Wealthsimple Crypto is a top Canadian cryptocurrency trading app that works well for beginners.

If you are one of those looking to jump into the cryptocurrency craze, the Wealthsimple Crypto platform is an excellent option for getting started.

Cryptocurrency is a volatile investment. If you know the risks and want to bet some funds to diversify your portfolio, this Wealthsimple Crypto review covers what you need to know.

Featured Offers

Wealthsimple Trade

On Wealthsimple’s website

- Trade thousands of US and Canadian stocks and ETFs commission-free, plus crypto.

- $25 bonus when you sign up and deposit $150 or more.

- Track stocks easily with a watchlist and set alerts.

- Transfer fees are waived by up to $150.

Wealthsimple Crypto

On Wealthsimple’s website

- Trade 50+ popular cryptocurrencies.

- $25 bonus when you sign up and deposit $150 or more.

- Pay competitive trading fees (price spread).

- No fees to deposit or withdraw, and get access to staking.

Wealthsimple Crypto Summary

Wealthsimple Crypto Review Summary

-

Ease of use

-

Trading fees

-

Coin selection

-

Coin transfers

Overall

Summary

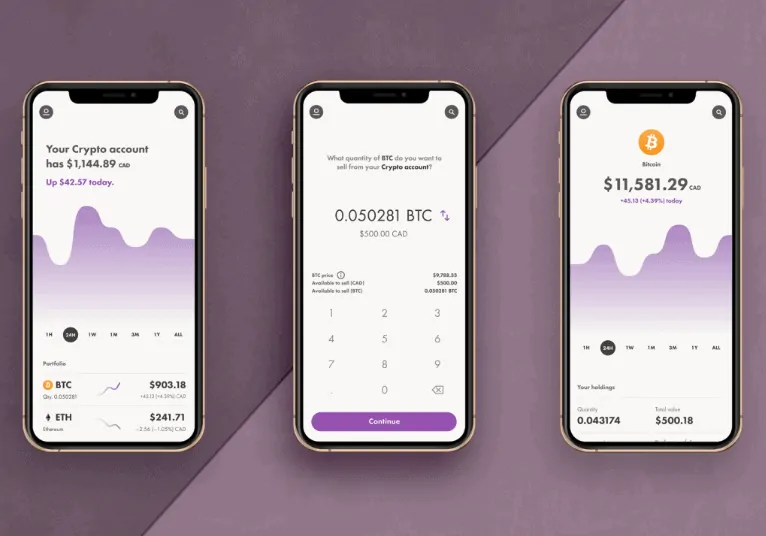

Canadians can use Wealthsimple Crypto to trade Bitcoin, Ethereum, Dogecoin, Litecoin, and several other cryptocurrencies in Canada. Owned by the top Caandian robo-advisor, Wealthsimple, this crypto brokerage platform simplifies crypto trading for beginners. You can use mobile or desktop platforms and also trade stocks and ETFs. This Wealthsimple Crypto review covers its fees, pros, cons, safety, and competitors.

When you open an account using our referral link and deposit $150 or more, you receive a $25 bonus.

Pros

- User-friendly interface

- No minimum balance required

- No fees for deposits and withdrawals

- Operated by a reputable company

- Uses a regulated crypto custodian – Gemini

- Welcome bonus

- Supports multiple coins

Cons

- Spread is 1.5% – 2%

- CAD-only funding

Using the Wealthsimple Crypto platform, you can instantly buy and sell 50+ cryptocurrencies using fiat currency (Canadian dollars).

As of this writing, you can only trade crypto using a personal non-registered investment account. TFSA, RRSP, and other registered accounts can’t be used to hold crypto directly; this also applies to other crypto trading platforms.

Wealthsimple Crypto List

The coins and tokens available for trading on Wealthsimple Crypto include the ones below and many others:

| Bitcoin (BTC) | Aave (AAVE) | Balancer (BAL) |

| Basic Attention Token (BAT) | Cardano (ADA) | Bitcoin Cash (BCH) |

| Chainlink (LINK) | Compound (COMP) | Curve (CRV) |

| Decentraland (MANA) | Dogecoin (DOGE) | Ethereum (ETH) |

| Fantom (FTM) | Filecoin (FIL) | Kyber Network (KNC) |

| Litecoin (LTC) | Maker (MKR) | Ox (ZRX) |

| Polkadot (DOT) | Polygon (MATIC) | Ren (REN) |

| Stellar (XLM) | SushiSwap (SUSHI) | Synthetix (SNX) |

| Uma (UMA) | Uniswap (UNI) | Yearn.Finance (YFI) |

| 1inch (1INCH) | Shiba Inu (SHIB) | Tezos (XTZ) |

| Axie Infinity (AXS) | Avalanche (AVAX) | Cosmos (ATOM) |

| Solana (SOL) | and several others |

The Wealthsimple Crypto and Trade apps work together, and you can also access both on desktop devices.

Wealthsimple Crypto Wallets were recently introduced, which means you can now transfer and deposit your crypto coins from other exchanges into Wealthsimple.

You can also move some coins offline from Wealthsimple Crypto into your hardware wallets.

How Wealthsimple Crypto Works

The Wealthsimple Crypto platform can be accessed on all devices. To get started:

- Open a Wealthsimple Crypto account here ($25 cash bonus link*).

- Complete the sign-up form and accept the terms and conditions.

- Fund your account using electronic fund transfer or deposit crypto.

- Buy and sell Bitcoin, Ethereum, and 50 other coins and tokens.

* Our readers get a sign-up bonus after they open a Wealthsimple Crypto account and deposit at least $150 within 30 days of account opening.

Wealthsimple Crypto Fees

A spread is applied to the price when you enter a buy or sell order. This spread varies between 1.5% and 2%.

Wealthsimple Crypto does not charge fees to deposit or withdraw funds, open or close your account, or for electronic statements and trade confirmations.

Pros of Wealthsimple Crypto

- The parent company, Wealthismple, has been around since 2014 and is a legitimate financial company.

- Wealthsimple Crypto is offered under “time-limited registrations and regulatory approach” via the Canadian Securities Administrators’ Regulatory Sandbox.

- It has no account minimums and no fees to deposit or withdraw funds.

- Coins are held in cold storage with Gemini, a regulated crypto custodian with $200M in cold storage insurance coverage.

- The platform is very user-friendly, even for beginners.

- It offers a wide variety of coins and is one of the largest selections in Canada.

- Now offers crypto wallets.

- Now offers staking.

Cons of Wealthsimple Crypto

- It is a crypto broker

- The price spread is not the most competitive

Is Wealthsimple Crypto Safe?

Yes, Wealthsimple Crypto is safe.

Coins on this platform are held by Gemini Custody. This cryptocurrency exchange and custodian is regulated by the New York State Department of Financial Services and was founded by the Winklevoss brothers (Facebook co-founders).

Gemini has $200 million in cold storage insurance, and the company has also partnered with CoinCover to keep coins safe from theft.

In addition, Wealthsimple Crypto is offered under a time-limited regulatory approach through the CSA’s Regulatory Sandbox, which means it has to comply with strict rules.

That said, it is worth noting that crypto assets in Canada are not protected by the Canadian Investor Protection Fund (CIPF) or Canada Deposit Insurance Corporation (CIDC).

Wealthsimple Crypto Wallets

You can now deposit several cryptocurrencies from external wallets into your Wealthsimple Crypto account wallet:

- 0x (ZRX)

- Aave (AAVE)

- Basic Attention Token (BAT)

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- Chainlink (LINK)

- Compound (COMP)

- Curve (CRV)

- Decentraland (MANA)

- Dogecoin (DOGE)

- Ethereum (ETH)

- Kyber Network (KNC)

- Litecoin (LTC)

- Maker (MKR)

- Polygon (MATIC)

- Ren (REN)

- SushiSwap (SUSHI)

- Uniswap (UNI)

- Yearn.finance (YFI)

You should confirm you are using a supported network when depositing crypto coins (e.g. ERC-20, BTC, BCH, Litecoin, etc.).

Crypto withdrawals are also supported for several coins.

Wealthsimple Crypto vs. Wealthsimple Trade

Wealthsimple Crypto and Wealthsimpe Trade are available through the same app.

Unlike the former, which allows you to buy and sell Bitcoin, the Trade App is for trading stocks and Exchange-Traded Funds (ETFs).

Wealthsimple Trade is unique because it is one of a few Canadian brokerage platforms offering $0 trades in thousands of stocks and ETFs. You can use it to invest in a self-directed TFSA, RRSP, or non-registered personal account.

Both platforms are also accessible using a web interface on your computer.

Wealthsimple Crypto vs. Bitbuy vs. Coinsmart

How does Wealthsimple Crypto compare to other cryptocurrency trading platforms in Canada?

We compare it with Bitbuy and Coinsmart below:

Bitbuy Crypto Exchange

Get a $50 bonus if your initial deposit exceeds $250

Trade approx. 40 coins

Great for new & advanced traders

0% to 2% trading fee

| Features | Wealthsimple Crypto | Coinsmart | Bitbuy |

| Coins offered | 50+ coins incl. BTC and ETH | BTC, LTC, ETH, XRP, EOS, BCH, XLM, ADA, USDC, UNI, DOT, LINK, etc. (now part of Bitbuy) | 40+ coins incl. BTC, ETH, XLM, EOS, LTC, BCH, AAVE, LINK, etc |

| Funding | CAD (electronic fund transfer) | CAD (Interac e-Transfer, credit card, debit card, ETF, bank wire); multiple fiat | CAD (Interac e-Transfer and bank wire) |

| Fees | 1.5%-2% for trades, no fees on deposits or withdrawals | 0.20% for CAD-crypto trades; 1.50% on Interac e-Transfer deposits (free if $200+); 1% on EFT withdrawals and bank wire | Up to 1.50% trading fee; |

| Mobile app | iOS and Android | iOS and Android | iOS and Android |

| Desktop interface | Yes | Yes | Yes |

| Security | Coins kept with Gemini – a regulated custodian | 95% of coins in cold storage | 90% of coins in cold storage |

| CIPF/CDIC protection | No | No | No |

| Other offerings | Investment portfolios, savings account, and a stock brokerage | n/a | n/a |

| Promotion | $25 bonus when you deposit at least $150 | $50 bonus when you deposit $250 | $50 bonus when you deposit an initial $250+ |

| Learn more | Learn More | Learn More | Learn More |

Is Wealthsimple Crypto for You?

Wealthsimple Crypto is one of the top platforms for trading cryptocurrency in Canada.

If you are a beginner looking for a one-click trading platform to buy various types of coins, this platform is as easy to use as it gets. And it helps that it also has an app for buying and selling stocks.

Wealthsimple Crypto Review FAQs

When you buy or sell crypto on the platform, you pay a spread that ranges from 1.5-2%. Deposits and withdrawals are commission-free.

Yes, you can now transfer bitcoin and other cryptocurrencies to your Wealthsimple Crypto account or wallet.

Yes, you can withdraw several coins from Wealthsimple Crypto to your own personal hardware wallet.

No, Wealthsimple Crypto does not support XRP.

There are lucky Crypto traders who have made millions of dollars betting on Bitcoin. Numerous traders have also lost money due to crashes, lost or stolen coins, and more.

It remains to be seen. While major coins like Bitcoin are now accepted as a means of payment by some merchants, its long-term elevation to “legal tender” status is anyone’s guess.

Digital currencies are not on the Canadian Revenue Agency’s list of permitted investments. That said, it may be possible to gain exposure to Bitcoin using an Exchange-Traded Fund (ETF).

When you earn a capital gain on Crypto trades, you are required to give the taxman his cut. In Canada, that means paying taxes on 50% of the gains at your marginal tax rate.

Related:

- How to Buy Bitcoin

- How To Buy Bitcoin Cash

- How To Buy Cardano in Canada

- Types of Investment Accounts

- Best Stock Trading Apps

- Questrade Crypto

Disclaimer: Cryptocurrency is a volatile and speculative investment. If you decide to invest, we recommend you do your own research and only commit funds you can afford to lose. The author may own one or more of the crypto assets mentioned in this article.

The Better Business bureau has a log of 13 complaints against Wealthsimple (WS) or which 9 went without any response. It ranks WS as an “F” (lowest rank possible).

Do these comments also apply to WS Crypto?

tnx

David Fournier

@David: I can’t speak to the complaints on the BBB and the lack of a response to them. I have used WS Crypto since its inception and have had no issues or complaints.