PC Financial was re-branded as Simplii Financial direct banking in 2017, with CIBC taking over the day-to-day banking services (chequing, savings, and mortgages) under the Simplii brand.

Like other Canadian online-only banks, Simplii Financial has grown in popularity due to its “no-fee” offerings for chequing accounts and significantly higher interest rates on savings accounts than traditional banks.

Simplii Financial Review Summary

Simplii Financial

-

Savings Interest Rate

-

Banking Fees

-

Customer Service

-

Convenience

Overall

Summary

Simplii Financial is one of a few other online-only (digital) banks operating in Canada. Others include EQ Bank, Tangerine, Alterna Bank, motusbank, and Motive Financial. It offers various financial products and can easily replace your traditional bank if you intend to save on fees.

Its no-fee chequing account makes it easy to conduct unlimited transactions monthly and not worry about monthly maintenance fees. It also comes with a juicy welcome bonus. You can use the promotional interest rate if you want a short-term savings account that earns high-interest rates. However, the promo rate is short-lived, and the standard rate may be less attractive.

My Simplii Financial review covers its products and services, fees to watch out for, and its pros and cons.

Pros

- No-fee chequing account

- Competitive welcome bonus

- High promotional interest rates for new clients

- Free cheques

- Multiple financial products

Cons

- Limited in-person support

Why Choose Simplii Financial Online Banking?

If someone is leaving their brick-and-mortar bank to patronize an online-only bank, they must have some good reasons.

For starters, let’s talk about the no-fee account options available with Simplii Financial:

1. Simplii Financial No-Fee Chequing Account

With the Simplii Financial no-fee chequing account, you get the following:

- Free, unlimited debit transactions – your account comes with a Simplii debit card

- Free, unlimited bill payments and withdrawals

- Free Interac e-Transfers

- Free, unlimited access to over 3,400 CIBC ATMs in Canada

- No minimum balance requirement

- Earn interest on your chequing account balance (0.05-0.10%)

- Free personalized cheques

You can get a $400 welcome bonus when you open a new Simplii chequing account and set up an eligible direct deposit of at least $100 for three consecutive months.

Eligible direct deposits include payroll, government pensions, and employment insurance benefits.

2. Simplii Financial High-Interest Savings Account

The Simplii Financial High-Interest Savings Account has a standard tiered 0.40% to 5.5% rate. That said, they are currently offering a special promotional 6.00% interest rate for 5 months.

Other benefits that come with the savings account are:

- No minimum balance required

- No monthly fees

- Automatic savings plan

3. Simplii Financial Cash Back Visa Card

Simplii has a Cash Back Visa Card, similar to the Tangerine Cash Back Credit Card. This card offers a tonne of benefits for a no-fee card.

- No annual fee (also free for three additional cardholders)

- Welcome 10% cash back bonus for four months at eligible bars and restaurants on up to $500 spend

- 4% cash back on eligible restaurant, bar and coffee shop spending (on up to $5,000 per year)

- 1.5% cash back on groceries, gas and pharmacy purchases (on up to $15,000 per year)

- 0.50% on all other purchases

- Introductory 9.99% interest rate for six months

- Free purchase security and extended warranty insurance

- Easily send a Global Money Transfer with zero/no fees

Qualifying for the card is easy, with a minimum personal income of $15,000.

Get the card here or read our detailed Simplii Visa Cash Back review.

4. Simplii Financial USD Savings Account

Looking for a place to park your US dollars? Simplii Financial’s new USD Savings Account is worth looking at. It offers:

- One of the best exchange rates1 in Canada

- 3.05% interest rate on your balance

- Easy access to a money transfer service with competitive exchange rates

- No monthly fees or minimum balance requirement

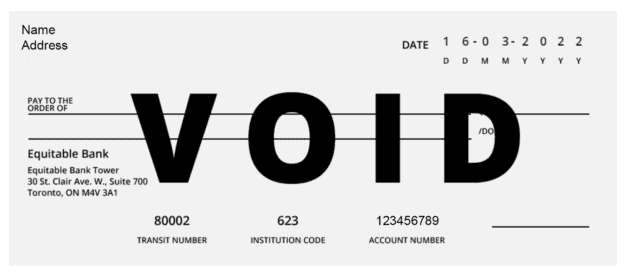

5. Simplii Global Money Transfer and Foreign Cash Service

Need to transfer money abroad? Check out Simplii’s Global Money Transfer (GMT) service, which allows you to easily send money to over 130 countries without transfer fees in as little as 1-3 business days. You can send up to $50,000 in 24 hours.

To send money, you will need your recipient’s name and address, the name and address of their bank, the bank account number, and the bank code.

Simplii Financial currently offers a cash bonus of up to $300 when you send money abroad using its GMT service.

To take advantage of this offer, use the promo code GMTEVENT.

Below is the cash back reward you get based on how much you transfer:

- <$5,000: $50 cash bonus

- $5,000 – $14,999.99: $100 cash bonus

- $15,000 – $24,999.99: $175 cash bonus

- $25,000 and over: $300 cash bonus

Need foreign currencies in cold-hard cash? You can use their foreign cash service, and they will deliver the cash to you at home, or you can pick it up at the Canada Post Office closest to you.

They provide exchanges in up to 65 currencies, and you can order cash up to $2,500 in a 24-hour period.

Another similar service for sending and receiving money (from) abroad and converting your funds into multiple currencies at the most competitive mid-market rate is Wise.

6. Simplii Financial Mortgages

Their mortgage offering includes variable and fixed-rate mortgages at competitive rates. If you transfer your mortgage from another provider, they cover the appraisal fee and guarantee your rate for 120 days.

While you are on it, check out their home affordability and mortgage prepayment calculators. To get pre-approved for a mortgage rate, you can reach them at 1-888-236-6362.

It’s always a good idea to compare the best mortgage rates available in your area before you commit to any rate. You can save thousands of dollars in interest fees this way!

7. Simplii Financial Investments

Simplii has seven index mutual funds that you can invest in a registered account (TFSA, RRSP, RRIF, and RESP) or a non-registered investment account. These funds are made available through CIBC Securities and cater to investors with varying risk tolerances and investment objectives.

Portfolio types include conservative income, income, income plus, balanced, balanced growth, growth, and aggressive growth.

Simplii Financial customers get a discount of 10 basis points on the fund’s management fee (MER), and you can invest as little as $25 per month. Read my in-depth Simplii Financial Investment Funds review.

They also offer GICs of varying maturities and rates. The minimum GIC investment is $100, and they are protected by the Canada Deposit Insurance Corporation (CDIC) up to $100,000.

8. Simplii Financial Personal Loans

If you want to borrow money, check out Simplii’s secured line of credit, personal line of credit, and personal loan offerings. Their secured line of credit requires a $150 one-time setup fee.

For competitive rates on personal loans, you can also check out these online lending platforms.

9. Convenience

You can do your banking from the comfort of your home, including sending and receiving funds through Interac (free), depositing cheques using your smartphone, and accessing thousands of CIBC ATMs across Canada.

If you need to talk to someone, telephone reps are available 24/7 at 1-888-723-8881.

10. Security

Your funds at Simplii Financial are held by CIBC. CIBC is a member of the Canada Deposit Insurance Corporation (CDIC); thus, your deposits are insured for up to $100,000.

11. Unlimited Refer A Friend Program

As a Simplii Financial customer, you can invite your friends and family to open an account using your Simplii referral link.

When they deposit at least $100 within six months of opening their account and maintain a minimum balance of $100 for at least 30 days, you both get a $50 bonus.

You can refer as many people as you’d like.

Fees at Simplii Financial

While you have access to free chequing and savings accounts, some fees apply when you need to conduct any of the following:

- Stop payments: $10 – $16.50

- Money Order and Bank drafts: $7.50

- Overdraft fee: $4.97 minimum

- NSF fees: $45

- Stop Interac e-transfer: $3.50

- Non-CIBC ATM withdrawal (Canada): $1.50

- Non-CIBC ATM withdrawal (foreign): $3.00 or more

- Inactivity fee: $20 per year

- Foreign currency conversion: 2.5%

- TFSA or RRSP account transfer: $50 per transfer

Cons of Simplii Financial Online Banking

The disadvantages below apply not just to Simplii Financial; they are downsides to online-only banks in general.

Limited Face-to-Face

There is limited human interaction when you use online-only banks. For people who only feel comfortable when talking directly to a financial representative, online-only banking may feel awkward for a while.

When Simplii Financial was still PC Financial, they had PC Pavilions inside Loblaw stores, like the Real Canadian Superstore, where you could walk in and talk to a customer service rep. Following the re-branding in 2017, these pavilions have been closed.

Cash Deposits and Daily Limits

If you deposit cash into your bank accounts frequently, you may find it cumbersome if: (1) CIBC ATMs are not close by (unlikely), and (2) You are not comfortable depositing cash through an ATM.

Additionally, there may be daily dollar limits on how much cash you can withdraw at an ATM.

My Final Verdict on Simplii Financial

My rating of Simplii Financial is based on my personal experience banking with them over the last several years.

I opened a chequing/savings account at Simplii Financial (then PC Financial) in 2012. It wasn’t intentional – I came by it after applying for the PC Financial Mastercard in-store at the Real Canadian Superstore.

I also have a line of credit with them, and the rate is very competitive compared to the other offers I have received from TD, CIBC, and RBC.

Simplii has some great and diverse offerings and can easily replace your traditional banking. For savings rates, my top choice is currently EQ Bank, with its solid non-promotional savings rates. However, EQ Bank does not offer a chequing account.

Related:

@Helen: Yes, it can feel a bit different when you are opening your first online-only savings or chequing account. However, once you get the hang of it, it’s not much different from other online accounts/services. When it comes to the interest rates, they sometimes offer some of the better savings rates out there.

Worst banking experience – they have been extremely unprofessional, my husband and i withdrew and closed both of our accounts.

@Ashley: Thanks for sharing your experience!

I am wondering anyone’s thoughts on dumping my big bank completely and making the switch. I’m nervous about overseas banking when we travel and other than that it only seems to be a minor inconvenience to make the trip to a CIBC to make a withdrawal other than making a purchase and adding any cash needed- most retailers seem to do it. Any thoughts from anyone?

I wouldn’t recommend counting on Simplii to secure your finanical needs. Best to look elsewhere for your own security.

I would not recommend banking with Simplii Financial. I had banked with PC Financial for approximately 15 years without any issues. When Simplii took over from PC, it has been an awful experience. I had a line of credit with PC for the 15 years without issue…i went to pay a bill today from my LOC to discover that SIMPLII decided to lower my LOC without advising me. Nothing told to me, they just decided to do lower it. I called them and they stated that they review their LOC’s and make decisions and that there should be a letter in the mail advising me they did that. I stated to them…Who Does That Without Advising Your Clients Ahead of Time.

VERY UNPROFESSIONAL…and obviously NOT A SECURE WAY TO BANK. Best to Look elsewhere for your PROFESSIONAL Banking Needs.

I went though something similar with Tangerine and that’s why I will be leaving them. They lowered my available amount when I deposit cheques from $2500 to $100 without telling me. I found out about it in the hard way when I needed the money.

I will not recommend this bank to anyone. They have the most frustrating customer service. I had a very bad experience with them and the issue is still not resolved until now.

Tell me why would they ask you for a FULL CREDIT BUREAU check just to open an everyday savings and chequing account? Before someone asks, No i was NOT applying for a credit card. I had no intention of applying for credit. When I asked why the need, their customer service person was not forth coming and briefly mentioned spending limits. I felt they were being dishonest why they couldn’t explain the need.

Highly disagree. Every time I have to call simplii financial to resolve a problem created by someone on their team, another issue is created.

I am constantly having to resolve issues created by errors on their team. The only reason I am still with them is because I have a loan with them I’m working to pay off otherwise I would never choose to remain with them for banking services.

Highly recommend avoiding the use of this bank.

Horrible customer service. Incredibly lengthy wait times on the telephone

froze my account due to suspicious deposit by their fraud department. Did not get the benefit of a phone call could not take any money out all weekend.

treated like a criminal after waiting 35 minutes to talk to an agent on the phone. That’s despite the fact I’ve been a customer going back to President’s choice days.

Not impressed cannot recommend these people at all

They lied to me and stole my money after they knew I was a victim of a fraudulent scam. The worst bank ever, really.

[* Shield plugin marked this comment as “Trash”. Reason: Failed Bot Test (expired) *]

Now that CIBC has taken over the day to day banking of Simplii, I find it perplexing you still have to wait 2 business days plus for a bank draft. Especially since your funds are held by the CIBC. I can think of no valid reason why a Simplii customer cannot walk into a CIBC branch and purchase a draft same day while the CIBC debits their Simplii account…..

You get what you pay for.

Long story short: one day, the bank started to ask me security questions from PC Financial times (5-year-old information about my closed account), which I could not recall. I did have my online banking password, phone password on file, my secret code word, and I was calling from a registered phone number on file. I ended up failing my security questions. I asked if I can go anywhere physically and ID myself, but was told it was not an option. I was requested to send my ID, phone bill, address, phone number, date of birth, and order of direction with my signature, which I did. I was told that something does not match. I double-checked with my online profile (which I still had access to), and all the information was correct. So my account was further locked. Another week later, I got a call from the CIBC fraud office (very shady, as it is not part of Simplii, and no instruction was given to me about such a call back from CIBC). The guy on the line was quite rude and was asking me to provide him with a credit card number outside of Simplii for confirmation for verification. I declined that, he threatened me if I don’t give him this information my account will be blocked — ten days into this mess. I called Simplii again and was told that I could go to Canada Post to verify myself personally (I was asking for this from the beginning). I was told that the email would arrive in two hours with instructions. I waited until later in the evening and decided to call again.

The agent on the phone took all the information back and told me that it takes 24h to receive the email with instructions. However, as soon as I finished the call, the email arrived right away. I’ve yet to go to Canada Post, but I anticipate that some more complications will come out. My recommendation is to stay away from financial institutions with no physical location. I would never again trust Simplii to hold my money. Ones you give Simplii you pay, you might not be able to get it back in a while. I feel like there is no proper way to complain, and all attempts come back to managers on the phone.

03/20 Update:

Submitted paperwork on 02/20, the update from Canada Post has not been received yet by Simplii. It’s been over a month without access to account.

Andriy, are you sure your accounts weren’t hacked or you aren’t the victim of an elaborate scam because the situation you described does not make sense? Why would Simplii Financial ask you security questions from PC Financial when you no longer have accounts with them? Why do you have to go to Canada Post to identify yourself when you could do that at any CIBC Branch? Simplii Financial is a subsidiary of CIBC so it’s not suspicious that you received a call from their Fraud Department, but how do you know that’s who you were actually talking to? I suggest you call CIBC at one of the telephone numbers listed on their website and arrange a meeting with someone who can straighten out the mess you seem to be in. In the meantime, do not give anyone personal information that can be used to steal your identity.

On October 25, 2018, the Bank of Canada increased its central bank rate by .25%. Simplii Financial chose not to increase its savings account interest rate so it remained at 1.25%. Since that date, even though the BoC central bank rate has NOT changed, Simplii Financial has LOWERED its savings account rate by .20% to its current interest rate of 1.05%. They did so by .05% at a time hoping their customers would not notice.

If I could give zero stars I would. I’ve been a loyal customer for years and because they partially messed up on their end on the mobile app, I’m FULLY RESPONSIBLE for the amount owed. Customer service is horrible and not empathetic. The agents give different answers for one single question. Questionable knowledge and training. I have switched back to RBC already as I’ve been with them for almost 20 years now and they haven’t let me down.

Worst bank ever never does anything on time and gives you false hope dont go to this bank ever

They keep saying they have great service. It was not my experience. every time I wanted to move money they would have me on endless hold, endless security screens even when I moved money to a linked account that I had used many times.

I got so mad on the 4th time I cancelled my account. When I inquired about my last statement they would not answer a simple question stating that require zero divulging information. “For security reason” I would need to send an email, take pics of my card, write and sign a letter and they would then get back to me in a few days. Talk about a make-work project, no wonder the service is bad.

I have a Tangerine account now that pays same interest but the service there is amazing

Simplii is horrible to deal with. Any minor issue takes countless calls over and over again to resolve. each rep promises to resolve by a certain date, then back on Friday calling back as it has not been resolved. We will be closing all our accounts shortly and HAPPY to pay fees to a decent bank. If no fees is appealing to you, keep in mind how much your time is worth when having to deal with a company for hours each week.

If you enjoy being treated like a child ,and told how much of YOUR money you are allowed to take at any one time ,this is the place for you. If you like paying to get a bank draft ,and waiting days to receive it ,knock yourself out. Calling customer service gets you policy quotes ,and if you don’t get your call dropped, no solutions. Everyone you talk with ,has a different answer to the same question. Anything out of the basic needs of banking ,seems to be a problem. At one point there was a place you could go to talk with a person ,when it was presidents choice. Now you call a voice on a phone in Toronto. I can only guess at the hell I am going to go thru when I try to close my accounts with them.

My issue with Simplii is that it appears as if no one monitors their talktous.simpli.com mailbox.

Even sent an email asking if anyone monitors the mailbox. You guessed it no response.

If you want an answer call them directly.