All-in-one ETF portfolios such as Vanguard Balanced ETF Portfolio (VBAL) have made self-directed investing easier than ever.

Also referred to as ‘single-ticket’ or ‘one-ticket’ solution funds, these asset allocation ETFs offer investors simplicity and hassle-free portfolio management at a low cost.

VBAL holds stocks and fixed-income assets at a 60:40 allocation, so you simultaneously enjoy long-term growth and income.

While the fund would probably suffer less volatility than its counterparts with a heavier equity weighting (i.e. VGRO and VEQT), it is not as conservative as VCIP and VCNS.

This VBAL review details its holdings, management expense ratio, pros and cons, how to purchase VBAL in Canada, and how it compares to XBAL.

VBAL Explained

VBAL is Vanguard’s balanced ETF portfolio and one of five all-in-one portfolios offered by the company. The others are:

- Vanguard Conservative ETF Portfolio (VCIP): 80% fixed income and 20% stocks

- Vanguard Conservative ETF Portfolio (VCNS): 60% fixed income and 40% stocks

- Vanguard Growth ETF Portfolio (VGRO): 80% stocks and 20% fixed income

- Vanguard All-Equity ETF Portfolio (VEQT): 100% stocks

VBAL has a target allocation of 60% stocks and 40% fixed-income securities. This portfolio is designed for investors who are seeking long-term capital growth as well as some income.

The ETF is traded on the Toronto Stock Exchange under the ticker symbol “VBAL.” It was launched on January 25, 2018, and has a risk rating of ‘low to medium.’

Key fund facts for VBAL.TO as of June 2023 are:

- Net assets: $2.6 billion

- Eligible accounts: RRSP, RRIF, RESP, TFSA, and non-registered accounts

- Management fee: 0.22%

- MER: 0.24%

- Listing currency: CAD

- 12-month trailing yield: 2.26%

- Distribution yield: 2.06%

- Return on Equity: 14.2%

- Price/Earnings Ratio: 15.5x

- Price/Book Ratio: 2.1x

- Earnings Growth Rate: 13.6%

VBAL Asset Allocation

This fund balances your exposure to the bond and stock markets and may suit investors with average risk tolerance.

VBAL holdings comprised 60.52% stocks, 39.41% bonds, and 0.07% short-term reserves (cash equivalents).

The funds constituting the portfolio are other Vanguard ETFs, including:

| VBAL underlying funds | Allocation |

| Vanguard US Total Market Index ETF | 26.39% |

| Vanguard Canadian Aggregate Bond Index ETF | 23.04% |

| Vanguard FTSE Canada All Cap Index ETF | 17.78% |

| Vanguard FTSE Developed All Cap ex North America Index ETF | 12.08% |

| Vanguard Global ex-US Aggregate Bond Index ETF CAD-hedged | 8.41% |

| Vanguard US Aggregate Bond Index ETF CAD-hedged | 7.96% |

| Vanguard FTSE Emerging Markets All Cap Index ETF | 4.27% |

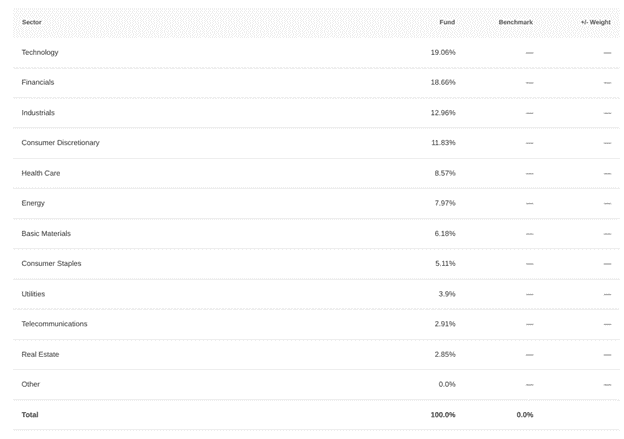

For the equities allocation, financials, technology, industrials, consumer services, and healthcare stocks make up most of the equities exposure.

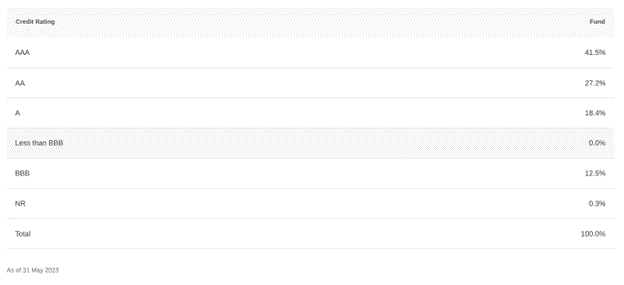

The bond components are mostly AAA, AA, and A-rated funds, with BBB and lower-tier bonds making up a smaller percentage of fixed-income assets.

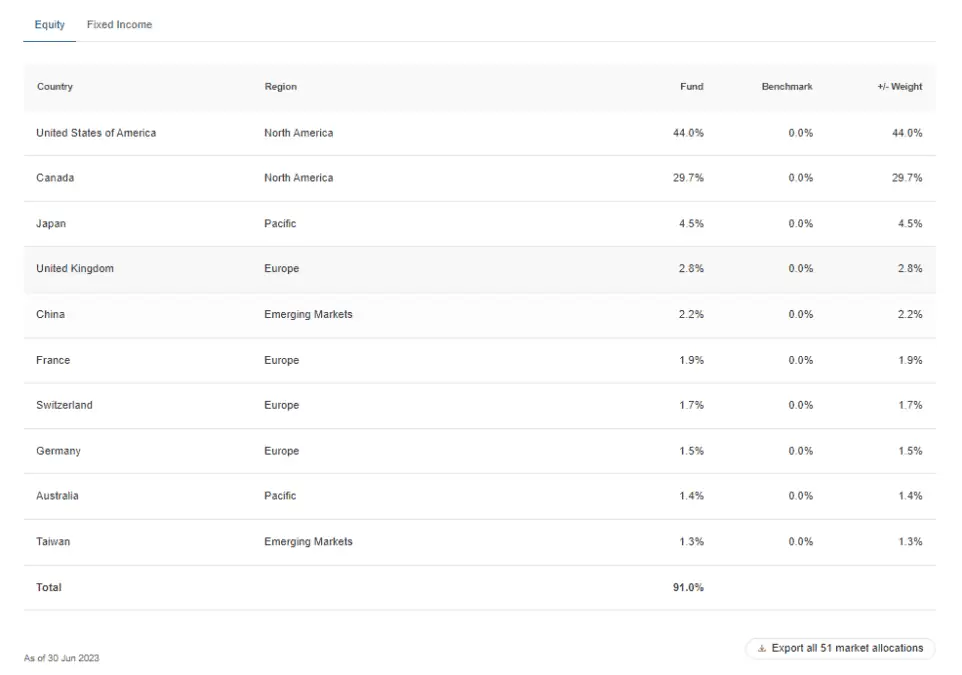

As expected for an asset allocation ETF portfolio, VBAL offers investors risk management through global diversification.

The top 10 market allocations for stocks held by the fund are:

A total of 13,630 stocks from 51 countries are held by VBAL.

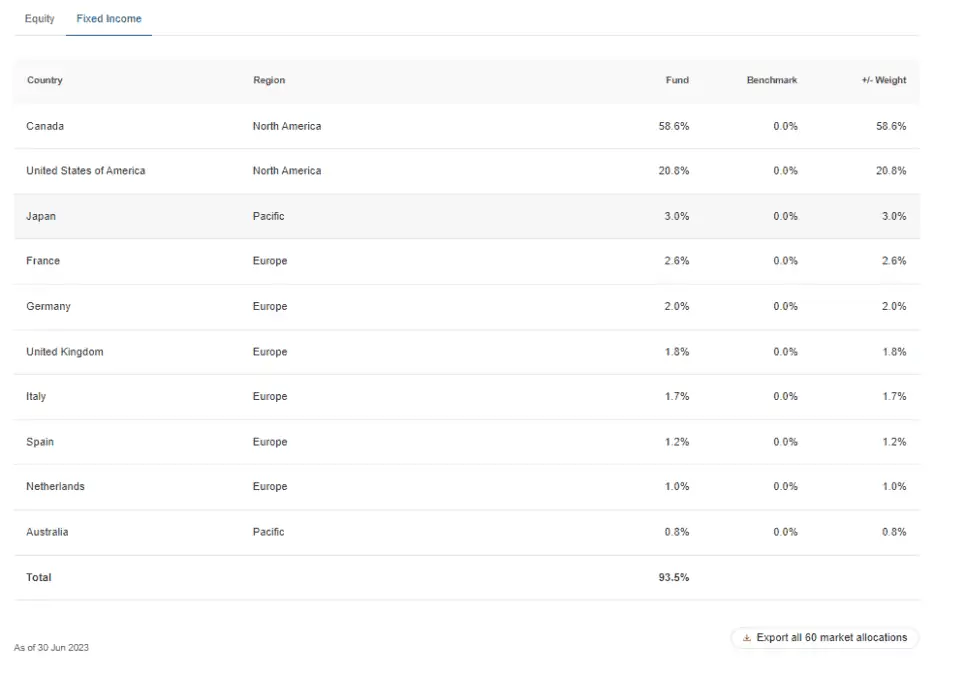

The top 10 market allocations for fixed-income assets held by the fund are:

A total of 18,714 fixed-income assets from 60 different markets are held by the fund.

Related: Best Money Management Apps in Canada

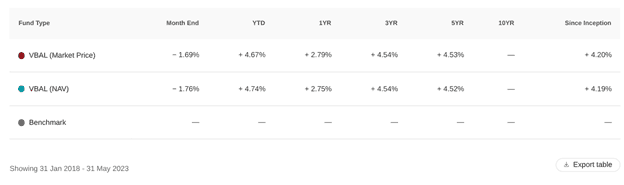

VBAL Returns

Generally, when looking at whether a fund is a good investment, you want to look at its returns.

After a rough 2022, this year has been better for investors. As of June 2023, VBAL had returned +2.79% in the last 12 months (1 year).

It should be noted that historical returns do not guarantee future performance.

In addition to its returns history, you should also consider your risk tolerance, investment objectives, and time horizon when choosing a fund for your portfolio.

VBAL has only been around since 2018. You can also dig further into its historical performance by analyzing how its constituent funds have performed over time.

VBAL Fees

VBAL has a 0.22% management fee and a total Management Expense Ratio (MER) of 0.24%. This is similar to the fees you pay for VGRO.TO and VEQT.TO. This means that for every $10,000 invested in VBAL, you will only pay $22.00 in annual fees.

Compared to purchasing a mutual fund from your bank, you could save a lot in management fees by choosing an appropriate one-ticket ETF portfolio.

We are talking about 0.24% for VBAL vs. 2% or more for a traditional mutual fund.

Compared to a robo-advisor, you also save some money. For example, Wealthsimple Invest would cost you 0.60% to 0.70% annually after including the inbuilt ETF MER.

That said, robo-advisors offer other perks, including free financial advice. Also, you won’t have to worry about your trading frequency and associated brokerage commissions.

You can purchase VBAL and other all-in-one ETFs directly using a self-directed discount brokerage, such as Wealthsimple Trade and Questrade.

Wealthsimple Trade offers a no-commission platform for trading ETFs and stocks. When you purchase or sell VBAL, you don’t pay trading fees.

Questrade does not charge a fee to purchase ETFs. A $4.95 to $9.95 per trade commission applies when you sell.

Related: How To Purchase ETFs for Free in Canada

Pros of VBAL ETF

Here are some of the benefits of investing in VBAL:

- Hassle-free portfolio management that eliminates the need for frequent rebalancing.

- Lower management fees compared to expensive mutual funds.

- A balanced portfolio that is not too risky or aggressive.

Cons of VBAL ETF

Here are some of the downsides of investing in VBAL:

- Trading fees can add up if your broker charges brokerage commissions. The effect of trading fees is more pronounced if you invest small amounts regularly. In this case, you may want to consider middle-of-the-road index fund portfolios.

- If you need to update the risk characteristics of your portfolio (e.g. change from balanced to conservative), you may need to sell your entire VBAL holdings to purchase new assets. This could have tax implications.

VBAL vs. XBAL

Blackrock’s iShares Core Balanced ETF Portfolio (XBAL) is similar to VBAL in that it also seeks to provide long-term capital growth and income.

XBAL has a target allocation of 60% equities to 40% bonds and a low-to-medium risk rating.

The fund has been around for longer than VBAL and is the updated version of an older fund, the iShares Balanced Income CorePortfolio Index ETF (CBD).

XBAL has a 0.18% management fee and total fees (MER) of 0.20%. Like VBAL, you can purchase XBAL on Wealthsimple Trade, Questrade, and other Canadian brokerage platforms.

How To Buy VBAL in Canada

Brokerage platforms like Wealthsimple Trade (aka Canadian ShareOwner), Questrade, Qtrade, BMO InvestorLine, ScotiaiTrade, and several others offer access to buy and sell Vanguard ETFs.

You can also purchase VBAL through a financial advisor.

Self-directed investors can save money on management fees by purchasing VBAL directly using an online brokerage account.

1. Buy VBAL on Wealthsimple Trade

Wealthsimple Trade is a commission-free platform for buying and selling stocks and ETFs.

After opening an account, search for “VBAL” and place a market, limit, or stop-limit buy order. There are no trading commissions for buying and selling VBAL on the platform.

As a reader of Savvy New Canadians, you get a $25 cash bonus when you sign up for an account and deposit at least $150.

Wealthsimple Trade

Trade stocks, ETFs, and options

Excellent trading platform for beginners

Deposit $150+ to get a $25 cash bonus

Transfer fees waived up to $150

2. Buy VBAL on Questrade

You can use Questrade to buy and sell stocks, ETFs, mutual funds, options, and more. They do not charge a fee for ETF purchases; however, you pay $4.95 to $9.95 per trade when you sell ETFs.

To start, open a self-directed account and search for “VBAL” or the ticker symbol of any ETF you want to purchase.

You can place market orders, limit orders, and many other order types on the platform.

Our readers get $50 in free trades when they sign up here and deposit at least $1,000.

Questrade

Trade stocks, ETFs, options, FX, bonds, CFDs, mutual funds, etc.

Get $50 trade credit with $1,000 funding

Low and competitive trading fees

No quarterly inactivity fees

Access to advanced tools and trading data

Top platform for advanced traders

Transfer fees waived

Is VBAL a Good Investment?

As per Vanguard, VBAL is for people who “…are looking for long-term capital growth and a moderate level of income” and can “handle the ups and downs of the stock market.”

In short, you should invest with a long-term mindset and be willing to see your portfolio fluctuate up and down. Volatility is expected for any portfolio that has a heavy weighting in stocks.

That said, VBAL is not as aggressive as VEQT or VGRO and may suffer less volatility during market corrections.

VBAL can be a good investment if it matches your risk tolerance, time horizon, and return expectations.

Related: The Best Investment Accounts in Canada

VANGUARD BALANCED ETF PORTFOLIO

-

Ease of use

-

Availability

-

Fees

Overall

Summary

The Vanguard Balanced ETF Portfolio VBAL is one of five all-in-one funds offered by Vanguard. Learn about VBAL ETF returns, fees, and how to buy it in Canada.

Pros

- Automatic rebalancing eliminates the hassle of self-directed investing.

- Lower management fees compared to mutual funds.

- Tax-efficient in registered investment accounts.

Cons

- Broker commissions can add up if you don’t use a commission-free trading platform.