JA Canada, a non-profit Canadian organization dedicated to helping young people succeed in a global economy, has partnered with the FinTech company Neo Financial to create the JA Money card.

This prepaid Neo Mastercard is designed specifically for teens, allowing them to start exploring how to manage money in the real world.

This article covers everything you need to know about the JA Money card, including its main features, benefits, downsides, and eligibility requirements.

Key Takeaways

- The JA Money card’s main features include no annual or transaction fees, the ability to earn cashback rewards, and the ability to easily track cash flow.

- Canadian residents who are at least 13 years old (or 14 years old in Quebec) are eligible to apply for this card.

- The three popular alternatives to the JA Money card include the KOHO Prepaid Mastercard, the Neo Money Card and the Mydoh Smart Cash Card.

The JA Money Card – An Overview

The JA Money card, powered by Neo, is a “debit card alternative” that provides teens with the necessary financial tools to properly manage their money, save more, and be rewarded for their financial habits.

Despite having no annual fee, this Mastercard lets its users enjoy free everyday transactions, up to 5% cashback, free virtual financial tracking tools, and access to Junior Achievement of Canada’s youth-friendly financial knowledge base.

About Neo Financial

Founded in Canada in 2019, Neo Financial is a financial services company that aims to provide Canadians with a smarter and more rewarding financial experience.

With the support of established financial service providers such as EQ Bank, Mastercard, and Concentra, this company has successfully offered a range of financial products, such as savings accounts, credit lines, and even wealth management services, to over 1 million Canadians online.

About Junior Achievement of Canada

As the largest non-profit business education organization in Canada, Junior Achievement of Canada’s main mission is to prepare youth to succeed in the economy by providing programs that boost their financial literacy, entrepreneurship skills, and work readiness.

It partners with volunteers, educators, and other organizations from coast to coast to deliver life-relevant skills to Canada’s youth in person or digitally.

JA Money Card Top Features

Here are the top features that make the JA Money card one of the best prepaid cards for teenagers.

No annual fee or transaction fees

Teens can enjoy all of the JA Money card’s features without paying an annual fee or worrying about transaction fees. However, like many debit and credit cards, this Mastercard charges a standard 2.50% foreign transaction fee.

Cashback rewards tailored to teens

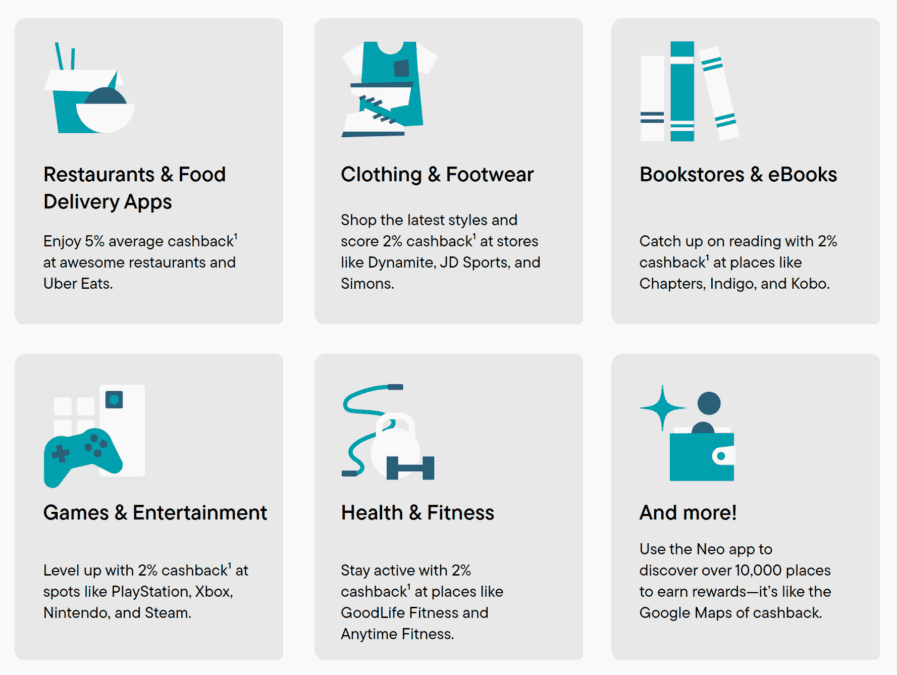

Apart from spending categories that typically generate rewards on most credit cards, the JA Money card also allows teenagers to earn cashback through purchases they’re more likely to make.

The categories of Gaming & Entertainment, Health & Fitness, Clothing & Footwear, and Books, which are often not cashback-eligible purchases, for example, allow teenagers who use the JA Money card to earn up to 2% cashback.

JA Money card users can earn the most rewards when purchasing from restaurants or food delivery apps, earning 5% cashback on average.

In-app financial tracking and updates

Like all of Neo Financial’s products, the JA Money card automatically syncs with the Neo Financial app, allowing users to track their transactions, get real-time insights about their cash flow, and receive notifications about their card’s activity in real-time.

JA Money Card Benefits

These are the most notable benefits of using the JA Money card:

- It has no income requirements

- Cashback rewards are as high as 5%

- No annual, transaction and hidden fees

- Free access to budgeting resources through the JA Knowledge Hub and Neo app

- The Neo Everyday account, which the JA Money card is linked to, earns 2.25% interest on your balance

Downsides of the JA Money Card

Although the JA Money card is an overall excellent Neo Mastercard, it also has some downsides, including the following:

- There may be minimum spend thresholds to qualify for earning cashback, depending on the merchant

- Only those 13 years old (or 14 years old for those in Quebec) are eligible for the card

Eligibility and How to Apply

Canadian residents over the age of 13 years old (or 14 years old in Quebec) are automatically eligible for the JA Money card.

Those who meet the age requirement can go ahead and apply for this Neo Mastercard through Neo Financial’s website as long as they know their Social Insurance Number (SIN).

JA Money Card Alternatives

If you want to know about other prepaid cards that can help you earn cashback and save money, these cards are some of your best options in Canada.

KOHO Prepaid Mastercard

The KOHO Prepaid Mastercard is a renowned prepaid mastercard that offers up to 6% cash back and up to 5% interest on your balance. Its most basic plan, Easy, is free to use, but you can subscribe to a monthly plan to enjoy better rates and pay to join a credit-building program.

Note, though, that only people at least the age of majority in their province or territory are eligible for this card.

Neo Money card

The Neo Money card is Neo’s modern alternative to debit cards. It offers an average of 5% cashback, 2.25% interest on every dollar, and customizable rewards. The Base plan is free, but an optional Premium upgrade costs $4.99 monthly if you want higher rates and exclusive features.

The Neo Money card is only available to Canadian residents who are at the age of majority and live outside of Quebec.

Mydoh Smart Cash Card

Like the JA Money card, the Mydoh Smart Cash Card is tailored to help young people save and spend better. Issued by the Royal Bank of Canada, this prepaid card acts like any debit card but without the complexities of interest, recurring fees, and overdraft charges.

Moreover, the Mydoh Smart Cash Card mobile application allows kids to manage their finances and household tasks and allocate their allowance to their spending or savings categories with ease.

The Mydoh Smart Cash Card cannot be used to withdraw cash from an ATM, but children as young as six can use it to make purchases online or at store terminals (can be under the supervision of parents).

This is Why Your Teen Should Get the JA Money Card

The JA Money card is one of the very few free prepaid cards that are tailored to teens yet still offers high cashback rewards and a very well-rounded in-app money-tracking feature.

As a prepaid card with the functionalities of a debit card and the rewards of a credit card, this Neo Mastercard is one of the best physical cards to introduce to teenagers who are slowly crawling their way into the finances of adulthood.

Not to mention, once teens have established a healthy spending habit using their JA Money card, it’ll be relatively easy to transition to not only traditional bank accounts but also financial products offered by Neo Financial to adults.