The best crypto trading apps and platforms in Canada make it easy to buy and sell cryptocurrency online from the comfort of your home.

Are you looking to trade cryptocurrencies like Bitcoin in Canada? This article covers some of the best cryptocurrency trading apps and platforms you can use, like Bitbuy, Wealthsimple Crypto, Newton, and VirgoCX.

Best Crypto App in Canada for April 2024

If you want to save time on vetting the best exchanges, our top recommendation for the best crypto trading app and exchange in Canada is Bitbuy.

Bitbuy Crypto Exchange

Get a $50 bonus if your initial deposit exceeds $250

Trade approx. 40 coins

Great for new & advanced traders

0% to 2% trading fee

Best Cryptocurrency Trading Platforms in Canada

There are several ways to buy and sell cryptocurrencies in Canada. You can trade on a cryptocurrency exchange or purchase using a cryptocurrency broker.

There are also Bitcoin or cryptocurrency ATMs where you can get coins or exchange them for cash.

Below, I have listed the best crypto trading platforms and apps in Canada. They are chosen based on their overall value and top features, including supported coins, trading tools, trading fees, security measures, company reputation, our personal experience, and welcome offers.

1. BitBuy – Overall Best Crypto App in Canada

Bitbuy is a top Canadian crypto trading platform operating out of Toronto. It was founded in 2016 and offers a wide array of 40 coins to choose from.

Bitbuy is the best crypto app in Canada overall.

This crypto exchange caters to beginners and advanced traders looking for additional features. It is available on iOS and Android and also has a nice-looking web interface.

Bitbuy site was recently acquired by WonderFi, which also owns CoinSmart and Coinberry. It has served over 900,000 Canadians and supported over $7 billion in crypto trades.

Coins offered: Bitcoin, Ethereum, Litecoin, EOS, Aave, Chainlink, Stellar, Polkadot, USD Coin, Polygon, Uniswap, Algorand, Axie Infinity, ApeCoin, Cosmos, Decentraland, Maker, Fanotm, Avalanche, Shiba Inu, Compound, Tezos, Chiliz, NEAR, and many others.

Funding options: Interac e-Transfer, bank wire, debit card, bill payment, and digital currencies.

Fees: 0% to 2% trading fees, depending on your trading level; free fiat deposits, crypto and fiat withdrawal fees vary.

Security and regulation: Bitbuy is a regulated Money Service Business with FINTRAC. It is also the first Canadian registered marketplace for crypto assets after receiving approval from the Ontario Securities Commission (OSC).

It uses 2FA encryption and has a 90% cold storage security policy.

Promotion: Create a Bitbuy account and make an initial deposit of at least $250 or more (lumpsum) to get a $50 bonus.

2. VirgoCX – Best Crypto App for Altcoins

VirgoCX is a top cryptocurrency exchange founded in 2018. It offers 65+ coins and can also be used to access various crypto services, including NFTs and OTC trading.

Coins offered: Bitcoin, Ethereum, Dogecoin, Solana, Litecoin, ApeCoin, Stellar, Chainlink, Uniswap, Ripple, Cardano, ARB, Cosmos, NEAR, Fetch, Blur, Hedera, Fantom, Filecoin, THORChain, GALA, Convex, Quant, Enjin Coin, Chiliz, and more.

Funding options: Interac e-transfers, wire transfers, bill payments, credit cards, debit cards, and crypto deposits. VirgoCX is one of a few Canadian crypto exchanges to support multiple currencies (CAD and USD).

Fees: 0.50% to 2.50% trading fee, depending on the asset you are trading (up to 90% trading fee discount available); free fiat withdrawals and deposits.

Promotion: Get a $20 bonus when you complete KYC ($5 bonus) and deposit at least $100 ($15 bonus).

Security and regulation: VirgoCX is registered as a Money Service Business with FINTRAC. As per its website, it utilizes several security measures and policies to protect users’ accounts.

This platform rewards users with lower trading fees based on their trading volume. For example, you could get a 10% to 90% discount on the spread if you place larger trades. It offers instant funding within minutes and has a large selection of Metaverse, NFT, and Web3 coins.

3. Newton – Crypto App for Altcoins

The Newton crypto trading platform supports several coins. It was established in 2018 and is a beginner-friendly platform (no advanced charting tools).

Coins offered: Bitcoin, Ethereum, Cardano, Solana, Ripple, Polygon, Ox, Enjin Coin, Dash, Balancer, Ren, Tezos, Dai, and many others.

Funding options: Interac e-Transfers, wire transfers, and crypto deposits.

Fees: Pay a price spread on transactions (up to 2%), free fiat deposits and withdrawals, no markup fees for crypto withdrawals.

Promotion: Get a $25 bonus when you trade your first $100 worth of crypto.

Security and regulation: Newton is registered as an MSB with FINTRAC. Most crypto is held offline.

4. Shakepay – Good Crypto App for BTC and ETH

Shakepay is one of the oldest places to buy crypto in Canada. It also has crypto trading apps you can download for both Android and iOS devices.

As of this writing, over 900,000 Canadians have used the platform to trade more than $6 billion in digital assets.

Coins offered: Bitcoin and Ethereum.

Funding options: Interac e-Transfer, wire transfer, and crypto deposits

Fees: Trading fees are embedded in the price spread and range between 1-3%, fiat and crypto deposits and withdrawals are free.

Promotion: Get a $5 bonus when you open an account and trade $100 worth of BTC or ETH.

Security and regulation: Shakepay is registered as an MSB by FINTRAC and Revenu Quebec, and the majority of coins on the platform are held offline.

5. Wealthsimple Crypto – Crypto App For Beginners

Wealthsimple Crypto is a regulated cryptocurrency platform in Canada. It is owned by Wealthsimple, Canada’s largest robo-advisor, and is available on iPhones, Android devices, and through a web interface.

It is one of the best crypto apps for beginners.

Coins offered: Bitcoin, Ethereum, Chainlink, Polkadot, Uniswap, Dogecoin, Polygon, Litecoin, Filecoin, Fantom, and many others.

Funding options: Bank transfer (CAD), debit card, and crypto deposits.

Fees: 2.00% trading fee.

Promotion: Get a bonus when you sign up and deposit at least $200.

Security and regulation: Your coins are held by Gemini Trust Company LLC, a regulated crypto exchange that has $200 million in insurance coverage.

Wealthsimple Digital Assets Inc. is a virtual currency dealer money services business authorized by the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC).

6. Coinsmart

Coinsmart is one of the cheapest crypto exchanges in Canada. It was founded in 2018 and is based out of Toronto. It was recently acquired by WonderFi, the same company that owns Bitbuy. While it is not accepting new users, you can sign up for Bitbuy to enjoy even more benefits.

It offers access to several popular cryptocurrencies and multiple ways to find your account, including using credit cards.

Coins offered: Bitcoin, Ethereum, Litecoin, Avalanche, Bitcoin Cash, EOS, NEO, Stellar, Cardano, Tether, Uniswap, Polygon, Solana, Chainlink, Shiba Inu, Polkadot, and more.

Funding options: Interac e-transfer, wire, bank draft, credit card, debit card, EFT, existing crypto holdings. Multiple fiats are supported, including Canadian Dollars, U.S. dollars, and Euros.

Fees: 0.20% to buy coins using fiat. Bank wires and bank draft deposits are free.

Interac e-transfer deposits are free when your deposit is $2000+ (otherwise 1.5%); 1% fee on ETF withdrawals and wires. Fees vary for direct cryptocurrency withdrawals.

Promotion: Get a $50 welcome bonus when you open an account and make an initial deposit of at least $250.

Security and regulation: 95% of the coins on this exchange are kept in cold storage wallets, and the site uses bank-level security to protect your account, plus two-factor authentication.

The Coinsmart interface is intuitive for beginner traders, and accounts are typically verified within minutes. It ranks as the best crypto exchange in Canada on this list.

7. Netcoins

Netcoins is a crypto brokerage platform owned by BIGG Digital Assets, a public company listed on the CSE.

This crypto trading platform and app is registered with FINTRAC and offers several coins, including many metaverse coins, stablecoins, and more.

Coins offered: Bitcoin, Ethereum, Decentraland, SushiSwap, Yearn.Finance, Enjin Coin, Curve, Fantom, Aave, The Sandbox, and others.

Funding options: Interac e-Transfers, bank wire, and crypto deposits.

Fees: 0.50% trading fee plus an undisclosed spread embedded in the prices.

Security and regulation: Netcoins is a registered Money Service Business (MSB) with FINTRAC, and it is also regulated and registered with the Canadian Securities Administrators and British Columbia Securities Commission.

8. Kraken

Kraken is one of the oldest crypto exchanges in the world, and it has over 9 million users.

The platform offers many crypto trading options, including spot, margin, crypto futures, and gas-free NFT trading. Kraken also offers crypto staking of 12+ crypto assets and the Kraken Pro mobile app with advanced trading tools to trade on the go.

Coins offered: 200+ cryptocurrencies, including Bitcoin, Ethereum, Flow, Kava, Cardano, Cosmos, Tron, Tezos, Mina, Polkadot, Kusama, etc.

Funding options: ACH bank transfer, wire transfer, e-Transfer, credit card, Etana Custody, and crypto deposits.

Fees: Starts at 0.26% and varies with volume.

Security and regulation: Kraken is a FINTRAC-registered Money Service Business in Canada (‘Payward Canada, Inc.’, MSB Registration No. M19343731).

The platform employs industry-leading security measures to protect user funds, including 2FA via Google Authenticator and Yubikey, email confirmation for withdrawals with self-serve account lock, and SSL encryption.

9. Coinbase – Global Crypto Exchange

Coinbase is a top crypto app and platform operating in 100+ countries, including Canada. It offers multiple cryptocurrencies, a crypto card, crypto derivatives, crypto loans, NFTs, crypto staking, and a self-custody crypto wallet.

That said, Coinbase is known for its high fees, especially for smaller orders between $10-$10k. Thus, it may only be cost-effective for experienced, high-volume traders.

Coins offered: Coinbase offers several cryptocurrencies, including BTC, ETH, ADA, SOL, GRT, AMP, NEAR, ATOM, XTZ, etc.

Funding options: Canadians can fund their Coinbase wallet via Interac e-Transfer, 3D Secure debit Card, and PayPal.

Fees: Coinbase Simple levies flat fees of $0.99-$2.99 for orders of $200 and below and a percentage fee of about 1.49% for orders above $200.

On Coinbase Advanced, fees are up to 0.60% and are based on your trading volume.

Security and regulation: Coinbase is undergoing the registration process to comply with Canadian securities laws.

The platform employs industry-leading security measures to protect user funds, including FDIC insurance up to $250K for USD balances, biometrics for mobile, address whitelisting, 2FA, Coinbase Vault, Yubikey support, etc.

10. NDAX

NDAX (National Digital Asset Exchange) is a Canadian cryptocurrency exchange operating out of Calgary. It offers a good number of CAD to crypto pairs and is available on smartphones and computers.

This platform is easy to join (instant ID verification) and has one of the lowest fees in Canada.

Coins: Bitcoin, Ethereum, XRP, Litecoin, EOS, Dogecoin, USDT, LINK, Stellar, Cardano, Uniswap, Matic, Compound, The Graph, and many others.

Funding options: Interac e-transfer, Bank draft, certified cheque, and wire transfer.

Fee: 0.20% to buy and sell crypto. $4.99 CAD when you withdraw fiat using a direct bank deposit or ETF. Fees vary for withdrawals.

Security and regulation: NDAX is a registered MSB under FINTRAC. It holds 95-98% of digital assets in cold storage, and 2FA is mandatory for all accounts.

In addition to regular crypto trading, NDAX offers a premium service for larger traders via NDAX wealth.

Binance

Binance is one of the best cryptocurrency exchanges in the world. It offers trading in hundreds of cryptocurrencies and has millions of users worldwide. Binance has recently stopped operating in Canada.

You can access its mobile app on the App Store and Google Play. Binance also has platforms you can install on Windows, macOS, and Linux.

Coins offered: More than 350 coins.

Funding options: Bank transfer, credit card, debit card, digital currencies, and several others.

Fees: 0.1% on crypto trades for entry-level membership (lower at higher levels). Deposit and withdrawal fees vary depending on the coin.

Promotion: Get a 20% discount on fees when you open an account using our referral link.

Security and regulation: Binance keeps most of its coins in cold storage. Binance.US is separate from Binance; however, it is unclear whether either company is registered with a regulatory authority.

Other crypto apps and Canadian exchanges are:

- Crypto.com ($25 bonus after staking for a crypto Visa card)

- Bitcoin Well

- Bitvo

- CEX.io

- KuCoin

- Gemini

- Bittrex

Methodology

To choose the best crypto apps in Canada, the Savvy New Canadians team assesses cryptocurrency exchanges and apps based on their coin offerings, trading and transaction fees, ease of use, access to advanced trading tools, user interface, company reputation, security measures, funding options, and other features. While these crypto trading platforms are some of the top ones on the market, they may not be right for you. Always do your own research and make informed financial decisions.

What to Look For in the Best Crypto Apps

The best crypto trading app for you will vary based on your needs. In general, you should look out for:

Security: Hackers are always trying to steal coins from cryptocurrency exchanges. Since it is a loosely regulated industry and things are decentralized, it can be hard to track stolen coins. Ensure the platform has reasonable measures to protect your account, including 2-factor authentication and SSL. Also, most of the coin holdings should be in cold storage wallets.

Coins offered: The two most traded coins are Bitcoin and Ethereum. If you plan to also trade lesser-known altcoins, you should consider that when choosing a crypto trading platform.

Trading fees: What you pay for fees impacts your long-term returns. Some platforms charge a spread on the buy and sell prices. Others charge a flat percentage fee. Some levy a fee when you deposit or withdraw funds, while others don’t. Compare transaction fees across exchanges and platforms to save on costs.

Mobile app: If you plan on trading while on the go, you should find a platform that offers a versatile mobile app.

Regulation: Unlike these stock trading platforms in Canada, cryptocurrency platforms are not secured or regulated by the Canadian Investor Protection Fund (CIPF). That said, the ones listed above are regulated by FINTRAC as MSBs.

Reviews: Read user reviews online to get a sense of the crypto app’s reliability and the issues customers are facing. There is a lot you can learn from complaints online and how these are being resolved.

Location: Is the crypto app available at your location? For example, Binance is not available in Ontario. It is best to sign up with a crypto platform that’s registered or allowed to operate where you reside.

Coin custody: As the saying goes, “not your private keys, not your bitcoin.” The best crypto trading platform will allow you to move your assets offline to a wallet of your choice.

Trading tools: Are you looking to day trade crypto? Then you may need access to advanced trading tools, charting, and indicators. Some crypto apps are designed for beginners and have basic tools, while others cater to both beginners and experienced traders and offer more trading tools.

How To Use a Crypto App in Canada

To purchase cryptocurrency, you will need a crypto trading account at a Canadian crypto exchange. A good starting point is CoinSmart, the overall top crypto app in Canada based on our selection.

Follow these steps to get started:

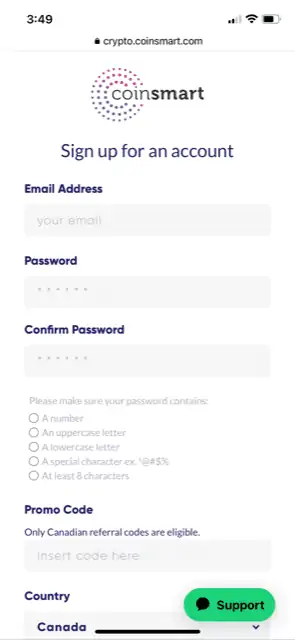

Step 1: Open a Crypto account

Visit CoinSmart to open an account (now part of Bitbuy). You receive a $50 bonus if you deposit at least $250.

Step 2: Verify your details

After providing your basic information (full name, date of birth, mailing address and phone number), you will need to verify your identity online. The process is usually instant; however, in some cases, you may need to upload documents for manual verification.

These KYC requirements are necessary for the company to abide by the Ontario Securities Commission rules and regulations.

Step 3: Fund your account

You can fund your new account using Interac e-Transfer, wire transfer, debit card, credit card, crypto coins, and more. Multiple fiat currencies are supported, including CAD, USD, and EUR.

Electronic fund transfers and Interac e-Transfers take 1-60 minutes, while wire transfers can take up to 5 business days.

Step 4: Trade Crypto

After funding your account, you can buy and sell cryptocurrency using the CoinSmart crypto app. The platform currently supports 16 popular coins, including BTC, ETH, SOL, ADA, DOT, and many others.

Top Crypto Apps in Canada Compared

| App Name | Number of Coins | Funding Options | Fees | Promotions |

| Bitbuy | 40+ | Interac e-Transfer, bank wire, bill pay, debit card, and digital currencies | 0% to 2% | $50 bonus with an initial deposit of at least $250 |

| Coinsmart (now part of Bitbuy) | 16 | Interac e-transfer, wire, bank draft, credit card, debit card, EFT, existing crypto holdings | 0.20% to buy coins using fiat; 1% fee on ETF withdrawals and wires | Get a $50 welcome bonus when you open an account and deposit at least $200 |

| Wealthsimple Crypto | 50+ | Bank transfer (CAD), debit card, and crypto deposits | Spread on ‘bid’ and ‘ask’ prices (1.5-2%) | Get a $25 welcome bonus when you sign up and deposit at least $200 |

| Shakepay | 2 | Interac e-Transfer, wire transfer, and crypto deposits | 1-3% | Get a $10 bonus when you open an account and trade $100 worth of BTC or ETH |

| Netcoins | 30+ | Interac e-Transfers, bank wire, and crypto deposits | 0.50% fee plus a hidden spread | – |

| Newton | 70+ | Interac e-Transfers, wire transfers, and crypto deposits | Up to 2% | Get a $25 bonus when you trade your first $100 worth of crypto |

| VirgoCX | 60+ | Interac e-Transfer, wire transfer, credit card, crypto deposits, debit card | Up to 2% | Get a $20 bonus when you open an account and deposit at least $100 |

| NDAX | 30+ | Interac e-transfer, Bank draft, certified cheque, and wire transfer | 0.2% | N/A |

Types of Crypto Exchanges

There are three types of crypto exchanges to choose from: centralized, decentralized and hybrid.

Centralized Exchanges (CEX)

Centralized exchanges are those exchanges that a single organization manages. Most trading takes place on these.

They make it easy to deposit funds that you can convert into various cryptocurrencies.

Many centralized exchanges have Know Your Customer (KYC) rules. These rules mean you must prove your identity, usually by submitting a form of ID, like when you open a bank account.

Centralized exchanges are subject to different levels of regulation depending on where they are based.

Decentralized Exchanges (DEX)

Decentralized exchanges are not run by a central organization. Instead, anyone can visit one and exchange different cryptocurrencies, and anyone who joins the network can certify transactions.

Proponents of DEXs suggest this increases transparency. However, they are not as user-friendly as centralized exchanges and are not ideal for beginners.

Also, you might not be able to deposit money and convert it into cryptocurrency using a DEX. This is because they are primarily limited to converting one cryptocurrency into another.

Hybrid Exchanges

Hybrid exchanges provide a mix of CEX and DEX features. They aim to offer the functionality of a CEX with the privacy of a DEX, providing the best of both worlds.

Crypto Exchange Fees

You will normally have to pay various fees when you use a crypto exchange. Of course, all exchanges are different, but here are the most common fees you might have to pay.

Trading Fees

When you convert fiat into a cryptocurrency or one cryptocurrency into another, you will nearly always have to pay a trading fee. This fee is usually a percentage of the amount you buy or sell.

Spread

The spread is the difference between the exchange rates and is essentially another type of trading fee. Some exchanges claim to charge no transaction fees, but they charge a higher spread instead.

The spread can often be more expensive than a trading fee.

Withdrawal Fees

Exchanges will often charge you to withdraw your crypto or fiat. The fee can be a set amount or percentage per withdrawal, expressed either as a fiat value or in the crypto you are withdrawing.

Some exchanges may provide a certain number of free withdrawals before they charge a fee.

Deposit Fees

Depending on how you deposit funds to the exchange, you may have to pay a deposit fee.

For example, a bank transfer may be free, but an international wire transfer or a credit card deposit may have a fee.

Blockchain Fees

While not a direct fee changed by exchanges, you should be aware of blockchain fees.

When you send cryptocurrencies on the blockchain, there is usually a fee to pay. In the case of Bitcoin, this is called the miner fee, and it is usually a small amount. The amount of the fee can depend on the size of the transfer.

Crypto Exchange vs Brokers

When you start trading crypto, you will encounter both exchanges and brokers. But what is the difference between them?

In a way, exchanges can be considered brokers because a broker is essentially an intermediary.

But a broker offers cryptocurrency trading and other investments like bonds and stocks. On the other hand, a crypto exchange is only used for cryptocurrency transactions.

Do You Need a Crypto Wallet?

A crypto wallet is a place where you can store your cryptocurrencies. Exchanges will often provide you with a wallet, which is simply a place where your cryptos are stored on the exchange.

However, you can get a separate wallet and transfer your cryptos to it if you prefer.

The benefit of using your own wallet is that the exchange does not control it. If something were to happen to the exchange, your cryptos would be safely stored in your wallet, and you could simply send them to another exchange to trade them.

You can also send or spend your cryptos directly from your wallet.

Wallets offer additional security features. For example, you will typically hold the key to your wallet, which could be a password or a list of 12 or 24 words, so only you can access your cryptos.

Custodial vs Non-Custodial Wallets

Wallets held on exchanges are custodial wallets, while wallets you hold are typically non-custodial. The benefit of non-custodial wallets is that you do not have to provide personal information to use them.

One problem with using non-custodial wallets is that you usually have to pay a withdrawal fee to transfer your crypto off the exchange in the first place.

Hot Wallets vs Cold Wallets

There are two main types of wallets: hot wallets and cold wallets.

Hot wallets are apps on your phone or computer that connect to the internet. They are often free to download and use.

Cold wallets are hardware wallets like Trezor and Ledger devices. They are always kept offline, making them more secure, but they are not free.

What is Cryptocurrency?

A cryptocurrency is a digital currency that is acceptable between various parties as a means of exchange, and it is secured using cryptography.

Cryptocurrencies operate on a blockchain and are decentralized, which means they are not tied to any country’s central bank.

The most popular cryptocurrency is Bitcoin, followed by Ethereum. In their wake have followed thousands of alternative cryptocurrencies (alt-coins), including Ripple (XRP), Tether (USDT), Litecoin (LTC), Cardano (ADA), and Binance Coin.

The hype for trading cryptocurrency is high; however, you should tread with caution, as cryptocurrencies have no intrinsic value other than the faith placed in them by users.

The bottom line is that you can lose 100% of your money… or you could make a fortune.

Best Crypto Apps in Canada FAQ

Bitbuy is the best crypto exchange in Canada. It is easy to understand for those who are just beginning to invest in crypto, and it offers great tools to advanced traders. The platform also has competitive trading fees.

The best Canadian crypto exchange for crypto traders is Bitbuy. It offers low trading fees, access to multiple fiat deposits, top security, and advanced trading tools.

Crypto apps come in many forms. A crypto exchange app typically allows you to deposit funds, convert money into a cryptocurrency, transfer between cryptocurrencies, and withdraw cryptos.

The top crypto wallets in Canada are the Ledger Nano X and Ledger Nano S hardware wallets.

The easiest way to get crypto in Canada is to buy your coins using a Canadian crypto exchange or brokerage app. While you can also get crypto from crypto ATMs, the fees are usually higher.

The safety of the crypto app depends on several factors. It’s usually best to only use an app with a good reputation in the industry.

If you want to do day trading in Canada, we recommend using a platform like Bitbuy or Coinbase. However, explore the other apps because one may be more suitable depending on your situation.

While there are many altcoin exchanges in Canada, we recommend VirgoCX for its large selection of coins and low fees.

A crypto off-ramp allows you to change a cryptocurrency into fiat and withdraw it. In our opinion, the best off-ramp in Canada is Bitbuy.

Bitcoin is the most established crypto coin, and it has been adopted by some merchants as a means of payment. That said, all cryptocurrencies are a risky bet, and you can lose all your money.

They are not legal tender and have not been recognized by the central bank as an official currency for the country. However, it is not against the law to trade cryptocurrencies or use them as a method of payment wherever they are accepted in Canada. The Canadian government has several rules in place for cryptocurrencies and other alternative investments.

Bitcoin has the highest market capitalization at $508 billion as of this update. It was also the most expensive at 1BTC = $26,091 USD.

No. Binance is leaving Canada in September 2023.

Disclaimer: Cryptocurrency is a volatile and speculative investment. If you decide to invest, we recommend you do your own research and only commit funds you can afford to lose. The author may own one or more of the crypto assets mentioned in this article.

Thanks for the info. I’m currently looking at Binance but am curious, what is the process like for withdrawing funds back to our bank? Possible? TIA

@Rob: I think it is easier to withdraw crypto from Binance than it is to withdraw fiat. So, you could transfer your crypto assets into an external wallet and sell your holdings at a Canada-based exchange where it may be easier to withdraw CAD. You could potentially also swap your crypto on Binance for BUSD and withdraw the USD to a US dollar bank account using SWIFT.

Enoch,

I think I’ve been bitten by a Cryptofraud company called Metexxa. I’ve given them 320.00 USD but the Financial planner keeps asking for more $ in the neighbourhood of $10,000-$20,000.00. USD Have you ever heard of Mettexxa or Frank ElCosta as Cryptocurrency traders in the Canadian Market?

Thank you.

@Donna: I haven’t heard of this company before, but it sounds like a scam. I would advise you to avoid sending them money immediately. There are many similar scams out there.

Hello Enoch,

I just finished a book on bitcoin investing and they recommend investors store their coins on a special external drive and not on the exchange. This ensures your crypto is always safe and you are responsible for it. I looked at some of your recommended exchanges to buy like Coinsmart. It says this “Security and regulation: 95% of the coins on this exchange are kept in cold storage wallets and the site uses bank-level security to protect your account.” Does this mean any coins purchased cannot be stored personally and only on that exchange?

@Phil: Good question. An exchange like CoinSmart also allows you to move your crypto assets “offline” to a hardware wallet like Ledger or Trezor. What they mean by keeping your coins in cold storage wallets is that they are also taking precautions to protect your assets by keeping them off the internet…similar to what you do when you move your coins off the exchange. Regardless of their security precautions, you should consider getting your own personal hardware wallet if you intend to invest a significant amount in crypto. It may end u being safer that way.

Im using crypto .com . Is this legal in canada ?

@Dang: As of today, Crypto.com is legal to use in Canada.