In the retirement series, I wrote about the Canada Pension Plan, RRSPs, Old Age Security, and other employment pension plans.

Taking it a step further, I want to address a question I’ve often asked myself (and have been asked by others):

“How much money do I need to have saved up before I retire?”

“How can I retire at age 50, 55, 60, or 65 years old?”

“Do I need $1 million to retire?”

“How much income will I need in retirement?” …

or more specifically: “How much money do I need to retire in Canada?”

These, of course, are important questions!

As you grow older, you start to wonder if you’re putting aside enough money for retirement and if your retirement nest egg will hold up when you finally do retire.

While I do not have all the answers, I’ll take a stab at providing an answer that hopefully gets you started on the road to arriving at the “magic number” or “multiple” that works for you.

How To Calculate Retirement Income in Canada – Rules of Thumb

When it comes to income required in retirement in Canada, there are several rules of thumb or schools of thought out there. If you are looking for a definite answer to put your mind at rest, you may be disappointed.

The one thing everyone readily agrees on is that when it comes to retirement income, it is not “black and white,” and there is no 100% consensus.

Popular rules of thumb include:

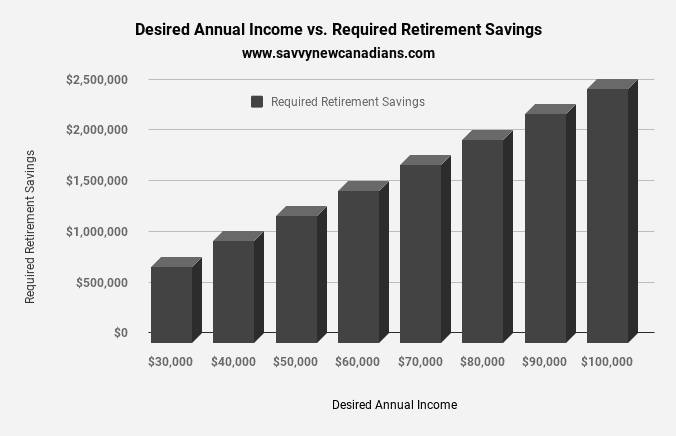

Rule 1: 4% Withdrawal Rate

The 4% withdrawal rule infers that you build up a retirement portfolio that provides a certain amount of income per annum at a 4% or so withdrawal rate. A 4% withdrawal rate is often referred to as a “safe” withdrawal rate.

For example, say you have figured out that you need $40,000 per year in retirement. Using a withdrawal rate of 4%, you should have a minimum of $1 million in retirement savings before you retire.

⇒ $40,000 ⁄ 4% = $1,000,000

This rule of thumb works whether you plan to retire early at 35 or go the conventional route and retire at 65 years or later. It’s the strategy often utilized by many “early retirement” enthusiasts or the movement popularly referred to as “FIRE” – Financial Independence/Retire Early.

Note: For earlier retirement plans, consider that you will not be receiving a government pension or retirement benefits until later in life and adjust your income needs accordingly.

The general idea behind the funds lasting you for life is based on historical market returns. If we assume your investment portfolio generates approximately 7% annually in long-term returns, then real returns of approximately 4% are expected after accounting for inflation (assuming an inflation rate of 3%).

Essentially, a 4% withdrawal rate assumes your investment portfolio is not highly conservative (i.e. you are invested in a good proportion of stocks/equities).

Rule 2: Desired Annual Retirement Income x 25

This rule follows the 4% withdrawal rate rule. They are pretty much the same, but this is easier to calculate for those who would rather not dabble in fractional math. It infers that to meet your income needs in retirement, you want to have at least 25 x your desired annual retirement income.

For example, say you estimate that your expenses per year in retirement are $40,000. You would be expected to save up a minimum of $1 million in retirement savings.

⇒ $40,000 x 25 = $1,000,000

Related: The Complete Guide to Retirement Income in Canada

Rule 3: 70% of Working Income (or more)

This rule estimates that you will need between 70% and 100% of your pre-retirement income in retirement: 70% if you are typical and do not have a mortgage and up to 100% if you are still paying a hefty mortgage plus other atypical expenses while retired.

The idea behind this rule is that your expenses are generally expected to be lower in retirement: no mortgage payments, no longer need to save for retirement, kids are financially dependent, etc. After computing this amount, you can then proceed to calculate how much you need (lump sum) by going back to Rule 1 or 2.

For example, assume you earn $100,000 per year before retiring. Using the 70% rule, you will need approximately $70,000 ($100,000 x 70%) in annual income to maintain your lifestyle in retirement. Going back to Rule 2, it implies you need:

⇒ $70,000 x 25 ⇒ $1.75 million in retirement.

I think the 70% rule is a reasonably liberal estimate of retirement income needs (barring exceptional circumstances). A survey conducted by Sunlife and released in 2016 shows that Canadian retirees were, on average, living on 62% of their pre-retirement income.

Rule 4: Pre-Retirement Income x Multiples of 10 to 14

This rule suggests that you can calculate how much you need to save for retirement by multiplying your income just before retirement by a number between 10 and 14.

For example, say your income before retirement was $100,000/year. Following this rule, you should accumulate at least (depending on which multiple you’re working with):

- Multiple of 10: $100,000 x 10 = $1 million

- Multiple of 11: $100,000 x 11 = $1.1 million

- Multiple of 12: $100,000 x 12 = $1.2 million

- Multiple of 13: $100,000 x 13 = $1.3 million

- Multiple of 14: $100,000 x 14 = $1.4 million … during your working years.

Rules 3 and 4 implicitly assume that you are using the income earned during your highest income-earning years as the basis of your calculation. This means that if you are a younger person in an entry-level position (i.e. low starting salary) looking at retiring early, calculations using these approaches will not work for you in the longer term.

Related: CPP vs. OAS: How Do They Compare?

How To Estimate Your Retirement Income Needs in Canada

The income available to you during your retirement years (distribution phase) will depend largely on how much you were able to set aside during your working years (accumulation phase), plus other available government and employment benefits.

Steps to estimating or calculating your retirement income needs include:

A. How much income do you expect to live on per year?

You can compute this amount using different strategies – for example, by using the 70% pre-retirement income rule or by simply looking at the lifestyle you envisage living in retirement and estimating what your expenses will add up to (including taxes).

Note: In your calculations, if looking at your current lifestyle and expenses, remember to eliminate expenses that may no longer be relevant in retirement such as mortgage payments, cost of commuting to work, childcare expenses; RRSP, CPP, and EI payments, etc. And remember to add new expenses that may crop up, such as travel expenses, hobbies, health issues, etc.

B. How much government benefit do you expect to receive?

If you have lived and worked in Canada before retirement, you can expect to receive Old Age Security (OAS) and Canada Pension Plan (CPP) benefits.

The amount you receive will generally depend on how long you have lived in Canada (for OAS), how much you have contributed to the plan, and for how long (for CPP).

Using OAS and CPP numbers for 2024. Let’s assume the maximum monthly OAS payable is $713.34 for a total of $8,560.08 per year (ages 65 to 74), while the maximum CPP is $1,364.60 for a total of $16,375.20 per year.

Most people will get less than the maximum amount. For example, the average monthly CPP benefit paid in 2024 is $831.92 (40% less than the maximum amount payable).

For individuals who immigrated to Canada in their adult years (like me), the total government pension they will be eligible for will be significantly reduced.

Using the 2024 maximum government pension amounts as an example, total payouts from this source to a single senior are:

$8,560.08 (OAS) + $16,375.20 (CPP) = $24,935.28 per year

Here’s how many years you need to work to get the maximum CPP.

C. How much do you need to save up?

To calculate this amount on an annual basis, you will need to subtract expected government pensions from the annual expenses you calculated in Step A, and then multiply the remainder by 25 (or divide by 4%).

For example, a couple who estimates their annual retirement income needs to be $70,000 will need to save:

| Annual expenses in retirement from age 65 (couple) | $70,000 |

| Deduct Total Government Pensions expected (couple) a | -$34,909.39 |

| Income Withdrawn from Savings/Year b | $35,090.61 |

| How Much Do You Need To Save For Retirement? c | $877,265 |

a. Most individuals will not get the full government pension amount from OAS and CPP. The amount here reflects 70% of the maximum CPP & OAS amounts for a couple in 2024, i.e. (70% x $24,935.28 ) (x 2) – moderately conservative estimate.

b. Line 1 minus line 2

c. Derived by multiplying the annual income withdrawn by 25 (i.e. $35,090.61 x 25) or dividing by a 4% withdrawal rate (i.e. $35,090.61 / 4%). The result is the same for both formulas.

As shown in the table above, government pensions offset some of the savings required by the couple pre-retirement. The more government pension they qualify for, the less money is required in their investment portfolio.

Additionally, if one or both partners have a defined benefit pension, it will further lower the amount of savings required to meet their desired retirement income.

Overall, to fund their preferred retirement lifestyle, the couple in the scenario above will need about $900,000 in their retirement nest egg.

Related: CPP and OAS Benefits for Surviving Spouse and Children

How Much Do You Need To Retire?

How much you need to retire will depend on your needs. Using the couple described above, who needs $70,000 annually, almost half of this is provided through their government pensions.

So, instead of requiring $1.75 million based on the 4% withdrawal rule ($70,000 x 25), they may need less than $1 million in their personal retirement accounts and be able to retire comfortably.

Some Canadians will need even less, with paid-off homes and decreased income requirements when retired. As such, it’s no surprise that the average retirement savings as per Statistics Canada, are much lower.

You can check out various income scenarios using this Canadian Retirement Income Calculator.

What Can Change Your Retirement Income Needs?

Calculating your income needs in retirement is not an exact science. Life happens, and it may leave your retirement plan in tatters. Some possibilities include the following:

- Health issues that cause you to retire earlier than planned or which result in higher-than-expected medical bills early in retirement

- Financially dependent kids in retirement

- Divorce

- Significant mortgage payments

- Run-away inflation or a market crash, and much more.

If, for one reason or the other, you are unable to save enough money for retirement at age 60, 65, or earlier, depending on what your plans were initially, the following strategies may be useful in managing your “savings/income gap”:

1. Work for longer and delay government pension till later: Working for a few more years and/or delaying when you start receiving OAS/CPP can significantly increase your eligible payouts down the road.

2. Semi-retire and work part-time: Every year you delay dipping into your retirement nest egg means more money to spend in the future.

3. Start saving aggressively: The earlier you start saving, the better for you. Time is the game-changer regarding the returns you can earn on your investment portfolio. If you are running out of time, you will need to put aside more funds more often.

4. Consider adjusting your retirement lifestyle expectations and spending less: If you have run out of time to build an adequate retirement portfolio to pay for the lifestyle you desire, you may have no choice but to take out less money from your savings and live accordingly.

5. Downsize and sell your home: You can consider beefing up your retirement savings by downsizing and selling your home to utilize the equity you have built up over the years. Alternatively, you may consider taking out a home equity line of credit (HELOC) or a reverse mortgage.

6. Other Government safety nets: If your income in retirement puts you in the low-income bracket (as specified by the government on an annual basis), you may qualify for additional government benefits, including the Guaranteed Income Supplement (GIS) or the Allowance.

Some resources that may come in handy as you plan for retirement include those provided by the Canadian Life and Health Insurance Association and this Retirement Calculator.

START INVESTING: Lower your investment fees with Canada’s lowest-cost wealth manager (robo-advisor), Questwealth. Our readers can invest up to $10,000 for one year for free. Learn more.

Closing Thoughts

When it comes to your retirement planning in Canada, starting early is the key. Compounding interest is your best friend, and it’s better to be over-prepared than under-prepared.

So, do you feel you are on track with your retirement savings/planning? What amount do you feel you would need in retirement? Leave answers in the comment section below.

Other Retirement Investing Posts:

- How To Generate Retirement Income From Your RRSP

- How To Generate Retirement Income From Your LIRA

- The Ultimate Pre-Retirement Checklist For Canadians

- 5 Reasons to Delay Collecting CPP

- How To Save For Retirement in Canada

- Ideal Retirement Savings By Age

- How Much RRSP Should I Contribute?

Hi Steve. I like your plan and the idea of not relying mainly on your house and government pensions. This definitely looks a solid plan that could stand the test of time. Cheers!

Awesome rules and structured very well 😀

I will definitely recommend this post to my dad who is at the stage of retirement

This is a great summary to this age old question. I personally prefer not to use the income estimates because even though income can be high the spending can be low. There’s no need to aim for 70% of gross income or whatever estimate. I like my own rule! Haha, never touch the principle and accumulate enough dividend income to cover my estimated annual spending. I am aiming for $35,000-$45,000 dividend income.

@GYM: Good plan! By not touching the principle and getting to btw $35,000 and $45,000 in annual dividends, you are pretty much covered, especially with your dividends coming mainly from longstanding blue chip stocks.

What’s the point of Saving All Your Life if you do not touch the principal do people think they are going to live forever

Great article but no one ever mentions if the values are net or gross and when inflation is supposed to be calculated? And when you decide how much you need in retirement for these rules, do you use what you would need today or the number with inflation if you retire in 20 years for example? Makes a huge difference in numbers. Please explain!

Sounds great. The reality though is that only a tiny amount of people can even dream of putting that amount of money away since few actually have the incomes to do so.

Doctor, Lawyer, IT manager, no problem. Truck driver, mechanic, salesperson, forget it.

This is quite old but I don’t want people to be discouraged.. you definitely can save this much as a truck driver. If you start saving early, lets say age 25, and save $500 per month until you retire at 65, you will have a nest egg of $1.08 million for a comfortable retirement, assuming average ARR of 6.5%. Your returns will actually be higher than this if you use tax-sheltered accounts like RRSP and TFSA and also invest your RRSP tax refund. Average trucking salary is $50-60k/year. Let’s assume $50k. Your 500/mth savings is a 15% after-tax savings rate, very achievable..

This is so true. People who choose a career in one of the trades 1. Have zero to minimal student debt and 2. Start earning at a much younger age. An university degree sets you back 4 years plus the years you spend paying off the loan. Usually all that happens when you also start a family and take on a mortgage. Of course you can live beyond your means no matter what your career path is.

I want to know why the bi-line says posted December 1, 2018 but Steve and Enoch’s conversation is from Nov 2017? Hmm…

@ Thyme: This post was originally published in 2017 and has been updated several times since then to reflect new information. The CMS for the blog does not currently have the capacity to show “updated” as opposed to “published,” when a post is refreshed.

I would suggest that you as an author should get out and talk to real retirees and see what they live on and how much they actually spend

I retired in my mid 50s and am now 65 we retired on about 70,000 a yr , but this notion of having a million in the back on retirement is not reality for most Canadians

So please talk to real retirees

70,000 a year my friend?? You definitely have more than a million if you are living on $70G a year 🙂

Hi Enoch –

This is one of the more clearly written pieces of general guidance regarding how much is needed for retirement. Very helpful. Thanks much.

@Patrick: You are welcome and I’m glad to hear you found this useful.

Cheers.

Hello Enoch,

Thank you for the very informative article.

Does the 4% withdrawal rule assumes one only lives for 25 years after retirement at age 65? (65+25 = 90 years)

How much margin should one plan for life span – 87 +/- 10% (where the average life span in Canada is 87 years)? (87+8.7=95.7 years)

Thank you.

Regards,

KM

@KM: No, it doesn’t. Infact, the idea is that even if you retire at age 30 with $1 million dollars, you could draw $40,000 per year from your stash for 70 years if you live until you are 100 years old. This rule assumes you will still have close to $1 million bucks in your account when you pass.

The 4% withdrawal rule assumes you are going to keep your funds invested in a portfolio that earns at least 4% per year (after taxes, inflation, fees, etc.). The long term historical average return of the stock market is closer to 10%. Most experts believe that for our time and day, the average return will be closer to 7%. Based on this assumption, a 4% withdrawal is actually conservative and is one of the reasons why most people may not need a million bucks even if they are going to spend $40K every year.

Of course, your money can’t be in a savings account that is paying 2% or less if you are following this rule of thumb. On the other hand, you do not need to go chasing returns or hold a 100% stock portfolio. It’s kind of a middle-of-the-road approach.

Cheers.

What concerns me is that $40,000/year at retirement (say age 65) is very different than $40,000 20 years later at age 85, or after 30 years. There’s no accounting for the devaluation of that money over the (potentially) 30-40 years of retirement. Especially if countries keep printing money like it’s just paper.

It seems to me that if I want to maintain a $40K lifestyle for the next 30+ years I probably need (at least) double that amount as an overall average for those years. So I’d need $2M and I’d only withdraw $40K + inflation annually so the buying power is maintained year to year.

This is a bit more complicated (a spreadsheet can do it nicely) but this way you still have the equivalent of $40K in today’s dollars even when you’re 90+

@Ian: Good point. Some of that inflationary difference will be embedded in the market returns on your investments over time, resulting in a potentially higher retirement nest egg and room to raise your withdrawals on a yearly basis. That said, I get where you are coming from.

From what I understand, couples should also realize that if their spouse passes away and the surviving spouse is receiving a close to or maximum Government pension, that the surviving spouse will only receive a fraction of the deceased spouses Government pension ? If this is true, this should be factored into retirement planning and life insurance should be part of the plan.

Good article overall but I don’t think the 4% rule that I see so many times on American articles don’t apply to Canadians. If you’re relying on your RRSP and RRIFs, then the withdrawal rate is based on your age starting at 65 yo at a rate of 4%. It goes up every year until around 80 something when you have to withdraw 20%. And all that is taxable (which means, unless there’s a withholding tax on all your withdrawals, you need to withdraw the required % of funds according to your age plus an amount to pay the taxes).

Also, I never liked or agreed with the 70% rule. During a person’s working years, there will always be some who need more money than his current income. This is true of many people regardless of income level and it goes all the way up to executives of multinational corporations. So the 70% rule won’t work for them in retirement. They need to tally up a realistic amount of what they need and make the hard decisions to cut out some of the things they want.

Then there are the savers. Some may find out after the kids have finished school, their mortgages have been paid that they are actually able to save money. Those are the people who need to calculate what they are living off annually in pre-retirement and compare that to how many years their nest egg with last.

A couple of corrections due to sentence structure errors.

I don’t think the 4% rule, that I see so many times on American articles, apply to Canadians.

And all that is taxable, which means, (unless there’s a withholding tax on all your withdrawals), you need to withdraw more than just the required % just to pay the tax.

Hi David,

One correction to your post: RRIF withdrawal jumps to 20% when you are 95.

It grows yearly from ~7% to ~11% when you are in your eighties

That confirms my initial question. How do you maintain the 4% rule of withdrawal if you are required by law to withdraw an increasing amount every year from your RRIF?

You raise a valid point regarding our need to withdrawal more than 4% but in practice, I would pay taxes on that excess percentage withdrawn then move the after-tax dollars into my TFSA and invest – tax-free.

Good article. With regard to savings required using 25x etc, are the multiples in the formulas based on all the money is in rrsps or needs to be nonregistered savings? I assume multiple needs to be different based on source What is the multiple if most is in rrsps ?

@Wayne: The rule applies to all retirement funds whether registered or unregistered. The broad assumption underlying this rule of thumb is that you are invested in at least a balanced portfolio (both stocks and income/bonds). This is both a strength and a flaw as not everyone has the stomach for equities (stocks) and as you get older, you may need to make your portfolio more conservative.

It’s amazing how much you can save when you stop being a consumer. My partner and I are just selling our house and are retiring at 49 and 55 with a plan to sail around the world for the next 10 years. With the sale of the house we will have 2.5 million invested and then we still have an income property to fallback on. Our total net worth is just over 3 million. We’ve often debated whether or not we could do it and quite often referred to the 4% rule however we have a long runway ahead of us and anything can happen. We had to sacrifice some in order to achieve this but our plan has been in action for many years. We even started cutting each others hair to save that little bit of money!

The 4% rule is assuming a 7% return. Is 7% realistic in 2020 (and the near to medium term future)? My advisor advises to plan for 5%. After inflation (is it still 3% in 2020?) that only leaves 2% for gross income (taxes need to be paid out of that).

With a $1M nest-egg, that means a paltry $20K gross.

It’s sickening to know that $1M is simply nowhere near enough to retire on any more.

You seem like a smart guy…DROP YOUR ADVISOR

Thank for posting this article. Like you, I landed in Canada (from US, in my case) as an adult — with half or more of my career and income generation years behind me. Do you have any advice on how to figure out what I can expect to get paid after I retire from CPP/OAS in Canada + Social Security from the U.S.? My research indicates there is a US/Canada “Totalization Agreement in place… This means that CPP and Social Security interact — one impacts the other. I still have a few years till retirement, but I am thinking ahead. I have worked long enough in both countries to exceed the miminum duration thresholds for each For planning purposes, I want to be able to estimate what I will get from each of these depending on when I apply for each of them. Do you have any advice on how to get these estimates and different scenarios (e.g., Apply for both at 65 or apply for one sooner than the other) and how to maximize potential income from these?

@Mark: Unfortunately, I am not very familiar with the U.S. social security and its old age benefits package. A few ideas on when to apply for CPP/OAS are in the links below:

https://www.savvynewcanadians.com/take-cpp-early-at-age-60/

https://www.savvynewcanadians.com/take-cpp-at-age-70/

And how to minimize OAS clawback:

https://www.savvynewcanadians.com/strategies-minimize-old-age-security-clawback/

Hope these help.

I’m not a new Canadian but I haven’t found another site more comprehensive and user-friendly than this one. Congrats.

One issue I do have – and this pertains to every such site – is the interchangeable way the retirements data pertains to a single person, or a couple. I can figure it out, but every site should clarify. Thanks.

Curious to know if income taxes is considered in the example where you need $70,000 to cover expenses, the income derived from CPP/OAS/RRSP-RIF? After tax net is less than that $70,000. thanks.

Hi Enoch, thanks for the usefull information. Ablut the 4% rule, what type of investment is considered that will generates 4% + 3% for inflation? As you mentioned it may not be 100% conservative, what would be the anual returns in a more conseevative scenario to dont risk the equity?

@Juan: In today’s investment climate, you will need to hold a significant amount of equities to generate 7% or more. A balanced portfolio is generally weighted 60% stocks (equities) and 40% bonds (fixed income/cash). One example of a 100% conservative portfolio is a GIC. As of today, you’d be looking at a return of ~2% to 2.50% per year for a long-term GIC.

Good morning Enoch, this is a great article. I like how you illustrate the fact that not everybody was born in Canada, therefore there are considerations for every case.

I am hoping you can give me an idea on a general question: I’ve been living and working in Canada for 22 years, luckily with a high income. If I want to retire in 5 years, at age 55, and apply for CPP only at age 65 or 70, would my CPP benefits be impacted for not contributing for 10 or 15 years? And if so, any advice?

Thank you in advanced.

Lenny.

@Lenny:

Yes, it will be impacted because your CPP benefit amount is dependent on:

– the age you decide to start your pension

– how much and for how long you contributed to the CPP

– your average earnings throughout your working life

That said, delaying CPP till age 70 increases your benefits and this could balance things out a bit.

https://www.savvynewcanadians.com/take-cpp-at-age-70/.

Thanks for the article.

My husband (64) and myself (65) have retired. We have just over 1 million in savings and RRSP’s. We have a mortgage free home valued between 1.2 and 1.4 million. We will downsize in about 5 years. We have decided to delay taking OAS and CPP until age 70. We are hoping this isn’t a mistake. We want to have about $150,000 cash now to help the kids with downpayments. Hoping this is doable. We would like to have $65-$70,000 income per year. Are we on track?

Thanks.

@Charlene: I would advise you work with a financial planner to run the numbers for you so you can feel confident about your retirement plans.

For a $70,000 per year income using the 4% withdrawal rule, you will need approx. $1.75 million in retirement savings/investments. This does not account for your OAS and CPP benefits which would theoretically lower the amount you need. A lot of other factors go into this though…types of investments you are holding and your portfolio returns? Cost of accommodation when you downsize? etc.

You need to stop using millionaires as examples. Most retired Canadians do not have anywhere near a million dollars, most don’t even have half that. Those same Canadians on average also only have half the max of CPP or less. I am included in this group. I am 67 and have worked since I was 16. I put away as much as I could through work. But, the first 15-20 years we didn’t have a pension fund to contribute to. So I was in my 30’s before I even got started. And at that time there was very little left to save each week.

Due up some scenario’s based on these much lower amounts which is where most Canadians reside.

I read some of your Articles as to how much one needs for retirement. I currently live off of a little more than $2,000 a month & live quite well. My place is paid off & I don’t have any bills except the basics which I figure to be around $1,500 a month. With my Retirement in 2 months I figure I will be getting roughly $2,600 a month from my investments which include OAS & CPP. I just don’t see how one needs $ 700 to $1,000.000 to retire on unless they plan on living first class or are deeply in debt.

@Davis: Thanks for your comments. The numbers used in the calculation may be on the higher end for some people and lower for others. It’s only an approximation. In your case, with a paid-off mortgage/house, steady investment income, low ongoing bills, CPP, and OAS, your required retirement income could be much lower. Also, I don’t think these numbers translate to “first class” in many cases for a retiree who continues to live in Canada (not abroad). Perhaps, very comfortable? If you add in expenses like ongoing contributions/gifts to kids, mortgage, or rental costs, these can quickly create a dent in an otherwise stellar retirement pot. Lastly, Canadians are living longer than ever. I have factored this in as well.

I agree with G Doyle & his comments. I basicly done the same as he did & I will be 68 this year. Would be nice to see some figures.

@Davis & G Doyle: I have another retirement income article coming soon with additional analysis. Stay tuned!