If you send money abroad often or even once in a while, then you know about the expensive bank money transfer fees and the highly skewed exchange rates that often include hidden fees.

Fintech company Wise, formerly TransferWise, presents an inexpensive option when moving money across countries. Through Wise money transfer, you have an alternative that’s 6 times cheaper than your bank due to the mid-market exchange rate that Wise uses and a small upfront charge.

In this Wise review, I cover how the money transfer service works, its fees, pros and cons, and how it compares to its competition, including PayPal (Xoom), Western Union, MoneyGram, Revolut, WorldRemit, Remitly, and others.

Wise Canada Summary

Wise Canada (formerly TransferWise) Money Transfer

-

Ease of Use

-

Fees

-

Support

-

Overall Value

Overall

Summary

The Wise money transfer is a cheap alternative to fund transfer services like Western Union, MoneyGram, Remitly and WorldRemit. It allows you to transfer funds at mid-market exchange rates to nearly anywhere in the world for a low fee. The Wise service aims to make transferring funds cheap for the people, so it charges the real exchange rate rather than marking it up and slapping hidden charges, the way banks do. With sending fees starting from 0.43% and a strategy that keeps currencies local, Wise remains one of the cheapest ways to transfer funds since its launch in 2011.

Pros

- Mid-market exchange rate

- Convenient and cheap transfer rates

- Transparent fees

- No monthly fees

- No hidden fees

- Prices are upfront

- Pay only for what you use

- Low sending and converting fees

- Excellent customer support

Cons

- Limits on transfer amounts

- Delayed transfers

- Limited weekend support

- Deactivates accounts without warning

- No cash pickup option

How Wise (TransferWise) Works

Wise helps you to send and receive money internationally (to over 70 countries) at a low cost.

Typically, when you send money abroad through banks, they will mark up the interbank rate (or mid-market rate) and charge additional hidden fees, thus, increasing the total cost.

If you use Wise, you’ll be charged the mid-market rate when exchanging currencies, plus a small upfront fee. You can confirm the mid-market rate online using Google, Yahoo, or Xe.com.

The mid-market rate is as close to a competitive rate as you can get at any given time and is what the banks use when conducting transactions with each other.

The bottom line is that with the transparent fee charged by Wise and the real exchange rate conversion (which can also be guaranteed for some time), you’re able to get significant savings.

Wise can afford to make things cheaper because of its innovative approach to keeping currencies local, so they do not have to cross the border.

To use Wise, follow these steps:

- Create an account and initiate your transfer.

- Enter your basic details and the information about your recipient and their banking details. Recipients do not need to have a Wise account and can be a business or charity.

- Verify your identity by uploading the required ID and proof of address. This process can take up to 2 days, so complete this step before sending funds.

- Fund your transfer using various methods, including bank transfer, debit card, credit card, online bill transfer, SWIFT, wire transfer, SOFORT (Europe), etc.

When sending money from Canada, it takes 1-3 working days for your funds to reach Wise, depending on your payment method. Some transfer limits to be aware of are:

- Direct debit: Up to 9,500 CAD per day and 30,000 CAD weekly

- Debit or credit card: Up to 3,000 CAD per transfer

- Online bill payment and wire transfer: Up to 1.5 million CAD

- Interac e-Transfer: Up to 25,000 CAD (your bank may have a lower limit than this)

Banks that support automatic debit from your account to Wise in Canada include:

Get a Wise Account (send your first $800 free).

Wise (TransferWise) Fees

The fees you pay when sending money through Wise is dependent on the following:

The amount you are sending: A percentage is charged on the amount, and it varies from currency to currency (usually 1% or less).

How you pay for your transfer: Direct debits cost less than when you pay with a credit card. The means of payment may limit the maximum amount you can send per transaction.

Exchange rate: The rate you receive is the mid-market rate with no markup or hidden fees (same as the rate you see on Google). Depending on the currency, the rate may also be guaranteed for up to 48 hours.

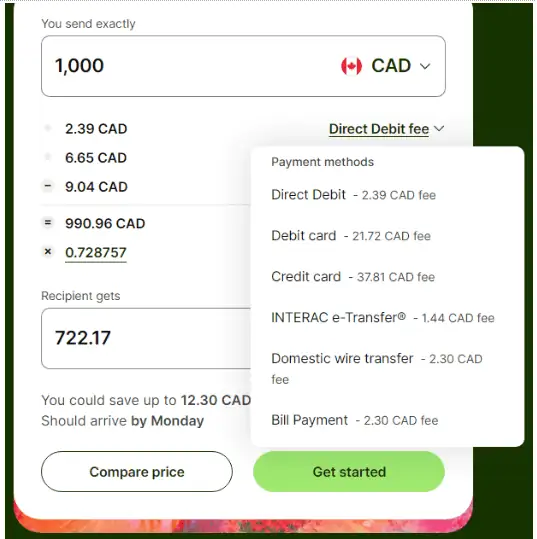

As an example of fees: supposing I want to send $1,000 CAD to a friend in Australia (the recipient’s currency is AUD), the following fees apply using a direct debit (the cheapest option for CAD transfers).

Wise Fees for Sending and Converting (Canada)

- Sending money – From 0.43% (Fee varies by currency)

- Converting money – From 0.43% (Fee varies by currency)

If sending 1,000 CAD to someone in the US, you can choose from among the following payment options and their corresponding fees:

For the complete list of fees, go to the Wise Pricing page.

Currencies you can send and receive through Wise

| AUD — Australian dollar | GBP — British pound | NZD — New Zealand dollar |

| BGN — Bulgarian lev | HKD — Hong Kong dollar | PLN — Polish złoty |

| BRL — Brazilian real | HUF — Hungarian forint | RON — Romanian leu |

| CAD — Canadian dollar | IDR — Indonesian rupiah | TRY — Turkish lira |

| CHF — Swiss franc | INR — Indian rupee | SEK — Swedish krona |

| CZK — Czech koruna | JPY — Japanese yen | SGD — Singapore dollar |

| DKK — Danish krone | MYR — Malaysian ringgit | USD — US dollar |

| EUR — Euro | NOK — Norwegian krone |

Currencies that you can only send money to (via local transfer)

| AED — Emirati Dirham | GEL — Georgian lari | PKR — Pakistani rupee |

| ARS — Argentine peso | GHS — Ghana Cedi | THB — Thai baht |

| BDT — Bangladeshi taka | ILS — Israeli shekels | UAH — Ukrainian hryvnia |

| BWP — Botswana pula | KES — Kenyan shillings | UGX — Ugandan shilling |

| CLP — Chilean peso | KRW — South Korean won | UYU — Uruguayan pesos |

| CNY — Chinese yuan | LKR — Sri Lankan rupee | VND — Vietnamese dong |

| COP — Colombian peso | MAD — Moroccan dirham | ZAR — South African Rand |

| CRC — Costa Rica Colón | MXN — Mexican peso | ZMW — Zambian kwacha |

| EGP — Egyptian pound | NPR — Nepalese Rupee | |

| FJD — Fijian dollar | PHP — Philippine peso |

How to Contact Wise?

You can reach their support team via email, phone, or in-app chat.

Wise Multi-Currency Account

The Wise Multi-Currency Account is a universal account for sending and receiving money like a local. It holds 40 currencies you can choose from and convert at the real exchange rate in seconds. It is free to sign up and there are no monthly fees.

If you need to get money from other parties in a country where you don’t have a bank account, Wise can provide you your own account for the following currencies: USD, GBP, EUR, AUD, NZD, CAD, HUF, RON, TRY, and SGD.

This account is a great option if you are a freelancer or have a business that does transactions with other businesses located internationally. When you open a Wise multi-currency account, you get the following for free:

- US account number and routing number

- British account number and sort code

- European IBAN

- Australian account number and BSB code

- New Zealand account number

- Canadian account number

- Turkish Lira account and IBAN

- Hungarian forint and account number

- Singapore dollar account

- Romanian Lei account

To open a Wise Multi-Currency Account, register and create an account with Wise, choose between opening a personal or business account, and provide your phone number for the 2-step verification and the country you’re residing in.

The borderless account, multi-currency account and the Wise account are all the same.

What makes it a highly appealing product is that if you have it, there is no need to open a US Dollar bank account in Canada and individual accounts for other currencies. The Wise account gives you access to multiple foreign accounts that function like local bank accounts even though you reside in Canada.

The Wise debit card is now available in the US, Switzerland, Singapore, Australia, New Zealand, Malaysia, the UK, Canada, and most of the Eurozone.

If you have an address in any of these countries, you will now be able to use your Wise card worldwide and spend it in any currency.

Wise Debit Card

Combined with your Wise Multi-Currency Account, use the Wise Card to spend money abroad directly from your account and enjoy mid-market exchange rates.

When making a payment using the card, it draws from the local currency in your Wise account if you have a balance. If not, it auto-converts the currency that is the cheapest.

Below are some of the top features of the Wise Card:

- Make payments (online and in-person) in 160 countries

- Pay directly in 40+ local currencies

- Spend using Apple or Google Pay (easily add your virtual cards, so there’s no need to carry the physical card)

- Get 2 free ATM withdrawals overseas (up to a total of 350 CAD each month)

Wise Card Fees

Getting your Wise debit card requires no fees. Reorders cost $5 each. Business customers get the Wise card free.

Both personal and business account customers get access to 3 virtual cards for free.

You can make a maximum of 2 free ATM withdrawals monthly if the total amount is under $350 CAD per month per account. Extra withdrawals cost $1.50 CAD per transaction.

If you withdraw more than $350 CAD per month, a 1.75% fee is charged on top of the $1.50 CAD withdrawal fee.

Is Wise (formerly TransferWise) Safe and Legit?

Wise is a legitimate company regulated by the relevant authorities in the various countries they operate in. For example:

Canada: They are regulated by Authorite des Marches Financiers (AMF) as a money service business. They are also registered with the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC).

United States: Registered with the Financial Crimes Enforcement Network (FinCEN). Their funds are held in banks insured under the Federal Deposit Insurance Corporation (FDIC).

United Kingdom: Authorized as Electronic Money Institution by the UK Financial Conduct Authority.

Australia: They are regulated by the Australian Securities and Investments Commission with AUSTRAC.

India: Approved by the Revenue Bank of India.

Japan: Regulated by the Kanto Local Financial Bureau and licensed as a Funds Transfer Provider.

Wise has a Trust Score of 4.1/5 on Trustpilot from over 197,000 reviews.

Pros and Cons of Wise

Some of the benefits of using Wise are:

- Convenient and cheap transfers abroad without leaving the comfort of your home

- Transparent upfront fees and a fair, competitive mid-market exchange rate

- No hidden fees

- Versatile mobile app

- Excellent customer support

- A free borderless account with the ability to hold balances in over 40 currencies

- Great for individuals, freelancers, and businesses

Cons: Some of the complaints posted by users online include:

- Account deactivation without prior warning

- Delayed account verification

- Delayed transfers

- Limits on amounts that can be transferred

- Limited support on weekends

- No cash pickup option

Wise Overview

Wise was launched in 2011 as TransferWise by Kristo Kaarmann and Taavet Hinrikus. Based in London, Wise currently services millions of customers who transfer over $9 billion monthly.

It is backed by well-known investors, including Richard Branson, Max Levchin, Peter Thiel, Index Ventures, David Yu, and many others.

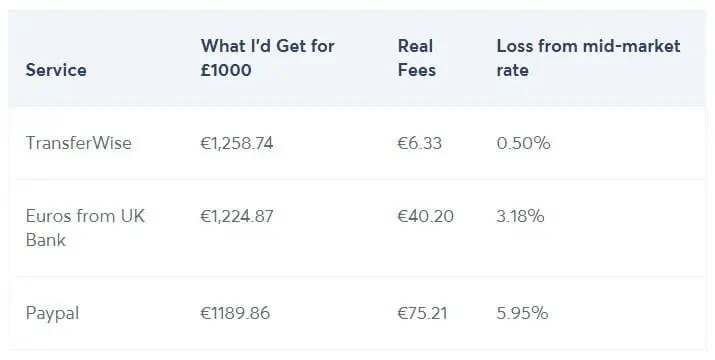

Wise vs. PayPal (Xoom) vs. Revolut vs. World Remit

Wise generally beats PayPal on the fee front because PayPal applies an exchange rate that includes currency conversion fees which can be significant.

The snapshot below from Wise mirrors my personal findings when I compared sending money (CAD to AUD) on both platforms.

Revolut is a UK-based fintech company offering currency exchange and peer-to-peer payments. I have heard some good things about them, and it appears they are launching in Canada soon.

Based on their website, they will offer a service to Canadians that allows you to send money abroad in multiple currencies using the interbank exchange rate and a 0.50% fee (plus a markup on weekends and certain currencies).

It will be interesting to see what their full suite of product offerings will look like when they launch in Canada.

Based on my personal experience with sending money transfers to Nigeria, Wise also generally beats WorldRemit and Remitly when you factor in the mid-market exchange rate they use.

Wise and EQ Bank

EQ Bank has a partnership with Wise to offer cheap international money transfers to EQ Bank customers. If you have an EQ Bank Savings Plus account, you can send funds directly in 46 currencies to recipients in 80+ countries using your online account or mobile app.

One advantage of using EQ Bank is that you earn a competitive savings interest rate on any balance you hold in your account.

You can also open an EQ Bank USD account and link it with Wise from your dashboard to make USD payments abroad.

Conclusion

High bank transfer fees and exchange rate markups can significantly eat into the money you are sending abroad. With a service like Wise, you pay lower fees which are apparent upfront. This means more money in your pocket.

Whether paying bills, sending money to friends and family, or receiving monies for services rendered, a reliable and cheaper money transfer service will make your life easier.

Hallo Enoch,

Thank you for the detail description and comparison with similar services.

What about the comparison with World Remit?

I recommend not using Transferwise in Canada. The company uses a bait and switch technique to get your personal details and then cancel your account based on not reading the fine print. I used Transferwise and clicked on the link provided for a business account and Freelancer bank accounts to accept foreign currencies. They know I’m in Canada because when you click on the Debit card, it says not available in Canada yet. I filled out the application only and submitted with my details. Shortly after Transferwise accused me of violating their terms of Use and cancelled my application and my personal account. When I asked for details the company TOU refers to engaging in a “marketplace” which is what freelancing and businesses do. I asked what that definition was and Transferwise said “that is internal to Transferwise”. After I asked for reconsideration, they said I could appeal using the link provided. That link was unusable after they closed my account.

This was recent in early 2020. Transferwise has some hidden policies and clicking on links provided are not safe if you intend to build your transaction there. This could leave you with balances not retrievable and legal issues at best. I found Transferwise to be intolerant of any appeal process although the people were polite. The fact that you can violate the TOU simply by accepting the offer to apply for an account is very disturbing. It is baiting the consumer to apply and then switching off the account. I give them 9+ for fees but zero for customer service and business acumen.

If I were a shareholder like Branson, I’d pull out while I can. Other startups with friendly approaches will do far better in the long run. Transferwise is worse than my bank for customer service. Shame on Transferwise for continuing to bait Canadians with those links.

@Paul:

The Transferwise debit card is not yet available to residents of Canada even though you can apply for the multi-currency Borderless account.

As of June 2020, the debit card is available to residents of Switzerland, Singapore, most of the US states, most of the EEA, the UK, Australia, and New Zealand. People from these countries can use the card to hold CAD and use it for payments when they are in Canada.

This is probably why your application did not go through.

I have used Transferwise for over 3 years and I have personally had no issues.

Hi Enoch,

Thanks for the informative review on TransferWise from a Canadian perspective.

I am deciding between TransferWise, OFX and WorldFirst to fund my Forex trading account in Oceania. Have you ever used the latter two? Seems all three companies have good reviews online with WorldFirst offering the best dollar to dollar outcome.

However TransferWise and OFX both have offices in Toronto but WorldFirst has no Canadian location which is a negative for me. Your input is appreciated.

@James,

This is the first I’m hearing about WorldFirst. I haven’t personally used OFX, but I have heard about them and based on the little I know, it appears they are competitive, but not as straightforward as TransferWise. Cheers!

Hello Enoch,

I am planning on setting up a transferwise USD account for the purpose of saving funds in USD since my local currency has been on a free fall and continues to lose value. Do you think this is a wise idea?

I am currently based in Nigeria.

Hi Benjamin: If you typically receive payments in USD, your plan could help to preserve the value of your funds in a way… you can make withdrawals when the exchange rates make sense. However, if your plan is to convert Naira into USD in order to hold USD, the eventual roundtrip conversions will likely eat up any gains over time.

Thank you very much for your response, Enoch.

The plan is actually to save it for my foreign trips since i plan to open an account in Canada and the US during my next trip there.

Can I transfer money from my Canadian Bank account and get the cash while I am in Panama? Where do I pick up my money when I am in Panama?

@Michael: I think it would be best to confirm that with TransferWise directly.

Thanks for the detailed review. Is it possible to transfer USD from my USD Savings account in my canadian bank account and pay recipient in CAD in their Canadian bank account. That is USD will be withdrawn from my account and CAD transferred to the recipient

Hi Enoch,

I’m planning to send CAD from a Canadian bank to a USD account in another country (not US). Do you know if it will incur SWIFT fees and intermediary fees with Transferwise?

Currently I am doing Nobert’s Gambit with a trading account for CAD to USD to get market rates. Then, sending to the bank in a USD account, and from there, wire to destination country. This will incur approximately $15 for the exchange(trading fees), $50 for the outgoing wire, $30 for the SWIFT, and whatever the local bank charges for incoming wire.

I’m trying to do cost analysis using $10,000 USD as an example.

Transferwise: $0.95 bill pay + $67 fee + SWIFT? =$68

Gambit+ Bank: $15 trade fee + $50 wire + SWIFT = $65

Using this example,

If transferwise will charge SWIFT, it is cheaper to Gambit+Bank.

If Transferwise is not charging SWIFT it is cheaper to use Transferwise.

Under 10,000USD (smaller amounts), it is better to use Transferwise regardless.

Thanks in advance for your comment.

I talked to chat and they sent a link with this info.

https://wise.com/help/articles/2946451/sending-usd-to-countries-outside-the-us

“How much it costs

Wise supports sending USD to people outside of the US, but to do this we need to send your transfer via the SWIFT network.

Because SWIFT incurs additional costs, we will add a fee of 3.20 USD to your transfer to pay for this. We charge the same fee for payments to Hong Kong through CHATS system.

Your bank or other banks the money passes through on the way may also charge you a fee, so your recipient might get less. These fees tend to be around 25–50 USD, but there’s no way for us to know what they’ll be in advance.”

So in summary, if you are sending USD outside the US, it is probably better to use one of the banks “Global money transfer” services for small amounts. Better to use the Gambit+Bank for large amounts (>$10K).

The same is true if you want to send GBP outside UK, or EUR outside EU.

I hope this helps someone

@YK: Thanks for posting your experience!

Hi Enoch,

You mention in your article that you can transfer your money from a Canadian bank account to transfer wise. My Scotiabank keeps telling me this isn’t possible. Do you know how I can move money from Scotiabank to wise?

Hi Juju,

You can use DIRECT DEBIT option FROM Transferwise to directly debit money from your Scotiabank account. There is a fee for that, but it’s still cheaper than sending a WIRE transfer from Scotiabank to Transferwise. So basically you PULL money

(Not push) Money from Scotiabank after logging into Transferwise using Direct Debit option.

The Wise debit card (Visa) is now available in Canada. I ordered mine this week.

I have had excellent experience with international transfers – to my own account to the US and to other people in the US and Europe. The transfers are usually completed in 2 -3 days and with savings similar to those shown in the article.

I don’t have a Canadian account with one of the banks listed but my credit union has Wise as a bill payment payee (actually still listed as TransferWise but it continues to work). It’s a glitch in their system that they make you choose one of the listed banks to pay for your transfer. I just select one of the banks, which opens that bank website in a separate window to log in, then close that window and indicate on the Wise website that I’ve paid. Then I go to my credit union account and pay the required amount by bill payment. I’ve never had any issues with this approach and bill payment is one of the cheapest options.

Generally I’ve been very pleased with this service. I hope the debit card works as well as the transfers have.

I’m confused, this article mentions Wire transfer as an option for transferring money to Wise.

But the Wise website says that they don’t support domestic wire transfers (https://wise.com/help/articles/2978083/how-do-i-use-my-cad-account-details).

If a domestic wire is sent to [a Wise] account, it will be returned to the originating bank with $25 CAD deducted to cover return processing fees.

“You can reach their support team via email, phone (1-888-445-2780 for Canada)” this number no longer connects