A Scotia iTrade brokerage account offers do-it-yourself investors access to various investment accounts, products, and trading platforms.

Owned by one of the biggest banks in Canada, Scotiabank, it is one of a few online brokers to offer commission-free ETFs.

Scotia iTrade’s flat-fee trading commissions are high compared to the pricing on independent discount brokers such as Wealthsimple Trade and Questrade.

This Scotia iTrade review covers its account offerings, trading platforms, fees, pros and cons, and alternatives.

Scotia iTrade Summary

Scotia iTrade

Overall

Summary

Scotia iTrade is a division of Scotia Capital Inc. and the online brokerage arm of The Bank of Nova Scotia (Scotiabank). It is one of the largest brokerage platforms in Canada and offers various investment accounts, including RRSPs, TFSAs, RESPs, and multiple non-registered accounts.

Flat trading fees on this platform are high at $9.99 per trade, and you also pay a yearly fee if you have a small balance. Investors who place 150 or more trades per quarter qualify for active trader pricing, which is significantly lower.

Pros

- Robust trading platform for experienced and active traders.

- Has a referral program.

- Access to a practice account.

- Young investors under 26 years can waive the quarterly fee.

- Active traders get a discount on trading fees.

Cons

- Flat-rate trading fees are high.

- A $100/year fee for small accounts increases costs for those investing small sums.

- The advanced trading platform and tools cater to active traders and high net worth investors.

Scotia iTrade Account Types

Traders using Scotia iTrade can access registered, non-registered, and non-personal accounts.

The registered accounts you can open on the platform include:

- Tax-Free Savings Account (TFSA)

- Registered Retirement Savings Account (RRSP)

- Registered Retirement Income Accounts (RRIF)

- Registered Education Savings Plans (RESP)

- U.S. Dollar Registered Accounts

For non-registered accounts, you can open a Scotia iTrade Cash Account, Scotia iTrade Margin Account, and a Scotia iTrade Cash Optimizer Investment Account.

Businesses can also use the platform for their direct investing needs.

Non-personal accounts available include:

- Investment Club

- Sole Proprietorship, Corporate, and Partnership Accounts,

- Trust or Estate Accounts

- Accounts for Non-Profit Organizations

Practice accounts are available if you want to test the trading platform without using real money.

Scotia iTrade Investment Types

The investment products you can buy on Scotia iTrade include stocks, Exchange Traded Funds (ETFs), mutual funds, bonds, new issues, GICs, and options.

Scotia iTrade was the first bank-owned brokerage in Canada to offer self-directed investors access to sustainable investing tools.

You can use the tool to rate over 1,200 companies on the Toronto Stock Exchange and Russell 1000 Index based on their performance with Environmental, Social, and Governance (ESG) factors.

Scotia iTrade Fees

Scotia iTrade’s trading commissions are among the highest in the industry at $9.99 per equity trade. This is similar to the base fee for TD Direct Investing and a few cents more than RBC Direct Investing and BMO InvestorLine.

Compared to these big bank offerings, Wealthsimple Trade does not charge trading commissions when you trade stocks and ETFs.

| Commissions | Stocks | Options |

| Standard fee | $9.99 | $9.99 + $1.25 per contract |

| Active trader pricing | $4.99 | $4.99 + $1.25 per contract |

| Phone-assisted trades | $65 | $65 |

You must place 150 or more trades per quarter to qualify for active trader pricing.

Fixed-income asset trades placed online cost $1 per $1,000 of face value. A minimum commission of $24.99 applies to each trade. If placed over the phone, an extra $65 fee applies.

For Exchange Traded Debentures, the fee is $1 per $1,000 of face value. A minimum commission of $24.99 applies to each trade. If you use the assistance of a phone representative, an extra $65 fee applies.

Scotia iTrade has 104+ commission-free ETFs you can buy without paying a trading commission when you execute your trade online or through TELE-TRADER and hold the ETF for at least one business day.

Regular trading fees apply when you sell.

Scotia iTrade Administrative Fees

A “low activity account administration” fee of $25 per quarter is charged if your account balance is $10,000 or less (non-registered accounts).

A $100 registered account fee is levied annually on RRSP, RRIF, LIRA, and LIF when the balance is less than $25,000 (sometimes waived).

These fees are waived if you are under 26 years of age.

Other fees to watch out for:

- Account transfer out: $150

- Copies of statements or confirmations: $5 each

- Canadian Controlled Private Corporation (CCPC) set up: $300

- CCPC annual fee: $100

- Monthly paper statement fee: $3

- Unclaimed account fee: $60 per quarter

Related: Best Online Stock Brokers in Canada.

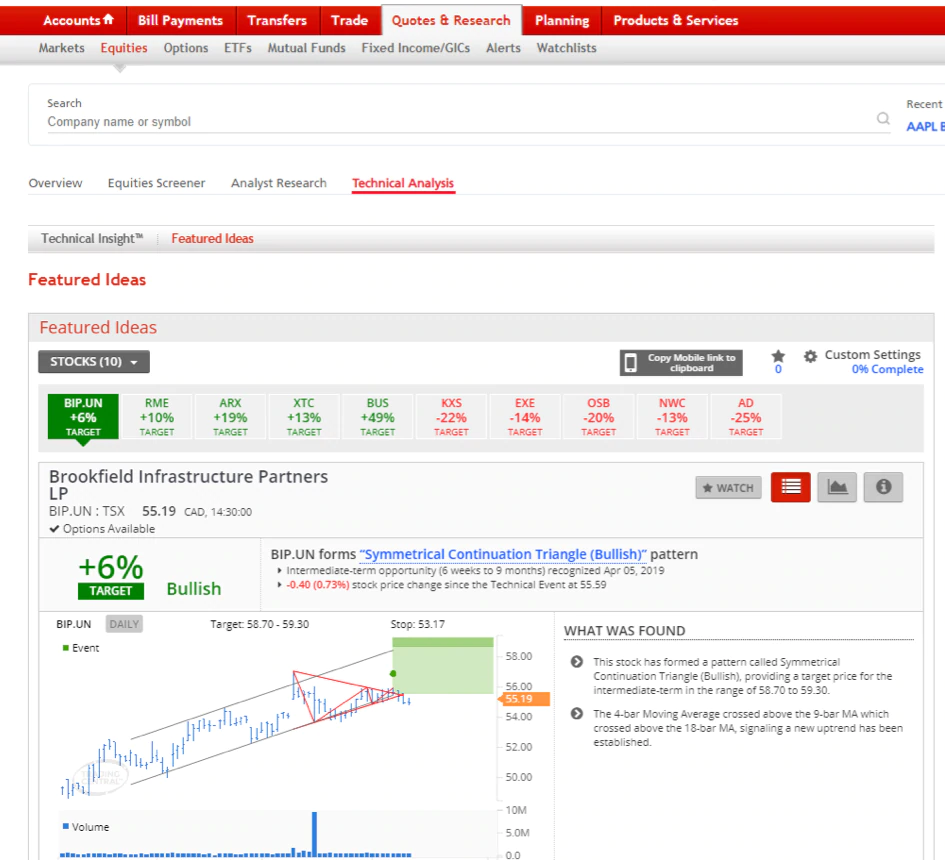

Scotia iTrade Trading Platforms and Tools

Scotia iTrade clients have access to several trading platforms and research tools.

Scotia Online is the standard interface that is integrated with your banking account. It offers access to research reports from Reuters, ValuEngine, Scotiabank Global Banking and Markets, Sabrient, and more, plus portfolio charting, sustainable investing, and screeners.

The Scotia iTrade mobile app can be used for buying and selling stocks and ETFs on the go. It is available on the App Store and Google Play.

Experienced investors and active traders can use the Scotia iTrade Flight Desk platform for access to powerful tools of options trading, customizable layouts, advanced strategies, in-depth analysis, heat maps, and level 2 real-time streaming quotes.

There is a fee for using the Scotia iTrade Flight Desk Standard or Premium service:

| Trades or total assets per quarter | Standard Service | Premium service |

| $50-$250k assets | $29.95 | $69.95 |

| 0-8 trades, or <$50k assets | $39.95 | $79.95 |

| 9-29 trades | Free | $39.95 |

| 30-149 trades or >250k assets | Free | Free |

| 150+ trades | Free | Free |

Scotia iTrade has a well-developed listing of free educational resources for new and experienced investors with how-to videos and guides.

The Scotia iTrade iClub has two membership tiers.

If you make 150+ trades per quarter or have $1 million in assets with Scotia iTrade, you gain Platinum iClub membership and enjoy;

- Dedicated personalized service

- Free Flight Desk Premium service

- Low commissions starting at $4.99 per trade

- Access to iClub member-only events

A Gold iClub membership is open to clients who place 30 or more trades per quarter or have $250,000 in assets with Scotia iTrade. It offers:

- Dedicated personalized service

- Free Flight Desk Premium service

- Annual administration fee waivers on registered accounts

- Access to member-only events

Scotia iTrade Pros and Cons

What are the benefits and downsides of Scotia iTrade?

Pros of Scotia iTrade

- A robust trading platform for experienced and active traders.

- Access to a practice account if you want to test-run the platform without committing funds.

- Young investors under 26 years can waive the low activity quarterly fee.

- A referral program that pays you up to $100 or 50 free equity trades per referral.

- Active traders and high-net-worth investors get a discount or commission and free access to the Flight Desk platform.

- Offers 100+ commission-free ETFs.

- Newcomers to Canada get ten free equity trades through the Start Right Program when they invest a minimum of $1,000 in a Scotia iTrade account.

- Access to a tool that helps to identify sustainable investments.

Cons of Scotia iTrade

- The standard trading commissions on this platform are some of the highest. You will get lower fees to trade stocks and ETFs on Questrade and Wealthsimple Trade.

- The $25 quarterly low activity fee can add up to $100 annually for small accounts and newbies.

- The advanced trading platform and tools cater to active traders and high-net-worth investors.

Is Scotia iTrade Safe?

Scotiabank is one of the largest banks in Canada and has been around for over 188 years.

Scotia Capital Inc. is registered by the Investment Industry Regulatory of Canada (IIROC) and is a member of the Canadian Investor Protection Fund (CIPF).

The CIPF insures your account up to $1 million against a member firm’s insolvency.

Also, Scotia iTrade offers a security guarantee and will cover funds and securities unlawfully removed from your account due to fraudulent and unauthorized online transactions in your Scotia iTrade account (terms and conditions apply).

Scotia iTrade vs. Alternative Platforms

The table below shows how Scotia iTrade compares to RBC Direct Investing, Wealthsimple Trade, and Questrade.

| Scotia iTrade | RBC Direct Investing | Wealthsimple Trade | Questrade | |

|---|---|---|---|---|

| Stock trading fee | $9.99 | $9.95 | $0 | $4.95-$9.95 |

| Options fee/contract | $9.99 + $1.25 | $9.95 +$1.25 | N/A | $9.95 + $1 |

| Commission-free ETFs | 100+ | No | Yes (free to buy and sell) | Purchases are free; fees apply when you sell |

| Trading commission discount | $4.95/trade for active traders (stocks) | $6.95/trade for active traders (stocks) | N/A | $4.95/trade for active traders (stocks) |

| Types of accounts | TFSA, RRSP, RRIF, RESP, cash, margin, investment club, trust, corporate, partnership, non-profit organizations | TFSA, RESP, RRIF, RRSP, margin, corporate, cash investment club, partnership | TFSA, RRSP, personal non-registered | TFSA, RESP, RRSP, LRSP, LIF, LIRA, RRIF, margin, corporate, partnership |

| Minimum investment | None | None | None | $1,000 |

| Maintenance fee | $25 per quarter if balance is ≤ $10,000 | $25 per quarter if balance <$15,000 | None | None |

| Platform | Web and mobile app | Web and mobile app | Mobile app; web and mobile app for robo-advisor | Web, mobile app, desktop app |

| Transfer fees waived? | – | Up to $200 with transfers of $15,000+ | Up to $150 on transfers of $5,000+ | Up to $150/account |

| Other features | Sustainable investing tools; referral program | Robo-advisor platform; RBC Investease | Access to low-cost robo-advisor (Wealthsimple Invest) | Access to low-cost robo-advisor (Questwealth) |

| Promotion | – | – | Get a $25 cash bonus (Wealthsimple Trade) when you deposit $150+ | Get $50 in free trades when you invest at least $1,000 |

| Learn more | – | Learn more | Learn more | Learn more |

Scotia iTrade FAQ

Active traders get a discount of $5 per trade for equities and options ($4.95 vs. $9.99). To qualify, you must place 150 or more trades per quarter. Investors with $1 million in assets also enjoy this discount. The $25 quarterly low activity fee is waived for clients under age 26.

You can easily transfer funds from your Scotiabank chequing or savings account. You can transfer funds from another financial institution by filling out an electronic funds transfer form. Lastly, you can transfer existing investments from another bank to Scotia iTrade by completing a transfer authorization request.

Call 1-888-872-3388 from Monday to Friday (8am to 8pm ET) or email [email protected].

No fee to sell the identified ETF’s if held for the minimum one business day period.

I’ve been trying unsuccessfully for over a month to get thru to Scotia iTrade to discuss my account and because they refuse to answer I keep hanging up after being on hold 45 minutes or longer. Today I’m now on hold for TWO HOURS and they still haven’t answered so I’ve spent my time on hold researching what other company I’ll transfer my share to rather than deal with a company who clearly does NOT value customer service or it’s clients. I will NEVER recommend Scotia iTrade!

They are the worst in sevice. I have a gold membership and it doesn’t help in the least.

I have been trying to transfer money to them for a month from Tangerine (which is owned by Scotia). ITrade says this poor service is caused by covid but the long waits and poor service started long before covid.

I have found Scotia itrade to be horrible overall. The entire system will go down for extended periods during market hours. Phone wait times are regularly more than one hour. Trades are expensive. Their flight desk pro screen crashes often. Trades can be slow to be acknowledged.

Hundreds of one star reviews confirm this.

Not sure how IROC allows itrade to operate in this manner and put clients funds at risk.

If you are considering ITrade – don’t ! The worst service ever. The transferring of my Rrsp to a Riff should have been a no brainer. It has been a nightmare and like others have waited hours to speak to someone; they have never resolved my problem. It has been six weeks and I have had no access to the Riff they say was created but not shown on my account. The paper work hasn’t been done to give me access to my own account. I sent it months ago. They have no plan other than waiting for someone to process, they say they will look for it and call back. No one calls back, emails to their complaint section aren’t answered. CRA has better service standards! It is upsetting and stressful. I can’t even move my account as it is not fully opened. The worst customer service I have ever encountered.

I have experienced the same as you with iTrade. Been waiting for going 2 months now for my approved TFSA trading account to be opened. Have tried numerous times to call and left on the phone for hours to no avail. Also,sent emails, but no success. It is horrible service and I will not be doing business with iTrade. Will use a competitor instead….

3 hrs on hold yesterday and their system keeps telling me insufficient funds when trying to cash out my shares. Will be looking elsewhere

Been trying to get my account figured out (can’t trade right now) and I’ve called every day for the past 4 days to try and get through to them to get it fixed. Called every day after the hours of trading and keep waiting…4th day in the row as I sit here and type this comment…Scotia Bank’s investment desk is no help either as they apparently don’t have “access” to iTrade. I have a couple stocks that are losing money now and I have no way of selling the shares right now. If you are looking to trade and have no issues, their platform is fine, but there are other platforms with zero fees, so you mine as well head over there considering customer service at iTrade is non-existent.

Usual call wait time is more than 3 hrs (am still holding for a live person), if you can actually get someone to assist before you die…

I have been trying to get through to itrade customer service but it is next to impossible some phone calls I was on hold for over 3 hours. I have sent them emails and got no response either, being a gold member doesn’t help either. Lately the DRP program; they are debting your account and not adding the stocks and it is taken days later for them to reinstate the funds. This could be an issue for TFSA accounts. I will be looking to transfer my accounts out.

Worst customer service on the planet! Was on hold for over 5 hours across two days. They don’t respond to e-mails either. The phone system doesn’t indicate place in queue nor does it give an estimated waited time, both of which are basic customer service features for an organization this large and given the fees they charge. They blame Covid, but I’ve experienced this cavalier attitude long before Covid and the least they can do is hire more staff when wait times get into hours, while their profits are still in the millions! It shows a total disrespect and mercenary disregard of their customers. I will be looking at other options for my investment trading. Do not do business with Scotia iTrade!

Scotia Itrade is not great and getting worse every year lately. Platform crashes frequently and it can take 45 minutes to get a human on the phone. I will be moving to another brokerage as it becoming an exercise in frustration dealing with this service.

iTrade is the WORST platform I do NOT recommend it, their customer service is absolutely BRUTAL… DO NOT GET AN ACCOUNT WITH THEM.

TERRIBLE!!! I have been with Scotia Itrade for 20 years. In the last couple years they have turned into the worst brokerage that i can imagine. There is virtually no customer service . I the last 18 months they have costed me hundreds of thousands of $$$ due lack of support during time sensitive situations. I cant even get support to close my 7 trading accounts. Im terrified that i will never see my funds again. If you value your Money STAY AWAY

I too find iTrade customer service the worst. Over last 6 months i have sent at least 6 emails on routine inquires. Not one has even been acknowledged. I dont buy the Covid excuse as we have been in this situation for a year now. They should have learned to adapt by now.

ITrade Flightdesk is a joke if you use Apple product as you cannot access it.

I think now i have had it with iTrade this time coz what they are doing in my account is not right. I have three stocks that i bought and i cant sell them coz each time i try their system tells me not found so now i can only sell them if i call in and once you do that they charge you a fee for that service. Getting in touch with customer care is close to impossible coz honestly having to wait for 3 hours only to be answered for some who cant even help you. I don’t reccomend iTrade to anyone who doesnt want headaches

I am a Platinum member and I have to say Scotia iTrade has the worst service I have ever experienced.It took me 2 1/2 months to get my wife and I TFSA transfered. I would get up at 5:00AM as I am on the west coast and call the minute they were open and then wait 1-2 hours. They don’t answer emails.I half to stay with them as it is too complicated to move. I do like their order placement process. I do over 150 trades a quarter. I am thinking of trying flight desk but am concerned if there are problems it would take forever to get them solved. I did look at Quest trade and opened a practice account but I did not like it.

I have been with Scotia iTrade since day one when it took over for the American company some 12 years ago. For the first 10 years or so it wasn’t too bad. But right now the service is not only the worst, holding the telephone line for over four hours and not getting any one to pick it up, they steal money when you transfer from your bank account to the Buying Power.

– I wrote even to Mr. Porter, the CEO of Scotia Bank, and never got a response.

I am in the process of changing my portfolio to another and hopefully a better broker.

This is not so much a review on itrade, more of a misleading price comparison to wealthsimple.

Wealth simple charges between 0.5% (example $500.00 on $100,000) and 0.4% on accounts with deposits over $100k ($1000.00 on $250k of deposits) annually.

From what I hear wealthsimple is great, but just like itrade, an old school broker or any other investment tool they serve a purpose and provide a benefit for certain clients.

And like many other reviewers here, I am and have been using itrade during the pandemic and getting through was a nightmare (however my friends on other platforms said it was the same for them TD & BMO).

I previously used TD and BMO as well. Dollar for dollar the bank options offer a lot of product and very similar pricing.

@Matthew: The comparison is of Scotia iTrade vs. Wealthsimple Trade (not Wealthsimple Invest). These are two different products and Wealthsimple Trade does offer free stock and ETF trades. It appears you have your products mixed up.

Although your website says you updated this article on March 28th the information is out of date. iTrade offers 104 free to buy and sell ETFs. iTrade/Scotia offers many options to reduce trading commissions. I pay $4.99 plus with their Ultimate package and other incentives, credits, and free trades are offered regularly. If you dig a little deeper you’ll find they are quite inexpensive and offer a ton of resources, tools, and incites not available with the pay for order flow platforms.

@Craig: The number of commission-free ETFs has been updated.

Could you refer me for opening an iTrade account please? Thanks

@Jason: Unfortunately, I don’t have a referral link for Scotia iTrade.

I have had similar experience with iTrade just horrible customer service. First call it took 4 hours to talk to someone and when I did get through they gave me wrong information. I was so mad I decided to move my accounts over to another company. Its been a nightmare they have locked my accounts come up with all sorts of excuses why I can’t transfer like I have to transfer defunct stocks to iTrade etc. So far its been over a month and still no transfers. I have wealthsimple and CI investments which are both far superior. It just gets me how iTrade can be so bad and continue to be in business. My advise stay clear of iTrade.

I am a platinum member due to having $1M in invested assets. I would like to correct one item in the article: platinum membership alone does not get you the discounted rate of $4.99 per trade. Only doing a minimum of 150 trades per quarter gets you that. I queried the bank and they replied today to confirm. I still pay $9.99 per trade. Also I have not experienced the negative customer service encounters mentioned by others in these comments.