The KOHO Mastercard from KOHO Financial is a reloadable prepaid card and app that aims to help Canadians budget, spend, save, earn cash back, rebuild credit, and more.

While KOHO is not a bank but a financial technology company, it is challenging the status quo in the banking industry by offering financial products that do not require users to pay fees at every turn.

With this platform, you can avoid credit card balances, interest payments, monthly fees, overdraft fees, and more. This KOHO review covers how it works, its benefits, downsides, fees, security, and alternatives.

Summary of KOHO Accounts and Plans

| KOHO Plan | Features | Rewards | Cost |

| KOHO Essential | Unlimited e-Transfers; discounted credit building service; comes with virtual and physical cards; 1 free credit score check per month | 1% cash back on transportation, eating out, and groceries | $0* when eligibility conditions met (otherwise $4 per month) |

| KOHO Extra (Premium) | High-interest savings; no foreign transaction fees; 30% off Credit Building; unlimited e-Transfers; comes with a virtual, physical and premium cards; 1 free international ATM withdrawal per month; 1 free credit score check per month | 1.5% cash back on groceries, dining out, and transportation; 0.5% cash back on all other purchases | Free for the first 30 days and then costs $9 per month or $84 when you pay for a full year (savings of $24) |

| KOHO Everything | Unlimited real-time e-Transfers; no FX fees; 50% off Credit Building; comes with a virtual, physical and premium card; 1 free international ATM withdrawal per month; 1 free credit score check per month | 2% cash back on groceries, eating & drinking, and transportation; 0.5% cash back on all other purchases | Free for the first 30 days and then costs $19/mo. or $228 a year |

| KOHO Credit Builder | An average credit score increase of 22 points after 3 months of using Credit Building; Credit Builder requires no interest, no applications and has guaranteed approval; comes with free financial coaching | n/a | Basic cost – $10; $7 per month for Extra plan; $5 per month for Everything plan subscribers |

How KOHO Works

KOHO Prepaid Mastercard

Top prepaid card in Canada

Annual fee: $0* monthly for Essential card.

Rewards: Earn up to 5% unlimited cash back on debit purchases and earn 5% savings interest on your entire balance.

Welcome offer: $20 welcome bonus after your first purchase (use CASHBACK promo code when signing up).

Interest rates: 0%

Minimum income requirement: None

Recommended credit score:

None

On KOHO’s website

KOHO offers a reloadable prepaid Mastercard and a versatile app that integrates with the card and helps you budget effortlessly and save automatically.

Opening an account takes less than 5 minutes. When setting up your account, you get to choose a Mastercard that more or less works like a debit card and allows you to spend while also encouraging savings – aka “a smart spending account.”

To start using your card, the easiest way to deposit funds is by using Interac e-Transfer. You can also set up a direct load to put all or a portion of your paycheque on your KOHO Card.

After loading the card, you are ready to roll! Whether you want to pay for coffee, groceries, or your monthly bills, the KOHO card does it all. You also earn 3.00% to 5.00% interest on your entire balance.

Not only that, but the app also provides easy-to-understand insights into your spending patterns, lets you set savings goals, and helps you reach them.

KOHO used to offer a prepaid Visa; however, it became a Mastercard in 2022. It is also now available in Quebec.

The Benefits of KOHO

1. No Monthly Fees*: Canadians pay an average of $220 in bank fees yearly. KOHO waives the $ monthly fee for the Essential account if you set up a recurring direct deposit, and Interac e-Transfers, bill payments, replacement cards, etc., are free.

2. Up to 5% Cash-Back on Purchases: Your traditional bank rarely rewards you when you use your debit card. This means that unless you are banking with an online-only bank like Tangerine, the concept of earning interest on your chequing, or in KOHO’s case, earning cash-back rewards when spending your “cash,” is surprising.

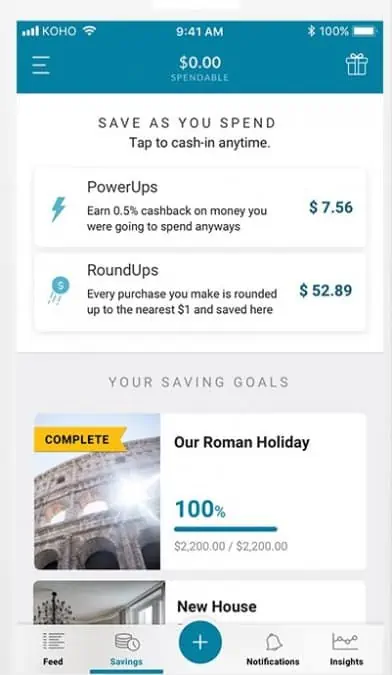

KOHO users earn up to a 5% cash-back bonus (aka PowerUps, with a varying base rate depending on which card you have) every time they spend, meaning you don’t need a credit card to enjoy loyalty rewards.

3. Automated Savings: The KOHO app allows you to set savings goals and helps you reach your goals. For example, say you want to save $1,500 for a vacation that is six months away; the app will show you how much you need to save on a daily, weekly, or monthly basis and debit that amount every day so you can meet your savings target.

In addition, KOHO also supports one of the best saving strategies ever invented – the RoundUp! Like Moka and Wealthsimple, the KOHO app allows you to save some money every time you make a purchase by rounding up your spending to the nearest $1, $2, $5, or $10 and saving the difference.

For example, let’s say you purchase a cup of coffee for $2.25; the app will automatically SAVE $0.75 (rounding up to the nearest $1), or $2.75 (if rounding up to the nearest $5), or $7.75 (if rounding up to the nearest $10).

4. High-Interest Savings Rate: Your entire balance (both savings and spending) earns interest.

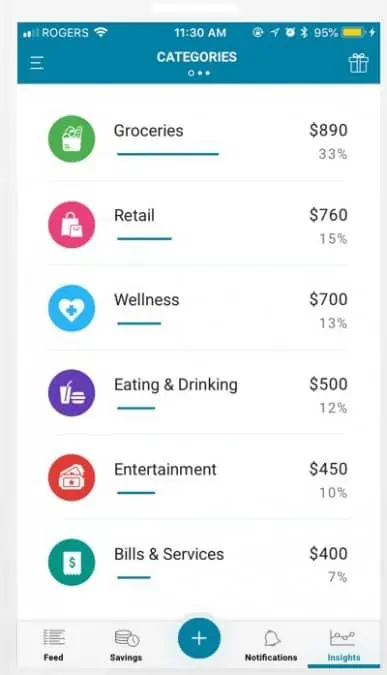

5. Real-Time Insights: Have you ever wondered where all your money goes at the end of the month? KOHO shows your spending categories and how much goes to what. It also shows how your spending compares to other KOHO users.

6. Versatile App: The app makes it easy to accomplish multiple transactions you would normally need your bank for. For example, you can easily set up payroll deposits, transfer money into your investment accounts, automate your bill payments, and more.

The live in-app support chat function is invaluable. You can reach real customer service reps between 9 am and 5:30 pm EST seven days a week.

7. Apple Pay: You can use KOHO with Apple Pay on your iOS device. Simply add KOHO to your Apple wallet, and you no longer need to bring out your physical KOHO card when you are shopping in-store. It also supports Google Pay and Samsung Pay.

8. Referral Program: The company has a generous referral program. Whenever you refer a friend to sign up using your referral link, you both receive a $20 bonus. You can refer up to 50 friends and earn up to $1,000.

Open a KOHO Account + $20 Welcome Bonus (use CASHBACK referral code).

KOHO Subscription Plans

The three KOHO plans are Essential, Extra (previously Premium), and Everything.

KOHO Essential

KOHO Essential is the entry-level account from KOHO, with features including:

- 1% cash back on transportation, gas, eating out, and groceries

- Earn up to 5% cash back at participating retailers

- Earn 5% interest on your balance

- Add the optional credit-building feature for $10 monthly

- KOHO Essential is free for 30 days, then costs $4 per month (fee is waived if you set up a direct deposit).

KOHO Extra (Premium)

KOHO also has a premium service for those who want to access additional benefits, including:

- 1.5% cash back on groceries, dining out, and transportation.

- 0.5% cash back on all other purchases

- Get a higher cash back rate at select merchants (up to 5%)

- Earn 5% interest on your balance

- No foreign currency transaction fees: Similar to the STACK Mastercard, KOHO premium users can now save the 2.5% to 3% FX fee normally charged by their credit card provider.

- Free financial coaching that includes weekly money tips and one-on-one coaching sessions where you can get answers to your pressing personal finance questions.

- Price matching: Get the best deal on your purchases. If there is a better deal elsewhere, KOHO will credit your account with cashback.

- Premium card design.

- Higher limits, meaning that you can now take out $400 at an ATM per transaction for a max of $810 per day. Your account balance can also be up to $50,000.

- KOHO premium is free for the first 30 days and then costs $9 per month or $84 when you pay for a full year (savings of $24).

Check out my KOHO Extra review.

KOHO Everything

KOHO Everything comes with all the bells and whistles and has the following features:

- 2% cash back on groceries, eating & drinking, and transportation

- 0.5% cash back on all other purchases

- Credit building for 50% less (or $5 per month)

- Up to 5% extra cash back at selected merchants

- Unlimited real-time e-Transfers

- No FX fees

- Access to free financial coaching

- 1 free international ATM withdrawal per month

- 1 free credit score check per month

- Save on the app with features like RoundUps, Savings Goals, and Vaults

- Lock card in-app

- Comes with a virtual card for your online shopping as well as physical and premium cards

KOHO Credit Builder

If you are looking to build your credit score, KOHO now offers an optional service called the Credit Builder, which helps you to grow your credit score over 6 months.

You can opt-in for KOHO Credit Builder via the app for a $5 to $10 monthly fee. You get a no-interest line of credit, and KOHO reports your repayments to the credit bureaus.

The credit-building feature works in 6-month cycles.

KOHO Joint Accounts

KOHO is now offering a Joint Account and Prepaid Mastercard for those who want to partner with a friend, spouse, roommate, or sibling. You can open a joint KOHO account without visiting a bank branch to complete long and complicated forms.

Shared account holders get a personal KOHO account along with a joint account. The benefits that come with the account remain the same and include:

- A Joint Account reloadable prepaid Mastercard card

- Expense tracking

- Real-time Joint updates and spending notifications

- RoundUps

- PowerUps

- Shared savings goals (you can set and contribute to goals together)

- Free e-Transfers

- Free, instant KOHO-to-KOHO transfers

- Personal account spending privacy and more

KOHO Instant Pay

One of KOHO’s features is Instant Pay. If your employer partners with KOHO, you can be eligible to cash out up to 50% of your daily paycheque for free. This way, you won’t have to wait until payday to access your funds.

Instant Pay allows you to take out pay that you have already earned, instead of taking out a loan, so that you can get ahead of your bills or give yourself some extra wiggle room.

No interest or fees are charged for Instant Pay unless you transfer your withdrawn pay to a different bank account, which costs $3.50 per transfer.

Is KOHO Safe and Legit?

As per its website, the company has a partnership with the Peoples Trust Company to hold your funds. Peoples Trust is based in Vancouver and is a member of the Canada Deposit Insurance Corporation.

In general, the CDIC insures deposits up to $100,000 per category.

Also, KOHO enjoys the backing of some of Canada’s biggest financial institutions, including Portag3 Ventures, Drive Capital, National Bank of Canada, and Greyhound Capital.

KOHO Fees

How does KOHO make money?

It splits the interchange fees with Mastercard when you pay using your card in-store or online. Also, it makes money when you opt for additional services like credit building.

| Fees | KOHO Easy Card (no longer offered) | KOHO Essential Card | KOHO Extra Card | KOHO Joint Card |

| Monthly fee | $0 | $0* | $9 | $0 |

| Interac e-Transfer fee | $0 | $0 | $0 | $0 |

| Bill payment fee | $0 | $0 | $0 | $0 |

| FX conversion fee | 1.5% | 1.5% | 0% | 1.5% |

| NSF fee | $0 | $0 | $0 | $0 |

| Earn interest fee | $0 | $0 | $0 | $0 |

| Credit building fee (optional) | $10/month | $10/month | $7/month | $10/month |

Cons of KOHO

Two downsides of KOHO are:

- KOHO does not fully replace your bank. For your investing needs, e.g. TFSA, RRSP, and RESP accounts, you will need to look elsewhere. That said, if your investment accounts are with Wealthsimple, KOHO makes it easy to directly fund your accounts using their app. They also have further app integrations in the works to make your banking easier.

- There are limits on how much you can load on your KOHO card, as well as daily transaction limits. For example, the maximum card balance is $50,000, there’s a $9,000 daily limit on transactions, and the ATM withdrawal limit (per withdrawal) is $300. In my opinion, these limits are reasonable and will not pose any problems to the average user.

Is KOHO Worth It?

KOHO may be right for you if want to/are:

Save More Money: As shown by data collected from KOHO users, “the average KOHO user reduces their spending by 15% and saves nearly $500” within the first three weeks following sign-up. This is because the service brings you closer to your money.

You get real-time information and see how your money is being spent – this helps you budget better. The savings plan and RoundUp features are also very practical.

Need to save for a wedding, vacation, emergency fund, etc.? A KOHO account is great for reaching your money goals. Even better, it pays up to 2% interest on your balance.

Save on Fees: if you want to pay less in banking fees, online banking options (like Tangerine and EQ Bank) and non-bank options (like KOHO) can help. While KOHO may not meet all your banking needs, they can help you save a lot in fees with free Interac e-Transfers and more.

Travelling: You can use your KOHO card outside of Canada and save on foreign transaction fees. Most credit cards/banks charge a flat 2.5% or more for this fee; however, when you use your KOHO card abroad, you only pay 1.5% (or 0% with KOHO Premium). You can use your card to make payments wherever Mastercard is accepted.

Comfortable With Online Banking: People are busy these days, and desire convenience, which KOHO provides. If you love or are comfortable conducting financial transactions using your phone or tablet, KOHO is an excellent choice.

KOHO Alternatives

Other prepaid cards like KOHO in Canada are the EQ Bank Card, Neo Money card and Wealthsimple Cash Card.

The EQ Bank Card offers 0.50% cash back on all purchases and has no monthly fee. It also offers free ATM withdrawals, and you earn up to a 4.00% interest on your balance.

EQ Bank Card

Rewards: Earn 0.50% cash back on all purchases and up to 4.00% savings interest on your entire balance.

Perks: Free ATM transactions in Canada, no foreign currency transaction fees abroad, and unlimited transactions.

Interest rate fee: 0%

Annual fee: $0

The Neo Money card pays up to 5% cash back on purchases at partner retailers across Canada. It also pays interest on your balance.

Neo Money card

Rewards: Earn an average of 5% cash back at over 12,000 retail partners and a guaranteed minimum of 0.50% (up to $50 monthly); Earn 2.25% interest on your account balance.

Welcome offer: Deposit at least $50 and complete your first purchase to receive a $20 welcome bonus, and you can earn up to 15% cash back on your first-time purchases.

Interest rate fee: 0%

Annual fee: $0 (no monthly fees)

The Wealthsimple Cash Card offers 1% cash back on purchases and has no fees. It also includes an app for tracking your purchases.

What is KOHO?

KOHO is a Canadian fintech company launched in 2017 by Daniel Eberhard. One of its goals is to save Canadians from the exorbitant banking fees we pay monthly – some of the highest in the world!

Also, the company wants to make budgeting and saving easier so average Canadians can up their financial game without drastically changing their lifestyle.

Because KOHO is not a bank, it has partnered with Mastercard and Peoples Trust (a federally regulated company) to hold the funds you load on your card. Deposits at People Trust may be eligible for CDIC insurance.

KOHO Canada FAQs

No, the prepaid KOHO Mastercard is not a credit card and does not impact your credit score.

You need to use the referral code of an existing KOHO client if you want to get a $20 welcome bonus. KOHO has provided our readers with the referral code CASHBACK, which can be used an unlimited number of times. To take advantage, download the app using the link above and enter the promo code.

KOHO is a prepaid credit card, and while it allows you to earn rewards similar to a premium credit card, it is not a credit card. Your spending is not reported to credit bureaus and does not impact your credit score. You can opt-in for a Credit Builder service offered by KOHO if you want to build your credit score.

KOHO makes money from Mastercard interchange fees and when you subscribe to the premium service. It also makes money from the credit-building feature.

KOHO Extra offers 1.5% cash-back on groceries, eating & drinking (bars, restaurants, food delivery, coffee, etc.) and transportation (gas, uber, public transportation, etc.), 0.5% cash back on all other purchases, no FX fees, free financial coaching, price matching, 1 free international ATM withdrawal per month, and a premium new card design.

The KOHO Prepaid Visa has been replaced by the KOHO Prepaid Mastercard. The cash back rewards and perks offered by KOHO remain the same, and existing clients who have the KOHO Visa Card can switch their existing card to a Mastercard.

You can use your KOHO Prepaid Mastercard to make withdrawals at any ATM carrying the Mastercard ATM logo. Select “credit” if you are asked to identify what type of card you are using by the ATM. Note that ATM withdrawal fees may apply.

Related: KOHO vs Tangerine.

KOHO Mastercard Review

-

Monthly Fees

-

Budgeting Insights

-

Automated Savings

-

Customer Support

-

Cash back offers

-

App Versatility

-

Referral Program

Overall

Summary

The KOHO prepaid Mastercard and KOHO app help Canadians earn cash back on online and in-store purchases. This KOHO review includes a $20 welcome bonus promo code!

Pros

- No monthly fee on regular account.

- Interest is paid on your balance.

- Earn cash back on purchases.

- Extra perks with KOHO Premium

- Automated savings and budgeting app.

- $20 referral bonus (with CASHBACK referral code).

Cons

- The prepaid card does not help you build your credit score unless you subscribe to Credit Building

This app is on fire🔥🔥🔥🔥🔥🔥🔥🔥🔥🔥 It’s free to use, gives you .5% cash back on everything and you can cash out anytime. I’ve already made $10 back in less than a month! And let’s be real, if you sign up using my referral code below, 👇 you get an extra 1% on top of the .5% for 90 days! You don’t get that offer when you sign up normally.

Can I use KOHO to pay property tax/utilities/Income tax? Will the cash back apply to these categories?

@Chee: Yes, you can use KOHO to pay these bills. However, the PowerUps (cash back) do not apply to bill payments…only everyday purchases.

Is KOHO good for students? I’m a student and I do like the idea of getting cash back without paying any monthly bank fees

@Ash: Yes, it is. With the free account, you earn 0.5% on your cash purchases.

Can you use KOHO to recieve salary? As payroll?

@Bri: Yes, you can setup payroll direct deposit to KOHO.

Excellent review, thanks Enoch!

Steve

@Steve: Thanks for your feedback!

When will KOHO allow for people to transfer ALL their banking?

@Jeff: It looks like they will get there at some point. They currently offer spending, saving, and credit accounts/features.

hi there.

i just signed up using your code, but I didn’t get the $20

@Edwina: The $20 bonus is applied to your account after you make a purchase within 30 days of signing up.

I just used your link to open an account but I can’t find where to use your referral code. 🤔

@Agnes: It should have applied automatically and you should get the $20 bonus after making a purchase with your card within 30 days of opening the account. If you don’t see the bonus, let them know through chat support. Cheers.

KOHO is amazing ! I saved a lot of money using it. I also love the round-up function that secretly saving money for me 😉 Plus, customer services are excellent. They are super helpful and explaining the issue i had very clear. I will never stop using this card.

Also, if you use my code, you will get $20 in your card to start with!

Where does the savings go, just on the card in general use, or in a separate account that is like a savings account.

With all due respect, Enoch, there is an error in this article.

While KOHO can be used to *pay* for things like renting a car or reserving a hotel room (through Travelocity, for example), it isn’t the kind of credit card these types of merchants need when they ask you for a credit card to have on file, for security/damage purposes. I’m using these specific examples because I have experience with them, in MB, AB, and BC, Canada. Maybe it’s different in other countries, but when the hotel or car rental agent asks for a credit card to have on file (which is usually toward the end of the transaction), they seem to have trouble with the card, then tell me that they can’t use prepaid cards. It’s the same with Visa Debit cards; it’s not a true credit card. This has, of course, severely messed up my plans because I don’t have the ‘normal’ credit card they proceed to ask for. The frustration it’s caused me is the very reason I am writing this comment/correcting the writer of this article about KOHO’s use as a credit card to rent a car.

(In summary-) At least in Canada, many merchants’ systems flag KOHO cards as ‘prepaid’, which isn’t accepted for things like renting a car or checking into a hotel room. It can still be used as a *payment method* for these things, as with most places Mastercard is accepted, but there are still restrictions on its use as a proper credit card.

I hope this helps. Sorry I don’t have the technical details about this matter.

Great article otherwise, Enoch—thank you.

Heather

@Heather: Thanks for your feedback. You are right that it may not always work for bookings where the merchant requires pre-authorization. I have had mixed experiences in this regard as well. Updated the article.

+1 about challenges for travel and certain merchant types, not just car rental or hotel but also some gas stations or eateries. It has to do with the system of pre-authorization these establishments used to book services in advance which sometimes can be wonky with KOHO even when there is sufficient loaded balance. Thankfully I’ve had few issues and usually rely on a standard credit card for reservations but may ask or opt to pay final charges with KOHO.

I also wish the earlier part of the article would mention how the ‘free to open’ is true but there are subscriptions for higher tier options, especially as this impacts both the interest and cashback earning rates as well as the powerups. It’s mildly misconstrued to only explain the paid tiers later on and not correlate back the the key benefits mentioned (since if you want the maximum rate of interest or cashback, it is a fee-level account).

Appreciate you pointing out the travel issue as I hadn’t used KOHO for travel purposes in quite some time.

@Stumblmer: This article was initially published in 2019, and we have been adding updates to it as they have occurred over the years since then. You are right about the pre-authorizations, as I have had KOHO work in some situations and not in others.

Can I open a LIRA account on KOHO?

@Chris: No, they don’t offer registered savings or investment accounts.