BMO InvestorLine is an online trading platform for self-directed investors who want to be in charge of their investment portfolios.

If you are comfortable with buying and selling stocks and other investment products, the platform is fairly straightforward: sign up, do your research, trade, and track your portfolio performance.

That said, cost-conscious investors will quickly notice that the trade commissions on BMO InvestorLine are higher than average, and you could save on fees by using alternative brokers.

This BMO InvestorLine review covers its main features, benefits, fees, tools and research options, account types, and more.

BMO InvestorLine Overview

BMO InvestorLine is an online investing service operated by the Bank of Montreal (BMO) Financial Group.

BMO is one of the top banks in Canada and the oldest, given that it was founded in 1817.

In addition to its self-directed investing platform, BMO also offers:

- InvestorLine adviceDirect: An online trading service with access to personalized advice at an extra fee.

- BMO Smartfolio: A robo-advisor service that invests your portfolio on autopilot using low-cost ETFs. This service comes with an annual management fee.

The BMO InvestorLine App is available on the App Store and Google Play.

BMO InvestorLine Accounts and Investment Types

Investors can open various types of accounts, from registered to non-registered ones.

The registered trading accounts available are:

- Tax-Free Savings Account (TFSA)

- Registered Retirement Savings Plan (RRSP)

- Registered Education Savings Plan (RESP0

- Registered Retirement Income Fund (RRIF)

- Locked-in Retirement Accounts (LIRA, LIF, LRIF, LRSP)

The non-registered trading accounts include cash, margin, business, non-profit organizations, estate, or formal trust accounts.

Learn about how investment accounts work in Canada.

This platform is not short on the securities you can hold inside your account. It offers:

- Stocks

- Exchange-Traded Funds (ETFs)

- Mutual Funds

- Fixed Income Assets, including bonds, Guaranteed Investment Certificates (GICs), debentures, etc

- Options

BMO InvestorLine Trading Fees

Trading fees and commissions on this platform are high compared to competitors such as CIBC Investor’s Edge or Wealthsimple Trade.

Over time, paying high fees can erode your long-term returns, especially when making frequent small trades.

A flat $9.95/trade commission applies to stocks and ETFs using the online platform.

If you place stock trades by telephone using a BMO representative, these fees apply:

| Stock Price | Canadian Exchange | U.S. Exchange |

| $0-$0.245 | 2.5% of principal value | 3% of principal value |

| $0.25-$1.00 | $35 + ½ cent/share | $39 + 2 cents/share |

| $1.01-$2.00 | $35 + 2 cents/share | $39 + 3 cents/share |

| $2.01 – $5.00 | $35 + 3 cents/share | $39 + 4 cents/share |

| $5.01-$10.00 | $35 + 4 cents/share | $39 + 5 cents/share |

| $10.01 – $20.00 | $35 + 5 cents/share | $39 + 6 cents/share |

| $20.01 and over | $35 + 6 cents/share | $39 + 7 cents/share |

| $30.01 and over | $35 + 6 cents/share | $39 + 8 cents/share |

For equity trades with a principal value of $2,000 or less, a minimum commission of $43 CDN/USD applies.

Options cost $9.95 plus $1.25 per contract.

When you place options trades by telephone through a BMO InvestorLine representative, the applicable fees are:

| Option Price | Commission per contract |

| $0-$2.00 | $35 + $1.50 |

| $2.01 – $3.00 | $35 + $2.00 |

| $3.01 – $4.00 | $35 + $2.50 |

| $4.01 – $5.00 | $35 + $3.00 |

| $5.01 and over | $35 + $3.50 |

Options trades with a principal value of $2,000 or lower attract a $43 USD/CAD minimum.

More than 9,000 mutual funds are available on the platform, and they can be bought or sold with no commissions.

A minimum purchase amount ranging from $100 to $25,000 may apply to mutual fund purchases. Also, an early redemption fee of $35 or more may apply to funds held for less than 90 days.

Commissions on bonds, T-bills, GICs, and strip coupons are included in the quoted price.

Gold bullion deposit has a $35 + $1.00/oz commission, and it is $35 + $0.10/oz for silver bullion. Similar fees apply to gold and silver certificates.

Trades involving a foreign currency conversion pay a spread of up to $1.75% in addition to other fees and commissions.

BMO InvestorLine Account Fees

Non-registered accounts with a balance of less than $15,000 pay a $25 quarterly account maintenance fee.

For registered accounts (such as TFSA or RRSP), an annual $100 fee applies if your balance is less than $25,000.

This quarterly fee is waived for clients who also hold a registered account or have made 2 or more commissionable trades in the past 6 months.

Other general account fees include:

- Account transfer out: $150

- Mailed paper statement: $2/month

- Internal transfers for non-registered accounts: $25

- Security registration fee: $50/security

- RRSP/RRIF deregulation: $50

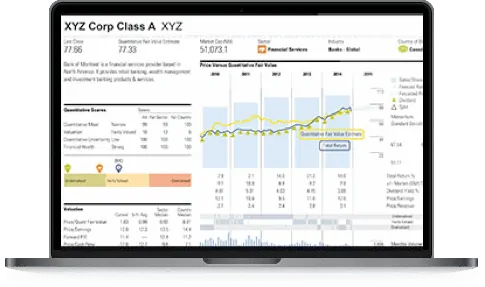

BMO InvestorLine Trading Platform and Tools

BMO InvestorLine offers a platform that meets the needs of new and experienced investors alike.

It has a mobile app for trading on the go and a web interface you can access on a computer.

The basic trading platform supports alerts, watchlists, interactive charts, stock screeners, and trading tools.

The screeners allow you to filter investments based on multiple criteria, including Environmental, Social, Governance (ESG) features, volatility, and more.

Clients can access research reports from MorningStar, Thompson Reuters, and S&P Global Ratings.

BMO Market Pro is available to active traders who make 75 or more trades per quarter. This advanced trading platform offers real-time streaming data, U.S. and Canadian options trading, and a customizable dashboard.

You can also access BMO Market Pro if you keep a minimum account balance of $2 million.

BMO has a 5 Star Program with lower account fees, real-time data, dedicated support, and discounts for eligible investors.

To be eligible for this program, you must make at least 15 trades per quarter or invest a minimum of $250,000.

The BMO 5 Star Program has three membership tiers:

- Gold Star: Invest $250,000+ or make 15-74 trades per quarter

- Platinum Star: Invest $2 million+ or make 75-179 trades per quarter

- Platinum Star: Invest $5 million+ or make 180+ trades per quarter

BMO InvestorLine adviceDirect

If you want the hands-on approach of self-directed investing while having access to professional investment advice when needed, adviceDirect may be for you.

This service offers:

- 24/7 portfolio monitoring

- Personalized investment advice

- Trade recommendations

- Advisor support

You need a minimum deposit of $10,000 to open an adviceDirect account, and annual fees apply as follows:

- 0.75% for assets between $10,000 and $500,000

- $3,750 maximum fee for accounts that are $500,000+

BMO Smartfolio

Online wealth management services or robo-advisors are a middle-ground between self-directed investing and costly mutual funds.

BMO’s robo-advisor service, BMO SmartFolio, offers automatic rebalancing, ETF portfolios, free financial advice, and hands-free investing at a lower cost than traditional wealth management fees (up to 2% or higher).

SmartFolio has a 0.40% to 0.70% annual management fee. In comparison, Questwealth and Wealthsimple Invest (both robo-advisors as well) have fees ranging from 0.25% to 0.50%.

Other competing robo-advisors in Canada are CI Direct Investing and RBC InvestEase.

Is BMO InvestorLine Safe and Legit?

BMO is a Big 5 bank in Canada and one of the largest banks in North America.

It is a member of the Canadian Investor Protection Fund (CIPF) and is regulated by the Investment Industry Regulatory Organization of Canada (IIROC).

CIPF membership means your account is protected against insolvency by up to $1,000,000.

BMO also offers a 100% electronic banking guarantee for personal banking customers. This means that losses to your personal bank accounts resulting from unauthorized transactions through BMO Online and Mobile banking are reimbursed (terms and conditions apply).

Pros of BMO InvestorLine

Below are some of the benefits and downsides of the BMO InvestorLine platform.

- Robust trading platform and research tools for active traders.

- Access to investment advisors via the adviceDirect service option.

- Flat fee pricing and discounts are available when you have a large account balance.

- Variety of account types and investments.

Cons of BMO InvestorLine

- Higher than average trading commissions. You will get lower fees with Questrade or Wealthsimple Trade.

- Advanced trading tools, support, and discounts target active investors and those with a large portfolio.

- The $25 quarterly fee for a non-registered account with less than $15,000 invested and the $100 annual fee for registered accounts with less than $25,000 adds up.

- The BMO InvestorLine mobile app is poorly rated by users.

BMO InvestorLine vs. Alternative Trading Platforms

Here’s how BMO InvestorLine compares to competing trading platforms such as RBC Direct Investing, Questrade, and Wealthsimple Trade.

| BMO InvestorLine | TD Direct Investing | Wealthsimple Trade | Questrade | |

|---|---|---|---|---|

| Stock and ETF trading fee | $9.95/trade | $9.99/trade | $0 | $4.95 – $9.95/trade |

| Options/contract | $9.95 + $1.25 | $9.99 + $1.25 | N/A | $9.95 + $1 |

| Commission-free ETFs | Yes (limited) | No | Yes | Yes ( purchases only) |

| Standard Trading fee discount | None | $7/trade for active traders (stocks) | N/A (no trading fees) | $4.95/trade for active traders (stocks) |

| Types of accounts | TFSA, RRSP, RRIF, RESP, LIRA, margin, corporate, non-profit, formal trust | TFSA, RRSP, RRIF, RESP, RDSP, margin | TFSA, RRSP, personal non-registered | TFSA, RRSP, RESP, LRSP, LIRA, RRIF, LIF, margin, corporate, partnership |

| Minimum Investment | None | None | No minimum balance | $1,000 |

| Maintenance fee | $25/quarter if balance less than $15,000 (non-registered) or $100/year if balance less than $25,000 (registered) | $25/quarter if balance is $15,000 or less | None | None |

| Platform | Web and mobile app | Web and mobile app | Web and mobile app | Web and mobile app |

| Transfer fees waived? | Up to $200 | Up to $150 with transfers of $25,000+ | Up to $150 on transfers of $5,000+ | Up to $150/account |

| Other features | Access to paid investment advice via adviceDirect | Has a dedicated platform for U.S. options trading | Access to low-cost robo-advisor (Wealthsimple Invest) and HISA | Access to low-cost robo-advisor (Queswealth) |

| Promotion | N/A | N/A | Get a $25 cash bonus with Wealthsimple Trade when you deposit $200+ | Get $50 in free trades with a minimum $1,000 deposit; or invest $10,000 free for one year (with Questwealth) |

| Learn more | – | Learn more | Learn more | Learn more |

Is BMO InvestorLine For You?

Self-directed investors can use this platform to buy and sell stocks, ETFs, mutual funds, bonds, GICs, and precious metals.

It compares well with its competitors based on the accounts offered, investment types, research, and analysis tools.

If you are an experienced investor looking for access to advanced charting and streaming real-time data, you will need to make 75+ trades to qualify for the BMO Market Pro platform. Alternatively, an account balance of $2 million or more can get you this perk.

If you are looking for priority support, active trading and/or a high account balance are also required.

Overall, BMO InvestorLine appears to be better suited to active traders and high-net-worth investors.

BMO InvestorLine FAQs

The application process can be started online and takes about 20 minutes. You will need your social insurance number, one piece of government-issued photo ID, your employment details, and your banking information.

You can transfer funds to your account from your BMO bank account or another financial institution. You can also transfer existing investments from another financial institution.

There is no minimum balance to open a BMO InvestorLine account. That said, small accounts pay a quarterly account maintenance fee.

You can reach them by phone at 1-888-776-6886. You can also complete a questionnaire to have them call you within 24 hours.

BMO InvestorLine

-

Ease of use

-

Trading fees

-

Accounts offered

-

Inevstment products

-

Security

Overall

Summary

BMO InvestorLine is a discount brokerage platform offered by the Bank of Montreal.

Pros

- Robust trading platform for active traders.

- Access to paid professional advice via adviceDirect.

- Discounts for traders with large accounts.

- Access to multiple account types and investments.

Cons

- Higher than average trading commissions.

- Advanced trading tools target those with a large portfolio.

- A $25 quarterly fee for accounts with less than $15K to $25K.

- $5,000 minimum account requirement for most accounts

- A poorly rated mobile app.

Enoch, I enjoy your articles very much but as a BMO InvestorLine client, they are a nightmare to deal with or try to reach! There on-line system constantly locks you out. When you try to contact them you enter your account number and password (correctly), I always get the message “your entry is invalid or it does not match their records”. Just in the past four days I’ve called 22 times, was on hold for an average of 8.5 hours and still did not get a representative. I emailed them and received a reply: average response time of 7 business days. You just can’t reach them. I even went back on-line and selected “forgot my password” (which I hadn’t) just to get back in. Message “we’re unable to verify your identity at this time to please call them. Very, very, painful process! So bad I have no choice but to transfer out.

@Lisa: Sorry to hear about your poor experience. Not to defend them, but it seems that the customer support provided by several online brokerages has deteriorated in the last few months. Part of this may be due to the increased number of people who have taken to trading on their own during the lockdown and with all the hype some stocks have been getting in recent times.

Thanks Enoch, take care and stay healthy during these difficult times 🙂

Customer support for Investorline hasnt deterioated, it is now none existent.

Telephone Calls dont get answered, (see their Twitter feed)

My link ( there online chat tool ) is not manned – so that they can transfer agents to the call centre.

Emails wont be answered because thay are “unsecure”.

It is impossible to contact Investorline !

I am an InvestorLine customer too and I agree with Lisa. My experiment with InvestorLine is very bad. They asked me to open an account to correct a transaction back in Feb, so I did that as they requested. After two months and it is still not done. They told me the correction need executive approval… The funny thing is, before all this mass happened, I actually talked to their assistant manager, told him that I have other option, but I can only either let them fix the problem or I fix the problem myself. Now I am so regret that I trusted them.

Here are the things I don’t like about them,

* They don’t deliver what they promised. They ask me to do my part but they don’t.

* They don’t own the problem, just open tickets and forget about them.

* They told me they will call me back, but it never happen.

I am still finding a way to file a complaint.

As a bank, building trust is very important. I don’t feel that InvestorLine is something I can depends on.

I am an investorline client . Had many many bad experiences with them . I actually lost so much money using their platform for soo many reasons ( system glitches, delayed response, ” pending approval” messages ) . I complained many times, managers were supposed to call me but never did. In one experience , i was selling my Tesla puts . By the time my ” pending approval ” order was approved. ( 4 min ) , TSLA price went up again and i lost 10K . Today, for the same reason , I lost 2k because my ” pending approval ” order took 6 min to approve. By that time, the stock price dropped …..Of course i complained, and of course i got promised that a manager will call me . Mind you , i am, on a cash account , not a margin account. Not sure why they need to approve selling a quantity I bought , and not sure how to trade if every order you place takes 4 min to approve . Just few examples of a very , very bad and frustrating experience . I called to verify why the orders are ” pending approval , but could not get through on time . I am checking with my branch to see how i can move to another broker without putting my account on hold ….. Cant wait for my stocks to reach my selling price to get out completely . My advise : DO NOT even think about joining.

do not use BMO inverstorline!!!

I have 3 accounts linked to 1 user login. I was told that for security reason, I have to change my user name. since then, I only have 2 accounts now. have been spend hours, hours on the phone, trying to get my third account back. it is still not resolved. it has been many months now.

it is terrible service.

I am also an unhappy Investorline client. Their support is horrible. One representative even hung up on me (not that I was being obnoxious or anything) and others simply did not follow through with what they promised, or gave me wrong information. Worse, their new website is horrible, with functions that are hard to find, or non-existent. It compares so unfavourably with the old website which was clean, well laid out and intuitive. I’m leaving.

BMO Investorline used to be OK, just OK, acceptable, back when they provided fairly decent indicators and charts, but NOW with this ridiculous horrible useless Investorline 2.0 conversion, they have deteriorated into a big nothing.

Do not, and keep in mind this advice is from a previously satisfied client, do NOT apply to Investorline. AVOID Investorline. They have absolutely zero interest in providing services to clients