RBC Direct Investing is an online brokerage platform for self-directed investors who want to trade stocks, ETFs, and other investment securities.

Its direct competitors in Canada include brokerages owned by big banks such as TD Direct Investing, as well as independent online brokers like Questrade and Wealthsimple Trade.

While the platform works well for both beginners and experienced investors, its standard trading fee is on the high side.

This RBC Direct Investing review covers its features, fees, benefits, downsides, trading platforms, and alternatives.

What is RBC Direct Investing?

RBC Direct Investing Inc. is the brokerage division of the Royal Bank of Canada (RBC), a top-five bank in Canada.

RBC was founded in 1864 and has more than 17 million clients worldwide. Individuals with an RBC personal account can convert their RBC Rewards points to contribute to their investment account.

The platform has an online community where investors can connect to discuss investing ideas.

You can access your RBC Direct Investing account on the go using the RBC Mobile app, which is available on the App Store and Google Play.

RBC Direct Investing Accounts and Investment Types

You can open a variety of registered and non-registered accounts, including:

- Registered Retirement Savings Plan (RRSP)

- Tax-Free Savings Account (TFSA)

- Registered Retirement Income Fund (RRIF)

- Registered Education Savings Plan (RESP)

- Cash Account

- Margin Account

- Non-Personal Accounts, e.g. corporate, investment club, and partnership

Learn about the best investment accounts in Canada.

A practice account is available to members who want to test-run the platform before investing real money.

For investment options, you can trade stocks, Exchange-Traded Funds (ETFs), mutual funds, options, bonds, Treasury bills, debentures, and Guaranteed Investment Certificates.

RBC Direct Investing Fees

RBC Direct Investing offers a flat-rate trading fee for stocks, ETFs, and options.

While active traders with 150 or more traders per quarter get a discount, the standard trading fees on this platform are some of the highest in the industry.

| Investment | Standard Pricing | Active trader pricing |

| Stocks | $9.95 per trade | $6.95 per trade |

| ETFs | $9.95 per trade | $6.95 per trade |

| Options | $9.95 + $1.25 per contract | $6.95 + $1.25 per contract |

When you place a stock or ETF trade using an RBC investment Services Representative (by phone), the fees below apply:

| Price | Commission Rate |

| $0 to $0.50 | 2.5% of trade |

| $0.51 to $2.00 | $35 + 2 cents per share |

| $2.01 and over | $35 + 5 cents per share |

Options trades over the phone attract a $35 + $1.75 per contract commission. When your phone trade value is $2,000 or less, a minimum $43 fee applies.

There is no commission to buy and sell mutual funds. However, note that deferred sales charges, setup fees, and early redemption fees may apply.

Commissions for Treasury bills, bonds, debentures, and other market instruments are included in the quoted price. The maximum commission for these securities is $250 per transaction.

You pay a commission of $28.95 + $1/oz for gold certificates and $28.95 + $0.10/oz for silver certificates.

A minimum of $43 commission applies to precious metal trades, and the fees are in U.S. dollars.

RBC Direct Investing Maintenance Fee

If your account balance is less than $15,000, you pay a $25 maintenance fee per quarter. This is a bummer as it increases the impact of fees on smaller accounts.

You can ask for the maintenance fee to be waived if you:

- Are a new client (6 months or less), or

- Have made at least 3 commissionable trades during the quarter, or

- Have a student banking account with RBC, or

- Have a group RRSP account with RBC Direct Investing, or

- Have set up pre-authorized contribution to your account of at least $100 per month or $300 per quarter, or

- Have an RBC VIP Banking package, or

- Have qualified for the RBC Direct Investing Royal Circle program.

Other administrative fees to watch out for include:

- Account transfer out fee: $135

- RRSP withdrawals: $50

- Statement replacement: $5

- Internal transfers with third-party name: $25

RBC Direct Investing Platform and Research Tools

RBC Direct Investing is available through a web interface and mobile app.

Traders have access to research reports from Morningstar and RBC Research, plus technical analysis from Trading Central.

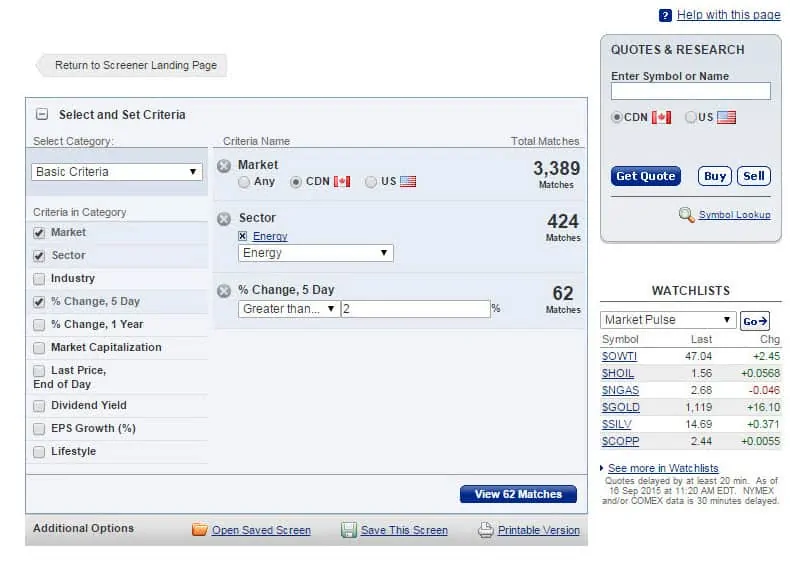

You can use the screeners to select securities based on set criteria and narrow your options.

One area where this platform shines is its streaming real-time level 1 data available to all traders regardless of their account size. Real-time level 2 quotes are also available for free for stocks and ETFs traded on the TSX and TSX/V.

New investors looking to learn the basics of investing can sign up for free investment seminars delivered by RBC reps.

Some other trading tools provided on the platform are:

Watchlists: Use this to keep an eye on the securities you are interested in.

Analyze and Rebalance Tool: Find out whether your portfolio is diversified and get suggestions about how to rebalance it.

Performance Tool: Use this to measure your portfolio’s rate of return against various benchmarks.

Alert: Set up alerts to monitor prices, events, and announcements.

Automatic Contributions: You can set up pre-authorized contributions to your investment accounts.

Dividend Reinvestment Plan (DRIP): Automatically reinvest dividends earned on your account.

Systemic Withdrawal Plan: You can use SIP to automate income withdrawals from your portfolio.

RBC Direct Investing clients get access to an online community where they can interact with other traders anonymously, see what others are investing in and get tips relating to investment strategies.

RBC Active Trader Program Perks

Active traders with 150 or more equity or options trades per quarter get a discount on commissions.

Even if you don’t trade as often, you can join the Active Trader Program when you place 30 or more trades per quarter. Benefits of this program include:

- Access to Level 2 quotes on stocks and ETFs that trade on the Canadian Securities Exchange and NASDAQ.

- Access to premium research reports from Morningstar and RBC Capital Markets.

Clients with account balances of $250,000 or more qualify for Royal Circle Membership and its perks, including priority support and preferred rates.

Related: Best Advisor Websites in Canada.

RBC Direct Investing Pros and Cons

Similar to the other trading platforms we have reviewed, RBC Direct Investing has its advantages and disadvantages.

Benefits

- It is managed by one of the biggest banks in Canada, which may put your mind at rest if you are concerned about the security of your funds.

- It offers a variety of accounts and investment products to choose from.

- It has lots of free educational and research tools.

- Free streaming real-time Level 1 data is available to all traders, and there is no minimum balance requirement.

- The RBC Mobile app can access your deposit and investment accounts, and you only need one app.

- It offers a practice (demo) account.

- If you transfer $15,000 or more from another financial institution, they cover the transfer fee of up to $200.

Downsides

- The standard flat trading fee is high. You can get lower fees with Wealthsimple Trade, Questrade, and others.

- A $25 quarterly maintenance fee applies when your account balance is less than $15,000.

- The mobile trading interface feels outdated.

Is RBC Direct Investing Safe and Legit?

RBC is one of the largest banks in North America based on asset size and market capitalization.

It is regulated by the Investment Industry Regulatory Organization of Canada (IIROC) and is a member of the Canadian Investor Protection Fund (CIPF).

CIPF membership means that your investment accounts are protected by up to 1 million should the bank become insolvent.

RBC Direct Investing clients enjoy an Online Security Guarantee. You will be reimbursed 100% for direct losses to your account resulting from unauthorized transactions (terms and conditions apply).

RBC Direct Investing vs. Other Trading Platforms

Find out how RBC Direct Investing compares to other discount brokers such as TD Direct Investing, Questrade, and Wealthsimple Trade.

| RBC Direct Investing | TD Direct Investing | Wealthsimple Trade | Questrade | |

| Stock trading fees | $9.95 | $9.99 | $0 | $4.95 – $9.95 |

| Options/contract | $9.95 + $1.25 | $9.99 + $1.25 | N/A | $9.95 + $1 |

| Commission-free ETFs | No | No | Yes | Purchases are free; fees apply when you sell |

| Trading commission discount | $6.95/trade for active traders (stocks) | $7/trade for active traders (stocks) | N/A | $4.95/trade for active traders (stocks) |

| Types of accounts | TFSA, RRSP, RESP, RRIF, margin, corporate, investment club, partnership | TFSA, RESP, RRSP, RRIP, RDSP | TFSA, RRSP, personal non-registered | TFSA, RRSP, RESP, LRSP, LIRA, RRIF, LIF, margin, corporate, partnership |

| Minimum investment | None | None | No minimum balance | $1,000 |

| Maintenance fee | $25/quarter if balance is less than $15,000 | $25/quarter if balance is $15,000 or less | None | None |

| Platform | Web and mobile app | Web and mobile app | Mobile app; web and mobile app for robo-advisor | Wed, mobile-app, desktop app |

| Transfer fees waived? | Up to $200 with transfers of $15,000+ | Up to $150 with transfers of $25,000+ | Up to $150 on transfers of $5,000+ | Up to $150/account |

| Other features | Access to robo-advisor service via RBC Investease | Has dedicated platform for U.S. options trading | Access to low-cost robo-advisor (Wealthsimple Invest); high-interest savings account | Access to low-cost robo-advisor service (Questwealth) |

| Promotion | N/A | N/A | Get a $25 cash bonus when you fund with at least $200 | Get $50 in trading fee credit when you deposit $1000 |

| Learn more | – | Learn more | Learn more | Learn more |

RBC Direct Investing FAQ

Active traders with 150 or more trades per quarter get a $3 discount per transaction on equity, ETF, and options trades. Also, you can avoid the quarterly $25 maintenance fee by investing $15,000 or more.

You can easily transfer funds from your RBC bank account or another bank. You can also transfer existing investments from another financial institution to your Direct Investing account.

You can access your investment using the RBC Mobile app. It is available on iPhone and Android devices.

You can call them at 1-844-208-0258 from 7am to 8pm ET (Monday-Friday), send a message using the email form on the website, or visit an Investor Centre location.

I seldom write reviews but RBC is so bad that I have to share this.

TL;DR: Worst account opening experience, stay away from RBC DI at all cost

RBC Direct Investing account opening is not one of the worst, but IS THE WORST experience you can ever have when opening an account.

I submitted the application in Dec 2020 and it’s Feb 2021 now and the application is still not processed. (I am an existing RBC client)Imagine how many opportunities I could have missed during this long wait time!

I received an email with a confirmation # and that’s it. There is no contact information in that email at all if you need to follow up or have questions. I have to google and look for that information myself.

After a week, I called 1-800-769-2560 to follow up on my application. I was told there was missing information in my application. Ridiculous! They will not contact you about the missing information but you have to call to find out yourself.I provided the required missing documents within a day or 2 and was told that no more information is pending on my end and the account will be processed in a couple of business days.

Another week passed by and nothing, no updates from RBC.I called the phone # again. I waited for more than an hour on the phone until RBC phone system decided to just disconnect me.Tried again and waited for another hour more and same thing, got disconnected from RBC. The 3rd trial waited for another 3+ hours to finally get to an agent. That’s a total of more than 5+ hours of wait on the phone!! Ridiculous!!The agent says the application was escalated already and would be processed in a couple of business days.

Another week passed by, same frustration, no updates. I sent them an email for updates. No response at all! Obviously, RBC does not care about their customer.I tried to call again and had to wait for another 2+ hours to get to an agent.The agent says pretty much the same thing as the previous agent that nothing is pending from my end and the application will be processed in a couple business days. I think RBC has a different meaning for “business days”. They probably mean months or even years.

Earlier, my friend was joking to me about opening an RBC DI account and said “Good Luck, u will probably have it by 2022, if you are lucky”.

I finally realized that is not a joke, it’s real. I gave up and don’t even want to do business with RBC at all.

I would strongly recommend anyone to save yourself all the hassles and to avoid RBC Direct Investing at all cost.

Unlike Wealthsimple Trade, RBCDI allows DRIP’s for USD holdings held on the USD side of your brokerage account (ie. no fx fees for dividends or DRIPs).

But their system is poor as your get cash credited to your account, and then a day or two later the cash is journaled and DRIP happens, but if you forget about the future drip and buy RBF2010 or RBF2014, a/c will go to overdraft.

Other downside is if u hold invts in USD, and currency moves big intraday, you don’t see live values on USD stock worth in CAD….have to wait for overnight batch process to update fx rate on USD holdings…..BMO investorline and Waterhouse do live intraday fx valuation during the day. Not a big deal just annoying.

Worst customer service ever, can’t even transfer in an account from a different institution, in the process of moving to Wealthsimple. Probably be about the same except no commissions.

I don’t understand the negative comments here. RBCDI for me has been nothing but outstanding, my account was opened within 36 hours after submission without any errors at all.

Plus their customer service is among the best I have ever experienced, and I switched from QTrade Investor which is known for their service.

Great investment product, tools, research and community. For me, RBCDI is an excellent choice for DYI investors.