The best life insurance companies in Canada can save you money on your monthly or annual premiums, provide adequate insurance coverage, and secure the financial future of your beneficiaries.

Finding the right life insurance policy can be tricky. While the costs you incur are often top of mind, other factors also come into play:

- What type of life insurance should you get: term life or permanent life insurance?

- How much life insurance coverage do you need?

- Is the life insurance company financially stable and reputable?

Below, I cover some of the best life insurance companies in Canada, how to choose one that meets your needs, and the cost of life insurance.

Best Life Insurance Companies in Canada

When assessing the top life insurance providers, you want to examine the cost of coverage, types of life insurance products available and terms, the company’s financial stability, user reviews, and ease of application.

For the cost of coverage, I use the cost of term life insurance, which is what most people need.

The numbers below reflect estimated quotes available to a 40-year-old male and female who are non-smokers, a 10-year term, and $500,000 coverage. They are obtained using the life insurance calculators provided by each company.

1. PolicyMe

PolicyMe is an online life insurance company and the first fully digital life insurance platform to launch in Canada.

The company initially started as a life insurance comparison site in 2018. It now offers affordable life insurance policies that are mostly issued by the Canadian Premier Life Insurance Company, a reputable federally regulated life insurance company.

Canadian Premier Life Insurance Company has been in business for over 60 years and has a Financial Strength Rating (FSR) of A from AM Best.

PolicyMe also offers policies issued by other top insurance providers like BMOLife Assurance Company, Canada Protection Plan, Manufacturers Life Insurance Company, and Wawanesa Life Insurance Company.

Where this company truly shines is its online onboarding. After completing its 15-minute online application, most applicants receive a quote instantly and don’t require medical exams.

The rates at PolicyMe are approximately 10-15% lower than other big players, making it the best life insurance company in Canada for affordable life insurance.

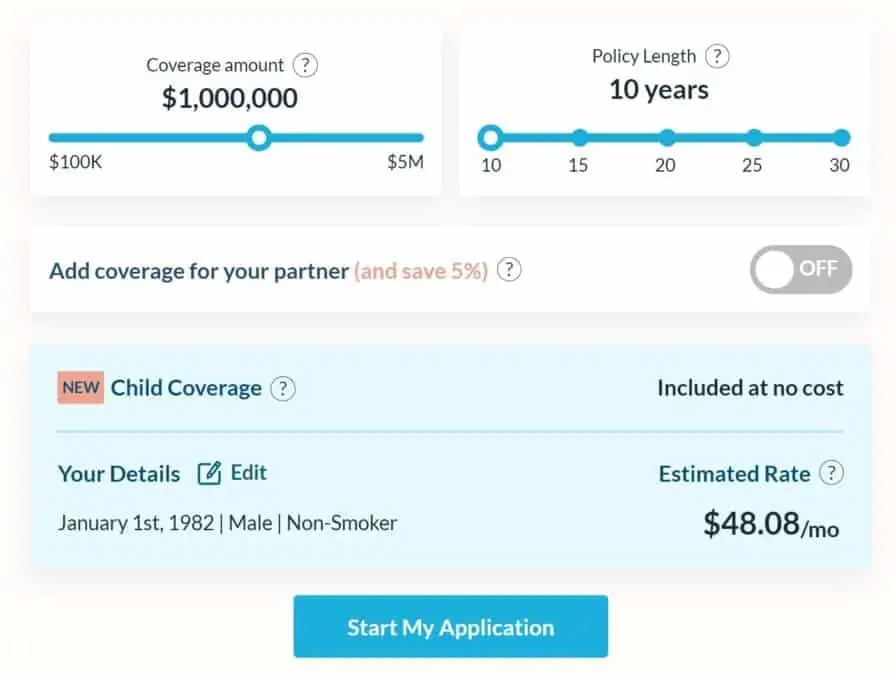

- Coverage amount: $100,000 to $5,000,000

- Term length: 10, 15, 20, 25, and 30 years.

- Cost of 10-year term life insurance: $26.55/month (male, non-smoker, $500k coverage)

- Cost of 10-year term life insurance: $19.24/month (female, non-smoker, $500k coverage)

PolicyMe offers a 5% discount on monthly rates for couples, and child coverage is included at no extra cost if you have kids.

Pros of PolicyMe

- You get a decision instantly from the comfort of your home and don’t have to wait for weeks.

- It is available nationwide.

- If you have children, a $10,000 coverage per child is included in your policy at no extra cost.

Considering that life insurance premiums are an additional expense in your monthly budget, every little bit of savings helps, and PolicyMe’s policies are generally cheaper.

Cons of PolicyMe

- It does not offer permanent life insurance and is not as big as some of the other life insurance companies on the list.

Related: PolicyMe Review.

2. Manulife

Manulife is the largest insurance company in Canada, with 1.3 trillion in assets.

In addition to providing insurance policies, Manulife also offers banking and investment services. This company’s life insurance policies offer a variety of options.

For example, for term life insurance, you can select CoverMe, Family Term, Business Term, and Family Term with Vitality, a policy that can lower your premiums when you complete fitness and health-related activities.

Its term life insurance policies also include an option to waive medical exams.

Manulife also issues policies for permanent life (or whole life) insurance, including a “Guaranteed Issue Life Insurance” that provides coverage regardless of age or health history.

- Coverage amount: $50,000 to $20 million

- Term length: 10, 20, or until age 65 or 100

- Cost of 10-year term life insurance: $30.35/month (male, non-smoker, $500k coverage)

- Cost of 10-year term life insurance: $25.29/month (female, non-smoker, 500k coverage)

Pros of Manulife

- Manulife is one of the oldest life insurance companies in Canada, with a history dating back 133 years.

- You can easily submit your application online, and there are several coverage options to choose from.

- It offers policies where no medical exam is required.

- There are options to lower your premiums when you participate in specific programs.

Cons of Manulife

- Manulife is not the cheapest life insurance company if you are looking for the lowest rates available.

- Its term lengths are limited.

3. PolicyAdvisor

Although PolicyAdvisor is not an insurance company, it is a portal to compare life insurance quotes from Canada’s top 20 life insurance providers.

And it’s not just life insurance (term and whole life); you can also get quotes for critical illness insurance, disability insurance, mortgage protection, and no medical insurance.

To find the best rates for your needs, visit PolicyAdvisor to complete an application.

Instant quotes are provided from several providers for various terms, insurance types, and more. You can speak to a licensed advisor for free by phone if you have questions about the options available.

This platform also provides a plethora of free calculators you can use to figure out your coverage needs.

- Coverage amount: $25,000 to $5,000,000

- Term length: 10, 15, 20, 25, 30, 35, and 40 years

- Cost of 10–year term life insurance: $28.80/month (male, non-smoker, $500k coverage)

- Cost of 10-year term life insurance: $20.52/month (female, non-smoker, $500k coverage)

Pros of PolicyAdvisor

- This free service makes it easy to compare real-term quotes from 20 of the best insurers.

- The online application is fast, and they assist you with your final application to increase your chances of approval.

- There are many free tools, calculators, and resources available on the site.

Cons of PolicyAdvisor

- PolicyAdvisor is only licensed to sell insurance products in Ontario, Alberta, and Manitoba.

4. SunLife

SunLife Financial is one of the largest insurance companies in the world.

Its total assets exceed $328 billion, and it operates in other countries, including the United States, Australia, and the United Kingdom.

SunLife provides a wide array of options if you are looking for life insurance coverage, including various term life insurance and permanent life insurance options.

Term lengths vary with a choice of 10, 15, 20, or 30 years.

There are also options for those who do not want to go through an extensive medical underwriting process.

- Coverage amount: $5,000 to $1 million (up to $10 million for permanent life)

- Term length: 10, 15, 20, or 30 years

- Cost of 10-year term life insurance: $51.24/month (male, non-smoker, $500k coverage)

- Cost of 10-year term life insurance: $41.20/month (female, non-smoker, $500k coverage)

Pros of Sunlife

- There are several riders available, so you can customize a life insurance policy for your unique situation.

- SunLife is a reputable company with a 150-year history in Canada. It also has a strong financial rating and scores an A+ from A.M. Best Company as well as an AA rating from Standard & Poors.

- You can use the company for your other insurance needs, including personal health, long-term care, and critical illness insurance.

Cons of SunLife

- SunLife’s term life insurance policies can be significantly more expensive than other life insurance companies and their products.

- The application process is not entirely online.

- The no medical insurance policies are very expensive.

5. RBC Insurance

RBC Insurance is the insurance arm of the Royal Bank of Canada, the largest bank in Canada by market capitalization.

Its line of insurance products include:

- Term life insurance with coverage for 10, 15, 20, or 40 years and amounts up to $1 million.

- Whole life insurance with various coverage up to $25 million, cash value guarantees, and potential for dividends.

- Universal life insurance with various options and riders, plus tax-advantaged investing Term 100 life insurance with coverage starting at $50,000 and various add-ons.

Guaranteed acceptance life insurance with no medical exam and up to $40,000 coverage.

- Coverage amount: $5,000 to $25 million

- Term length: 10-40 years

- Cost of 10-year term life insurance: $29.25/month (male, non-smoker, $500k coverage)

- Cost of 10-year term life insurance: $20.52/month (female, non-smoker, $500k coverage)

RBC Insurance has an A.M. Best Financial Strength Rating of A.

Pros of RBC Insurance

- This is a reputable insurer owned by Canada’s largest bank by market cap.

- It offers a high maximum coverage amount of $25 million, and term lengths can easily be customized from 10 to 40 years.

- Surprisingly, RBC’s term life insurance premiums are very competitive, and you may be able to exchange your policy without needing a medical exam.

Cons of RBC Insurance

- The application and approval process is not entirely electronic.

- To be eligible, you must either be a Canadian citizen or a permanent resident who has lived in Canada for longer than 12 months.

6. Canada Life

Canada Life Assurance Company is a top life insurance company in Canada. With the consolidation of Great-West Life Company, London Life, and Canada Life into one company, it is also one of the largest.

This company offers several insurance products, including critical illness, life, disability, health, and creditor insurance.

For term life insurance, you can choose a coverage period starting at 5 years to as long as 50 years.

It can also be rewarded on an annual basis, converted to longer-term or permanent insurance. The two forms of permanent life insurance it offers are: universal and participating life insurance.

Canada Life has an AM Best rating of A+.

- Coverage amount: Varies; $100,000 minimum

- Term length: 5-50 years

- Cost of 10-year term life insurance: Not available online

Pros of Canada Life

- Flexible terms ranging from 5 to 50 years

- Can easily extend term life insurance or convert to permanent life

- The company is reliable and has been around since 1847

Cons of Canada Life

- You need to speak to an advisor to get a quote, as there is no online calculator to get estimates.

- Also, a minimum coverage amount of $100,000 or a $500 annual premium is required.

7. Canada Protection Plan

If you are looking for ready access to no medical and simplified issue life insurance coverage in Canada, Canada Protection Plan tops the list.

For term life insurance, there are five options to choose from, with coverage up to $500,000 (no medical) or $1 million (with medical).

It also provides permanent life insurance of 6 different kinds, including no medical underwriting.

This insurer has been around since 1992, and you can purchase its policies from 25,000+ independent advisors across Canada.

- Coverage amount: $25,000 to $1,000,000

- Term length: 10, 20, 25, and 30-year term

- Cost of 10-year term life insurance: $39.15/month (male, non-smoker, $500k coverage)

- Cost of 10-year term life insurance: $33.75/month (female, non-smoker, $500k coverage)

Pros of Canada Protection Plan

- It is great for hard-to-insure applicants who find it harder to qualify for life insurance, e.g. due to poor health or if you engage in extreme sports.

- Pricing is competitive, and you can apply online or get a quote.

- Offers other kinds of insurance, including health, travel, and critical illness.

Cons of Canada Protection Plan

- If you are in good health, you may be able to get a lower premium elsewhere by undergoing medical tests.

- The coverage amount is limited to $1 million.

8. Industrial Alliance (iA)

iA Financial Group is one of the largest insurance and wealth management groups in Canada, with $214.5 billion in assets as of September 30, 2021. It has an AM Best Rating of A+.

Its insurance arm, Industrial Alliance Insurance and Financial Services Inc., offers personal insurance products, including life insurance, car, RV, home, mortgage, health, disability, and travel insurance.

Term life insurance is available via Access Life (15, 20, or 25 years, no medical exam, and up to $500,000 coverage) and Pick-A-Term (10-40 years and coverage up to $10 million).

Its permanent life insurance product includes four products you can customize to meet your financial needs.

- Coverage amount: $10,000 to $10 million

- Coverage term: 10-40 years

- Cost of 10-year term life insurance: $49.05/month (male, non-smoker, $500k coverage)

- Cost of 10-year term life insurance: $36/month (female, non-smoker, $500k coverage)

iA Insurance also offers participating life insurance (with access to dividends) and universal life insurance. These are more expensive and come with a cash value or savings component.

Pros of Industrial Alliance

- There is flexibility in the coverage term and several permanent life insurance options.

- You can use the insurer for your other insurance needs, including home, car, mortgage, travel, and health.

- No medical exam life insurance coverage is available.

Cons of Industrial Alliance

- There may be cheaper life insurance options if you shop around and compare rates.

- The onboarding/application process is not fully electronic.

9. Desjardins

Desjardins Insurance provides life and health insurance products across Canada.

The company was founded in 1948 and had $139.5 billion in assets under management at the end of 2020. It is ranked as the fifth largest insurance company in Canada based on written premiums.

Desjardins’ life insurance products include term, permanent, participating, and universal life insurance. It also offers travel, home, auto, credit, disability, and health insurance. Its term life insurance policies provide coverage for 10, 20, or 30 years.

And you can access tax-efficient dividends or a tax-deferred savings fund via its participating and universal life insurance products respectively.

- Coverage amount: Not available online

- Term length: 10, 20, or 30 years; or until age 65

- Cost of 10-year term life insurance: Not available online

Pros of Desjardins

- Desjardins provides a wide variety of insurance products, so you can stay with one insurance company if that is your preference.

- Its life insurance policies can be highly customized with riders and add-ons.

Cons of Desjardins

- You need to speak to a representative to get a quote for term life insurance coverage. This makes it harder to compare rates online.

- Term lengths are limited to 10, 20, or 30 years.

10. Empire Life

Empire Life is a top 10 life insurance company in Canada. The company also offers investment products (annuities, segregated funds, mutual funds), and other insurance plans.

Its asset base, as of December 31, 2020, was $18.7 billion.

Term life insurance is available for 10, 20, 25, and 30-year terms. It also offers an annual renewable term policy that renews every year- a good option if you are looking for temporary coverage.

Empire Life’s other life insurance products include permanent life insurance, permanent participating life insurance, and guaranteed issue life insurance.

- Coverage amount: $50,000 to $10 million

- Term length: 10, 20, 25, and 30 years

- Cost of 10-year term life insurance: Not available online

Empire Life has an A rating with A.M. Best Company.

Pros of Empire Life

- Empire Life offers several options for both term and permanent life insurance coverage.

- You can select from 10-, 20-, 25-, and 30-year terms, and its ART product allows for flexible and temporary coverage.

Cons of Empire Life

- The maximum coverage for its Solution ART product is $499,999.

- It does not offer an online calculator you can use to estimate premiums before talking to an advisor.

Largest Insurance Companies in Canada

Based on their share of the life insurance market (i.e. the amount of premium) in Canada, the five largest life insurance companies are:

- Manulife

- Canada Life

- Sun Life Financial

- Desjardins

- Industrial Alliance

Top 10 Life Insurance Companies in Canada

To recap, the top 10 life insurance companies and providers are:

- PolicyMe

- Manulife

- Policy Advisor

- Sun Life Financial

- Canada Life

- Desjardins

- Industrial Alliance

- Canada Protection Plan

- Empire Life

- RBC Insurance

What is Life Insurance and How Does it Work?

Life insurance is a contract between you and an insurance company, where the insurer agrees to pay your beneficiaries a tax-free lump-sum benefit after your death. In return, you make monthly or annual payments to the company that is referred to as premiums.

It is designed to protect your dependents so they can meet their financial needs and replace lost income if you pass away.

According to a recent study, most Canadians (62%) with life insurance get it through their employer.

While more people appear to have bought or considered life insurance since the start of the pandemic, a good portion of them are also being sold “expensive permanent policies” they don’t need.

Types of Life Insurance

There are two main types of life insurance:

- Term life insurance

- Permanent life insurance

Term Life Insurance

Term life insurance provides protection over a specific timeframe.

For example, if you have a 10-year life insurance policy with a coverage amount of $500,000, it means that your beneficiaries will receive a $500k death benefit if you die during the duration of the policy (i.e. 10 years).

Note that your life insurance policy only remains in force while you are paying premiums. If you stop paying the agreed-upon fees to the insurer, they may cancel your policy.

The common term lengths for term life insurance are 10, 15, 20, 25, or 30 years. You can also purchase custom coverages such as until age 65.

If the policyholder is alive after the policy term ends, their beneficiaries do not receive any benefits.

Many insurers in Canada allow you to convert your term life insurance policy to a permanent one.

Permanent Life Insurance

Permanent life insurance provides coverage throughout your life as long as you continue to pay the premiums. After your death, your beneficiaries or estate receive a death benefit.

They are more expensive than term life insurance because it is guaranteed that a death benefit/cash value will be paid out.

Permanent life insurance is also often referred to as whole life insurance.

There are many types of permanent life insurance policies, including:

- Participating life insurance that pays dividends

- Universal life insurance that includes an investment component

How To Choose a Life Insurance Company

There are several questions you should be asking yourself before buying life insurance, including whether the company will be able to meet its obligations if required.

Factors to consider when comparing life insurance companies include:

Financial stability: Does the company have a healthy financial base? You can gauge the insurer’s financial strength by looking at its financial records or looking at the ratings provided by independent firms such as Moody’s, Fitch, A.M. Best, and Standard & Poor’s.

Canadians also have a guarantee via Assuris that they are protected and will receive at least 85% of their promised benefits if their life insurance company fails.

Insurance products: Does the insurer offer the type of policy you need? For example, if you have a significant medical issue and are looking for “no medical” insurance, you should look for a company that offers the same.

Insurance policies vary across providers. Some offer add-ons and riders that make it easier to get coverage befitting your situation. While most companies will offer standard term and permanent life insurance, these products can be further differentiated.

Cost: Premiums can vary widely for the same policy coverage and amount. It is always best to compare rates across several providers so you can get the best deal.

Note that a cheaper policy doesn’t always mean better. Read the fine print and take into consideration the other benefits an insurer may be providing, such as a stellar reputation and reliability.

Customer satisfaction: Read the reviews and ratings provided by other customers. A good place to start is the Better Business Bureau.

How Much Does Life Insurance Cost in Canada?

Life insurance companies and their actuaries consider several factors when pricing life insurance premiums, including:

Age: The older you are, the higher your premiums.

Sex: Statistically, women live longer than men and generally pay less for life insurance premiums.

Coverage amount: A higher coverage amount (death benefit) increases your premiums. For example, using PolicyMe’s calculator, the 40-year-old male (non-smoker) in our example above pays $26.55/month for a $500,000 coverage amount (10-year term) and $48.08/month for a $1 million coverage.

Occupation: If you have a dangerous job, your premiums will be higher.

Health history: Your health history and that of your family factor into how much premium you pay. Insurers also look at whether you are a smoker or non-smoker.

Policy length: A shorter policy term is cheaper than a longer one.

So, how much can you expect to pay for life insurance in Canada? It depends on all these factors and the life insurance company.

For the top life insurance companies on this list, the premiums varied as follows (the table only shows numbers from insurers with an online life insurance calculator) as of 2022.

| Company | Coverage Amount | 10-year Term Life Insurance (40-year-old male) | 10-year Term Life Insurance (40-year-old female) |

| PolicyMe | $500,000 | $26.55/month | $19.24/month |

| Manulife | $500,000 | $30.35/month | $25.29/month |

| PolicyAdvisor | $500,000 | $28.80/month | $20.52/month |

| SunLife | $500,000 | $51.24/month | $41.20/month |

| RBC Insurance | $500,000 | $29.25/month | $20.52/month |

| Canada Protection Plan | $500,000 | $39.15/month | $33.75/month |

| Industrial Alliance | $500,000 | $49.05/month | $36/month |

How Much Life Insurance Do I Need?

Life insurance is designed to protect those who depend on you financially.

You can also get coverage to ensure your funeral costs, debts, and tax liabilities are covered when you pass.

Experts advise you should have coverage that is anywhere from 5x to 10x your annual income. Since there is no consensus on a specific amount/coverage you should get, a practical way to estimate your life insurance coverage needs is to use DIME formula, that is:

- Debts: How much debt will your family have to deal with (excluding your mortgage balance).

- Income: Determine how long (in years) your family will need financial support and multiply that by your annual salary.

- Mortgage: Add your mortgage balance.

- Education: Estimate how much it will cost to put your kids through post-secondary education.

Life Insurance Needs Example

Let’s use a scenario to see how the DIME formula works and assume you are married with two kids (ages 8 and 10).

Debt: Your total personal and family debt balance is $30,000.

Income: Your account annual salary is $85,000, and you project that your family will depend on this income until your kids turn 18 (i.e. maximum of 10 years from today). Add $85,000 x 10 = $850,000.

Mortgage: Let’s say that your current mortgage balance owing is $300,000.

Education: You estimate that your kids will need a total of $100,000 to pay for tuition for 4-year university education. Since you already have $20,000 invested in their RESP, you add $80,000 to your coverage amount.

Using the DIME formula, you will need:

($30,000 + $850,000 + $300,000 + $80,000) = $1,260,000 in life insurance coverage for at least a 10-year term.

This is just an example, and your needs may vary.