In this article, I cover some of the best prepaid credit cards in Canada for earning cash back rewards and making payments online and in person.

Prepaid credit cards are an alternative to traditional credit cards without the ridiculous interest fees.

Like your bank’s debit card, the best reloadable prepaid cards can be used to access cash at an ATM, pay bills, make online purchases, and send money to friends and family.

Even better, some prepaid credit cards have apps that work as budgeting tools and offer rewards.

If you want to curtail impulse spending and minimize your access to easy credit and debt, a prepaid card could be for you.

Best Reloadable Prepaid Credit Card in Canada

The top reloadable prepaid card in Canada is offered by KOHO.

KOHO Mastercard Prepaid Card

KOHO Prepaid Mastercard

$20 welcome bonus after first purchase (use CASHBACK promo code during sign-up)

$0 monthly fee*

Earn up to 5% unlimited cash back

Get 5% savings interest on your balance

Unlimited Interac e-Transfers and debit transactions

Free budgeting app and access to credit building

KOHO offers a reloadable Mastercard prepaid card you can use to make payments online, in-store, and anywhere that Mastercard is accepted. This card is connected to a spending and savings account that can help you cut back on monthly banking fees.

When you sign up, you get access to a smartphone app for budgeting, automating your savings, and making stress-free payments using Apple Pay or Google Pay.

Here are some of the basic features of KOHO:

- $0* monthly account fee (for KOHO Essential Mastercard)

- 1% cash back on grocery, restaurant, gas and transportation purchases, and up to 5% unlimited cash back at participating retailers

- Earn 5.00% interest on your entire balance

- $20 welcome bonus after your first purchase (use our CASHBACK referral code when signing up)

- Automatic savings using the roundup feature and the ability to create financial goals on the app

- No credit check requirement (poor and bad credit accepted)

- Your money is eligible for CDIC deposit insurance (limits apply)

- Access to 0% APR cash advances of up to $250

- Check your credit score for free each month

- Access to KOHO Credit Builder as an optional add-on for a $5 to $10 monthly fee (build your credit score fast)

- Access to an instant virtual card

- Unlimited free debits, eTransfers, and access to free Equifax credit score checks

Power users can enjoy even more benefits by upgrading their accounts. For example, with the KOHO Extra Mastercard, you earn higher cash back on some purchases and pay no FX fees when abroad. You also get access to price matching at several stores, free financial coaching, and more.

- Monthly fee: $0* for KOHO Essential

- Reload methods: Interac e-Transfer, direct deposit, online bill payment, Canada Post cash load

- Best for: Earning cash back on spending and interest on savings

- Learn more: KOHO Mastercard Card Review

Best Prepaid Mastercard in Canada

A prepaid Mastercard works very similarly to your Mastercard credit card. You can use it to pay for online shopping, make bill payments, and make point-of-sale transactions wherever Mastercard is accepted.

The best prepaid Mastercard reloadable cards in Canada include KOHO, EQ Bank Card, Neo Money Card, and Wealthsimple Cash Card. We touched on the KOHO Prepaid Mastercard earlier.

EQ Bank Card

EQ Bank Card

Earn up to 4%* interest on your balance

0.50% cash back on purchases

No monthly account or FX fees

Free ATM withdrawals

Following the KOHO Prepaid Card, another top prepaid Mastercard in Canada is the EQ Bank Card.

Recently launched last year, this card offers several benefits and perks, including no monthly or annual fees and:

- Unlimited transactions online and in-store

- 0.50% unlimited cash back on all purchases

- No foreign currency transaction fee – a saving of up to 3%

- Free ATM withdrawals in Canada at any location (ATM fees are refunded)

- 2.50% to 4.00% interest is earned on your entire balance

- Access to free Interac e-Transfers

To get a free EQ Bank Mastercard, simply open a free EQ Bank Personal Account online, fund it with $100+, and order a card in a few clicks.

There is no minimum balance to maintain your EQ Bank Account, and cash back earned is paid out monthly.

Also, your deposits are protected by the Canada Deposit Insurance Corporation by up to $100,000 per insured category, per depositor.

- Monthly fee: $0

- Reload method: Transfer funds from your savings account

- Best for: Earning cash back and waiving FX fees

- Learn more: EQ Bank Card Review.

Neo Money Prepaid Card

Neo Money Account

Unlimited 5% average cash back

No monthly fees + $20 bonus

2.25% non-promo interest rate paid on balance

Unlimited free transactions

Get a Mastercard for payments online and ATMs

Access to a no-annual-fee credit card

The Neo MoneyTM card is a reloadable prepaid card that converts your Neo MoneyTM account (spending account) into a hybrid account that earns cashback on purchases and high interest rates on your balance.

This Mastercard pays an average of 5% cashback when you shop at thousands of Neo partners. It also pays interest on your account balance.

To get a free card, open a Neo MoneyTM account here ($20 bonus – see terms below), fund it using Interac e-Transfer, direct deposit, or by linking another bank account. You can then request a physical card on your dashboard. A virtual card is also provided.

The main features of the Neo Money card include:

- Up to 5% unlimited cash back at thousands of partners; 1% cash back on groceries and gas

- Free everyday transactions and no monthly fees

- Earn 2.25% interest on your balance

- Withdraw cash from any ATM worldwide

- Your money is eligible for CDIC deposit insurance (limits apply)

- Reload method: Access to funds in your Neo Money account

- Best for: Earning interest on your savings and cash back on your spending

- Promo: $20 bonus when you deposit $50 or more in your new account and complete your first purchase

If you prefer an easy-to-qualify-for credit card that helps build credit, you can also apply for the Neo Credit Card and earn the same cash back rewards on all purchases.

Wealthsimple Cash Mastercard

This free reloadable Mastercard pays 1% cash back on purchases. It is available to users of the Wealthsimple Cash App, the free money transfer app that allows you to claim your unique Dollar $ign, like the Cash App in the U.S.

The Wealthsimple Cash Card and the app also offer these benefits:

- Send cash instantly to people on your contact list

- No monthly account fees

- No fees for deposits or withdrawals

- Add the Card to your preferred digital wallet (Apple and Google Pay)

- Easily request money from friends or split a bill with them

The 1% cash back you earn is added to your account balance. Alternatively, you can use your cash back to buy stocks on Wealthsimple Trade or cryptocurrency on Wealthsimple Crypto.

- Monthly fee: $0

- Reload methods: Direct bank transfer

- Best for: Cash back rewards

Best Prepaid Visa Cards in Canada

While big banks, including CIBC, issue prepaid Visa cards, some of the best offers are from newer financial technology companies.

CIBC AC Conversion Visa Prepaid Card

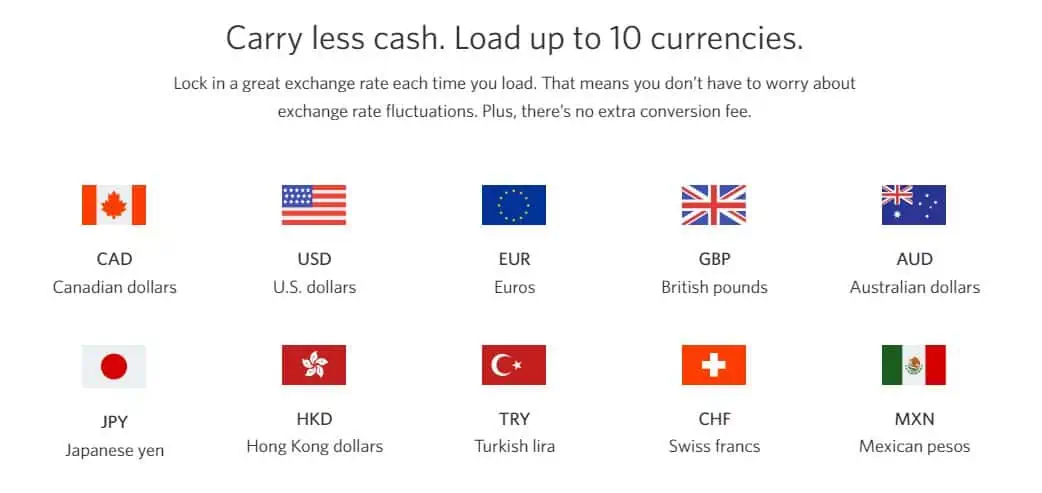

This card is unique in that it can hold more than one currency at a time, saving you the hassle of currency exchanges when you are travelling abroad.

The CIBC AC Conversion prepaid card can take up to 10 currencies, including USD, EUR, GBP, JPY, and more. After locking in an exchange rate, you can simply make payments in the currency of your choice. You don’t need to be a CIBC customer to apply, and the bank does not run a credit check.

- Monthly fee: $0

- Reload method: Online banking

- Best for: Holding multiple currencies

Regular transaction fees apply if you need to make an ATM withdrawal outside Canada – the first ATM withdrawal is free each month.

Learn more about how this card works in our detailed CIBC AC Conversion Card review.

Other Canadian Prepaid Credit Cards

BMO Prepaid Mastercard

The BMO Prepaid Mastercard is a secured credit card with a $6.95 annual fee. You can load the card with funds starting at $100 up to a maximum of $10,000.

To load your BMO prepaid Mastercard, transfer money from your BMO chequing or savings account. Non-BMO customers can load the card by adding it as a bill payment to their online banking.

Note that using your card for cash-like transactions incurs a $5 fee. Also, the standard 2.5% fee applies to foreign currency conversion.

Here is a list of the best BMO credit cards.

Vanilla Prepaid Mastercard

The Vanilla Prepaid Mastercard and its Visa alternative can be used to pay for purchases at millions of locations worldwide. These prepaid cards make the perfect gift for birthdays, graduations, and more.

The Vanilla Prepaid Mastercard and Vanilla Prepaid Visa are available in various denominations, and an activation fee is also required as follows:

| Vanilla Prepaid Mastercard (denomination) | Activation Fee | Vanilla Prepaid Visa (denomination) | Activation Fee |

| $25 card | $3.95 | $25 card | $4.95 |

| $60 (3 x $20) | $8.95 | $75 card | $5.50 |

| $50 card | $4.95 | $150 card | $6.50 |

| $100 card | $5.95 | $250 card | $7.50 |

| $200 card | $6.95 |

Vanilla prepaid cards cannot be used for recurring billing or cash withdrawals at ATMs. When you make payments in foreign currencies, a 2.5% fee applies.

You can easily purchase a Vanilla prepaid card at Walmart, Petro-Canada, Giant Tiger, London Drugs, or Best Buy.

Related: KOHO vs STACK

American Express Prepaid Cards

American Express also had prepaid cards you can purchase in Canada. They are available in $25, $50, $100, $200, $500, and $1,000 denominations.

Amex Prepaid Cards have no monthly fees and can be used wherever Amex credit cards are accepted.

After purchasing the card online, it is mailed via Canada Post and may take up to 1 week before delivery.

Other reloadable prepaid cards include:

Canada Post Prepaid Reloadable Visa Card: (costs $15 to purchase; $3 monthly service fee). It offers purchase protection and extended warranty insurance. Learn more.

Vanilla Prepaid Mastercard: This is offered alongside Vanilla Mastercard prepaid cards. It is offered in various denominations, including $25, $75, $150, and $250, and charges activation fees. Learn more.

The CIBC Smart Prepaid Visa Card was discontinued at the end of January 2023.

STACK Prepaid Mastercard

*No longer offered* The Stack prepaid Mastercard is a prepaid Mastercard with features including:

- A $7.99 monthly fee applies if you don’t spend at least $350 each month

- No foreign currency conversion fees (spending limits apply)

- Bill payments

- Cash back offers at participating retailers

- Free STACK-to-STACK money transfers

You get a user-friendly mobile app that tracks your spending. It also helps you save on autopilot by rounding up your purchases to the nearest $1, $2, $5, or $10 and adding it to your savings.

- Monthly fee: $7.99

- Reload method: Interac e-Transfer, Visa Debit, Direct payroll deposit, Canada Post

- Best for: Waiving FX fees

- Learn more: STACK prepaid Mastercard review

Methodology:

Savvy New Canadians ranks the best prepaid credit cards based on the rewards they offer, ease of application, lack of annual fees, welcome bonuses, top features, and other perks. We carefully evaluate each prepaid card and place more weight on the value of the long-term rewards it offers. Visit the card issuer’s website using the links to confirm each product’s terms and conditions before applying.

Compare the Best Prepaid Credit Cards in Canada

Below is a summary of the best prepaid credit cards.

| Card | Neo Money Card | KOHO Prepaid Mastercard | EQ Bank Card | CIBC AC Conversion Card | Wealthsimple Cash Card |

| Best for | Cash back and earning high interest rates | Cash back; earn high interest rates on your balance; free budgeting app | Cash back, ATM withdrawals, and no FX fees | Holding multiple currencies | Cash back rewards |

| Annual fee | $0 | $0* | $0 | $0 | $0 |

| FX Fee | Regular fees apply | Lower 1.5% for regular KOHO; 0% for KOHO Extra | 0% | Regular fees apply | $0 (Mastercard fees apply) |

| Perks | Up to 5% cash back, earn interest on balance | Up to 5% cash back on purchases; free budgeting app; free e-Transfers, earn 5.00% interest on balance | 0.50% cash back on purchases | Load multiple currencies | Earn 1% cash back on purchases |

| Issuer | Equitable Bank | People’s Trust | Equitable Bank | CIBC | People’s Trust |

| Reload options | Interac e-Transfer, Direct deposit, electronic funds transfer | Interac e-Transfers, direct deposit, online bill payment, Canada Post | Electronic transfer from your savings | Online banking | Direct bank transfer |

| Load Limits | n/a; maximum balance for Neo Money account is $200,000 | $20,000 maximum card balance, $3000 daily max transaction limit; $30,000 monthly transaction limit | $10,000 maximum card balance; $5,000 daily transaction limit | $20,000 maximum card balance; $2,999.99 maximum purchases per day; $2,999.99 maximum load amount | $3,000 maximum spending limit per transaction; $5,000 maximum spending limit per day |

| Available in Quebec | No | Yes | No | Yes | Yes |

| Security | Mastercard Zero Liability protection, CDIC coverage via Concentra Bank | Mastercard Zero Liability; CDIC coverage via People’s Trust | Mastercard Zero Liability; CDIC coverage via Equitable Bank | Visa Zero Liability | Visa Zero Liability, CDIC coverage via People’s Trust |

| Promotion | $20 sign-up bonus when you open a Neo Money account, fund it with $50 or more, and complete first purchase | $20 welcome bonus after your first purchase | None; perks come standard | – | n/a |

| Apply | Apply now | Apply now | Apply now | – | – |

Summary of the Best Prepaid Cards of 2024

- Best prepaid card for savings, cash back, and credit building: KOHO Mastercard

- Best prepaid Mastercard for no FX fees, ATM use and savings: EQ Bank Card

- Best prepaid card for cash back rewards: Neo Money card

- Best prepaid card for P2P money transfer: Wealthsimple Cash Card

- Best prepaid card for multiple currencies: CIBC AC Conversion Visa Prepaid

Prepaid Credit Cards Explained

A prepaid credit card is similar to a gift card that has been preloaded with money, and you can use it to make payments like you would with a credit card. Technically, it is not a credit card but is often referred to as such.

Prepaid credit cards are issued by banks, retailers, and other financial institutions using the Visa, Mastercard, or American Express payment networks.

After obtaining your card, you will need to transfer money to it. You can load the card using Interac e-Transfer, payroll, direct deposit, or bill payment through your online banking.

Even if you do not have a bank account, you may be able to load money onto the card by visiting a designated location, e.g. Canada Post.

A prepaid card only gives you access to the money you have loaded. When you make a payment, it is deducted from your balance until you have nothing left. Unlike regular credit cards, prepaid cards do not give you a line of credit to draw on.

This is why they are often also referred to as prepaid debit cards.

Your credit rating does not matter when you apply for a prepaid card. So, whether you have poor or great credit, you can easily qualify.

Benefits of a Prepaid Credit Card

The main advantages of prepaid cards relate to convenience and better money management.

Budgeting: Prepaid cards like Neo Money and Wealthsimple Cash Card work hand-in-hand with a phone app you can use to manage your spending and track your purchases. If you struggle with staying within your budget, a prepaid card can help since you can’t spend more than you have loaded.

Convenience: If you don’t have a debit card, a prepaid card can be used to pay for purchases at millions of locations worldwide. It is safer than carrying cash.

Credit Rating: You don’t need a good credit score to apply for a prepaid card. You can get one even if you have a bad credit score and cannot qualify for a regular credit card.

Fees and Interest: Since you can’t spend more than what you have, prepaid credit cards do not charge interest on your balance. You also won’t be paying a hefty annual fee. Note that you may incur ATM withdrawal and foreign currency fees when applicable.

Security: A prepaid Visa card may offer protection for unauthorized purchases via Visa’s Zero Liability policy. The same goes for a prepaid Mastercard via Mastercard’s Zero Labiality coverage.

Disadvantages of a Prepaid Credit Card

Even though the prepaid cards on this list replicate many of the features you would find in a credit card; they are not “credit” cards,

Credit Score: A prepaid card does not affect your credit card. If you cannot qualify for a regular credit card, you cannot use a prepaid card to build your credit score.

If this is the case, you should look at these secured credit cards.

Limited or no Rewards: Most prepaid credit cards do not offer loyalty rewards or cash back. This means you aren’t getting anything back for every dollar spent. KOHO, the EQ Bank Card and Neo Money Card excel in this regard.

Transaction Limitations: You may have to pay a fee to withdraw cash from an ATM, or the card may not even offer that functionality (e.g. Vanilla Prepaid Cards). They also do not offer recurring bill payments.

Acceptability: Some vendors do not accept prepaid cards.

Funding Your Card: Some prepaid cards are just a hassle to load. You may need to visit Canada Post or a retail store to load funds on your card. Look out for those that accept direct deposit, Interac e-Transfer, or Bill payment through your bank’s online banking portal.

How Prepaid Credit Cards Work

Prepaid cards all work slightly differently, but the basic principle is the same. With these cards, you deposit funds into your account, and you can then spend those funds wherever your card is accepted.

As such, you are spending your own money, like with a debit card, rather than borrowing money like a traditional credit card. Depending on the card, you may earn points or cash back for your purchases.

Some cards come preloaded with funds to spend, but most are reloadable.

Gift cards or store prepaid cards may be closed-loop cards. With these, you can only use the card at selected merchants or retail networks.

On the other hand, open-loop prepaid cards can be used anywhere as long as your card network is accepted.

Most allow you to reload funds when needed, but load options differ. For example, most allow you to load using a bank transfer, but you may be able to load in person at a retailer or via a credit card.

You may even be able to set up a direct deposit, so you can get your pay cheque sent straight to your prepaid card.

Many prepaid cards come with apps and bank accounts. Fintech companies usually provide these apps with additional features like spending insights.

They may have additional tools to boost your credit score for a monthly fee or round-up features, where your purchases are rounded up to the dollar, and the extra money is automatically saved.

Depending on the card, you may be able to save on foreign transaction fees, but these often come at a cost, and a monthly subscription may be required.

Types of Prepaid Cards in Canada

There are several types of prepaid cards available in Canada. Here we take a look at the main ones.

Prepaid Visa Cards

Prepaid Visa cards are prepaid cards that work on the Visa network. They can be used anywhere Visa is accepted, and banks, stores and fintech companies issue them.

Prepaid Mastercards

Prepaid Mastercards are the same as Visa cards but can only be used where Mastercard is accepted. Some major stores like Costco only accept Mastercard.

Prepaid American Express Cards

These cards work the same way as Visa and Mastercard prepaid cards, but they can only be used where American Express cards are accepted.

Prepaid Rewards Cards

Many prepaid cards come with the option to earn rewards, including reward points and cash back.

Prepaid Travel Cards

These are reloadable cards that usually come with the option to hold several currencies, so you can use them to make purchases more easily when you travel.

Prepaid Gift Cards

Specific merchants or retail networks provide these cards. They may or may not be reloadable.

Alternatives to Prepaid Cards in Canada

There are several alternatives to prepaid cards in Canada that you may want to consider using.

Debit Cards

A debit card is the closest alternative to a prepaid card. With this, you are spending your own money rather than borrowing it.

However, the money comes straight out of your bank account, so you don’t need to load your card with money. In addition, these may or may not come with the option to earn rewards and cash back.

Secured Credit Cards

A secured credit card is a card where you deposit your money as a security deposit. For example, you deposit $500 and can then spend up to that limit. You are restricted to borrowing up to the amount of your deposit.

The difference is that you are not spending your own money. You are borrowing money just like a normal credit card and must make regular monthly payments. Secured credit cards are a good option to rebuild your credit score.

Unsecured Credit Cards

These are standard credit cards where you do not need to make a security deposit. With these, you borrow the money and pay it back at the end of the month. You pay interest on your balance if you don’t pay it back after the grace period.

Unsecured cards are a good option if you have a good credit score. They may have better rewards and premium perks than prepaid cards, but this depends on the card.

Prepaid Card vs Secured Credit Card

A secured credit card is similar to a prepaid card; however, you can use it to improve your credit score.

You must put down a security deposit as part of the application process for a secured credit card. Your security deposit is returned to you when you close your account or your credit improves, and you qualify for a secured credit card.

Three of the best secured credit card options in Canada is the Neo Secured Credit Card.

Neo Secured Mastercard

The Neo Secured Mastercard is the best secured credit card in Canada. It has no annual fees and offers:

- $25 welcome bonus

- Up to 5% cash back at 10,000+ partner stores

- Minimum 0.50% cash back on all purchases (up to $50 cash back monthly)

- Guaranteed approval

- 15% welcome cash back at several stores (first-time purchases)

- $50 minimum security deposit

- Your credit limit is equal to the security funds you provide

Learn more in this Neo Secured Mastercard review.

Secured credit card issues report your payments to the credit bureau. If you stay on top of your payments, you can use these cards to improve your credit rating.

Related: Secured vs Prepaid Credit Cards.

Where to Buy Prepaid Cards

You can buy prepaid cards from various places. Here are the most common places to buy them:

Websites and Apps

You can often order a prepaid card online via the card issuer’s website. For example, fintech companies usually operate entirely online, and you apply via the website, and they deliver the card upon approval.

However, you may have to download the mobile app and apply via this instead of the website.

If a bank or store offers prepaid cards, you may also be able to apply for these online. The card may or may not be free, but you might have to preload it. For example, if it is a gift card, you will normally need to buy it and pay the amount preloaded onto it.

Stores

If a store offers a prepaid card, you may be able to apply for it online. For example, you could buy a prepaid gift card or apply for a free prepaid store card. You may or may not have to go through an application process.

Credit enquiries are not normally made because you are not applying for a credit card.

Banks

Where banks issue prepaid cards, you may be able to apply at the bank branch in person. For prepaid card issuers like KOHO, you can order a card online.

Should You Get a Prepaid Card?

Getting a prepaid card can be a good option if you cannot get a credit card because of your credit score or because you don’t have a long credit history.

You may also want a prepaid card if you:

- Want to keep track of exactly how much you are spending.

- Want to earn reward points or cash back that your debit card does not provide.

- Don’t have a bank account, but you still want to enjoy the convenience of making purchases with a card.

- Want to provide someone with a gift.

FYI: The CIBC Smart Prepaid Visa is no longer for sale.