TD Direct Investing is one of the brokerage platforms available to self-directed investors in Canada. You can use it to trade stocks, ETFs, mutual funds, and various other investment securities.

While TD Directing Investing is popular, its trading fees are not competitive compared to many of the trading platforms on our list of the best trading platforms in Canada.

Trading fees and commissions are not the only factors to consider when opening a brokerage account. You should also look at the available investment products, types of accounts, trading platform features, customer support, and more.

TD Direct Investing Summary

TD Direct Investing

-

Ease of use

-

Trading fees

-

Accounts offered

-

Investment products

Overall

Summary

TD Direct Investing is one of the best brokerage platforms in Canada. This bank-owned brokerage offers several investment products and accounts, including registered investment accounts like the RRSP, TFSA, RESP, and others.

While it has the advantage of having advanced trading tools for those who need them, TD Direct Investing has higher fees than some of its competitors at $9.99 pre trade. This TD Direct Investing review covers its fees, features, benefits, downsides, and alternatives.

Pros

- Access to a versatile investing platforms.

- Multiple investment accounts and securities.

- Canada’s largest online brokerage.

- Well-rated user-friendly mobile app.

Cons

- One of the highest trading fees in Canada.

- A $25 quarterly fee on small accounts.

- No access to professional management.

- No trading fee discount for students.

TD Direct Investing Accounts

Self-directed (DIY) investors can use the TD Direct Investing platform to trade and invest using various accounts, including:

- Tax-Free Savings Account (TFSA)

- Registered Retirement Savings Plan (RRSP)

- Registered Education Savings Plan (RESP)

- Registered Retirement Income Fund (RRIF)

- Locked-in Retirement Accounts (LIRA)

- Life Income Funds (LIF)

- Registered Disability Savings Plan (RDSP)

- Margin and Cash accounts

TD Direct Investing Investment Products

You can choose from a variety of investments for your account:

Equities: These are stocks or shares of a company. When you purchase a stock, you become a part-owner in the company and may earn dividends and capital gains.

Exchange-Traded Funds (ETFs): These are baskets of stocks, bonds, or commodities that track the performance of a benchmark index. ETFs are traded on a stock exchange.

Options: These financial derivatives have values dependent on the underlying asset (e.g. stock). An options contract gives an investor the right to buy or sell the underlying asset at a specific price within a specific time frame.

Mutual Funds: These are professionally managed portfolios of stocks, bonds, etc. They have built-in management fees.

Precious Metal Certificates: You can buy gold and silver certificates to diversify your portfolio or hedge against inflation.

Fixed Income Assets: Includes Government of Canada, provincial, corporate, and municipal bonds; mortgage-backed securities; and money market instruments, e.g. treasury bills, banker’s acceptances, and commercial papers.

Term Deposits: Investors with a short-term investment horizon or low-risk tolerance can invest using term deposits and GICs.

TD Direct Investing Fees

TD Direct Investing fees are some of the highest in the industry.

Compared to low-cost trading platforms, TD’s standard flat rate pricing is not competitive.

| Stocks | Options | |

| Standard trading fee | $9.99/trade | $9.99 + $1.25 per contract |

| Active trader pricing | $7.00/trade | $7.00 + $1.25 per contract |

| Telephone trades | Minimum $43 fee | Minimum $35 + $1.50 per contract |

Commissions for bonds, GICs, and term deposits are included in the quoted prices. A minimum purchase amount may apply.

There are no commissions to buy or sell mutual funds. If you hold the fund for less than 30 days, a short-term redemption fee equal to 1% of the redemption value or $45 (whichever is greater) plus mutual fund company fees apply.

Gold bullion trades cost $30 + $1/oz, and silver bullion cost $30 + $0.10/oz. These fees are quoted in USD.

TD Direct Investing Maintenance Fees

If your total account balance is less than $15,000, a $25 maintenance fee is paid per quarter.

You can waive this fee via TD’s Household Program if:

- The combined assets in your household accounts exceed $15,000

- You have made 3+ trades that incurred a commission in the last quarter

- Your account is new and not older than 6 months

- Your household has a Registered Disability Savings Plan account with TD

- One or more of the accounts in your household is signed up for a pre-authorized contribution of at least $100 each month

Additional administrative fees that may apply to your account are:

- Full RRSP account withdrawal: $100

- Partial RRSP withdrawal: $25

- Mailed account statement: $2 each

- Duplicate statement: $5 each

- Account transfer (partial or full): $150

TD Direct Investing Trading Platforms

Clients of TD Direct Investing have access to four trading platforms.

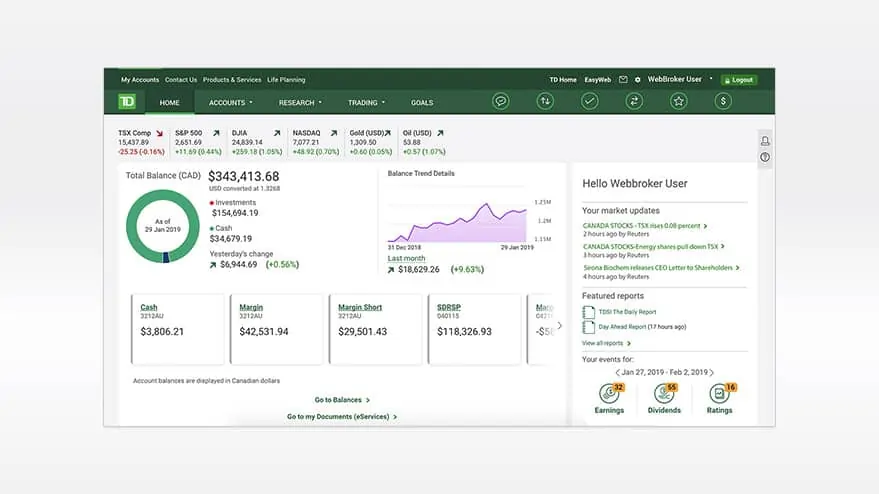

Web Broker: This is TD’s most popular trading platform. It offers real-time level 1 market data, investment screeners, charting tools, advanced order types, automated alerts, and more.

TD mobile app: Works on iOS and Android devices and is available in English, French, and Chinese. It can be used to trade stocks, ETFs, and options and integrates well with Web Broker.

Advanced Dashboard: Offers real-time streaming data with advanced charting and options analysis for experienced traders.

ThinkorSwim: For active U.S. options traders and requires a minimum of $25,000 USD balance to activate. Provides access to level II streaming data, customizable charting, live CNBC news feed, and more. This platform is powered by TD Ameritrade.

TD Direct Investing clients can access market research, analysis, webinars, video lessons, and an introductory Master Class.

TD Direct Investing Pros and Cons

Below are some benefits and downsides of using TD Direct Investing for your trading.

Pros

- Access to feature-packed investing platforms with advanced trading tools.

- Access to multiple investment accounts and securities.

- Customer service support from 7am to 6pm ET on Monday to Friday.

- Canada’s largest online brokerage.

- Well-rated mobile app by real users.

- Comprehensive and free investment education resources.

- If you transfer your account of $25,000 or more to TD Direct, your transfer fees may be reimbursed up to $150.

- You can easily set up dividend reinvestment plans (DRIP) and pre-authorized purchases for mutual funds.

Cons

- Standard trading fees for stocks are high at $9.99. There are many online brokerages with lower fees. e.g. Questrade starts at $4.95/trade, and Wealthsimple Trade has no trading commissions.

- The $25 quarterly fee increases your investment costs if you don’t have more than $15,000 to invest.

- Self-directed investing platform with no access to professional management. Unlike robo-advisors, you don’t enjoy free portfolio advice or automatic rebalancing.

- There are no trading fee discounts for students.

Is TD Direct Investing Safe and Legit?

TD Bank is a Big 5 bank in Canada and one of the largest banks in North America.

TD Direct Investing is also one of Canada’s largest online discount brokerages.

TD is a member of the Canadian Investor Protection Fund (CIPF) and the Investment Industry Regulatory Organization of Canada (IIROC). CIPF membership protects your account against insolvency by up to $1 million.

Lastly, TD offers an Online and Mobile Security Guarantee. If you experience a loss due to unauthorized transactions on your account, you will receive 100% reimbursement (subject to terms and conditions).

TD Direct Investing vs. Alternatives

The table below shows how TD Direct Investing compares to other brokerage platforms in Canada, including CIBC Investor’s Edge, Wealthsimple Trade, and Questrade.

| TD Direct Investing | CIBC Investor’s Edge | Wealthimple Trade | Questrade | |

| Stock trading fees | $9.99 | $6.95 | $0 | $4.95 – $9.95 |

| Options fee/contract | $9.99 + $1.25 | $6.95 + $1.25 | $0 | $9.95 + $1 |

| Commission free ETFs | No | No | Yes | Purchases are free; fees apply to ETF sales |

| Trading commission discount | $7/trade for active traders (stocks) | $5.95/trade students; $4.95/trade active traders (stocks) | No trading commission | $4.95/trade for active traders (stocks) |

| Types of Accounts | TFSA, RRSP, RESP, RRIF, DPSP, LIRA, Margin | RRSP, TFSA, RESP, RRIF, LRSP, LIRA, PRIF, LRIF, margin, corporate, partnership, Formal trust | TFSA, RRSP, personal non-registered, cryptocurrencies | TFSA, RRSP, RESP, LRSP, LIRA, RRIF, LIF, margin, corporate, partnership, forex, CFDs |

| Minimum investment | None | None | None | $1,000 |

| Maintenance fee | $25/quarter if balance ≤ $15,000 | $100/year if balance ≤ $10k-$25k | None | None |

| Platform | Web and mobile app | Web and mobile app | Mobile app; web and mobile app for robo-advisor platform | Web, mobile app, desktop app |

| Mobile app rating | 4.5/5 on the App Store | 3.3/5 on the App Store | 4.2/5 on the App Store | 1.9/5 on the App Store |

| Transfer-in fees waived? | Up to $150 with transfers of $25,000+ | No | Up to $150 on transfers of $5,000+ | Up to $150/account |

| Other features | Access to advanced charting tools, market data, and investor education | Access to advanced charting tools, market data, and investor education | Access to low-cost robo-advisor service, SRIs, HISA, and some investor education | Access to low-cost robo-advisor service, advanced charting tools, and market data |

| Promotions | N/A | N/A | Get a $25 cash bonus when you open an account and deposit at least $150 | Get $50 in free trades when you start investing with at least $1,000 |

| Learn more | – | Read Review | Learn More | Learn More |

TD Direct Investing FAQ

Trading Commissions on the platform are a flat $9.99 for Canadian and U.S. stocks. Add $1.25 to this base fee per options contract.

You can reach TD Direct Investing’s customer support at 1-800-465-5463 (English), 1-800-361-2684 (French), 1-800-838-3223 (option 1- Cantonese), and 1-800-838-3223 (option 2 – Mandarin).

If you qualify as an active trader with 150 or more trades per quarter, you pay $7 per trade (instead of $9.99). Also, when you transfer an account of $25,000 or more to TD Direct Investing, they reimburse your transfer fees up to $150.

Hello. After reading your review, I decided to open a TD Direct account, for relatively low trading of stocks and mutual funds. After opening it, I found the whole experience underwhelming for the following reasons:

1) No secure way to upload documents (neither insecure, anyway). If one needs to fill a form, one has to email it (totally insecure), mail it, or, perhaps, dropping it at one if the TD branches. All the options totally inconvenient.

2) To set a trading password, one has to call TD! With the current call volumes, one should expect to be on hold for at least 90-100 minutes!

3) As in 2 above, for any issue that may arise there is no online help (chat), but only that 90-minute-hold phone call.

It seems that as they were the first to develop this WebBroker back in the nineties. they left it as it was first developed. No improvement at all since then.

The points I just made were from my first impression with the WebBroker. I would welcome any correction if I misunderstood something. I would hate to go and close this account.

I totally agree with Rob; there is much needed to improve the system. Lately, there have been a lot of service interruptions. This morning, it is 10AM and I have not been able to fully sign in – I get part way, and then I get an TD error message “There is a problem at our end………please try again later”. There is no compensation for any of these delays. For the “fast Mobile service”, you currently have to wait for almost an hour to speak to someone. Is this just an anomaly, maybe, but there seems to be at LEAST 1 service interruption every 2 weeks (there was a service interruption yesterday and again this morning) so, go figure.

Also, I have been trying for several months to get a proper explanation of the difference in day-over-day Total Balance values with the corresponding(?) Yesterday’s Change values. Apparently, it has something to do about different systems/sources being used, but, no site explanation details.

Further to my above comment, here is the current TD message:

10:12AM Thursday, January 28, 2021

“We are currently experiencing an issue with our system that is affecting a small percentage of our clients. We appreciate your patience as we work towards a solution. Alternatively, you may use the TD Mobile App.”

What time zone is this site using?

I have been with TD Waterhouse for about 10 years and I am looking currently for a better option. I have had problems making trades (on hold right now because I couldn’t exercise a sell order). TD continues to suggest their issues with not being able to get through on there phone lines and having difficulty is due to covid. The reality is that these problems may now be a bit worse but they have had these issues for the last few years.

this is the worst customer support center. i spend all day to speak with agent for help to reset my trading password, all day I’m lessening this stupid music, and your call is wary important

Hello,

I am currently using itrade and looking for transferring my trading account some where. For the past few days I have been expericing similar issue and not able to trade anything in the morning.

With what you’ve expericing it sounds like a global events. I am wondering any other platforms that have no downtime in the last few days.

I wanted to open TD web broking account and the worse service and long hold I got from TD ever. Never felt this worse before in my 10 plus years banking with them but, TD investing is the most worse

I have been using TD Direct Investing for a long time but no more. I am looking for a better option. Their customer service is non-existent and my time is too important to sit for up to two hours on hold only to then receive an automated message saying they are having technical difficulties and telling me to call back later. My current issue is I have two fixed income securities I want to sell but their automated system tells me there is an error in the system and I have to speak to a representative. I have been trying to get through to them for four days! Their local office number delivers an automated message telling me to call the number where I keep being put on hold. PS I am a former executive at TD, now retired, who is being forced to find a better alternative.

Customer service hours are no longer 24/7 but 5 workdays a week and the hours are reduced to slightly longer than trading hours.

Using my desktop computer, online trading and very minor account changes are still adequate, but if one needs to make a non-trading phone call (#3, #3), expect to wait at least an hour or 2 over the phone. Even then you may have to do it all over again when somebody at TD Waterhouse screws up. This has happened repeatedly to me on several occasions even before COVID and now it’s even worse.

Worst brokerage ever , when i send an order hold the order “under review ” for 45 minutes and price changes in that 45 minutes. I always lost money with this brokerage. They are horrible , very outdated , super slow their platform is not user friendly at all. 45 minutes later price goes down and i update price again it goes to another 45 minutes under review. This is unacceptable. I will transfer everything all my portfolio to IB. I had enough of this TD BS

How could you give them a good rating trying calking them in hold for hours go to google reviews for the truth 1 star rating you must be working for td or trying to get a job with them worst customer service even zero rating

TD direct invest have highest fees and worse service. Starting from opening an account that last for more than one month to be opened. Calling customer service last more than 2 hours. Customer support lack competence as most of them don’t really know how to resolve minor problems and many contradict each other. Many order with limit price to sell have not been executed for unknown reason!

I wonder why they charge $9.99 without providing the minimal customer satisfaction. Currently, I am looking to get out of TD even for my checking account. My expectation about this bank was not right unfortunately

I totally agreed with Rob. Reason is their horrible phone customer service and their management do not care even if you escalate. In order to do a purchase, you either call or do it online. When you call, you wait on the phone for more than 2 hours. But when the 2 hours wait is up, they cut you off. Ok, I will do it online. But it requires a trading password which they never gave you when you setup the account. To setup that password, you need to call. I ended up calling 5 days in order to get someone on the phone to reset my trading password, with each day waiting for 2 hours and then TD cut me off on the phone.

I am so frustrated that I email the TD escalation line. All management said is that their line is busy due to COVID and ask me to continue to call. I requested someone from TD to call me to reset my trading password. They said yes but did not call at all. TD used to have good management but now TD management simply focus on advertising and totally ignore customer service(at least the phone side).

I am not telling you what I am doing with my TD account. You decide!

Horrible performance regarding the platform. Constantly out of service during the day. Examples of issues: Can’t login, buy orders can’t be modified or cancelled. Market top stock performers information is not working. Closing account value is incorrect. Sorry to say, TD Webbroker is pathetic for a top 5 large bank in Canada.

Wow, I thought it was only me who is experiencing these problems with TD customer service, webbroker and staff lacking knowledge about their products.

I spent hours in the branch trying to set up an account I wanted but I was told it is no longer available but they still advertise it as available on their website. I was given the wrong information about buying mutual funds in TD-DI that I will be charged a trading fee. Does it really take a whole day to switch from Mutual fund A to Mutual fund B in TD-DI? Customer support over the phone have no clue about their products. I’ve been with TD for over 10 years, it is just recently that I started actively organize my investment portfolios and experiencing these issues with TD. I feel like they are behind in customer support/service and technology.

How are the other big banks? CIBC, Scotia, BMO and RBC?

I have TD, BMO and CIBC brokerage accounts. All 3 places have had their share of issues as call centres are overwhelmed with calls. If you trade in US$ TD is great exchanging money using Norbert’s Gambit.

I have not experienced the issues others have encountered but I don’t doubt these things happened. I tried calling to CIBC and most times were more than 2hrs before giving up. Now its better there since they’ve hired more people. I’m sure its the same at TD now – my guess.

Been with this service for a few yrs now, looking for something else. Was never good (and getting worse), fee’s are outrageous, customer service is non existent, site is down plenty of time and hence can’t trade, too often when I log on to my homepage, it has the wrong values, I could go on and on. This AM it showed a loss of over $5K, investigating, the value of a specific stock showed a loss of circa 60%, but checking the stock ticker on their own site, and others websites, they simply showed the wrong value per stock – by a mere $30/share on a $33/share stock!! How can this happen?!? Total lack of professionalism, and never anything but excuses. As they don’t seem to care about customers, I can’t see myself staying with them. The interface is good, but that’s simply not enough to keep paying high fee’s for the total lack of service or customer care.

Their fees are outrageously high. It looks like TD hasn’t realized yet that many people are starting with small accounts, and that nowadays you can’t ‘buy and hold’ stocks forever like before, as the market is much more volatile. However, there are some pros: I find their research tools very useful, it’s easy to find stocks to borrow for shorting purposes, and you can have multi-legged options transactions for a single price. I don’t know of any other web broker which allows that. In general, I would suggest to anyone to have 2 trading accounts. That way if one account freezes for some reason, you can always use the other account to execute a transaction.

Hi, Can you please suggest more on buying metal certificate. I do not find any options in direct investment to buy silver certificates.

Open a TD account, deposit $100 per month to get free access to the platform and just invest it in a global ETF which pays a decent dividend yield once you have $1000 in there (so the 9.99 fee doesn’t hurt too much).

Then use wealthsimple to do all your trading. This way you get TD’s great research and education effectively for free so you can make more informed trades through wealthsimple.

TD direct investing has screwed me a few times. Most recently was today when trying to sell a call option. I Entered my password to preview the trade but I couldnt submit the trade. I missed out on $680 profit. I called in to find out what the error was and TD didnt have a response. This is not the first time this has happened. I have been dissappointed in TD direct investing a few times.

TD Waterhouse’s service is atrocious. If there is something you cannot do online by yourself, expect to wait HOURS for someone to pick up the phone to address your issue.

If you love waiting on hold for hours, piss poor service and incompetent staff….TD direct investing is for you.

Otherwise avoid this customer service lacking joke of a company

I’m in the same boat as others. Absolutely terrible service. On hold for hours, agents don’t give correct information or just make it up, system down, tried to by Mutual fund (other than TD) wasn’t able to place the order myself, agent tried and they couldn’t either, then hung up on me. Never called me back. Trying to transfer out and they keep rejecting the fax saying they can’t read it but then how do they know it a request on my account. Then they said the signature guarantee was missing. Now they say they have 20 business days to transfer the money and I have to pay for this! I’m just about rid of them!

I never had any of the problems reported above when using TD WebBroker. It’s been pretty easy to use and have been happy with the service over the years. Customer support has been great, they respond almost instantaneously if you dial in using the mobile app. Honestly TD is one of the better banks to deal with in terms of customer service.