This is an extensive guide to Canada’s retirement income system. It summarizes the retirement income sources available to seniors and also gives pointers on how to get started on your retirement planning and your journey toward financial freedom.

You will learn about the Canada Pension Plan, Old Age Security, RRSP, Guaranteed Income Supplement, company pensions, and how to calculate your retirement income needs.

To make navigation easy, I have added links to specific topics you can jump to using the links below. If you want to read the entire guide on retirement income in Canada, just keep scrolling.

Let’s get started!

Topic Areas Covered:

- Canada’s Retirement Income System: A Walk Down Memory Lane

- Pillar One: The Old Age Security Pension Explained

- Guaranteed Income Supplement, Allowance, and Allowance for the Survivor

- Pillar Two: The Canada Pension Plan Explained

- Pillar Three: Workplace Pensions and Voluntary Retirement Savings Plans

- Registered Retirement Savings Plan Explained

- Don’t Overlook the TFSA

- How Much Money Will You Need in Retirement?

- No-Sure Guarantees

- Do-It-Yourself Investing

Canada’s Retirement Income System: A Walk Down Memory Lane

Retirement is a relatively new phenomenon in Canada, and frankly, the same goes for the entire world. Around 100 years ago, people worked till they dropped dead or were unable to continue to work and were then provided for by their extended families.

No gold-plated pension, no government assistance or benefits, no – nothing!

The early beginnings of the retirement income and benefits system in Canada are remarkable.

The first semblance of a retirement savings plan was introduced in 1908 as the Canadian Government Annuities Act. The idea was that you could buy annuities priced for varying lengths of time and receive fixed annual payments accordingly.

Times were tough! The First World War came and went, and since very few could afford the “luxury” of annuities, many aged Canadians wallowed in extreme poverty.

Government assistance to retirees, similar to what we have in the Old Age Security (OAS) as it is known today, first came into existence in 1927. That year, the Old Age Pension Act was enacted, and seniors aged 70 years or older became eligible for a maximum pension of $240 annually. This pension was “means-tested,” and only those with consolidated annual incomes below $365 could benefit.

In 1952, the Old Age Security Act was passed, generously expanding the availability of government retirement benefits to all men and women who were 70 years of age or older, irrespective of their income. The benefit amount was $40 per month or $480 per year.

Fast forward to 1957, and the Registered Retirement Savings Plan (RRSP) was introduced to cater to employees who did not have the luxury of a company-funded pension plan. The contribution limit was restricted to 10% of the previous year’s income, up to a maximum of $2,500.

In 1966, in a bid to boost the retirement income available to seniors, the Canada /Quebec Pension Plan (CPP/QPP) was introduced. Unlike the OAS, the CPP and QPP are contributory and based on an individual’s employment history, contributions, and employer contributions.

To make it universal and fair, the CPP/QPP was also made mandatory for anyone earning employment income.

In 1967, the Guaranteed Income Supplement (GIS) was introduced as a supplement to the Old Age Security program. It was designed to temporarily provide additional income to seniors not yet benefitting from the CPP. In the 1970s, when poverty was noted to be prevalent among the majority of seniors, the GIS became a permanent part of Canada’s retirement benefits system.

In the last 50 years or so since the introduction of the GIS, lots of changes, increases, updates, and reforms have been implemented in Canada’s social legislation and benefits system. Compared to what was available during the 18th and 19th-century era, Canadians have come a long way – and for the better.

The Three Pillars of Retirement Income in Canada

Today, Canada’s retirement benefits system is built around three main pillars:

- Universal Government Benefits: Old Age Security (OAS) and Guaranteed Income Supplement (GIS)

- Canada /Quebec Pension Plan

- Voluntary Retirement Savings Plans: including Employment Pension Plans (Defined Benefit and Defined Contribution Pension Plans) and Individual Retirement Savings (RRSPs – Group, Spousal, and Pooled).

Pillar One: Understanding The Old Age Security (OAS) Pension

The Old Age Security (OAS) pension is one of the three main pillars of Canada’s retirement income system. The two other pillars are the Canada Pension Plan (CPP) and Employment Pension Plans/Individual Retirement Savings.

The universal OAS pension is a taxable monthly payment available to seniors who are aged 65 and older and who meet the eligibility requirements. It was designed to replace 15% of a senior’s pre-retirement salary. Unlike the CPP, Old Age Security benefits are not tied to your employment history. You may be eligible to receive the OAS pension even if you have never worked or are still employed.

More than 6 million seniors receive the OAS annually, and it is forecasted that annual basic OAS pension costs will increase from $46.3 billion in 2020 to $94.3 billion by 2035.

Eligibility for the Old Age Security Pension

- You must be at least 65 years of age.

- If living in Canada: You must be a Canadian citizen or legal resident and must have lived in Canada for at least 10 years since you turned 18.

- If living outside Canada: You must have been a Canadian citizen or legal resident before you left Canada and must have resided in Canada for at least 20 years since you turned 18.

- There are a few other scenarios where you may be eligible for the OAS; for example, if you have lived in a country with which Canada has established a social security agreement.

How To Apply for OAS Pension

If you wish to start receiving your OAS pension at 65 years of age, you can send in your application the month after you turn 64. Service Canada will sometimes enroll seniors automatically and send them a notification letter.

If you are not automatically enrolled, you can complete and mail the Application for the Old Age Security Pension Form to them.

How Much OAS Benefit Will You Receive?

The amount you will receive monthly depends on how long you have lived in Canada after turning 18.

To qualify for a full OAS pension, you must have lived in Canada for at least 40 years after age 18. You will receive a partial pension benefit if you haven’t resided in Canada for the full 40 years.

The partial pension benefit is 1/40th of the full pension amount for each complete year you have lived in Canada after age 18. For example, if you had lived in Canada for 20 years as an adult, you may qualify to receive 20/40th or one-half of the full benefit.

OAS benefits are adjusted quarterly in January, April, July, and October based on the prevailing Consumer Price Index. For the second quarter of 2023 (i.e. April to June), the maximum monthly OAS benefit is $691.00 if you are aged 65 to 74 and $760.10 if you are 75 or older.

OAS Deferral Option

Since July 1, 2013, individuals have been allowed to voluntarily defer their OAS pension for up to 5 years after the date they become eligible. By deferring when you start taking your OAS pension, you become eligible for a higher monthly pension later.

For every month the OAS is deferred, the monthly pension amount increases by 0.6% up to a maximum of 36% at age 70.

OAS Clawback

What is generally referred to as the OAS clawback is officially known as the OAS recovery tax.

What this means is that since the OAS pension is a means-tested benefit, not every that is generally eligible for the maximum or a partial amount will get it.

Your OAS benefit will be reduced by a clawback if your net income for the previous calendar year exceeds the income threshold set by the government for that year:

- For the 2021 income year: $79,845 (applies to July 2022 to June 2023)

- For the 2022 income year: $81,761 (applies to July 2023 to June 2024)

If your net income exceeds this amount, you must pay back 15% of the excess income up to a maximum of the total OAS benefit received. This deduction is like an additional 15% tax on top of your current tax rate.

The reduction in OAS benefits from January to June 2023 is based on your net income for the 2021 tax year, while the reduction in benefits for July to December 2023 is based on your net income for the 2022 tax year.

Clawback Example: Assume Clark, age 65, is recently retired. His net individual income (including the OAS pension) is $95,000 for 2021. He meets the eligibility requirement for a full OAS pension for the July 2022 to June 2023 benefit period.

However, since his net income exceeds the threshold amount of $79,845 (for 2021), he would have to pay back some of his OAS pension.

Net income: $95,000

Minus threshold amount: $79,845

Excess income: $10,155

Clawback (15% on excess income): $1,523.25 or $126.94 monthly.

Based on a maximum monthly OAS payment of $691 (for those aged 65 to 74), Clark’s benefits would be reduced by $126.94, and he will receive $564.06.

For the April to June 2023 quarter, if your net income exceeds $129,757, your OAS benefit will be reduced to zero.

Strategies to Minimize the OAS Clawback

To limit your OAS clawback, consider the following strategies:

Income Splitting

Splitting of retirement income between spouses, including income from Registered Retirement Income Funds, annuities, and CPP, can lower individual income for either spouse and help them minimize or avoid OAS clawbacks.

Maximize Your TFSA

Income from investment or savings in Tax-Free Savings Accounts (TFSA) is tax-free, making TFSAs an excellent tool for minimizing your taxable income and OAS clawback.

Withdraw RRSP Early

Consider withdrawing some of the funds from your RRSP if you have a hefty RRSP account and experience any periods of low taxable income prior to age 65 or retirement. This may lower your taxable income later and maximize the OAS benefit you qualify for in retirement. The funds you withdraw can be re-invested in a tax-efficient account like the TFSA if you have contribution room.

Contribute To Your RRSP

You can continue to contribute to your RRSP until you turn 71 if you have a contribution room or have any employment income. RRSP contributions lower your net income for OAS calculations.

Make Spousal RRSP Contributions

If you are over age 71 and your spouse is not, you can continue to make spousal RRSP contributions to their RRSP if you have unused contribution room. RRSP contribution deductions lower your taxable income.

Evaluate Your Income Sources

Income from non-registered investments is treated differently at tax time. For instance, only 50% of capital gains are included in taxable income, while interest from GICs and savings are fully taxable. Dividends are grossed up to 138% before they are taxed. When a greater portion of your investment income falls in the taxable category, your total income may be pushed over the OAS-clawback income threshold.

Use Younger Spouse Age for RRIF Calculations

If you have a younger spouse, consider using their age to calculate your minimum RRIF payments. This will lower the mandatory minimum annual withdrawal requirement and lower your overall net income for OAS calculations.

For more OAS-clawback reduction strategies, click here.

In addition to the universal OAS pension, there are three other benefits under the OAS that low-income seniors may also qualify for:

- Guaranteed Income Supplement

- Allowance, and

- Allowance for the Survivor

Pillar One Cont’d: The Guaranteed Income Supplement (GIS), Allowance, and Allowance for the Survivor

The Guaranteed Income Supplement (GIS), Allowance, and Allowance for the survivor are additional Old Age Security (OAS) income-tested benefits.

Guaranteed Income Supplement (GIS)

The GIS is a monthly benefit available to seniors who have a low income and are living in Canada. Unlike the universal OAS and Canada Pension Plan, GIS benefits are not taxable.

In the 2016 Federal Budget, the Liberal government increased the maximum top-up benefit that low-income seniors can receive through the GIS by up to $947 annually.

Over 1.8 million Canadians receive the GIS annually, and for the 2015/2016 fiscal year, GIS payments by the government cost approximately $10 billion.

Eligibility for the GIS and Benefit Amount

You qualify for the GIS if:

- You are receiving the OAS pension; and

- Your annual income is lower than the maximum annual threshold; and

- You reside in Canada.

If you are incarcerated for two years or more, your GIS eligibility is suspended.

The amount of GIS benefits you qualify for depends on your income level and marital status. Your net income (excluding OAS, GIS, and Allowance income) for the previous calendar year is used to determine benefit amounts. For couples, the combined annual net income is used when calculating the guaranteed income supplement amount.

GIS Amounts for Individuals Receiving a Full OAS Pension (Second Quarter 2023)

| Scenarios | Maximum Monthly payment | Maximum annual income threshold |

| If you are a single, widowed, or divorced pensioner | $1,032.10 | $20,952 (individual income) |

| If your spouse/common-law partner receives the full OAS pension | $621.25 | $27,648 (combined income) |

| If your spouse/common-law partner does not receive an OAS pension | $1,032.10 | $50,208 (combined income) |

| If your spouse/common-law partner receives the Allowance | $621.25 | $38,736 (combined income) |

The table above shows that for the second quarter of 2023, you are eligible to receive GIS if you are:

- A single senior with a total annual income of less than $20,952.

- A couple both receiving OAS and with a combined annual income less than $27,648.

- A couple with only one person receiving OAS and a combined annual income of less than $50,208.

- A couple with one person receiving the Allowance and a combined annual income less than $38,736.

GIS benefit amounts and income levels are updated quarterly using the Consumer Price Index. For the most updated Service Canada GIS rate calculation, see here.

Applying for the GIS

You are required to apply in writing for the GIS and can apply immediately after you have started receiving the OAS. For subsequent years, once you file an income tax return, your eligibility for GIS will be assessed automatically.

Allowance

The Allowance is one of the supplementary monthly benefits available through the OAS program to low-income individuals who are the spouse or common-law partner of someone who is receiving the GIS. Like the GIS, the Allowance is also a non-taxable benefit.

Who is Eligible for the Allowance Benefit?

To qualify for Allowance benefits:

- You must be between the ages of 60 and 64;

- Your spouse or partner must be receiving the OAS and be eligible for the GIS;

- You must be a Canadian resident;

- The combined income of the couple must be lower than the maximum amount threshold, i.e. $38,736 for 2023.

The maximum monthly Allowance benefit paid to eligible recipients in the April to June 2023 period is $1,312.25. You will stop receiving Allowance benefits the month after your 65th birthday.

Applying for the Allowance Benefit

You must apply in writing if you want to receive the Allowance, and your application can be sent in starting from the month after your 59th birthday.

OAS Benefit for Surviving Spouse

The OAS extends a survivor benefit to the spouse of a deceased recipient as follows:

Allowance for the Survivor

This is the third supplemental benefit under the OAS program. It is a non-taxable benefit available to low-income seniors between the ages of 60 and 64 whose spouse or common-law partner has died.

Eligibility for the Survivor Benefit

To qualify for OAS survivor benefits:

- You must be between the ages of 60 and 64;

- You must be a Canadian resident;

- Your annual income must be less than the maximum threshold set by the government ($28,224 for 2023);

- Your spouse or common-law partner has died, and you have not remarried or entered into another common-law relationship.

The maximum monthly benefit payable under the Allowance for the Survivor benefit is $1,564.30 for the April to June 2023 quarter. Allowance for the Survivor benefits stops the month after you turn 65, at which time you may qualify for the OAS and/or GIS benefits.

Applying for the Allowance for the Survivor Benefit

The application for this benefit is similar to that for the Allowance. You must apply in writing and can send in your application the month after your 59th birthday. Your eligibility for the benefit in subsequent years is assessed automatically based on your income tax return.

If you have questions regarding your eligibility for any Old Age Security benefits, contact Service Canada at 1-800-277-9914. You can also download application forms for the Guaranteed Income Supplement, Allowance, and Allowance for the Survivor here.

Pillar Two: Understanding the Canada Pension Plan

The second major source of retirement income available to eligible seniors and their families is the Canada Pension Plan (CPP). The CPP is a type of defined benefit and was initially designed to replace about 25% of a retired worker’s average wage. Subsequent changes to the program mean it will replace approximately one-third (33%) of a senior’s pre-retirement savings in the future.

The amount you receive is based on what you have contributed to the plan during your working years and for how long you made those contributions.

The Canada Pension Plan Investment Board (CPPIB) manages CPP funds and, as of December 31, 2022, had over $536 billion in assets under management.

For those who work in Quebec, the provincial plan is called the Quebec Pension Plan (QPP). About 6.5 million Canadians currently receive CPP/QPP payments annually.

Future CPP Plans

As corporate defined benefit pension plans continue to shrink, the Canadian government implemented a plan via Bill C-26 to enhance CPP benefits starting in 2019. The enhancements will increase the pension amounts seniors receive and also the benefits available to survivors.

When the updates to CPP are completed, pension amounts are expected to increase to over 33% or one-third of a senior`s pre-retirement earnings. Note that since contributions fund the CPP, the expected increases require a simultaneous increase in contributions from employees and their employers.

The contribution rate for employees and employers increased from 4.95% to 5.95% (from 2019 to 2023) or to a combined 11.90% for self-employed individuals.

Starting in 2024, an additional 4% contribution rate payable by employees and employers will be levied on an additional earnings range over and above the standard Yearly Maximum Pensionable Earnings (YMPE) amount.

CPP Eligibility

- The standard age to start receiving the CPP pension benefit is age 65. However, a person can become eligible for the reduced CPP as early as age 60. If you want an even increased pension benefit, you can postpone your CPP pension until after age 65 (up to a maximum age of 70).

- To be eligible, you must have worked in Canada and made CPP contributions.

- You must apply to receive the CPP pension benefit and can do so for up to 12 months before you plan to start receiving the benefit.

- Individuals under the age of 65 who have contributed to the CPP and who have become severely disabled and unable to work may qualify for CPP disability benefits.

CPP Contributions

Unlike the OAS benefit, you must have contributed to the CPP to qualify to receive CPP benefits in retirement. The contribution rate is 5.95% (or 11.90% if self-employed) on earnings above $3,500 up to $66,600 in 2023.

If you earn $3,500 or below (Yearly Basic CPP Exemption), you do not contribute to CPP, and for earnings above $66,600 (Yearly Maximum Pensionable Earnings), no CPP is deducted.

The maximum CPP contribution for employers and employees is $3,754.45 each (2023). CPP contributions are required from age 18 but are no longer required after you start receiving CPP benefits or turn 70.

CPP Contribution Rates (2019-2023+)

| Year | Employee contribution rate | Employer contribution rate | Self-employed contribution rate |

| 2018 | 4.95% | 4.95% | 9.90% |

| 2019 | 5.10% | 5.10% | 10.20% |

| 2020 | 5.25% | 5.25% | 10.50% |

| 2021 | 5.45% | 5.45% | 10.90% |

| 2022 | 5.70% | 5.70% | 11.40% |

| 2023 and later | 5.95% | 5.95% | 11.90% |

How Much Will You Receive?

Your monthly CPP pension payment will depend on how many years you worked and contributed and your average salary during this time. Let’s break it down:

The maximum monthly CPP benefit for 2023 is $1,306.57, while the average monthly payment for new beneficiaries is $811.21. Most people will not receive the maximum amount either because:

- They have not contributed to the CPP for at least 39 years between the age of 18 and 65, or

- They have not made the maximum CPP contributions during their working years for at least 39 years. The maximum annual CPP contribution is based on the Yearly Maximum Pensionable Earnings (YMPE) announced by the Canada Revenue Agency every year.

Based on how the CPP is set up, if you immigrated to Canada in your 30s (like myself) or later, you should not expect to receive the maximum CPP amount.

This highlights the need for “new Canadians” to aggressively maximize their individual savings accounts and available registered plans, including the Registered Retirement Savings Plans (RRSP) and Tax-Free Savings Accounts (TFSA). More on these later.

To estimate how much CPP benefit you will receive at retirement, you can use Service Canada’s Retirement Income Calculator. Your CPP Statement of Contribution will come in handy when utilizing this calculator, and you can obtain it by accessing your My Service Canada account online. You can also obtain this information by calling Service Canada at 1-877-277-9914.

What Age Should You Choose To Take CPP?

The standard age to start collecting CPP benefits is 65 years; however, you can choose to start collecting it earlier or delay it till later.

If you begin taking CPP benefits early (from age 60), your CPP payment is reduced by 0.6% for each month you receive it before turning 65.

Conversely, if you begin taking your CPP later (i.e. after age 65), your CPP payment is increased by 0.7% for every month you delay receiving up to age 70.

Therefore, an individual who starts receiving CPP benefits at age 60 will get only 64% (less 0.6% x 60 months) of the benefits they would be eligible for if they had waited till age 65.

And an individual who waits until age 70 before they start receiving benefits will get 42% (plus 0.7% x 60 months) more than they would have been eligible for if they had taken it at age 65.

Deciding on what’s best for you depends on your peculiar circumstances. There is no “one-size-fits-all” solution. Factors that you should take into consideration include your:

- Life expectancy

- Health status

- Current income

- Debt level

- Number of years worked

- Amount of benefits you qualify for

- Plans to continue working, etc.

CPP Provisions

CPP is adjusted annually for inflation: CPP benefits are adjusted annually to account for increases in the cost of living based on the Consumer Price Index (CPI).

General drop-out provision: Up to 8 years of your lowest earning years can be dropped when calculating your CPP benefits. This helps to boost the amount you qualify for if you have had periods of low or no earnings.

Child-rearing provision: Besides the general drop-out provision, if raising children caused you to stop working or earn a lower income, the child-rearing provision increases your CPP benefits by excluding this period when calculating your CPP benefits.

Pension sharing: Retired and eligible spouses or common-law partners can choose to share their pensions in a way that minimizes tax for both parties. This works well when one spouse is taxed at a higher marginal rate.

CPP Benefits for Surviving Spouses and Children

The CPP extends benefits to the spouse and children of a deceased contributor. These include:

Survivor’s pension: The spouse or common-law partner of a deceased contributor may be eligible to receive a monthly survivor’s pension. The amount paid under this benefit depends on whether the survivor is receiving other pensions, their age, and the contribution made by the deceased during their lifetime.

You can only receive one survivor’s pension. So, if you survive more than one spouse, you will be paid whichever benefit is largest. In 2023, the maximum monthly CPP survivor’s benefit is $707.95 (for those under age 65) and $783.94 (over age 65).

Death benefit: This is a one-time, lump-sum payment made to the estate of the deceased contributor. The maximum death benefit payable is $2,500.

Children’s benefits: These are monthly payments provided to dependent children of a disabled or deceased CPP contributor. The children must be between the ages of 18 and 25 to qualify. The maximum monthly children’s benefit paid out in 2023 is $281.72.

Pillar Three: Workplace Pensions and Voluntary Retirement Savings Plans

The third arm of Canada’s retirement income system comprises Employment Pension Plans and Individual Retirement Savings. In my opinion, this is probably the most important and (and maybe most neglected) of the three pillars.

Employment pensions refer to workplace plans, including defined benefit plans and defined contribution plans. Individual retirement savings generally refer to the RRSP.

Another tax-sheltered vehicle that can be used to save for retirement is the Tax-Free Savings Account (TFSA) – more on this later.

If the OAS is expected to replace about 15% of a senior’s pre-retirement salary and the CPP about 25% of the same, any shortfall in your income needs will likely have to come from the third arm of the retirement income system.

Depending on what your needs are in retirement, this expectation can be very significant.

Let’s take a look at the different plans:

Workplace Pensions

Defined Benefit Pension Plan: A Great Deal!

The defined benefit pension plan (DBPP) is a pension plan where your employer pays you a specific monthly income when you are retired. The pension amount you qualify for is calculated using different methods, but the formula is usually based on your average highest earnings and the number of years of service.

One of the more popular formulas used is:

Annual Pension = 2% X average yearly pensionable earnings during the highest five earning years X years of pensionable service.

This formula may vary from employer to employer, but the idea is the same.

You and your employer usually contribute to the plan, and the funds are then invested in a pension fund. Your employer manages the investment and is responsible for ensuring that funds are available to make payments in the future. Your employer bears all the investment risk.

DBPPs often offer some type of inflation protection on expected benefits and may also allow for the provision of survivor benefits.

Defined Contribution Pension Plan

For this workplace pension plan, both you and/or your employer contribute a defined amount to the plan. Often, the employee is required to contribute a certain percentage of their salary, and the employer matches all or part of this contribution.

Unlike in a defined benefit pension plan, contributions to a defined contribution pension plan (DCPP) are invested for the individual in their personal pension account, where the employee can tailor the investments to fit their own investment goals and risk profile.

At retirement, the proceeds from your pension account (your contributions + employer’s contributions + accumulated investment income) are given to you. There are no guarantees on what your total payout will be, and market returns may or may not have been good.

If you prefer to receive scheduled payments instead of a lump-sum amount, you can transfer the funds from your DCP plan to other registered plans. These plans include Locked-in Retirement Income Fund (LRIF), Life Income Fund (LIF), or a Life Annuity.

For both DCPP and DBPP, if you change employers before retirement or before you are 55 years old, there are a few options for what you can do with the commuted value of your pension.

Depending on your circumstances, this may include using a Locked-in Retirement Account (LIRA) or a Locked-in Retirement Savings Plan (LRSP).

For more information on LIRA, LRSP, LIF, RLIF, LRIF, and the like, click here.

When comparing the DBPP and DCPP, it is easy to see that the defined benefit pension takes the crown among workplace pension plans.

The number of employees who are participating in an employer-sponsored pension plan has declined in recent times, and private-sector workers covered by a defined benefit pension are in the minority.

These days, if you are enrolled in any type of workplace pension, you can count yourself lucky! As of 2020, 39.7% of paid workers had access to a registered pension plan.

The Registered Retirement Savings Plan

Of all the investment vehicles available to Canadians for their retirement planning under Pillar 3, this is one of the most important. It is one that comes to mind when you hear folks say – “it’s time to take your destiny into your own hands.”

When the RRSP was first established in 1957, the intent was to help workers who were not benefitting from employer-sponsored pension plans to save for retirement. Although RRSP uses have increased since then, with the introduction of the Home Buyers’ and Lifelong Learning plans, its original use is as significant today as ever.

The Registered Retirement Savings Plan (RRSP) is a type of savings and investment account that is registered with the Federal Government and which allows you to save for your retirement.

In 2020, over 6.2 million Canadians contributed to an RRSP, putting aside $50.1 billion towards retirement.

Since its inception in 1957, the contribution limit allowable to an RRSP account has grown from 10% of the previous year’s earned income (and a maximum of $2,500) to 18% of the same income, up to a maximum of $30,780 in 2023.

There’s a wide range of investment instruments that qualify for investing in an RRSP account. They include Treasury Bills, Guaranteed Investment Certificates (GICs), Cash, Mutual Funds, Equities, Mortgage Loans, Bonds, Exchange Traded Funds (ETFs), Gold, Silver, Income Trusts, and more.

Apart from saving for retirement, the government also allows individuals to withdraw funds tax-free from their RRSP to buy or build a home (up to $35,000) or to pay for their education (up to $20,000).

For more on these options, click here.

Types of RRSPs

There are four types of RRSPs:

1. Individual RRSP: Here, an individual opens an RRSP account in their name. They are the sole contributor, and the tax benefits from the account accrue to the contributor or account holder. Individuals may manage their RRSP account by themselves or leave it to their financial institution to manage on their behalf.

2. Spousal RRSP: In this case, one spouse (aka contributing spouse – usually the higher-earning spouse) contributes to an RRSP opened in the name of the other spouse (aka account holder – usually the lower earner). The spouse making the contributions, in this case, still gets the tax deduction, and their contribution does not affect the other spouse’s contribution limit.

3. Group RRSPs: This RRSP package is offered by some employers to their employees. Contributions to the plan are made by the employees and or the sponsoring employer. Employee contributions are usually deducted at source via payroll deductions on a pre-tax basis.

4. Pooled RRSPs: These were introduced in 2011 to cater to self-employed individuals and employees at small-sized companies who do not have access to a workplace pension plan or Group RRSP. The plan is administered by a third party, and employee participation is voluntary. The idea behind pooled RRSPs is that members can benefit from cheaper administration costs and ease of portability if they change jobs.

How To Set Up an RRSP Account

Setting up an RRSP account is easy. You can walk into any bank or credit union to have an account set up.

If you are a daring DIY-type individual, you can also set it up through an online discount brokerage.

How Much Can You Contribute to an RRSP?

Annual limits are placed on the contributions that you can make to your RRSP. There are limits to the contributions you can make to your RRSP. This limit is published by Canada Revenue Agency (CRA), and for 2023, is the lower of:

- 18% of your earned income in 2023, up to a maximum contribution amount of $30,780.

- Your remaining contribution limits following a pension adjustment if you are on an employer-sponsored pension plan. If you contribute to a workplace pension plan, your contribution room will be what’s left after you and your employer’s contributions to the plan are deducted. You can find the relevant pension adjustment numbers on your T4 slip.

- Plus, any unused contribution room you have accumulated from previous years in which you had earned income.

If you’re unsure about your available contribution room, check the last Notice of Assessment or Reassessment you received from CRA.

Some non-standard contributions can be made to an RRSP account. They include:

RESP to RRSP: If you had set up an RESP for a child, and they decided not to pursue post-secondary education, you may be able to transfer up to $50,000 from the account to your RRSP.

Retiring Allowances to RRSP: If you receive severance pay following retirement, you can transfer the eligible portion of the severance to your RRSP without needing a contribution room. The non-eligible portion of the retiring allowance can also be contributed to your RRSP or that of a spouse if you have a contribution room left.

Registered Pension Plans to RRSP: You can transfer lump-sum payments from a Registered Pension Plan to an RRSP on a tax-deferred basis if the transfer is done directly by your employer.

RRSP Over-Contribution Penalty

RRSP contribution room that has not been used in any particular year can be carried forward to future years without penalty. You can contribute to an RRSP until the end of the year in which you turn 71.

The taxman will penalize you if you make RRSP contributions that exceed what you are allowed to contribute or if you invest in prohibited or non-qualified investments.

For more on RRSP penalties, click here.

Advantages of an RRSP

Tax deductions: when you contribute to an RRSP, you get to deduct your contributions from your earned income, thus lowering your taxable income. This tax benefit is either immediate or realized at tax filing season when you get a tax refund consisting of any excess taxes you had paid on your gross income.

For example, if your taxable income is $80,000 in 2022 and you contribute $10,000 to your RRSP. Using Ernst and Young’s RRSP savings calculator, you can expect tax savings of between $2,750 (Nunavut) and $3,717 (Nova Scotia).

To get the maximum benefit from this tax relief, you can re-invest your tax refunds.

Tax-sheltered returns: Investment income earned on your RRSP investments are tax-sheltered and will not be taxed until you withdraw funds from your account.

Lower Taxes: Most Canadians will fall into a lower tax bracket in retirement. This means that when they start withdrawing funds from their RRSP in retirement, they will likely pay tax at a lower rate than would have been possible at the peak of their earning years.

Increased Government Benefits: For those with kids under 18 years old, contributing to an RRSP can bring a nice and unintended benefit – since RRSP contributions lower your net income, they may increase the Canada Child Benefits you qualify for. This also applies to other government income-tested benefits.

For more on increasing your Canada Child Benefits by making an RRSP contribution, click here.

Income splitting between spouses: RRSPs can be used for income splitting between spouses in such a way that benefits both individuals and lowers their combined tax rates in retirement. This works especially well if one spouse is in a significantly higher tax bracket than the other spouse.

RRSPs are not Forever.

If you are still alive at 71, the government will come for your RRSP. Okay, scratch that! Not really, but you will be required to shut down your RRSP account and do one of four things with it:

- Cash out your RRSP funds

- Convert it into a Registered Retirement Income Fund (RRIF)

- Use the funds to buy an annuity

- Do a combination of the above

The idea behind the RRIF and life annuity is that at age 71, you’re expected to have stopped working, and it’s time for you to start getting a steady and regular income for the rest of your life. Also, at this age, you are no longer allowed to contribute to an RRSP.

RRIFs

You can convert your RRSP to an RRIF at any time before age 71 when it becomes one of the compulsory options. Following opening an RRIF account, you must withdraw a minimum amount every year based on a prescribed rate published by the government.

Assets that can be invested in using an RRIF are similar to what is possible for RRSPs. And, like RRSPs, you can share income from an RRIF with your spouse as part of a tax-limiting strategy.

For greater details on Registered Retirement Income Funds, click here.

Annuities

An annuity is an insurance product sold by insurance companies which pays a guaranteed regular income over an agreed period of time.

There are different types of annuities, including Term certain, Life, Joint life, and survivor annuities. You can choose to receive payments on a monthly, quarterly, semi-annual, or annual basis.

For more on Annuities and how they work, check out this article.

What Happens to Your RRSP After Death?

What happens to my RRSP after I die? Good question, eh?

In general, after an RRSP account holder dies, they are deemed to have cashed out their remaining funds, and the amount shows up on the final tax return of the deceased. In essence, the RRSP account becomes part of the estate.

However, depending on how you set up your account and if you had designated beneficiaries before your death, left-over RRSP funds may be treated differently. A few potential scenarios include:

- You have designated “qualified beneficiaries,” including a spouse or partner, a child or grandchild (infirm or otherwise) who is financially dependent on you.

- You have designated a non-qualified beneficiary, including a financially independent child or charity.

For your qualified beneficiaries, your RRSP assets are treated as follows:

Spouse or Common-law partner: The RRSP assets can be transferred directly to your surviving spouse’s RRSP or RRIF to maintain the tax-deferred status. They do not need to have contribution room to effect this transfer. Taxes will be levied when they start withdrawing income from the account, and your estate is spared a tax bill on the transferred assets.

Financially Dependent Child or Grandchild: When your financially dependent child or grandchild becomes the beneficiary of your RRSP assets, their options will vary depending on their age and if they are also deemed physically or mentally disabled.

If they are under 18, they can buy an annuity that pays them annually until they are 18 years old. Alternatively, if they are infirm, the funds can be rolled into a Registered Disability Savings Plan (RDSP). In both cases, the beneficiaries will be required to pay taxes in the future when they receive annuity or disability payments.

Adult financially dependent children can also choose to take out the RRSP assets in cash and have the proceeds taxed at their hands, at a presumably lower tax rate than the estate.

For non-qualified beneficiaries, your RRSP assets are treated as follows:

Charity: if a charity is the beneficiary of your RRSP account, the funds are included on your final tax return. However, it is expected that the charitable donation tax credit received will cancel out any taxes payable on the funds.

Financially Independent Adult Child/Grandchild: The amount is transferred to them in cash, and your estate is responsible for paying any taxes due on the amount.

There are a few other scenarios and tax treatments possible; for more info, check out this article.

A Re-Cap of the Three Pillars

In the previous chapters, I discussed the three basic pillars of Canada’s retirement income system and how they work.

Again, they are:

- Pillar #1: Old Age Security – a universal plan available to all Canadians. It includes additional support for low-income seniors through the GIS and Allowance.

- Pillar #2: Canada Pension Plan – a mandatory government-organized contributory pension plan for all workers.

- Pillar #3: Workplace Pensions and Individual Retirement Savings – including defined benefit pension, defined contribution pension, and the RRSP.

In the final part of this guide, I will briefly touch on other available tools for your retirement savings, how much you will need for retirement, DIY investing solutions, and more.

Don’t Overlook The TFSA!

There are other options to save and invest for retirement – think non-registered investment accounts and the TFSA.

The tax-free savings account is a nifty little tool that should always be resident in your retirement planning toolbox. Although it does not have “retirement” in its name, this savings tool is one of the most important vehicles for savings, investing, and generally, financial planning!

The TFSA came into effect in 2009 and allowed Canadian residents who are 18 years or older an opportunity to invest a specified amount annually tax-free. Investment income earned on your investment was sheltered from taxes for life.

Since its introduction in 2009, the allowed annual contribution amount has grown from $5,000 to $6,500 in 2023 (increased briefly to $10,000 in 2015).

There were 15,304,460 TFSA holders in Canada as of 2019, and an average contribution amount of $8,160 that year, numbers from Statistics Canada show.

TFSA Basics

- You must be 18 years of age or older, be a resident of Canada, and have a valid social insurance number.

- Like the RRSP, you can invest in almost anything, including cash, Guaranteed Investment Certificates (GICs), bonds, mutual funds, stocks, etc.

- You can withdraw money from your account at any time, for any reason, tax-free, and without penalty.

- The annual TFSA contribution room is indexed to inflation and rounded off to the nearest $500. The annual contribution limit for 2023 is $6,500. If you have been eligible to contribute since 2009, your total contribution room in 2023 is $88,000. If in doubt about your TFSA limit, you can contact Canada Revenue Agency (via My Account) or use their Tax Information Phone Service.

- You can carry forward unused contribution room indefinitely. The contribution room over the years has been:

| Year | Contribution Limit | Cumulative Contribution Room |

| 2009 | $5,000 | $5,000 |

| 2010 | $5,000 | $10,000 |

| 2011 | $5,000 | $15,000 |

| 2012 | $5,000 | $20,000 |

| 2013 | $5,500 | $25,500 |

| 2014 | $5,500 | $31,000 |

| 2015 | $10,000 | $41,000 |

| 2016 | $5,500 | $46,500 |

| 2017 | $5,500 | $52,000 |

| 2018 | $5,500 | $57,500 |

| 2019 | $6,000 | $63,500 |

| 2020 | $6,000 | $69,500 |

| 2021 | $6,000 | $75,500 |

| 2022 | $6,000 | $81,500 |

| 2023 | $6,500 | $88,000 |

- If you withdraw funds from your TFSA account in one year, you can re-contribute them in the next year. As such, your contribution room in the year following the year of the withdrawal is: accumulated TFSA contribution room over the years + amount withdrawn in the previous year + your standard contribution room for the current year.

For example, if you have $20,000 in your TFSA and you withdraw $5,000 this year (2023) to fund your travel expenses. In 2024, you can contribute that $5,000 plus your normal contribution room for 2024 plus any other carry-over contribution room from prior years.

- There are penalties for over-contributing to your TFSA. CRA will levy a 1% tax on any excess contributions monthly until you remove them. For more on TFSA over-contribution penalties, click here.

- You can open more than one TFSA account and can transfer funds from one account to the other. However, the transfer must be a direct transfer between the financial institutions involved to avoid errors and penalties.

- Capital gains or investment income generated on a TFSA are not taxed. However, you cannot claim a capital loss for any losses incurred in your account.

When TFSA Beats RRSP

Both plans are great for saving and investing. However, there are instances where the TFSA is a better or only option. Scenarios include:

Low Income: If you are just entering the workforce and are earning a low income (<$40,000), a TFSA may be preferable. You can maximize your TFSA now and carry your RRSP contribution room forward to future years when your marginal tax is higher, and you will get more in tax refunds.

No Income, No Problem: To contribute to an RRSP, you need to have earned income from employment. However, funds contributed to a TFSA can come from any source.

High Tax Bracket in Retirement: Utilizing all your TFSA room is a good strategy if you expect to be in a high tax bracket in retirement. Since withdrawals from your TFSA do not count towards your taxable income, this can lower your overall tax burden, as well as reduce the clawbacks of OAS by the government.

Emergency Funds or Savings: You can withdraw your TFSA anytime without penalty. This makes them a great tool for saving towards projects, travel, car purchase, or building up an emergency fund.

Retirement Investing: After age 71, you can no longer contribute to an RRSP. This leaves the TFSA as a great tool for continuing to invest in a tax-sheltered environment while retired. A TFSA account can stay open until death.

TIP: If you expect to have a low income in retirement, then your TFSA should be your best friend! The TFSA will keep your savings non-taxable and enable you to qualify for as much Guaranteed Income Supplement (GIS) as possible. This is because GIS benefits decrease by $1 for every $2 in additional income above the maximum threshold.

TFSA After Death

Like the RRSP, you can also designate a beneficiary for your TFSA account. There are two main designations possible:

Designated Beneficiary: This can be anyone – spouse/partner, kids, friends, frenemies, etc. If you have designated someone as your “beneficiary” on your TFSA application, they receive the proceeds from your TFSA when you die. The account’s value at the time of death is not taxable; however, any income earned between the date of death and the date of transfer to the beneficiary is taxable.

Successor Holder: Only a spouse or partner can be designated as a “successor holder” to a TFSA. The difference between this designation and “beneficiary” is that the successor holder can simply transfer the existing TFSA account to their own name. The account stays open – they simply replace you as the plan holder and do not need a TFSA contribution room to keep the account in place.

For more on designating TFSA beneficiaries, click here.

If you want to read a more elaborate comparison between the TFSA and RRSP, click here.

As you can probably tell, I love the TFSA! It’s a great tool for average Canadians and immigrants trying to get their foot in the door in preparing for retirement. Even if you have no other retirement savings account – i.e. no workplace pension, no RRSP – ensure you have a TFSA in place and use up your contribution room.

How Much Retirement Income Will You Need in Canada?

After looking at the options and tools you have for generating retirement income, the question that comes to mind is: “How much income will I need in retirement?” or “How much do I need to have saved up before I can retire comfortably?”

It’s important to find an answer to this question because how else are you supposed to know if you are adequately prepared for retirement? No one really wants to wait until retirement before figuring out if they have set enough money in their retirement pot.

Many theories abound on how to compute minimum retirement income needs, and the jury is still out on which is absolutely accurate. For our purposes, I’ll summarize the more popular assumptions (or rules of thumb), and you can decide which one makes sense to you.

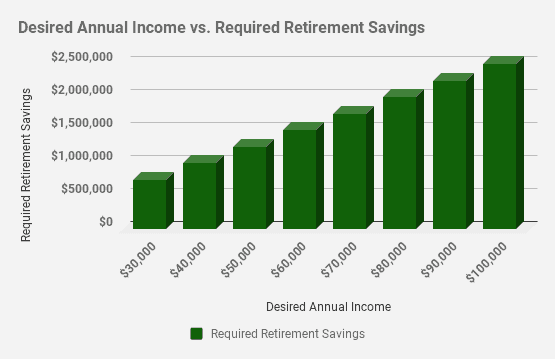

RULE 1: 4% Withdrawal Rate

The 4% withdrawal rule is the most commonly utilized and assumes that you need to build up a retirement portfolio that provides a certain amount of income to you per annum at a 4% or so withdrawal rate. The 4% withdrawal rate is often called a “safe” withdrawal rate.

For example, let’s assume that you think your annual expenses in retirement will be approximately $40,000 per year. At a withdrawal rate of 4%, you will need to have a minimum of $1 million in retirement savings before you retire.

⇒ $40,000 ⁄ 4% = $1,000,000

This rule of thumb works whether you plan to retire early at 30 or wait till you are 65 years old. It’s the strategy often utilized by many “early retirement” enthusiasts or the movement popularly referred to as “FIRE” – Financial Independence/Retire Early.

The general idea behind the funds lasting you for life is based on historical market returns. We assume your investment portfolio generates approximately 7% annually in long-term returns. After deducting an average inflation rate of 3%, real returns of approximately 4% are expected.

A four-percent (4%) withdrawal rate assumes your investment portfolio is not highly conservative (i.e. you are invested in a good proportion of stocks/equities).

RULE 2: Desired Annual Retirement Income x 25

This rule follows the 4% withdrawal rate rule. The outcome is actually the same; however, this is easier to calculate for those who dislike math. The assumption here is that to meet your income needs in retirement; you must have at least 25 x your desired annual retirement income.

For example, say you estimate that your expenses per year in retirement are $40,000. You would need at least $1 million in retirement savings/investment.

⇒ $40,000 x 25 = $1,000,000

RULE 3: 70% (or more) of Working Income

This rule estimates that you will need between 70% and 100% of your pre-retirement income in retirement: 70% if your needs are typical and your house is paid for, and up to 100% if you are still paying down a hefty mortgage plus other atypical expenses while retired.

The idea behind this rule is that your expenses are generally expected to be lower in retirement: no mortgage payments, no longer need to save for retirement, kids are financially dependent, etc. After computing your expected annual expenses, you can proceed to calculate how much you need (lump sum) by going back to Rule 1 or 2.

For example, assume you earn $100,000 per year before retiring. Using the 70% rule, you will need approximately $70,000 ($100,000 x 70%) in annual income to maintain your lifestyle in retirement. Going back to Rule 2, this implies you will need:

⇒ $70,000 x 25 ⇒ $1.75 million in retirement.

RULE 4: Pre-Retirement Income x Multiples of 10 to 14

This rule suggests that you can calculate how much you need to save for retirement by multiplying your income just before retirement by a number between 10 and 14.

For example, if your income before retirement was $100,000/year. Following this rule, you should accumulate at least (depending on which multiple you’re working with):

- Multiple of 10: $100,000 x 10 = $1 million

- Multiple of 11: $100,000 x 11 = $1.1 million

- Multiple of 12: $100,000 x 12 = $1.2 million

- Multiple of 13: $100,000 x 13 = $1.3 million

- Multiple of 14: $100,000 x 14 = $1.4 million … in savings/investment before retiring.

In calculating Rules 3 & 4, we implicitly assume that you’re using income amounts earned during your higher income-earning years as the basis of your calculation. This means that if you are a younger person in an entry-level position (i.e. low starting salary) looking at retiring early, calculations using these approaches may not work for you in the longer term.

Estimating Your Retirement Income Needs (2023 Numbers)

The income available to you during your retirement years (distribution phase) will depend largely on how much you can set aside during your working years (accumulation phase), plus other available government and employment benefits.

Answer the following questions to estimate your retirement income needs:

1. How Much Income Do You Expect To Live on Per Year?

You can compute this amount using different strategies – for example, by using the 70% pre-retirement income rule or by simply looking at the lifestyle you envisage living in retirement and estimating what your expenses will add up to (including taxes).

Note: In your calculations, if looking at your current lifestyle and expenses, remember to eliminate expenses that may no longer be relevant in retirement, such as mortgage payments, transportation, childcare expenses, RRSP, CPP, EI contributions, etc. And remember to add new expenses that may crop up, such as travel expenses, hobbies, health issues, etc.

2. How Much Government Benefits Do You Expect To Receive?

If you have lived and worked in Canada before retirement, you can expect to receive Old Age Security (OAS) and Canada Pension Plan (CPP) benefits. The amount you receive will generally depend on how long you have lived in Canada (for OAS), how much you have contributed to the plan, and for how long (for CPP).

The maximum monthly OAS payable in 2023 (April to June quarter) is $691 (if aged 65 to 74) for a total of $8,292 per year, while the maximum monthly CPP is $1,306.57 for a total of $15,678.84 per year (2023).

Most people will get less than the maximum amount. For example, the average monthly CPP benefit received in January 2023 was $811.21 (37.9% less than the maximum amount payable).

Individuals who immigrated to Canada in their adult years (like me) can also expect that the total government pension they will be eligible for will be significantly reduced.

Using the 2023 maximum government pension amounts as an example, total payouts from this source to a single senior is:

$8,292 (OAS) + $15,678.84 (CPP) = $23,970.84 per year

3. How Much Do You Need To Save Up?

To calculate this amount annually, you will need to subtract expected government pensions from the annual expenses you calculated in Step A, and then multiply the remainder by 25 (or divide by 4%).

For example, for a couple who estimate the annual retirement income needs to be $70,000:

| Annual expenses in retirement from age 65 (couple) | $70,000 |

| Deduct Total Government Pensions expected (couple) – A | -$35,399 |

| Income Withdrawn from Savings/Year – B | $34,601 |

| How Much Do You Need To Save For Retirement? – C | $865,025 |

- A – Most individuals will not get the full government pension amount from OAS and CPP. The amount here reflects 60% of the maximum CPP amount and full OAS amount for 2023 (i.e. 60% x $15,678.84 x 2) + ($8,292 x 2) for a couple – a moderately conservative estimate.

- B – Line 1 minus line 2

- C – Derived by multiplying the annual income withdrawn by 25 (i.e. $34,601 x 25) or dividing by a 4% withdrawal rate (i.e. $34,601 / 4%). The result is the same for both formulas.

As shown in the table above, government pensions offset some of the pre-retirement savings this couple requires. The more government pension you qualify for, the less money you must have in your investment portfolio.

Your portfolio should be considered a complete package. For example, if you and/or your spouse have a defined benefit pension, it will lower the other savings or investments you need to meet your desired retirement income.

Related:

- Retirement Income Guide for Canadians

- How To Plan For Retirement

- How To Save For Retirement in Canada

- Retirement Savings By Age in Canada

No Sure Guarantees

It’s always great to plan ahead for the future. However, there are no guarantees that your plans will always work out the way you want them to – life happens, and it may leave your retirement plan in tatters. Things that can throw a wrench in your retirement plans include:

- Divorce

- Health issues that cause you to retire earlier than planned or that result in higher-than-expected medical bills early in retirement

- Financially dependent kids in retirement

- Significant mortgage payments

- A world or country-wide financial crisis or run-away inflation.

If you are close to your preferred retirement age and find you do not have adequate funds in your retirement pot, the following strategies may be useful in managing your savings-income shortfall:

- Work longer and delay government pension till later: Consider working for a few more years or delaying when you start receiving government benefits. Delaying OAS/CPP for a few years will significantly increase your eligible benefits later.

- Start saving aggressively: The earlier you start investing or generating investment income, the better for you. Compounding interest and time are your best friends when it comes to the returns you can earn on your investment portfolio. If you are running out of time, you will need to put aside more funds more often.

- Semi-retire and work part-time: Every year you delay dipping into your nest egg means more money to spend in the future.

- Adjust your retirement lifestyle expectations: If you have run out of time to build an adequate retirement portfolio that could pay for your desired lifestyle, you may have no choice but to take out less money from your savings and live according to your means.

- Downsize and sell your home: You can consider beefing up your retirement savings by downsizing and selling your home to utilize the equity you have built up over the years. Alternatively, you may consider taking out a home equity line of credit (HELOC) or a reverse mortgage.

- Tap into Government benefits for low-income seniors: Thankfully, safety nets are in place to cater to lower-income seniors. Suppose your income in retirement puts you in the low-income bracket (as specified by the government on an annual basis). In that case, you may qualify for additional government benefits, including the Guaranteed Income Supplement (GIS) or the Allowance.

Do-It-Yourself Investing

A discussion about saving and investing for retirement would not be complete without looking at DIY investing and how paying exorbitant fees to manage your investment portfolio can hobble your retirement plans.

By DIY, I do not intend to convey the idea that you need to manage every aspect of your investment portfolio. As a start, it means that you have a fair understanding of the following:

- How investing and financial markets work – risk and risk tolerance, return, compound interest, time value of money, etc.

- What you are invested in – cash, stocks, bonds, mutual funds, etc.

- The fees you pay and why you pay them

- How your investments are performing – annual returns compared to an appropriate benchmark

In my opinion, understanding these key matters are fundamental to your success in investing – regardless of your skill level.

Case Example

Say you are currently 25 years old and just started your first full-time professional job earning $50,000 per year. You plan to retire when you turn 50. You bought a brand new car that you intend to use for at least ten years. You are renting and have no plans to buy a house in the near future. You already have an emergency fund in a savings account that effectively covers six months of your living expenses.

Scenario 1

- If the rest of your investment portfolio is invested in 80% GICs and 20% stocks because you feel that the market may crash and you will lose your retirement savings, it makes one wonder if you understand the principles of risk vs. return, investment time horizon, compound interest, and so on. There is no return without risk and a super-conservative portfolio like this one had better match your return expectations.

Scenario 2

- If instead of the highly conservative portfolio in scenario #1, you are instead invested 100% in a mutual fund that pays a Management Expense Ratio (MER) just shy of 2% and sales commissions (front and back-end loads). The fund also has a return less than its benchmark index (i.e. underperforming) for the last several years.

- This makes one wonder if you understand how fees impact your return over time and if you are aware of cheaper and better options that are readily available. There are now so many index funds and ETFs with much lower MERs and no sales commissions.

Scenario 3

- Suppose you are invested in stocks and follow your investments every day. Your mood fluctuates as the prices of stocks go up and down. You are tempted to sell when prices go down and buy when prices go up.

- This makes one wonder if you understand how financial markets work? With the approach above, you’re inadvertently buying the market when it’s expensive and selling when it’s cheap. Essentially, you are attempting to “time the market,” and the result is often a dismal failure.

Note: The examples above may be simplistic, but they should get you thinking about your investments. What’s going on with them – do you know?

For more on the investment fees we pay in Canada and how to lower them, click here.

Following these basics, depending on your understanding of investing in general, discipline, and comfort level with managing your own money, the self-ascribed DIY investor may decide to take further steps in managing their money.

Low-Cost ETF and Index Investing

Most actively managed funds do not perform as well as you would expect them to do, given the fees they charge their clients. In trying to “beat the market,” traditional mutual funds rack up enormous costs and often end up underperforming.

It’s this lacklustre performance that has led many to embrace what is now known as “index investing” or simply as “indexing.”

What index investing does is to put your money into index funds or Exchange Traded Funds (ETFs) that have been designed to track one or more market indexes (such as S&P 500).

Theoretically, the index fund or ETF will hold a basket of stocks, bonds, commodities, or other investments that mirror the market index whose performance you’re trying to replicate.

For example, an index fund that tracks the S&P 500 will hold stocks that mirror or are representative of the composition of the S&P 500 in an attempt to theoretically replicate the market return (i.e. the same annual return generated by the S&P 500 as a whole).

Since index funds are cheaper to administer, they often beat their much-hyped active fund counterparts. In describing index funds, John Bogle (founder of Vanguard Group) put it best:

Don’t look for the needle in the haystack. Just buy the haystack!

Here are some ETF options to consider in your self-directed portfolio.

Self-Directed Investing, Robo-Advisors, and Index Funds

If you are comfortable managing your investments, you can buy ETFs for your portfolio and rebalance them as needed.

You can also use an online wealth manager (robo-advisor) and pay them a fee to manage your portfolio. Lastly, you can use a one-fund solution.

There are literally thousands of options out there for those who want to try their hands on indexing – from simple one-fund solutions to individual index funds and ETFs.

A. Exchange-Traded Funds

ETFs are similar to mutual/index funds except that they are traded like stocks on a stock exchange, and prices can fluctuate intra-day like stocks.

Management fees (MER) for ETFs are very low compared to mutual funds, and you can find fees as low as 0.03%! Transaction fees may be charged when you buy or sell ETFs.

ETF providers in Canada include Vanguard, BMO, iShares, Horizons, and others. To purchase these ETFs, you can use an online brokerage platform such as Wealthsimple Trade or Questrade.

Similar to buying individual index funds, you will also need to rebalance your portfolio once or twice a year when using ETFs to keep your asset allocation close to your desired levels.

To avoid the hassle of rebalancing, you can use an all-in-one ETF portfolio that automatically rebalances as needed. Examples include VGRO and VEQT offered by Vanguard.

Questrade offers trading in stocks, ETFs, options, mutual funds, GICs, precious metals, IPOs, and other financial instruments. You will need a $1,000 minimum balance to trade on Questrade. Learn more about the company in this review.

Wealthsimple Trade offers no-commission trading, which means you can buy and sell stocks and ETFs without paying a trading fee. They also do not require a minimum account balance. Learn more about the platform in this Wealthsimple Trade review.

B. Robo-Advisors

A Robo-advisor can help you manage your retirement portfolio and take care of all the hassles at a much lower cost than traditional mutual funds. They help you choose a custom portfolio that matches your investment objectives and risk tolerance and automatically rebalance your portfolio when required.

In addition to building your portfolio using low-cost ETFs, a robo-advisor can help with dividend re-investing, tax-loss harvesting, and free financial advice.

Check out my review of Wealthsimple, Canada’s most popular robo-advisor. When you open an account with them, you get a $25 cash bonus. You can also use the low-fee Questwealth robo-advisor.

C. Individual Index Funds

You can also buy individual index funds (not ETFs) and combine them in a portfolio to meet your own investment objectives, asset allocation, and risk tolerance. There are several individual funds sold by banks that meet these criteria.

You will need to rebalance your portfolio at least once every year, and these funds tend to be a bit more expensive than comparable ETFs.

Popular options are those included in TD’s e-series index funds stable – you can read more about TD e-Series Funds.

D. One-Fund Solutions

One-fund solutions make for an easy entry into the “art” of index investing. They provide investors with access to low-cost, diversified portfolios that are designed to suit the average investor and risk tolerance.

There are also options designed to meet different criteria, such as regular income, risk tolerance, or growth needs.

With the one-fund option, you can forget the need to re-balance your portfolio annually – just buy into a balanced fund, and the rest will take care of itself. Examples are the Tangerine Investment Funds.

Conclusion

With the average Canadian living longer than ever, it’s important for us to plan for our retirement. And, if you are not banking on winning the lottery or outliving your money, you’ve got to start planning early.

When you arrive at your own retirement party, it’s my hope that you will feel confident about your future – AND proud of yourself!

It is not fair that a married person of low income can receive The Allowance but a single person with low income and no spouse on OAS/GIS cannot. I would not have had to use retirement savings if this had been fair. If you are single too bad, you must work until 65. My married friend didn’t have to plus her spouse was getting income from OAS/GIS and worked part time. Where is fair in that? Widows get widows Allowance, survivors get survivors Allowance and marrieds get The Allowance. Way to punish the single people.

What is considered a severe & prolonged disability?i lost the site in my left eye in 1990 ,do I qualify for a pension.

retirement income : estimate

Hello Enoch, so happy to have found your blog……my wife and I have been arguing about the estimate example given….if the annual expenses are in the order of 75K that would need to be net/after tax income right ? in most cases both the gov’t pensions and the 1.2M$ nest egg would also need to be after tax or am i missing something?

And thank you for the history of our Canadian pension system very informative…..

Regards

Ray

@Raymond: No, the traditional 4% rule assumes that your withdrawals are before tax. The focus is on the total amount you are withdrawing and does not account for taxes paid. That said, you get to add on a bit per year to the base amount to account for inflation rate and to maintain your purchasing power.

The safety of the 4% withdrawal rate has come under a lot of scrutiny in recent times due to lower yields on fixed income assets, etc. A better approach would be to either scale your withdrawals down to about 3% or be ready to adjust as necessary — with higher withdrawals when the market does well, and slightly lower withdrawals in lean years.

Also, you should account for mandated minimum withdrawals from your RRIF starting at age 71.

Thanks for the information!

Looking for a hard copy or a printable version of the Retirement 101 that I just read. Do you know where I would find this?

Thank You

@Regan: Unfortunately, we don’t have it in print. We will add this to our future projects!

I applied for the allowance for the survivor benefit in March and was told I wouldn’t get it till September why does it take so long?

Dear Enoch,

thank you for your comprehensive work.

When applying for the OAS, would years of residency as an international student count towards my 40 years?

@Cat: You ask an interesting question. I have seen financial advisors answer it as a “yes” and “No”, and the right answer is probably that “it depends” (how much time you spend in Canada and your home country during those years, etc. may impact their decision). I would advise you to contact OAS directly to get a definitive answer on how they assess student/temporary resident visa stays for OAS benefit calculations.

Income splitting between spouses from your RRSP. Let’s say you want to retire @ 58 and your spouse would be 54. Would you be able to do income splitting right away or would you have to wait til you are both over 65???

Bars on Enoch for the great write up.Wondering if you do financial planning and investment?

Please PM me

@Tony: Glad to hear you found it useful. Unfortunately, I am not offering one-on-one financial planning and investment as I am not licensed to do so at this time.

Excellent and very comprehensive article Enoch.

Thank you,

Very informative!