In recent years, Canada has witnessed a substantial surge in consumer debt, painting a vivid picture of the nation’s financial landscape.

In 2019, the total consumer debt across the country stood at a staggering C$1.99 trillion. Fast forward to 2023, and this figure has ballooned to an astonishing C$2.42 trillion, marking a significant uptick of 17.7%.

As a result, Canadians now find themselves with over C$65,000 of consumer debt on average.

To comprehensively grasp the intricacies of consumer debt in Canada, we delved into data sourced from the Canada Mortgage and Housing Corporation (CMHC). This information was meticulously cross-referenced with the latest demographic data from Census Metropolitan Areas (CMA), enabling us to provide nuanced insights into the evolving consumer debt trends spanning 2019 to 2023.

In the following pages, we unravel the complexities of this financial narrative, shedding light on the changing dynamics that have shaped the borrowing habits of Canadians nationwide.

Key Takeaways

- Canadian household debt levels are the highest among G7 peers, with 74.3% tied to mortgages.

- Mortgage debt significantly contributes to overall consumer debt by 22.88% due to limited housing supply and increased borrowing capacity.

- Credit card debt remains a notable aspect of consumer debt, although lower in total value by 4.5%, indicating consumer financial behaviour.

- Vancouver (C$360,683.00 per capita): Vancouver leads the nation in consumer debt, reflecting the city’s high housing prices and 14.14% growth since 2019.

- Toronto (C$187,350.00 per capita): Toronto follows, indicating the economic vibrancy but also the financial challenges faced by residents, with an 18.78% increase in consumer debt since 2019.

- Victoria (C$12,874.00 per capita): Victoria tops the list for credit card debt, reflecting consumer spending habits and financial behaviours, with a moderate 2.72% growth since 2019.

- On the contrary, Vancouver, with C$12,332.00 per capita credit card debt, shows stability with a 4.14% increase since 2019.

- Oshawa demonstrates a robust economy with per capita consumer debt of C$175,566, ranking 4th overall; concurrently, it ranks 3rd in credit card debt with C$7,505 per capita, reflecting a 5.69% growth, indicating prudent credit card usage aligning with its overall consumer debt trends.

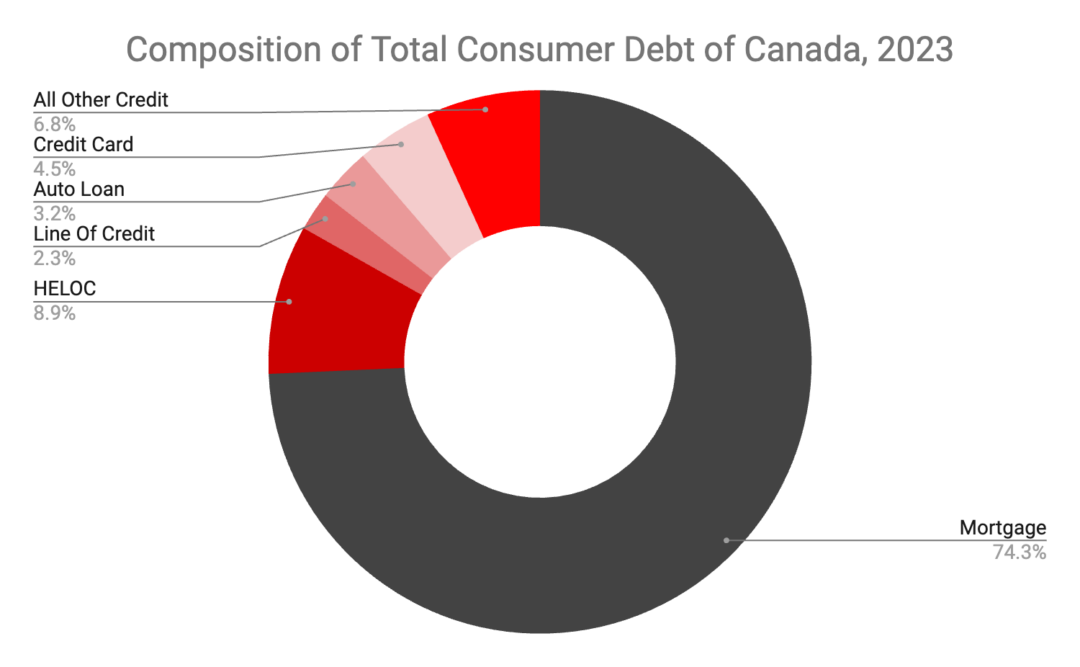

Composition of Total Consumer Debt in Canada, 2023 (Q2)

Canada’s consumer debt landscape is shaped predominantly by mortgages and Home Equity Lines of Credit (HELOCs), which account for a substantial portion of the borrowing habits, totalling 83.2% of the debt composition.

The surge in mortgage debt, constituting 74.3% of Canadian household debt, was propelled by soaring housing prices during the pandemic, prompting individuals to take on higher mortgage obligations to secure homes.

Population growth and immigration have further intensified housing demand, exacerbating the housing market’s competitiveness. Notably, Canada faces challenges in housing affordability compared to its G7 counterparts, as indicated by the unfavourable price-to-income ratio.

HELOCs, contributing 8.9% to the debt landscape, highlight Canadians’ flexibility in leveraging home equity for additional financial needs, demonstrating homeowners’ adaptability in managing their finances.

Additionally, diverse borrowing practices are evident in credit card usage (4.5%), underscoring the significance of short-term credit, and in auto loans (3.2%) and lines of credit (2.3%), emphasizing transportation and general borrowing priorities.

While these categories individually represent smaller percentages, they collectively reflect the multifaceted nature of consumer borrowing behaviours in Canada, showcasing the adaptability and resilience of Canadians amidst the evolving economic landscape.

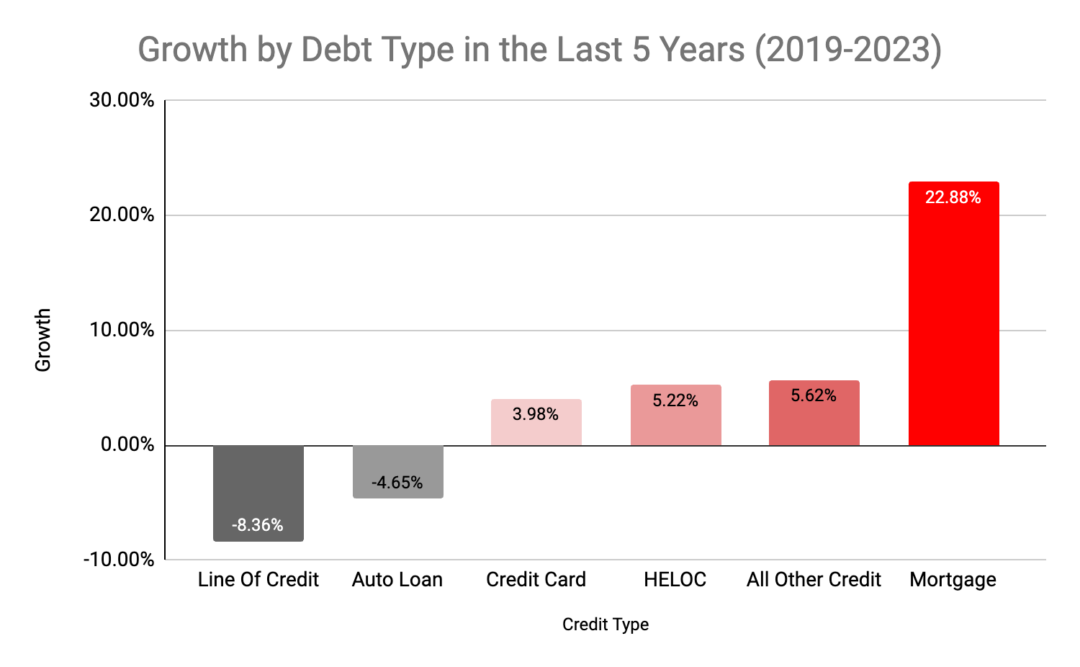

Growth by Debt Type in the Past 5 Years (2019-2023)

Canadians are taking more loans to buy houses. Mortgage debt has increased significantly by 22.88% from 2019 to 2023.

Limited supply of housing in some areas of Canada has led to increased competition among buyers, driving up prices and leading to more borrowing.

Increasing discounts offered by financial institutions continue to boost borrowers’ interest in variable-rate mortgages.

By contrast, Canadians have taken out fewer auto loans and other lines of credit in the last five years due to several factors.

One reason for this trend is that Canadians with bad credit or limited credit history need help getting approved for financing.

Moreover, long-term financing has exploded in Canada, and at one point earlier this year, 55% of all new car loans were for at least 84 months. Longer loans mean less frequent new car purchases.

Canadian consumers must face tough stress tests to qualify for mortgages, likely contributing to some rationalizing their lines of credit by not applying for new lines.

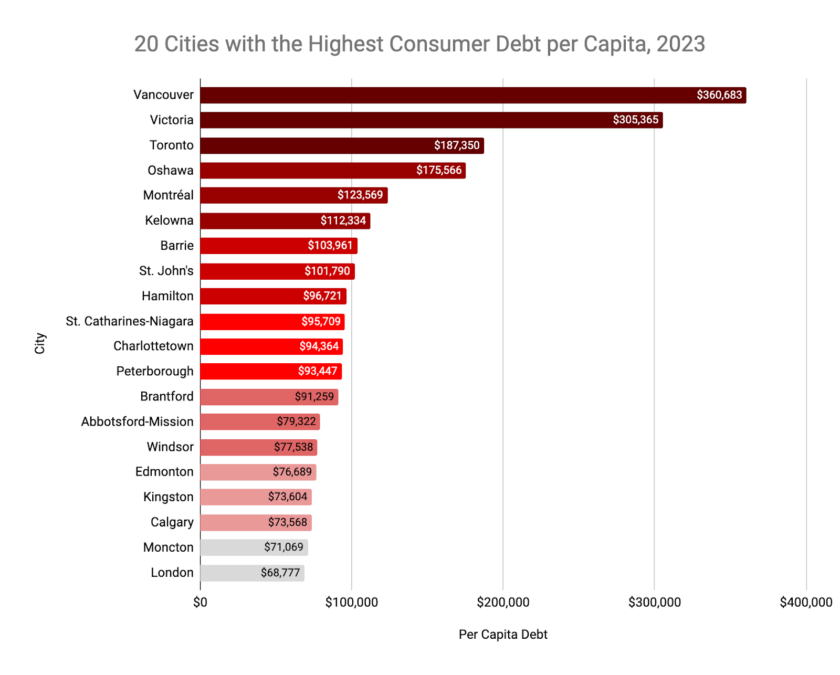

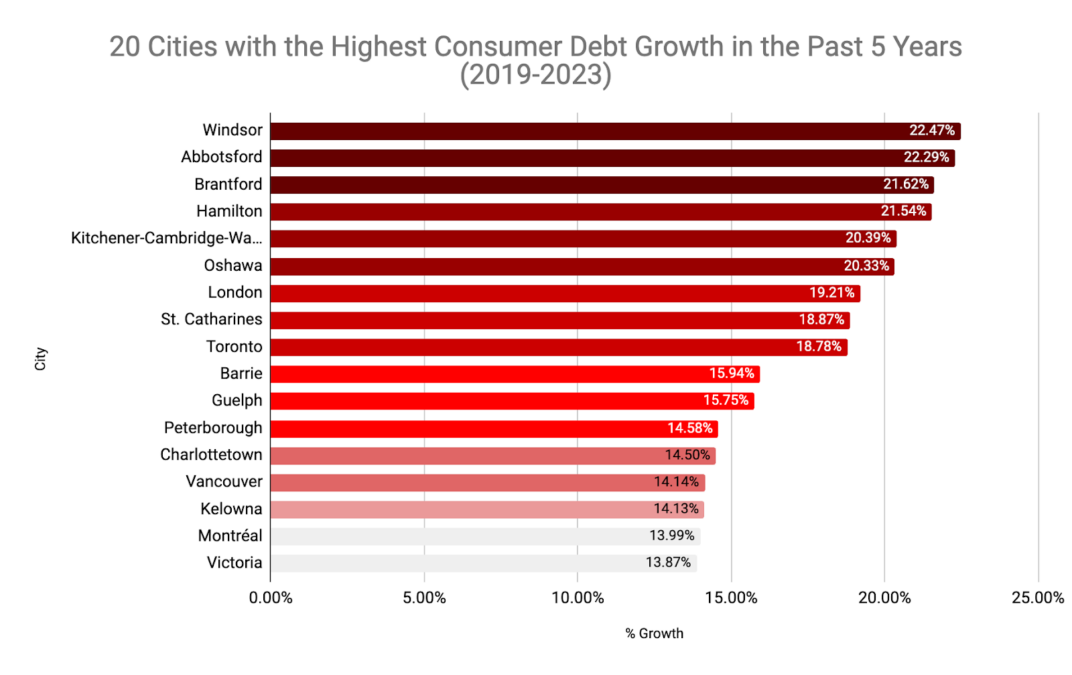

20 Cities with the Highest Consumer Debt per Capita, 2023

Highlighting the 20 Canadian cities with the highest consumer debt per capita in 2023, the following list also provides the city ranking with a comparative analysis of debt growth since 2019-2023, shedding light on the changing economic dynamics across these urban centers.

1. Vancouver

Vancouverites have the highest appetite for debt in the country, ranking 1st among the top 20 cities for highest consumer debt per capita. The city also ranks 17th among the top 20 locations measured for the highest consumer debt growth in the last five years.

- Total consumer debt in 2019: C$205,096,367,341.00

- Total consumer debt in 2023: C$238,861,519,123.00

- Total consumer debt increased (2019-2023): C$33,765,151,782.00

- Total consumer debt growth % (2019-2023): 14.14%

- Per capita consumer debt in 2023: C$360,683.00

2. Victoria

Another city in the province of British Columbia, Victoria, ranks 2nd for the highest consumer debt per capita and 20th for the highest consumer debt growth in the last five years. This suggests that BC-based consumers are pulling back on new debt.

- Total consumer debt in 2019: C$24,633,497,235.00

- Total consumer debt in 2023: C$28,601,676,126.00

- Total consumer debt increased (2019-2023): C$3,968,178,891.00

- Total consumer debt growth % (2019-2023): 13.87%

- Per capita consumer debt in 2023: C$305,365.00

3. Toronto

As the country’s economic epicentre, Toronto residents rank 3rd for consumer debt per capita and 9th for the highest consumer debt growth in the last five years. Residents have been resisting the urge to be exposed to more debt.

- Total consumer debt in 2019: C$4252,132,71,035.00

- Total consumer debt in 2023: C$523,523,565,727.00

- Total consumer debt increased (2019-2023): C$98,310,294,692.00

- Total consumer debt growth % (2019-2023): 18.78%

- Per capita consumer debt in 2023: C$187,350.00

4. Oshawa

This city in the province of Ontario ranks 4th for the highest consumer debt per capita and 6th for the highest consumer debt growth in the last five years.

- Total consumer debt in 2019: C$24,529,937,695.00

- Total consumer debt in 2023: C$30,791,326,397.00

- Total consumer debt increased (2019-2023): C$6,261,388,702.00

- Total consumer debt growth % (2019-2023): 20.33%

- Per capita consumer debt in 2023: C$175,566.00

5. Montréal

This city in northeastern Canada ranks 5th for the highest consumer debt per capita but does not feature in the top 20 cities with the highest consumer debt growth in the last five years.

- Total consumer debt in 2019: C$187,365,419,923.00

- Total consumer debt in 2023: C$217,845,384,962.00

- Total consumer debt increased (2019-2023): C$30,479,965,039.00

- Total consumer debt growth % (2019-2023): 13.99%

- Per capita consumer debt in 2023: C$123,569.00

6. Kelowna

Kelowna, another British Columbia city, ranks 6th for the highest consumer debt per capita and 18th for the highest consumer debt growth in the last five years.

- Total consumer debt in 2019: C$13,946,322,376.00

- Total consumer debt in 2023: C$16,240,796,093.00

- Total consumer debt increased (2019-2023): C$2,294,473,717.00

- Total consumer debt growth % (2019-2023): 14.13%

- Per capita consumer debt in 2023: C$112,334.00

7. Barrie

This Ontario city ranks 7th for the highest consumer debt per capita and 10th for the highest consumer debt growth in the last five years.

- Total consumer debt in 2019: C$12,918,374,675.00

- Total consumer debt in 2023: C$15,368,523,577.00

- Total consumer debt increased (2019-2023): C$2,450,148,902.00

- Total consumer debt growth % (2019-2023): C$15.94%

- Per capita consumer debt in 2023: C$103,961.00

8. St. John’s

St. John’s, the capital and largest city in the province of Newfoundland and Labrador, ranks 8th for the highest consumer debt per capita but does not feature among the top 20 cities for highest consumer debt growth in the last five years. The city saw a negative percentage of debt growth in the last five years, suggesting its residents are averse to additional debt.

- Total consumer debt in 2019: C$11,409,828,038.00

- Total consumer debt in 2023: C$11,250,344,389.00

- Total consumer debt increased (2019-2023): C$-159,483,649.00

- Total consumer debt growth % (2019-2023): -1.42%

- Per capita consumer debt in 2023: C$101,790.00

9. Hamilton

The city of Hamilton ranks 9th for the highest consumer debt per capita and 4th for the highest consumer debt growth in the last five years.

- Total consumer debt in 2019: C$44,045,528,096.00

- Total consumer debt in 2023: C$56,138,189,624.00

- Total consumer debt increased (2019-2023): C$12,092,661,528.00

- Total consumer debt growth % (2019-2023): 21.54%

- Per capita consumer debt in 2023: C$96,721.00

10. St. Catharines-Niagara

The most populous city in the Niagara region ranks 9th for the highest consumer debt per capita and 4th for the highest consumer debt growth in the last five years.

- Total consumer debt in 2019: C$17,954,183,006.00

- Total consumer debt in 2023: C$22,129,649,284.00

- Total consumer debt increased (2019-2023): C$4,175,466,278.00

- Total consumer debt growth % (2019-2023): 18.87%

- Per capita consumer debt in 2023: C$95,709.00

11. Charlottetown

Charlottetown ranks 11th for the highest consumer debt per capita and 16th for the highest consumer debt growth in the last five years.

- Total consumer debt in 2019: C$3,131,236,778.00

- Total consumer debt in 2023: C$3,662,160,650.00

- Total consumer debt increased (2019-2023): C$530,923,872.00

- Total consumer debt growth % (2019-2023): 14.5%

- Per capita consumer debt in 2023: C$94,364.00

12. Peterborough

This city ranks 12th for the highest consumer debt per capita and 12th for the highest consumer debt growth in the last five years.

- Total consumer debt in 2019: C$6,677,190,681.00

- Total consumer debt in 2023: C$7,816,893,472.00

- Total consumer debt increased (2019-2023): C$1,139,702,791.00

- Total consumer debt growth % (2019-2023): 14.58%

- Per capita consumer debt in 2023: C$93,447.00

13. Brantford

This Ontario city ranks 13th for the highest consumer debt per capita. Its residents have been taking on additional debt in the last five years as it ranks 3rd for the highest consumer debt growth.

- Total consumer debt in 2019: C$7,487,885,048.00

- Total consumer debt in 2023: C$9,553,745,283.00

- Total consumer debt increased (2019-2023): C$2,065,860,235.00

- Total consumer debt growth % (2019-2023): 21.62%

- Per capita consumer debt in 2023: C$91,259.00

14. Abbotsford-Mission

This city ranks 14th for the highest consumer debt per capita. Its residents have also been taking on additional debt in the last five years as it ranks 2nd for the highest consumer debt growth.

- Total consumer debt in 2019: C$12,022,921,384.00

- Total consumer debt in 2023: C$15,471,252,493.00

- Total consumer debt increased (2019-2023): C$3,448,331,109.00

- Total consumer debt growth % (2019-2023): 22.29%

- Per capita consumer debt in 2023: C$79,322.00

15. Windsor

Windsor ranks 15th for the highest consumer debt per capita. Its residents have demonstrated an increased appetite for new debt over the last five years as the city ranks at the top of the list for the highest consumer debt growth.

- Total consumer debt in 2019: C$14,123,930,087.00

- Total consumer debt in 2023: C$18,217,950,545.00

- Total consumer debt increased (2019-2023): C$4,094,020,458.00

- Total consumer debt growth % (2019-2023): 22.47%

- Per capita consumer debt in 2023: C$77,538.00

16. Edmonton

The capital of Alberta province ranks 16th for the highest consumer debt per capita. However, the city is not among the top 20 cities for the highest consumer debt growth in the last five years. Edmonton saw a negative percentage of debt growth in the previous five years.

- Total consumer debt in 2019: C$81,948,145,376.00

- Total consumer debt in 2023: C$77,525,130,511.00

- Total consumer debt increased (2019-2023): C$-4,423,014,865.00

- Total consumer debt growth % (2019-2023): -5.71%

- Per capita consumer debt in 2023: C$76,689.00

17. Kingston

This Ontario city ranks 17th for the highest consumer debt per capita. It does not feature among the top 20 cities for the highest consumer debt growth in the last five years.

- Total consumer debt in 2019: C$8,937,149,946.00

- Total consumer debt in 2023: C$9,987,171,045.00

- Total consumer debt increased (2019-2023): C$1,050,021,099.00

- Total consumer debt growth % (2019-2023): 10.51%

- Per capita consumer debt in 2023: C$73,604.00

18. Calgary

Another city in Alberta province, Calgary, ranks 18th for the highest consumer debt per capita. Like fellow Alberta city Edmonton, it does not feature among the top 20 cities for highest consumer debt growth in the last five years. The city also saw a negative percentage of debt growth in the last five years.

- Total consumer debt in 2019: C$99,521,525,343.00

- Total consumer debt in 2023: C$96,137,935,866.00

- Total consumer debt increased (2019-2023): C$-3,383,589,477.00

- Total consumer debt growth % (2019-2023): -3.52%

- Per capita consumer debt in 2023: C$73,568.00

19. Moncton

As the most populous city in the province of New Brunswick, Moncton ranks 19th for the highest consumer debt per capita. The city is not among the top 20 cities for the highest consumer debt growth in the last five years.

- Total consumer debt in 2019: C$5,947,628,269.00

- Total consumer debt in 2023: C$6,408,573,069.00

- Total consumer debt increased (2019-2023): C$460,944,800.00

- Total consumer debt growth % (2019-2023): 7.19%

- Per capita consumer debt in 2023: C$71,069.00

20. London

This Ontario city ranks 20th out of the top 20 Canadian cities with the highest consumer debt per capita. It ranks 7th for the highest consumer debt growth over the period.

- Total consumer debt in 2019: C$23,467,279,445.00

- Total consumer debt in 2023: C$29,046,177,336.00

- Total consumer debt increased (2019-2023): C$5,578,897,891.00

- Total consumer debt growth % (2019-2023): 19.21%

- Per capita consumer debt in 2023: C$68,777.00

Decomposing Consumer Debt: Reviewing Canada’s Credit Card Debt 2023

Of the six featured debt types, our analysis delves into credit card debt. This type of debt provides potential clues to how consumers respond to financial conditions. In tough economic times, households may rely more on credit to meet ends.

Conversely, people might accumulate debt linked to their confidence in their ability to pay it off. Finally, credit card debt could give clues to conditions for access to credit and interest rates.

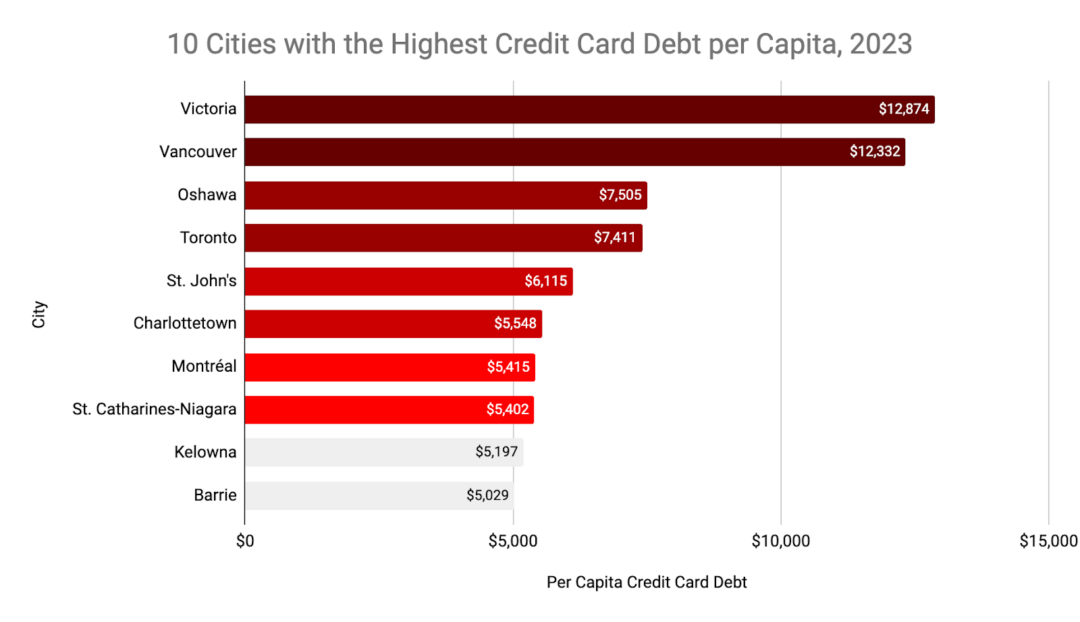

10 Cities with the Highest Credit Card Debt per Capita, 2023

These ten cities reflect the highest levels of credit card debt in Canada over the review period. The following section provides more information.

1. Victoria

Residents of Victoria carry the highest levels of credit card debt per capita in all of Canada. This city collaborates with fellow BC city Vancouver to form one of the most indebted cities per capita.

- Total credit card debt in 2019: C$1,173,041,278.00

- Total credit card debt in 2023: C$1,205,815,114.00

- Total credit card debt increased (2019-2023): C$32,773,836.00

- Total credit card debt growth % (2019-2023): 2.72%

- Per capita credit card debt in 2023: C$12,874.00

2. Vancouver

Fellow British Columbia city Vancouver ranks 2nd for credit card debt per capita in Canada. The total credit card debt growth percentage for the five years under review is 4.14%.

- Total credit card debt in 2019: C$7,828,937,495.00

- Total credit card debt in 2023: C$8,166,977,645.00

- Total credit card debt increased (2019-2023): C$338,040,150.00

- Total credit card debt growth % (2019-2023): 4.14%

- Per capita credit card debt in 2023: C$12,332.00

3. Oshawa

This city in the province of Ontario ranks 3rd for highest credit card debt per capita in 2023. The per capita credit card debt in 2023 for residents of this city is C$7,505.00.

- Total credit card debt in 2019: C$1,241,370,240.00

- Total credit card debt in 2023: C$1,316,282,764.00

- Total credit card debt increased (2019-2023): C$74,912,524.00

- Total credit card debt growth % (2019-2023): 5.69%

- Per capita credit card debt in 2023: C$7,505.00

4. Toronto

This financial capital of the country ranks 4th for the highest credit card debt per capita in 2023, with a figure of C$7,411.00.

- Total credit card debt in 2019: C$20,241,952,234.00

- Total credit card debt in 2023: C$20,707,749,835.00

- Total credit card debt increased (2019-2023): C$465,797,601.00

- Total credit card debt growth % (2019-2023): 2.25%

- Per capita credit card debt in 2023: C$7,411.00

5. St. John’s

The capital and largest city in Newfoundland and Labrador, ranks 5th for the highest credit card debt per capita in 2023. Total credit card debt growth for the period has been slightly negative, registering at -1.08%.

- Total credit card debt in 2019: C$683,146,105.00

- Total credit card debt in 2023: C$675,830,922.00

- Total credit card debt increased (2019-2023): C$-7,315,183.00

- Total credit card debt growth % (2019-2023): -1.08%

- Per capita credit card debt in 2023: C$6,115.00

6. Charlottetown

Charlottetown ranks 6th for the highest credit card debt per capita in 2023. City residents have taken on 5.61% of new credit card debt between 2019 and 2023.

- Total credit card debt in 2019: C$203,219,631.00

- Total credit card debt in 2023: C$215,296,934.00

- Total credit card debt increased (2019-2023): C$12,077,303.00

- Total credit card debt growth % (2019-2023): 5.61%

- Per capita credit card debt in 2023: C$5,548.00

7. Montréal

The Quebecois city ranks 7th for the highest credit card debt per capita in 2023. Credit card growth for the period has been substantially negative, registering at -9.40%.

- Total credit card debt in 2019: C$10,443,616,899.00

- Total credit card debt in 2023: C$9,546,309,840.00

- Total credit card debt increased (2019-2023): C$-897,307,059.00

- Total credit card debt growth % (2019-2023): -9.40%

- Per capita credit card debt in 2023: C$5,415.00

8. St. Catherines-Niagara

St. Catherines-Niagara ranks 8th for the highest credit card debt per capita in 2023. Total credit card debt growth has been modest, at 5.54%.

- Total credit card debt in 2019: C$1,179,949,115.00

- Total credit card debt in 2023: C$1,249,139,861.00

- Total credit card debt increased (2019-2023): C$69,190,746.00

- Total credit card debt growth % (2019-2023): 5.54%

- Per capita credit card debt in 2023: C$5,402.00

9. Kelowna

Kelowna ranks 9th for the highest credit card debt per capita in 2023. The average per capita credit card debt for city residents is C$5,197.00.

- Total credit card debt in 2019: C$712,284,984.00

- Total credit card debt in 2023: C$751,346,603.00

- Total credit card debt increased (2019-2023): C$39,061,619.00

- Total credit card debt growth % (2019-2023): 5.20%

- Per capita credit card debt in 2023: C$5,197.00

10. Barrie

Barrie ranks 10th for the highest credit card debt per capita in 2023. Total credit card debt for the period has swelled by 6.03%.

- Total credit card debt in 2019: C$698,667,912.00

- Total credit card debt in 2023: C$743,465,273.00

- Total credit card debt increased (2019-2023): C$44,797,361.00

- Total credit card debt growth % (2019-2023): 6.03%

- Per capita credit card debt in 2023: C$5,029.00

Methodology

The methodology ensured rigorous analysis, relying on credible sources and robust metrics to deliver accurate, insightful observations regarding Canada’s consumer debt trends.

Data Sources:

Our study relies on data from the Canada Mortgage and Housing Corporation (CMHC), spanning from the fourth quarter of 2019 to the second quarter of 2023. This dataset offers insights into outstanding debts across various Canadian cities and their Census Metropolitan Areas (CMAs).

Additionally, population data from Statistics Canada for 2021 provided context, allowing us to calculate per capita debts and gain insights into individual financial burdens within specific cities.

Metrics and Analysis:

We calculated the total outstanding debt for each city, emphasizing trends from 2019 to 2023.

By comparing this data with population statistics, we derived per capita debt figures, offering a nuanced perspective on individual financial burdens. Our analysis focused on percentage growth calculations, highlighting cities experiencing significant shifts in their financial landscapes.

This approach allowed us to provide valuable insights into the interplay between population dynamics and evolving debt scenarios, offering a comprehensive understanding of Canada’s economic fabric.

Re: your stats on Canadian credit card debt… Nowhere is it clear whether you are just taking stats about total amount owing at this moment, or whether you are talking about balances unpaid and attracting balance interest. If it is the latter, we look bad, but if it is the former, it means that the high cashback rewards are causing the savvy to put everything they can on the card and pay balance in full every month.