If you are a self-directed investor looking to spend the least time possible on your investment portfolio, an asset allocation ETF may work for you.

All-in-one ETF solutions such as XGRO remove the need for rebalancing your portfolio since you now have just one fund instead of the four or more funds that would otherwise have made up your portfolio.

And, of course, they are a lot easier than picking individual stocks.

This XGRO review covers its holdings, returns, fees, pros and cons, how it compares to Vanguard’s VGRO, and how to purchase iShares ETFs in Canada.

Blackrock Asset Management Canada offers a line-up of all-in-one ETF portfolios similar to those from Vanguard.

They are:

- XCNS: iShares Core Conservative Balanced ETF Portfolio

- XINC: iShares Core Income Balanced ETF Portfolio

- XBAL: iShares Core Balanced ETF Portfolio

- XGRO: iShares Core Growth ETF Portfolio

- XEQT: iShares Core Equity ETF Portfolio

Each ETF portfolio is designed with a different investor risk profile in mind. Here’s a quick reminder of how conservative, balanced, and growth portfolios differ.

What is XGRO?

XGRO is iShares’ All-in-One Growth ETF Portfolio, designed to provide long-term capital growth by investing in equity and fixed-income securities. It is a basket of 8 funds with approximately 80% equity and 20% bond exposure.

This Blackrock iShares ETF trades on the Toronto Stock Exchange and has a “low to medium” risk rating. For comparison sake, XCNS, which is made up of approximately 60% bonds and 40% equity has a “low” risk rating.

The key facts for XGRO as of March 13, 2023, are:

- Net assets: $1,504,090,677 CAD

- Management fee: 0.18%

- Management expense ratio: 0.20%

- Distribution yield: 1.44%

- 12-month trailing yield: 1.81%

- Distribution Frequency: Quarterly

- Eligible accounts: Registered and non-registered

- Frequency of rebalancing: Quarterly

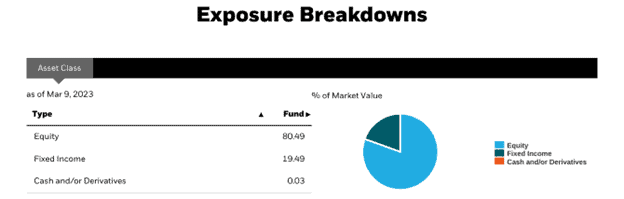

XGRO Asset Allocation

As of March 2023, XGRO was made up of 8 iShares ETF funds as follows:

| XGRO Fund Holdings | Allocation |

| iShares Core S&P Total U.S. Stock (ITOT) | 36.52% |

| iShares MSCI EAFE IMI Index (XEF) | 20.39% |

| iShares S&P/TSX Capped Composite (XIC) | 19.77% |

| iShares Core CAD UNIV BND IDX ETF CA (XBB) | 12.45% |

| iShares Core MSCI Emerging Markets (IEMG) | 3.81% |

| IShares Core CAD ST Cor Bd Index (XSH) | 3.12% |

| IShares US Treasury Bond ETF (GOVT) | 1.96% |

| iShares Bond USD Investment G (USIG) | 1.95% |

Overall, the fund is currently weighted at 80.49% stocks, 19.49% bonds, and 0.03% cash (or cash equivalents).

As you can probably tell, XGRO is for investors with above-average risk tolerance, and you should be comfortable with some volatility.

As of March 2023, XGRO holds 20,725 assets, with the top 10 equity holdings comprising mostly technology and financial stocks.

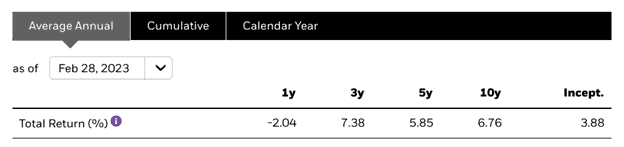

XGRO Returns

XGRO has been around since 2007 but was formerly known as the iShares Balanced Growth CorePortfolio Index ETF (CBN).

The investment objective and management fee of the fund changed when it was converted in December 2018, so you probably shouldn’t pay too much attention to the returns before the change.

That said, below are its published returns over the years as of February 28, 2023:

Past performance does not guarantee future results.

XGRO Fees

XGRO has a 0.18% management fee and a Management Ratio (MER) of 0.20%. Compared to the average equity mutual fund fee of 1.98%, you could save a lot in fees.

Note that trading commissions can pile up to erase your fee savings if you are trading a small amount frequently.

One option to limit your trading expenses is to use a zero-commission brokerage platform such as Wealthsimple Trade.

Questrade also offers free ETF purchases; however, you pay commissions when you sell.

Invest with Wealthsimple Trade, or

Invest with Questrade ($50 free trade credit).

The big banks also offer trading platforms to purchase XGRO, VGRO, XBAL, VBAL, and other asset allocation ETFs.

While you may pay a bit more in trading commissions, you can learn about what they offer in the reviews below:

- TD Direct Investing Review

- BMO InvestorLine Review

- RBC Direct Investing Review

- Scotia iTrade Review

- CIBC Investors’ Edge Review

Pros and Cons of XGRO

All-in-one ETFs have truly changed the investment landscape for a lot of people.

Previously, you would typically need a few ETFs to design your portfolio and had to rebalance after a while because each fund performed differently.

With all-in-one funds, there’s no need to worry about rebalancing your holdings. A few clicks to buy or sell is all you need, and you are on your way.

Also, they are cheaper than comparable mutual funds. When you think of 0.20% vs. 1.98% (average fee for equity mutual funds) over several years, this could result in some significant savings.

The reality is that high mutual fund fees rarely translate into fund managers beating the market year in and year out.

If you don’t mind playing with numbers when you make new purchases or rebalance, you could hold the individual ETF funds and save a bit on the MER.

That said, more funds translate into more trades, and trading fees can add up unless you use a no-commission broker.

XGRO vs. VGRO

Vanguard’s Growth ETF Portfolio (VGRO.TO) is similar to XGRO’s equity: bond allocation and investment objectives.

As of January 31, 2023, it had an 80.82% stock vs. 19.14% bond allocation. Cash and cash equivalents made up the remaining 0.04%.

Its underlying ETF funds at the time were:

| VGRO Fund Holdings | Allocation |

| Vanguard US Total Market Index ETF | 34.69% |

| Vanguard FTSE Canada All Cap Index ETF | 24.11% |

| Vanguard FTSE Developed All Cap ex North America Index ETF | 16.22% |

| Vanguard Canadian Aggregate Bond Index ETF | 11.34% |

| Vanguard FTSE Emerging Market Cap Index ETF | 5.83% |

| Vanguard Global ex-US Aggregate Bond Index ETF CAD-hedged | 3.96% |

| Vanguard US Aggregate Bond Index ETF CAD-hedged | 3.85% |

While VGRO holds fixed income (bonds) from emerging markets, Europe, North America, the Middle East, and the Pacific, XGRO bond holdings are limited to the Canadian and U.S. markets.

XGRO has an MER of 0.20%, while the MER for VGRO is 0.24%.

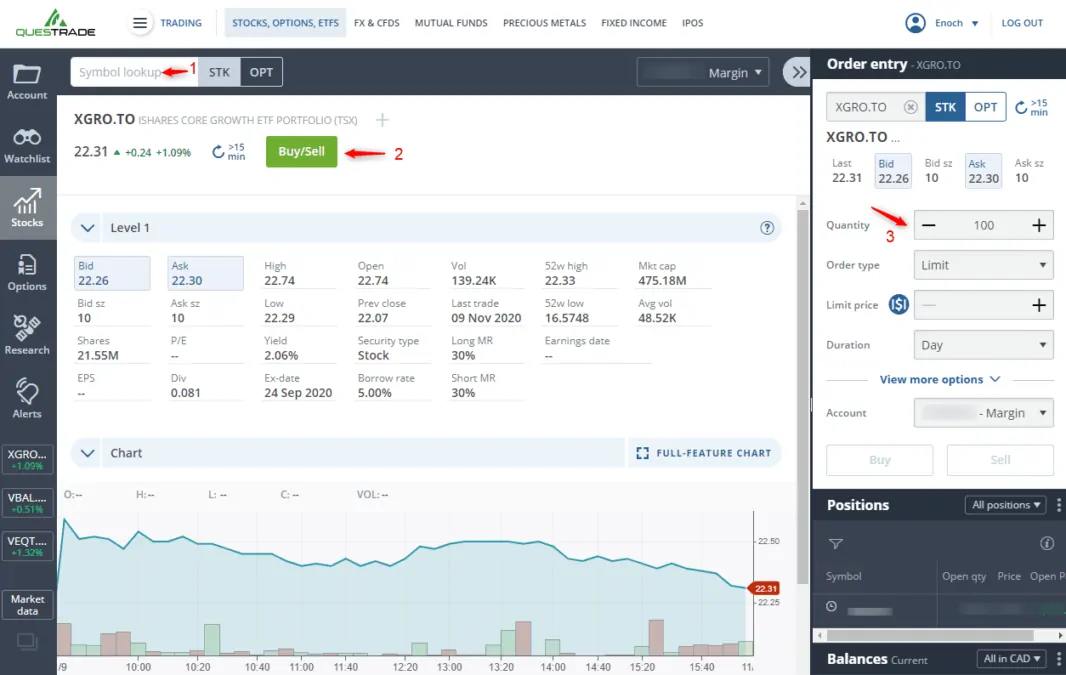

How to Purchase XGRO on Questrade

Questrade does not have a trading fee for ETF purchases; however, trading fees apply when you sell (at $4.95-$9.95/trade).

In addition to ETFs, you can also use Questrade to buy and sell stocks, options, FX, bonds, mutual funds, and more.

To purchase XGRO, open a Questrade account and get $50 in free trades when you fund your account with at least $1,000 and place at least 10 trades. You can also use the SAVVY50 promo code.

1 – Sign in to your account and enter XGRO in the “symbol lookup” box.

2 – Click on the Buy/Sell button. This populates the order entry box with the Last, Bid, and Ask prices.

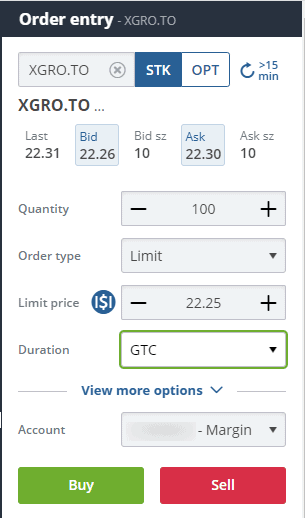

3 – In this box, you can choose the number of units you want to purchase, order type (limit, market, stop), and how long you want the order to stay open (i.e. duration).

In the example above, I am placing an order to purchase 100 units of XGRO at $22.25 using a limit order. I also want the order to stay open until it is either filled at this price or until I cancel it (Good Till Cancelled – GTC).

Learn more about Questrade in the review.

How To Buy XGRO ETF on Wealthsimple Trade

To purchase XGRO on Wealthsimple Trade and pay no trading fees, sign up here.

Sign in to your account and search for “XGRO.”

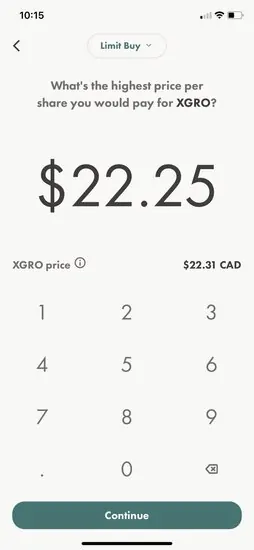

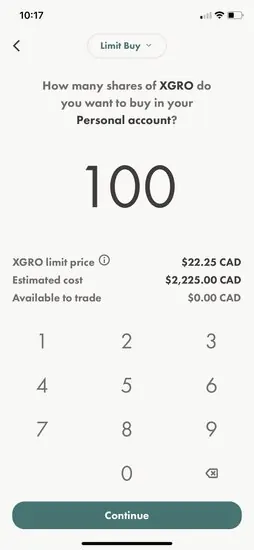

Click on “Buy” and select either a market buy, limit buy, or stop-limit buy from the drop-down at the top.

If you want to control how much you pay for each ETF unit, choose “limit buy” and enter your preferred price, e.g. $22.25, followed by the number of units.

Otherwise, if you want to buy at the current price, choose “market buy” and enter the number of units you want to purchase.

Place your trades. In the example below, I’m placing a limit buy for 100 units of XGRO at $22.25 for a total of $2,225.

Find out more in this Wealthsimple Trade review.

XGRO ETF review

-

Ease of use

-

Availability

-

Fees

Overall

Summary

XGRO is iShares’ All-in-one Growth ETF Portfolio. This XGRO review covers its features, fees, pros and cons, and how it compares to VGRO.

Pros

- One solution fund

- No need for rebalancing

- Low cost compared to mutual funds

Cons

- Trading fees can add up

Thanks Enoch. This was helpful

@Bee: You are welcome – glad to hear you found it useful.

Thanks for this well written piece Enoch. Very helpful!

@Ray: Happy to hear you found it useful! Cheers.