A virtual credit card makes it easy to pay for online purchases without exposing your credit card account to hackers and data breaches.

Virtual credit cards work just like your regular credit card. They are actually one and the same, with the exception that your virtual credit card offers an extra layer of protection.

This guide covers the best virtual credit cards in Canada, how they work, their pros, cons, fees, promotions, load limits, and top features.

Best Virtual Credit Cards in Canada

1. KOHO Prepaid Mastercard

The KOHO Mastercard Prepaid Card offers a free* virtual Mastercard to make payments online or add to your digital wallet.

This card is unique because users earn 1% cash back on gas, restaurant and grocery purchases and up to 5% cash back at select merchants. With your account, you also benefit from the following:

- Earn 5.00% interest on your entire balance

- Unlimited Interac e-Transfers to anyone with a Canadian bank account

- Free credit score checks

- 0% APR cash advances available in-app

- Low foreign currency transaction fees (1.5% instead of the standard 2.5%)

- Access to a free budgeting app

- Access to credit building (optional add-on)

Perhaps, more importantly, you can get a KOHO Essential account for free ($0* monthly) by setting up a recurring direct deposit or loading funds. You can upgrade to a KOHO Premium account and enjoy extra perks (more on this below).

Transaction limits: $4,000 maximum amount per transaction; $600 daily ATM limit; $20,000 maximum monthly load amount.

Promotion: Get a $20 welcome bonus when you use the CASHBACK referral code during signup and complete your first purchase with the card.

KOHO Prepaid Mastercard

$20 welcome bonus after first purchase (use CASHBACK promo code during sign-up)

$0 monthly fee*

Earn up to 5% unlimited cash back

Get 5% savings interest on your balance

Unlimited Interac e-Transfers and debit transactions

Free budgeting app and access to credit building

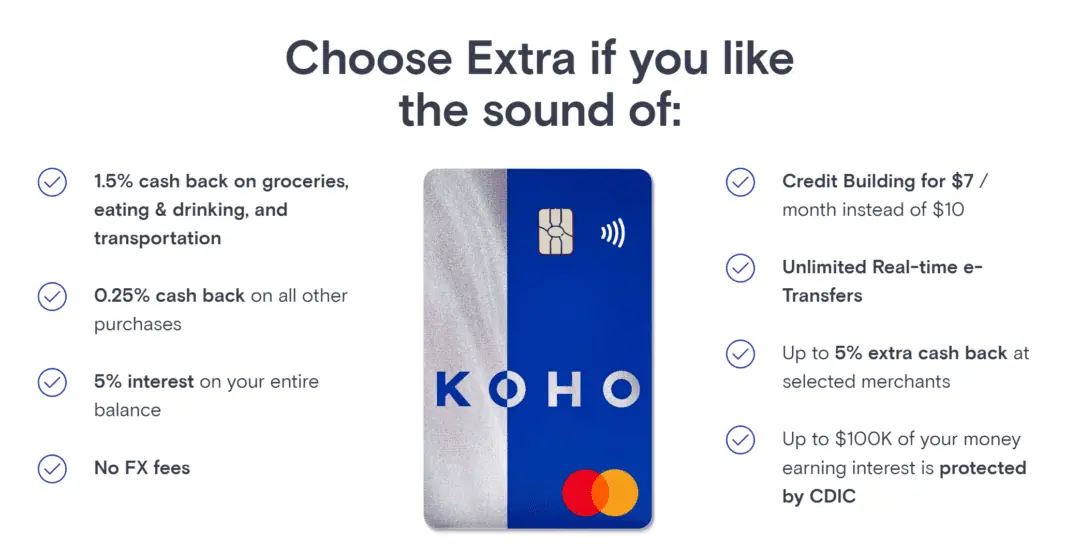

2. KOHO Extra Prepaid Mastercard

The KOHO Extra Prepaid Mastercard is a step up from the regular KOHO card. In addition to the benefits the standard card offers, premium users also get the following:

- 1.5% cash back on groceries, transportation, and restaurant orders (up to 5% cash back at partners)

- No FX fees (the 2.5% fee is completely waived)

- Earn 5% interest on your balance

- Price matching feature, so you pay the lowest prices on all purchases

- Access to free financial coaching

- Access to the credit building service for a lower fee

- One free international ATM withdrawal each month

- A premium physical Mastercard prepaid card

- Real time etransfers

The virtual KOHO Premium Mastercard can be used for quick online purchases, and you can also add it to your digital wallet.

Fees: This card has a $9 monthly fee, or you can pay $84 per year and save on the monthly fee.

Transaction limits: $4,000 maximum per transaction, $800 maximum daily ATM limit, $60,000 maximum monthly load amount, and $5,000 per Interac e-Transfer.

KOHO Extra Prepaid Mastercard

$20 sign up bonus after first purchase (use CASHBACK promo code during sign-up)

Earn 5% cash back

5% savings interest on balance

Unlimited transactions, no FX fees

Free financial coaching

$9 monthly fee

3. Neo Money Prepaid Mastercard

The Neo Money card is one of the top prepaid credit cards in Canada. When you sign up, you get a virtual and physical card for payments online and in-store.

This card pays users an average of 5% cash back at thousands of Neo partners in Canada. Its top features include:

- Average of 5% unlimited cash back at participating stores

- Up to 15% cash back on your first purchases

- 1% cash back on groceries and gas

- Unlimited transactions and bill payments

- No monthly fee for a regular card

- 2.25% interest on your account balance

- Access to a spending account with unlimited Interac e-Transfers

- Access to a high interest savings account with competitive rates

Fees: No monthly or annual fees (you can upgrade to a Premium account for $4.99 monthly to access credit score monitoring, group life insurance, purchase protection, extended warranty, and priority support).

Transaction limits: $200,000 maximum balance, $25,000 max bill pay (per payment), $10,000 daily maximum Interac e-Transfer ($3,000 per transaction).

Promotion: Get a $20 welcome bonus via our exclusive link when you open an account, fund it, and complete your first purchase.

Neo Money Account

Unlimited 5% average cash back

No monthly fees + $20 bonus

2.25% non-promo interest rate paid on balance

Unlimited free transactions

Get a Mastercard for payments online and ATMs

Access to a no-annual-fee credit card

4. Wealthsimple Cash Card

The Wealthsimple Cash Card is a free prepaid Visa card that offers 1% cash back on all purchases.

This card works alongside the Wealthsimple Cash App, a free app you can use to send money transfers instantly in Canada.

Cash back earned using the Cash Card is added to your balance or you can choose to invest it in stocks or cryptocurrencies via your Wealthsimple Trade/Crypto account.

You can add the virtual card to your Apple Wallet or freeze it using the Cash App.

Fees: There is no monthly or annual fee.

Transaction limit: $10,000 maximum daily spending limit; maximum of $500 per ATM withdrawal and $1,000 per day.

Wealthsimple Cash Card

Prepaid Mastercard

1% cash back on purchases

Free money transfer app

Access to virtual and physical card

5. Wise Virtual Card

Wise is a top global money transfer company. When you apply for the Wise debit card, you also get access to a virtual card you can use to make payments online and in-store.

The Wise virtual card is one-of-a-kind because it gives you access to:

- 50+ currencies through your multi-currency account. This way, you can make payments directly in the local currency and avoid FX conversions altogether.

- Up to 3 virtual cards at any one time

- Easy integration with Apply Pay and Google Pay

- Instant generation of new cards and payment details

- One-click to freeze your account if required

The Wise virtual card is free if you already have a personal or business Wise account.

Fees: No monthly or annual account fee.

Transaction limits: $2,650 daily ATM withdrawal limit ($7,000 monthly); $17,500 daily limit for online payments ($55,000 monthly). Your limit may vary, so check your online account to confirm.

While your Wise virtual card is tied to your Wise debit card and account, it offers many standard credit card protections and is licensed by Visa.

Learn more about Wise in this review.

Additional: RBC Virtual Visa Debit

You can apply for the RBC Virtual Visa Debit Card if you already have a chequing account with the bank.

Simply enter the virtual Visa debit number, expiry date, and security code when making an online purchase and choose “Visa” or “Visa Debit” as your payment option.

Overview of Virtual Credit Cards

Virtual credit cards give you a unique credit card number that is automatically generated while keeping the 16-digit number on your physical credit card safe.

This decreases the chance that your personal information is leaked and limits your exposure to credit card fraud and identity theft.

You can use your virtual credit cards to easily make payments when shopping online.

Simply enter the 16-digit number on the card (as shown on your phone), the expiry date, and the security code if required, and your payment will be processed as usual.

How Virtual Credit Cards Work

As already noted, virtual credit cards can be used to make payments online instead of using your main credit card.

Some card issuers also allow you to set spending limits, set expiration dates, generate multiple virtual credit card numbers, and even freeze your virtual credit card with a single click.

When you want to shop online, simply log into your credit card account and use the payment details of your virtual credit card.

It’s like making a payment with your actual credit card but using different numbers.

The payment processor or merchant does not get the financial details of your main credit card account, and you can avoid fraudulent access.

Benefits of a Virtual Credit Card

Virtual credit cards offer several advantages, including:

Security: You can make payments from your credit card account without divulging too much information. Virtual credit card numbers can easily be generated each time you need one, and if a virtual credit card number is compromised, they won’t be able to drain your account (simply lock or freeze the card).

Easy online shopping: Tired of searching for your wallet each time you need to make a payment online? Virtual credit cards make it super easy to shop online as they are easily accessible on your phone.

Budgeting: Some virtual credit cards support spending limits. When you have reached the limit you set, you can no longer access cash through the card. This can help you budget and prevent overspending.

Free: Virtual credit cards are typically free, i.e. they don’t come with a separate annual fee.

Fast payments in-store: Paying with your digital wallet (i.e. Apple Pay, Google Pay, etc.) in-store has become a lot popular. When you link your credit card to these digital wallets, they generate virtual card numbers and protect your physical credit card information.

Instant use credit cards: If you have just applied for a credit card, you no longer need to wait for days or weeks before you can use it. A virtual credit card is immediately available, and you can start making payments while awaiting the physical card.

Regular credit benefits: Virtual credit cards offer many of the same benefits you get by using your physical credit card. If it’s a cash back credit card, you continue to earn cash back when you use the virtual card.

The same applies to the zero-liability benefit Visa and Mastercard provide when your credit card is used fraudulently for unauthorized transactions.

Lastly, transactions on your virtual credit card are reported to the credit bureaus as usual, and responsible use can help improve your credit score.

Downsides of Virtual Credit Cards

Virtual credit cards do have a few downsides, including:

- If you are shopping in-store and they don’t accept digital wallet payments, you will need your physical credit card.

- Returning an item you purchased online using your virtual credit card to a physical store and getting a refund may present some challenges. The retailer may ask you to provide the credit card number you used to make the purchase earlier. If this is no longer available, you may have to settle for store credit instead.

- If you have used a single-use virtual credit card number for a subscription, you will need to renew your subscription manually every time it expires.

- Virtual credit cards can still be susceptible to fraudulent activity if a hacker gains access to the numbers while it is still active. That said, you can simply cancel the virtual card, make a claim for the unauthorized charges, and there’s no need to cancel your main credit card.

How To Get a Virtual Credit Card in Canada

In order to get a virtual credit card in Canada, you can:

Apply for a credit card: Credit card issuers and banks like TD, CIBC, RBC, BMO, Scotiabank, etc., all offer credit cards you can apply for. Log into your credit account to see if they offer a virtual card you can use.

For example, RBC business clients can create single- and multi-use virtual credit cards to pay suppliers and employees.

Apply for a prepaid credit card: Many of the best virtual credit cards on this list are actually reloadable prepaid cards. They are free to use, and you can get approved even if you have a bad credit score. The top virtual credit card is the KOHO Prepaid Mastercard.

Get a debit card: Many bank draft cards now offer a virtual card option you can use when shopping online. A good example is the RBC Virtual Visa Debit Card.

Use a digital wallet: Even if your credit card provider does not offer a free virtual credit card, you can create virtual credit card numbers by adding your credit card to a digital wallet like Apple Pay or Samsung Pay.

Virtual Credit Cards Vs. Digital Wallets

Digital wallets like Apple Pay, Google Pay, Visa Checkout, and Samsung Pay allow you to save your credit and debit card details to make payments without needing your physical cards.

Like virtual credit cards, a digital wallet can help in protecting your financial information.

For example, let’s say you have an iPhone and have set up Apple Pay with your credit cards.

When shopping at online stores or making point-of-sale payments at a physical store that accepts Apple Pay, you can simply scan your phone to pay and be on your way.

For each payment, your digital wallet creates a unique 16-digit number or single-use token and it does not reveal your actual card numbers.

Digital wallets are also often referred to as mobile wallets, and they can store the information for multiple credit and debit cards.

In fact, you can also add your virtual credit card to a digital wallet.

Virtual Credit Cards in Canada FAQs

Are virtual credit cards safe?

Virtual credit cards offer protections similar to what you enjoy when you use a regular credit card. This includes the zero-liability protection that is standard with Visa and Mastercard credit cards.

A virtual credit card adds an extra layer of protection by keeping your personal information secure.

Which banks have virtual credit cards in Canada?

Virtual cards are not yet very popular in Canada. The Royal Bank of Canada offers a virtual debit card, and you can obtain a virtual prepaid card from KOHO.

Since most credit cards can be added to your digital wallet (Google or Apple Pay), you can easily link your current credit card and enjoy the security (via tokenization) that digital wallets offer.

Related: