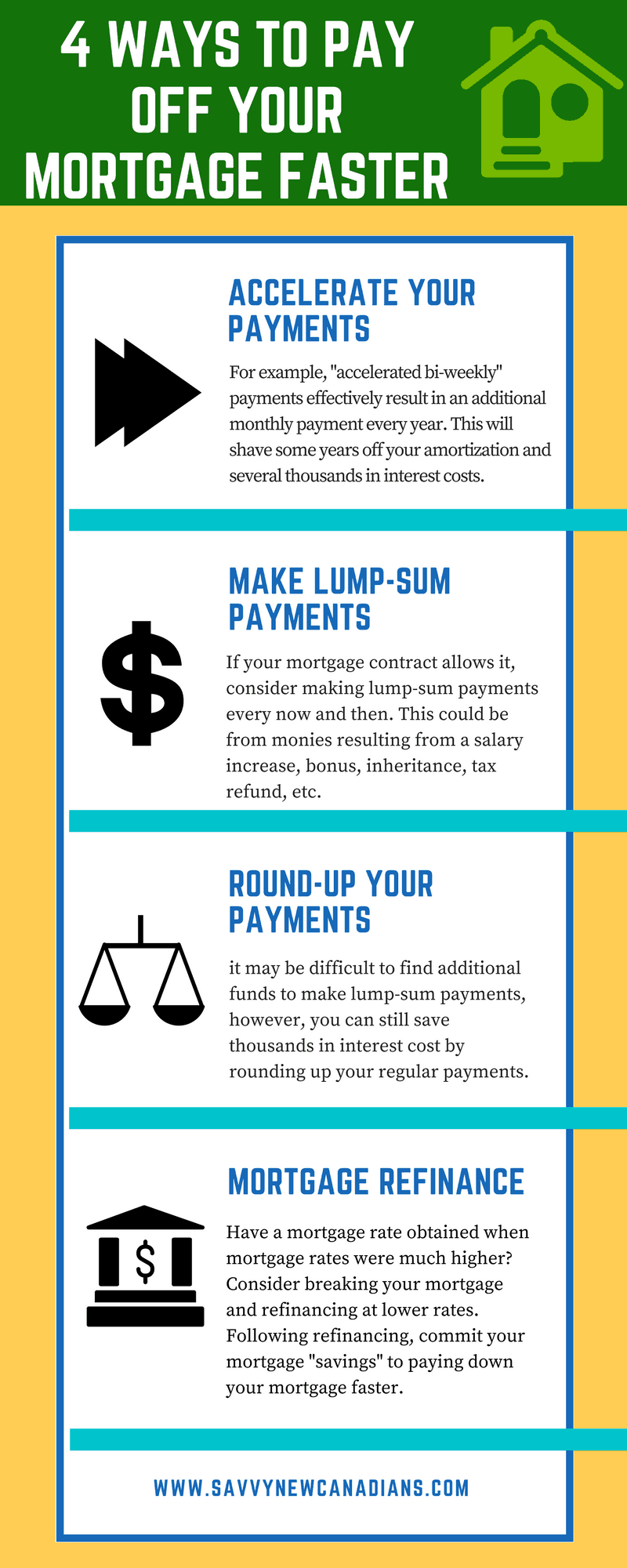

How To Pay Off Your Mortgage Early

Let us go through some mortgage payment calculations and scenarios.

Scenario #1 – Increase The Frequency of Your Payments

This is also known as the accelerated payment option. For example, instead of making your mortgage payments once a month, you can choose an ‘accelerated bi-weekly‘ payment option that cuts your monthly payment into two, with each half payable every 2 weeks.

When you make these 26 bi-weekly payments for 1 year (calculated as 52 weeks/2), you have essentially made 1 additional month of mortgage payments.

Using our 25-year $400,000 mortgage scenario, your monthly payments are $1,892.98 (at a 3% interest rate). When you start paying half of this amount every 2 weeks in order to accelerate your payments, it means you pay $946.49/bi-weekly (calculated as $1,892.98/2).

Outcome: By simply making one additional monthly payment spread over the year with the accelerated payments strategy, you will have:

- Saved $20,628 in interest costs

- Paid off your mortgage about 3 years earlier

Scenario #2 – Increase Your Payment Amount

You can become mortgage-free faster than you expect if you are able to simply top-up your bi-weekly or monthly payments. Using the same 25-year $400,000 mortgage at 3%, let us assume you are able to top-up your normal monthly payment (of $1,892.98), with $100.

Outcome: By simply adding $100 every month in additional mortgage payments (for a total of $1,200 over the course of the year), you will have:

- Saved $13,349 in interest costs

- Paid off your mortgage almost 2 years earlier

Strategies #1 and #2 are great. Accelerated payments shave off $20,628 and approximately 3 years of mortgage debt. Topping up with an additional $100 every month ends up saving you over $13,000 and gets you mortgage freedom 2 years early!

So, how about the big savings mentioned in the title, eh? How can you save over $70,000 and become mortgage-free 10 years early?

We will get there. In the meantime, let us look at how you can become mortgage-free 6 years early while saving $46,000 in interest payments.

Read: Best Mortgage Rates in Canada

Strategy #3: Make Lump-sum Deposits Every Year

This is where the numbers get very interesting! Using the same 25-year $400,000 mortgage example above. Let us assume you make an additional payment of $5,000 every year!

Outcome: By putting down an extra $5,000, you will have:

- Saved $46,000 in interest costs

- Cut your mortgage term by more than 6 years (74 months, to be precise)!!

This is all made possible by using the power of compounding to your benefit. Your lump-sum payments cut into your principal debt and significantly lowers the amount of interest you need to pay over time.

You may ask: “where do I find the extra $5,000?” Some possibilities include:

1) Tax Refund: The average annual tax refund in Canada is $1,650, and in the U.S., it is $2,895. So, instead of hitting the shopping mall, think about paying down mortgage debt.

2) Salary Increase: Your annual salary raise or bonus can go a long way.

3) Cash gifts or inheritance

4) Side hustles to make more money or passive income.

Now to the big-baller scenario of all. Let us see what the numbers say when you add $10,000 annually in mortgage payments!

Outcome: Using the same 25-year $400,000 mortgage and a 3% rate, you will have:

- Saved $72,423.96 in interest costs

- Become mortgage-free approximately 10 years earlier!

This is a big deal scenario!!

The question a lot of people may ask at this point is: “How the heck can I come up with an additional $10,000 every year on top of my other expenses?” I hear ya, and know that the struggle is real!

I have put together a pretty detailed list of 100 practical ways to save up an extra $20,000 per year.

Here are just a few highlights:

- Shop for insurance (car, home, and life)

- Save hundreds of dollars

- Cancel unused subscriptions

- Learn to negotiate

- Earn cash-back on groceries and general shopping

- Do comparison-shopping

- Cut your investment fees

- Choose a variable mortgage

- Cut your water bill

- Decline mortgage life insurance

- Winter-proof your home

- Avoid extended warranties

- Don’t keep up with the Joneses. To save thousands of dollars. You can read my complete guide to saving money here.

Strategy #3 of paying down a lump sum shows us that you can save $46,000 and shorten your mortgage by 6 years, or even shoot for the moon and save $72,000 plus 10 years of additional mortgage freedom.

Bonus

Let us assume there is absolutely no way you can come up with:

- An extra $100 per month (i.e. strategy #2), or

- An extra $5k to $10k per year (strategy #3)

There is one more strategy to save money on your mortgage. It is pain-free.

Strategy #4: Round Up Your Payments

Using our now famous example of a 25-year $400,000 mortgage at a 3% rate and $873.10 in normal bi-weekly payments. Let us say you are able to round up the bi-weekly payments to $900 (i.e. $873.29 + $26.71).

This means that every 2 weeks, you find an extra $26.71 to add to your basic mortgage payment (for example, by skipping a few lattes, packing your lunch, etc.).

Outcome: By making an additional payment of $26.71 every 2 weeks, you will have:

- Saved $8,262.88 in interest costs

- Cut your mortgage term by 13 months (over 1 year!!)

What we can see from this last example is that even little additional payments make a massive difference. Savings of over $8,000 is nothing to play with.

You do not need a massive windfall to start your journey toward mortgage freedom. Start early, start now, and you will reach your goals.

Other Related Posts:

- 20 Smart Ways To Save Money Around Your House

- 29 Ways To Save Money On a Daily Basis

- 12 Best Financial Apps To Automate Your Savings and Investing

- How To Use Your RRSP To Buy A Home

The mortgage payment scenarios were computed using this calculator here provided by the Financial Consumer Agency of Canada.

Nice post. Learnt so much from the write up. Enjoyed reading it too.

@Wale: Glad to hear it. Cheers.