The best online brokers in Canada give everyday investors easy and direct access to the financial markets where they can buy and sell stocks, ETFs, options, and other financial instruments as they wish for their portfolios.

These online discount brokerage firms remove the need for middlemen, who are traditionally required when you want someone else to trade on your behalf.

Self-directed trading can help you save money in commissions and fees. Read on to learn about the best brokerages and online trading platforms in Canada (for both beginner and experienced investors).

Best Online Discount Brokerages in Canada for 2024

Here are the top five stock trading platforms in Canada.

| Brokerage | Best For | Promotion | Account minimum |

| Moomoo | Top brokerage platform | Up to $2,400 | $0 |

| Questrade | Best broker for investment products | $50 in free trades | $1,000 |

| Qtrade | Best broker for customer support | $50+ signup bonus | $0 |

| Webull | Best for earning interest on uninvested cash | $100 bonus | $100 |

| Wealthsimple Trade | Best for beginners | $25 bonus | $0 |

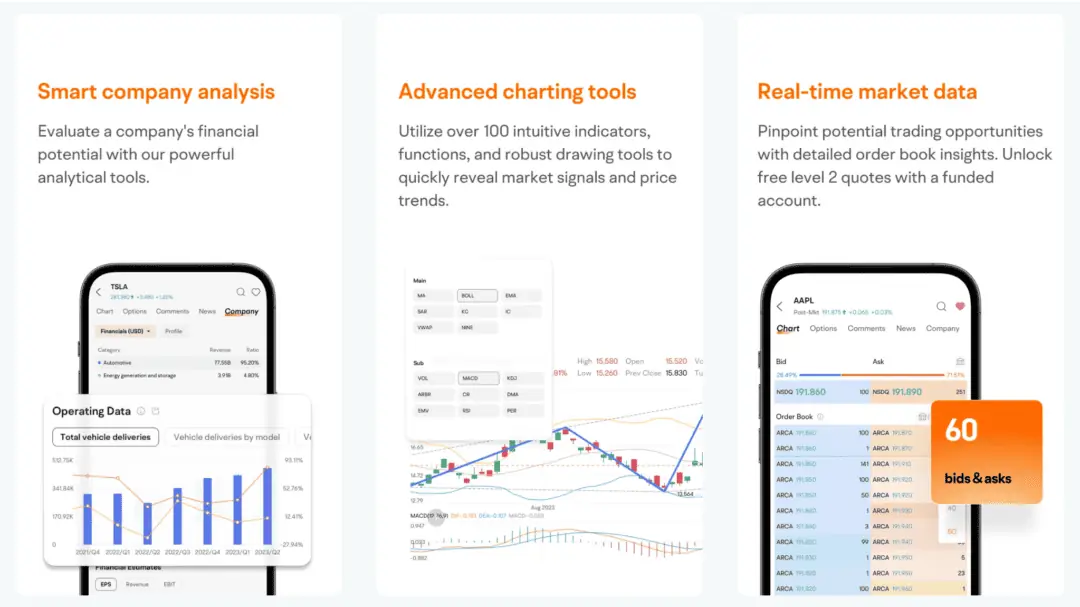

1. Moomoo

- Account minimum: $0

- Commissions: $0.014 per share (min $1.49 per trade) on Canadian stocks

- Accounts offered: Cash, Margin, RRSP, TFSA

- Activity fee: None

- App: Yes, the Moomoo mobile app to trade on the go

- Promotion: Create an account and deposit $100+ to receive up to $2,400 in cash rewards. You’ll also have access to free Lv2 market data and virtual funds to test your trading strategy.

Founded in 2018, Moomoo has become one of the best online brokerages in Canada and beyond. The platform boasts over 21 million users globally and offers access to US, Canadian, and Chinese markets.

Trading commissions on US stocks are $0.0099/share (minimum $1.99 per trade), and on Canadian stocks, they are $0.014/share (minimum $1.49 per trade).

Moomoo is a member of the Canadian Investment Regulatory Organization (CIRO) and the Canadian Investor Protection Fund (CIPF), which protects your assets up to $1 million.

Pros

- Low trading commissions for stocks, ETFs, and options

- Free access to real-time US and CDN level 2 market data

- Advanced charting and technical analysis tools

- Robust mobile app and desktop trading platforms

- Access to Hong Kong and China investments

- Free paper trading to test your trading strategy risk-free

- AI monitor to find more investment opportunities

- 24/7 financial news from trusted sources

Cons: No RESPs, RRIF, or business investment accounts. Mobile platform may be complicated for some beginners.

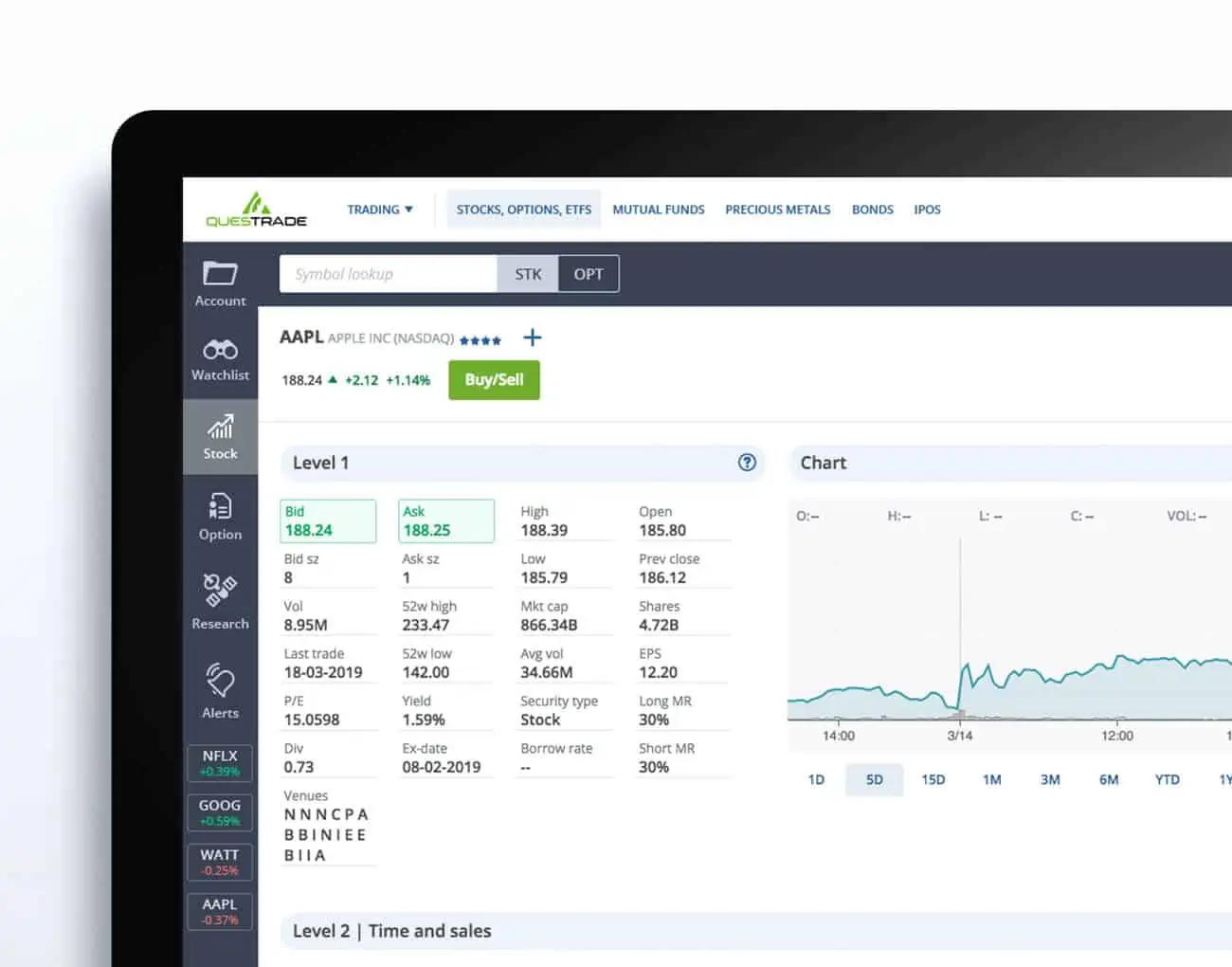

2. Questrade

- Account minimum: $1,000

- Commission: $4.95 to $9.95 per trade

- Accounts offered: TFSA, RRSP, RESP, LIRA, RIF, LIF, Margin, Corporate

- Inactivity fee: None

- App: Yes – 2/5 rating on the App Store

- Promotion: Get $50 in FREE trades through this promo link

Questrade is a Canadian discount brokerage service established in 1999.

The company has over $30 billion in assets under management and is one of the fastest-growing stock trading platforms in the country, with more than 200,000 new accounts opened every year.

Trading commissions are $4.95 to $9.95 per trade, and ETFs are free to buy.

Questrade, Inc. is a member of the Investment Industry Regulatory Organization of Canada (IIROC) and the Canadian Investor Protection Fund (CIPF).

Pros

- Questrade offers a variety of investment products, including stocks, ETFs, options, GICs, bonds, international equities, precious metals, and IPOs

- ETF purchases are free, although trading fees apply when you sell

- Offer robo-advisor services via Questwealth

- Active traders can get a rebate on trading fees

- Deposit up to $3,500 instantly

- Enjoy private insurance coverage of up to $10 million

- No inactivity fees

- Private insurance up to $10 million

- Access to advanced trading tools and market data

Cons: A minimum of $1,000 is required to begin trading on Questrade.

3. Qtrade

- Account minimum: $0

- Commission: $8.75/trade

- Accounts offered: TFSA, RRSP, RESP, margin, RRIF

- Inactivity fee: $25 per quarter; waived with $25K in assets

- App: Yes

- Promotion: Get a $50 bonus when you deposit $1,000+.

Qtrade is one of the top online brokerages in Canada and has excelled over the years as one of the top picks for excellent customer service.

You pay $8.75 per trade (or $6.95 if you trade a lot) and do not pay commissions when buying or selling 100+ select ETFs.

Their platform offers access to technical research, news, and real-time quotes.

Pros

- Excellent customer service

- Can purchase stocks, ETFs (including SRIs), mutual funds, bonds, GICs, options, and new issues

- Newly launched mobile onboarding experience

- Trial account available

- Young investors (age 18 to 30) can qualify for $7.75 commissions and no quarterly fee

- Transfer fees are waived up to $150 when you transfer assets worth $15,000 or more to Qtrade

Cons: $25 per quarter inactivity fee (waived if you meet the eligibility requirements) and $100 for account closures within the first year.

Learn more about the platform in this Qtrade review.

4. Webull

- Account minimum: $0

- Commission: $2.99 per trade

- Accounts offered: Cash, Margin, and IRAs ( traditional, rollover, Roth)

- Inactivity fee: None

- App: Yes –Android and iOS

- Promotion: Get up to $100 cash rewards if you sign up and deposit $100-$1,000+.

Webull is a U.S.-based stock trading platform that launched in Canada in Jan 2024, enabling Canadians to access and trade CA and U.S. stocks & ETFs.

The platform is regulated by the Canadian Investment Regulatory Organization (CIRO) and is a member of the Canadian Investor Protection Fund (CIPF).

Its unique selling point in Canada seems to be low trading commissions and a cash management service with up to 4% APY on uninvested cash.

Pros

- Low flat fees of $2.99 per trade

- An introductory 90-day commission-free trading offer

- Versatile web, desktop, and mobile trading interfaces

- Levies no inactivity fee and requires no minimum deposit

- Advanced charting, trading tools, and real-time level 2 market data

Cons

- Limited platform features in Canada

- Limited account types – doesn’t yet offer RRSP/TFSAs in Canada

- Limited investment products – only stocks and ETFs

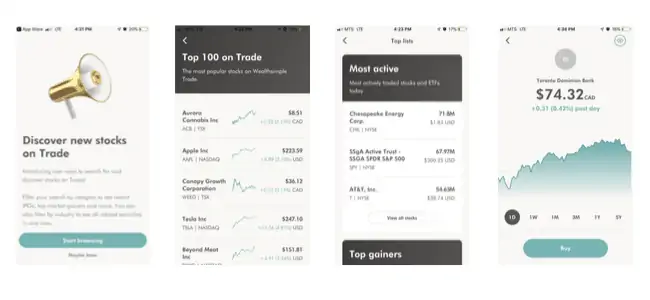

5. Wealthsimple Trade

- Account minimum: $0

- Commission: $0 ($10 monthly fee for an upgrade to access USD accounts and real-time quotes)

- Accounts offered: TFSA, RRSP, and non-registered personal accounts

- Inactivity fee: $0

- App: Yes – 4.6/5 rating on the App Store

- Promotion: Get a $25 cash bonus when you invest with Wealthsimple Trade and deposit at least $150.

Wealthsimple Trade is one of Canada’s commission-free stock trading apps. It is owned by Canada’s most popular online portfolio manager, Wealthsimple, and is separate from its robo-advisor service.

DIY investors can use Wealthsimple Trade to buy and sell thousands of stocks and ETFs listed on major Canadian and U.S. exchanges while paying no commissions. To access a USD account and avoid FX fees, you can upgrade to Trade Plus for $10 monthly.

Your funds are held with Canadian ShareOwner Investments Inc., which is a member of IIROC and CIPF.

Wealthsimple has more than $30 billion in assets under management. Read our detailed Wealthsimple Trade review.

Pros

- No trading commissions on buy or sell transactions ($10 monthly fee to access live trading data)

- No account minimums

- Have a robo-advisor service – Wealthsimple Invest

- User-friendly mobile app

- Offers a Premium upgrade with real-time market data and USD accounts

- No quarterly inactivity fees

Cons: Margin accounts and bonds are not offered. Also, the investment accounts you can open are limited (RRSP, TFSA, FHSA and personal taxable accounts).

6. CIBC Investor’s Edge

- Account minimum: None

- Commission: $6.95 per trade

- Accounts offered: TFSA, RRSP, RESP, RRIF, LIRA, LRSP, LRIF, PRIF, margin

- Account maintenance fee: $100/year if your account balance is less than $10-25K

- Mobile app: Yes, 3.7/5 on the Google Play Store

CIBC Investor’s Edge is the brokerage platform for the Canadian Imperial Bank of Commerce (CIBC). You can use it to trade stocks, ETFs, options, mutual funds, precious metals certificates, GICs, and bonds.

A flat $6.95 fee applies to equity trades; however, active traders and students enjoy discounted rates at $4.95 and $5.95 per trade, respectively.

CIBC is a member of CIPF, and it is regulated by IIROC.

Pros

- Access to stock screeners, real-time quotes, and market news

- Access to a mobile app on iOS and Android devices

- DRIPs is available

- The flat $6.95 trading fee is cheap compared to other big banks

- Student and active trader discounts are available

- Access to multiple investment accounts and products

Cons: A $100 annual account maintenance fee applies if your account balance is $10,000 or less (non-registered accounts) or $25,000 or less (registered accounts).

Find out more in our CIBC Investor’s Edge review.

7. TD Direct Investing

- Account minimum: None

- Commission: $9.99/trade

- Accounts offered: TFSA, RRSP, RESP, RRIF, RDSP, LIRA, LIF

- Inactivity fee: $25 per quarter; waived with $15K in assets

- App: Yes – 4.4/5 rating on the App Store

TD Direct Investing is the online brokerage service for Toronto Dominion Bank. It is often considered one of the most versatile trading platforms among the Big Five banks. In the U.S., it operates as TD Ameritrade.

Trades cost a flat $9.99 or $7 if you have 150 trades or more in a quarter. Those who want to make complex U.S. options trade will enjoy the features “thinkorswim” has to offer.

Here are the best options trading platforms in Canada.

TD Direct Investing is regulated by IIROC and is a member of CIPF.

Pros

- DRIPS is available

- Can combine household assets to waive the quarterly $25 account maintenance fee

- Great for options trading

Cons: $25 quarterly inactivity fee if your account has less than $15,000. No commission-free trading offer for stocks or ETFs.

For more on this platform, read our review of TD Direct Investing.

8. CI Direct Trading

- Account minimum: $1,000

- Commission: $1.99 to $7.99 per trade

- Accounts offered: TFSA, RRSP, RESP, RRIF, LIRA, LIF, margin

- Inactivity fee: $24.95 per quarter; waived with $5K in assets

- App: Yes – 4/5 rating on the App Store

CI Direct Trading (formerly Virtual Brokers) is a division of CI Investment Services Inc. and a popular discount brokerage in Canada.

You pay 1 cent per share or a minimum of $1.99/trade and a maximum of $7.99/trade. ETF purchases are free; however, trading commissions apply when you sell.

Pros

- 14-day demo account available

- A dividend purchase plan is available at a $1 monthly cost

- Active traders with more than 150 trades per quarter enjoy a $3.00/trade flat fee

Cons: A $24.95 inactivity fee applies per quarter unless your account has a minimum of $5,000. Also, a $1,000 minimum deposit is required for opening an account.

Learn more about the platform here.

9. Scotia iTrade

- Account minimum: None

- Commission: $9.99 per trade

- Accounts offered: TFSA, RRSP, RESP, RRIF, LIRA, LIF, margin

- Inactivity fee: $25 per quarter; waived with $10K in assets

- App: Yes – 1.4/5 rating on the App Store

Scotia iTrade is the brokerage division of the Bank of Nova Scotia and is another featured online trading platform from a Big Five bank.

You pay a standard $9.99 per trade. Active traders with at least 150 trades per quarter pay a flat $4.99 per trade.

Scotia iTrade offers various investment products, including stocks, ETFs, mutual funds, bonds, precious metals, GICs, and new issues.

Pros

- Commission-free ETFs available

- A practice account is available

Cons: $25 quarterly maintenance fee for inactive accounts and a high commission rate of $9.99 per trade for everyday investors.

We cover this platform in more detail here.

What is an Online Broker?

An online broker offers self-directed investors a trading platform to buy and sell financial assets, including stocks, Exchange-Traded Funds (ETFs), options, FOREX, bonds, and mutual funds.

Also referred to as discount brokerages, do-it-yourself investors can save on the fees and commissions they would otherwise pay to a full-service broker.

That being said, online trading platforms are not suitable for everyone.

The cost savings mean you are now responsible for determining your trades, portfolio allocation, and rebalancing when required.

Also, you will need to understand how the stock market works and know how your behavioural biases can negatively impact your long-term returns.

The aforementioned challenges are in no way to dissuade first-time investors from trading stocks and ETFs on their own. If anything, it is to tell you to be mindful and to trade with the understanding that your money is on the line and you are in the driver’s seat.

Self-directed portfolio management is easier than ever, with all the recently available all-in-one ETFs that require little to no management on your part.

If you are not comfortable with making the decision about what goes into your portfolio or basket of assets, investing with a robo-advisor is a fee-saving, hands-off approach you can consider.

How To Choose The Best Online Broker in Canada

When you go about selecting a platform for your online stock trading, here are some factors to consider:

Fees and Commissions: Trading fees can add up and even exceed the expense ratios for mutual funds if you don’t trade smartly. Look at the fees and commissions being charged.

Do they offer commission-free ETF trading? Do they charge a quarterly fee if you are inactive? Are these fees waived with a specific account balance? How about ECN/ATS fees? Minimizing the fees you pay is key to improving your long-term returns.

Account minimums: Find out how much money you need to deposit before you can start trading. If you plan on investing small amounts, a broker with a high minimum threshold is not for you.

Investment needs: Do they offer the types of investment assets you want to trade (e.g. stocks, ETFs…)? How about the investment account types? Order types (e.g. market, limit, and stop orders)? Trading tools available (e.g. real-time market data)?

Customer service: Take a look at the options they have provided for support. Can you reach someone easily by email, phone, or chat?

User-friendliness: What does the trading interface look like? Is it intuitive or confusing? Can you demo it? What are other users saying in the ratings and reviews available online?

Security: All the online trading platforms on this list are regulated by IIROC and CIPF, which means that if they should go bankrupt, you are protected for up to $1 million. In addition, some of them offer additional security features for your account, such as 2-factor authentication.

Other features: Some financial institutions offer investors a one-stop solution for all their banking needs, including investing, high-interest savings, chequing, portfolio management, and more. It may be convenient to have all your accounts in one place.

ECN and ATS Fees

Electronic Communication Networks (ECNs) and Alternative Trading Systems (ATSs) fees are small add-on costs you may incur when you place your trades.

Trades that remove liquidity from the market (i.e. a market order) attract ECN fees, while trades that add liquidity, such as a limit order that is lower than the ask or higher than the bid (i.e. non-marketable limit orders), do not attract ECN fees.

Market orders or marketable limit orders can be immediately filled and remove liquidity.

Non-marketable orders are unlikely to be filled right away and, thus, add liquidity.

The added cost of ECN or ATS fees is minimal and should not be your main focus when choosing an online broker. This is especially so if they already offer low or no-commission trading.

For example, on Questrade, the ECN fee on Canadian securities of $1 and above is $0.0035 per share.

For an order of 100 shares, this cost translates to 35 cents. Or, you can simply avoid it by only placing limit orders when it makes sense.

Final Thoughts

Investors can benefit from a DIY investment approach to lower their management fee costs and improve returns over time.

Self-directed investing puts you in control. You pick the stocks or ETFs in your portfolio and must be comfortable with doing your own research.

Investors who are uncomfortable with asset allocation or rebalancing can still save on fees by going with a robo-advisor. Read my complete Canadian robo-advisor review.

Moomoo makes it easy to access multiple products at competitive trading fees. It is one of the best options for international equities, options, and trading tools. Plus, it has a market-leading incentive for new sign-ups (up to $2,400).

If you want to try online stock trading, Questrade is a great option for trading several investment products, and seasoned traders would love their market data options. When you open an account with at least $1,000, you get $50 in free trades.

Qtrade offers commission-free trades on up to 105 ETFs. For a limited time, it offers new clients a $50 bonus when they open an account and fund it with $1,000 or more.

Wealthsimple Trade offers a cost-effective platform you can try out as a beginner. You also get a $25 cash sign-up bonus after funding with just $150+.

Best Trading Platforms in Canada FAQs

Questrade and Moomoo top this list of the best brokers based on the robustness of their offerings, including versatile trading platforms, low trading fees, multiple investment accounts, market data packages, investment products, and insurance coverage.

One of the best options trading platforms in Canada is Moomoo. It also works well for advanced U.S. options trades.

Wealthsimple Trade clients can purchase thousands of stocks and ETFs for free without paying a trading fee. It is one of the top brokerage platforms in Canada, offering no-fee stock trading. For access to free Level 2 data, Moomoo’s low trading fees are competitive.

Wealthsimple Trade is great for beginners who want to start trading. The app is intuitive and user-friendly, so beginner investors don’t get overwhelmed with too many options. It is also budget-friendly, and you can begin trading with just $1.

Related: Best Investment Apps in Canada

The biggest thing to consider is real time charts, Questrade requires you to purchase a data package to obtain real time charts. TD Direct does not work with Thinkorswim, they are creating their own proprietary system, which again requires a data package… up selling in Canadian stock market is getting worse all the time.

I have been with Questrade for many years. From time to time i get charged an ECN fee.

I always place my order outside of the bid and ask, and Questrade is unable to tell me why i get charged the fee, they just say the service provider charged the fee and they pass it on. Someone is making money. The last charge was $81.95 on a $3600 order…..so much for discount broker.

Weak article. How can you exclude National Bank Discount Brokerage which is the lowest priced brokerage in Canada?

Why can these companies hold our money for 5-8 business days? Stocks don’t stop and if I need to move money quickly this hold of my money is utter nonsense! It could cost me money.

I am interested in using the Wealthsimple Trade app. Does it offer DRIP fractional shares? I am looking for a no-fee or basically no cost to buy an ETF but would like to hold it for at least 3-5 years and automatically reinvest distributions, hence the DRIP fractional shares. I know some trading apps only offer DRIP full shares.

@Jeremy: The last time I checked, Wealthsimple Trade does not support dividend reinvestment programs.