This Tangerine Bank review covers its product offerings, fees, pros, cons, and alternatives.

If you are one of many Canadians fed up with paying excessive monthly bank fees, the growing popularity and the number of online-only (digital) banks are good news. As per Statistics Canada, Canadians pay more than $200 in bank fees per year.

The big banks keep increasing chequing fees or continually ask you to raise your minimum balance to get a fee rebate. Believe it or not, some monthly chequing fees are as high as $30!

It’s not just chequing fees that should make you consider banking with an online-only bank like Tangerine Bank. There are so many other convincing reasons, including:

- Interest payments on your chequing account balance

- Higher savings interest rates

- Cheaper or free chequebooks

- Unlimited free transactions

- Free Interac e-Transfer transactions

- Account opening cash bonuses

- Cash bonuses for referring friends

Tangerine Bank Summary

Tangerine Bank Review

-

Savings Interest Rate

-

Banking Fees

-

Customer Service

-

Ways To Bank

Overall

Summary

Tangerine Bank is one of Canada’s most prominent online-only banks. Owned by Scotiabank, this digital bank offers a complete suite of financial products, and can easily replace your traditional bank.

Besides a few cafes, pop-up locations, and kiosks in major cities across Canada, most of your interactions will be via an online interface. Tangerine customers enjoy many advantages, including free access to over 3,500 Scotiabank ATMs in Canada (and 50,000 ATMs worldwide), a versatile mobile app, and a call centre available 24 hours a day and 7 days a week.

Learn about its high-interest savings, no-fee chequing account, cash back credit cards, investment funds, and mortgage rates in this review.

Pros

- No-fee chequing account

- Competitive savings rates

- Offers several financial products

- No-fee credit cards

Cons

- Limited in-person support

- High savings rates are promotional

Tangerine Bank Accounts and Financial Products

One question that often comes to mind when people hear “online bank” is: “Do they have all the accounts I need in one place?”

The definitive answer to that depends on what kind of banking services you are looking for. In general, Tangerine offers services that would meet the banking needs of the average Canadian.

Here’s a list:

1. Tangerine 2% Money-Back Credit Card

This credit card comes with no annual fees and pays 2% cash back on up to three categories of spending, including Groceries, Gas, Entertainment, Home Improvement, Recurring Bill Payments, and more. New clients can also qualify for a Balance Transfer promotion of 1.95% for 6 months.

The personal income requirement to be eligible for the card is $12,000 annually. You can read our detailed review.

Tangerine Money-Back Credit Card

Best no-fee cash back credit card

Annual fee: $0

Rewards: Earn up to 2% unlimited cash back in up to 3 spending categories and 0.50% on all other purchases.

Welcome offer: Get an extra 10% cash back on up to $1,000 in spending in the first 2 months ($100 value).

Interest rates: 19.95% for purchases, balance transfers, and cash advances.

Minimum income requirement: $12,000

Recommended credit score:

Fair to Good

On Tangerine’s website

Tangerine offers a second credit card, the Tangerine World Mastercard®, which also pays 2% cash back on three spending categories. In addition to earning cash back, you also get mobile device insurance, free Global Wi-Fi, rental car insurance, and Mastercard Airport Experiences Provided by Loungekey.

The Tangerine World Mastercard® has no annual fees; however, you will need a personal income of $60,000 or more to qualify. Read our complete Tangerine World Mastercard review.

Tangerine World Mastercard

Excellent no-fee cash back card with travel perks

Annual fee: $0

Rewards: Earn up to 2% unlimited cash back in 2-3 spending categories and 0.50% on all other purchases.

Welcome offer: Get an additional 10% cash back valued at $100 in the first 2 months.

Interest rates: 19.95% for purchases, balance transfers, and cash advances.

Minimum income requirement: $12,000

Recommended credit score:

Fair to Good

On Tangerine’s website

Both credit cards currently offer a 10% cash back bonus worth up to $100 in the first two months.

2. Tangerine No-Fee Chequing Account

Free chequing accounts are nearing extinction in Canada’s big banks. With Tangerine, you have access to a chequing account that offers the following:

- No monthly fees

- Interest earnings on your chequing account balance, up to 0.10%

- Free and unlimited debit transactions

- Free and unlimited pre-authorized payments

- Free and unlimited email money transfers

- Free use of Scotiabank’s 3,500 ATMs in Canada and 50,000 ATMs worldwide

- Electronic cheque depositing via the mobile app

3. Tangerine Savings Accounts

Tangerine Bank offers a variety of savings accounts you can use to grow your money. Currently, these accounts offer a standard 0.70% interest rate.

Savings accounts offered by Tangerine include:

- Tangerine Tax-Free Savings Account

- Tangerine RSP Savings Account

- Tangerine US$ Savings Account

- Tangerine RIF Savings Account

- Tangerine Children’s Savings Account

New clients earn a higher promotional rate for the first five months and 0.70% after on the general savings account. You can learn about the best savings rates in Canada.

4. Tangerine Investment Accounts

Several Tangerine investment funds and GICs cater to various investing needs, including Tax-Free Investment Funds, RSP Investment Funds, RIF Investment Funds, and Guaranteed Investment Certificates.

These funds have a 1.07% annual fee, and you can read my detailed review for more information. You can also learn how to invest in this guide to investment accounts in Canada.

5. Tangerine Mortgage

In addition to offering fixed and variable mortgage loans, Tangerine also offers RRSP loans and Home Equity Lines of Credit (HELOC).

Tangerine’s fixed mortgage rates as of April 11, 2024:

- 1-year: 7.29%

- 2-year: 6.39%

- 3-year: 5.49%

- 4-year: 5.49%

- 5-year: 5.44%

The 5-year variable mortgage rate is 6.80%.

How To Open A Tangerine Account

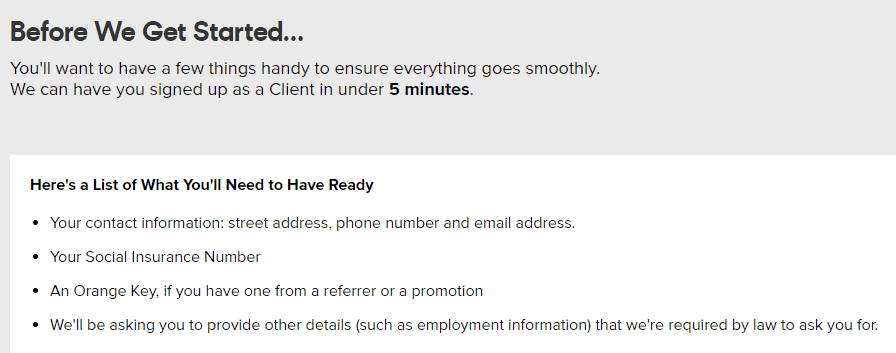

Opening a Tangerine account is easy and takes a few minutes (literally) for the initial setup. You may need to confirm your identity by visiting a Canada Post outlet with your ID to fully activate your account.

When signing up online, you will need to have the following available:

Other Tangerine Bank Benefits

Apart from saving on fees and competitive interest rates on savings and chequing, here are a few other reasons why you may choose to bank with Tangerine:

Convenience

You can stay at home and conduct your banking transactions, including free email money transfers (avoid Interac fees), deposit cheques by simply snapping a photo of the cheque with your phone, and a user-friendly website and mobile app.

Earn Cash Bonuses – Refer A Friend

After you open your Tangerine account, you will receive a personalized Orange key that you can give to friends and family. When they sign up using your key and deposit a minimum amount, you both get a $50 cash bonus. You can refer up to three friends every year.

Great Customer Service

My experience so far with the Tangerine customer service folks has been great. You can reach them 24/7 at 1-888-826-4374 (English) or 1-844-826-4374 (French).

Safety

Tangerine is a member of the Canada Deposit Insurance Corporation (CDIC). This means that similar to any other big bank, your deposits are insured for up to $100,000.

Tangerine Fees

Tangerine is attractive with its no-fee savings and chequing accounts. However, there are some fees you cannot avoid if you do any of the following:

- Cheque books (50 cheques) – first book free, $20/book after that

- Stop payments – 1 free/year, $10 each after that

- Canadian drafts – $10

- NSF fee – $40

- Non-Tangerine/Scotiabank ATM (Canada) – $1

- Non-Scotiabank ATM (foreign) – $2

- Overdraft fee – $5/use

Cons of Tangerine Bank (Online Banks)

Low Standard Interest Rate: After the promo period ends, the interest rate falls to 0.70%, which is not much better than the big banks. Neo Financial offers a standard high-interest rate and is non-promotional.

Not Brick and Mortar: Some people want to conduct every financial transaction in person. There’s really no increased security from doing so, but if that’s what you prefer, online-only banks may not suit your needs.

Cash Deposits: If you make a lot of cash deposits (including small change – coins), an online-only bank may be somewhat cumbersome. You want to be able to access a small local bank branch easily.

Cash Withdrawals: There may be daily dollar limits on how much you can withdraw per day using your debit card at ATMs. Additionally, transactions like bank drafts may take longer to process.

Tangerine Review – Final Verdict

If you want to join an online bank and save on chequing fees, Tangerine is one of the few online banks in Canada that offers this benefit.

If you want to grow your account with a high-interest savings rate or high-interest GIC, an online bank such as Neo Financial offers a more competitive rate for your money. However, it does not offer a chequing account like Tangerine.

Other competitor online banks in Canada include Simplii Financial, Alterna Bank, and Motive Financial.

Related: Tangerine Money-Back Credit Card vs SimplyCash Card from Amex.

Hi Enoch,

I’m a big believer in online banks, banking with Ally for around 8 years. The only reason I would want a brick-and-mortar bank is if I needed to deposit lots of cash, and I’d prefer a credit union for that purpose, since they generally provide higher interest and lower fees.

Cheers,

Miguel

@Miguel: Good point on the credit unions. You can get the best of both worlds – cheaper fees and maybe even some juicy share of profits.

Cheers.

Thanks for this review, Enoch!

I have thought of joining Tangerine only after I quit my bank job (one of this days) LOL. We are forced to have accounts with them and it’s convenient since they don’t charge any fees or whatsoever, and no min. balance required if you’re an employee. Oh man, I can’t imagine the progress I will have to go through when I transfer everything out — checkings, TFSA, RRSP, and the fact I have a few funds with them where they give us a lower MER. I don’t wanna think……. LOL

Currently, I only have the credit card with Tangerine, but no checkings/savings. I wonder if this $50 bonus would still apply if I join one of these days even though I am already signed up with them for CC? I have no idea how that would work! haha…

BTW, have you ever heard of EQ bank? I always see them when I’m google searching but I have no idea how their service is… the downfall is probably not having access to a bigger bank to pull money out.

@Finsavvy Panda:

Well I think having the access to no-fee banking is great while you have it…you can save money in the meantime. When you choose to leave, hopefully, it will be much easier to transfer your accounts.

I’m not sure if you will still be able to claim the cash bonus if you sign up for a savings/chequing account. You can try and see what happens.

Yes, I have heard of EQ Bank and currently working on a review! 🙂 You are right about the cons…but right now they have one of the best savings interest rate out there.

I am paying a monthly fee at my bank for checking, VISA & safety deposit box but I may still check out the Tangerine account. $50 of free money!

@Caroline: Absolutely – and if you open a checking account at the same time, you can get up to $150 in cash bonuses!

Hi Enoch -thanks for your previous feedback on other questions I’ve had.

With either the TFSA or the High interest savings account could I simply put… say $100,000 in for 6 months and then close the account once the higher interest period ends?

That wasn’t quite clear in your overview and would of course be ideal for my financial situation at the moment.

Hi Chris,

Absolutely, if your plan is to derive “better” than average returns on funds you only want to keep in a savings account for the short-term. The Tangerine savings (as of today) appears to be offering the highest promo savings rate and there is no penalty for withdrawing your funds and closing your account after 6 months as far as I know.

Just curious but do you get any referral bonus when someone creates an account via your link?

@Steven: Yes, I may, as indicated in the disclosure I have at the beginning of the post.

What are the foreign-currency conversion fees at Tangerine Bank?

Hi Enoch, I’m in the process of opening a Tangerine account. Can you provide your Orange key? I would be pleased if you got a referral for this, it’s certainly your evaluation that has me switching my savings account. BTW I’m with Simplii, have been for years and I’m a happy customer, mainly because of their PC points. Who can argue with free groceries? I just like the higher interest rate that Tangerine is offering.

RSP GIC renewal process inconvenient and error prone. Should give option to immediately reinvest principal and interest in new different term. Currently must cash out and reapply. Very inconvenient.

Rate zero stars.

Website slow as a snail as well.

One of the worst bank if you need to contact anyone at Tangerine, best of luck with that.

Take a look at their contact us page, the only way to contact them is via

1. Snail mail

2. 1-888 number where you need to wait 30+ min … on a good day!!

And their chatbot does NOT work.

TD is the absolute worst bank for a chequing account. Poor poor customer service. The 1-866-222-3456 TD easy line number is unbelievable! I was on hold for 2 straight hours just to be continuously told that “ my call was important to them, and my call would be answered by the next available agent” and then hung up on. For 5 straight days! A total of 7 hours on hold just to finally speak to someone and have them tell me I have to visit a branch. At the branch, they tell me to call the number!! Soo frustrating! Never will I ever let anyone I know use that bank again!

Sorry to hear about your experience.