I have previously written about reasons to take CPP early at age 60. In this post, I cover reasons you may want to delay taking CPP until age 70 instead of the standard 65 years.

Obviously, there is more to this issue than what I have provided below. Consider working with a financial planner to determine what’s best for your circumstances.

How Much is CPP at Age 70?

Your CPP payments depend on how much you have contributed to the plan and for how long you contributed.

To qualify for the maximum monthly CPP, you need to contribute to the CPP for at least 83% of the time you are eligible between ages 16 and 65 (i.e. for 39 years).

And, in those 39 years, you must have made the maximum contributions as per the Yearly Maximum Pensionable Earnings (YMPE).

For 2021, the YMPE was $61,600. This means that the maximum employee contribution to the CPP for 2021 was $3,166.45 (5.45% contribution rate), and for self-employed folks, the amount was $6,332.9.

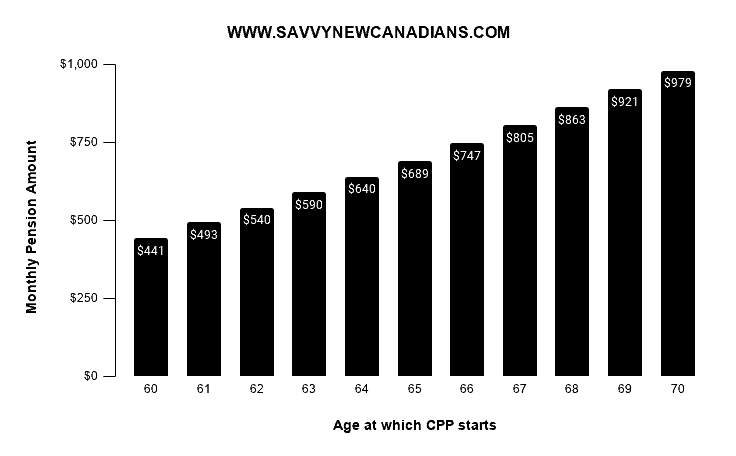

Canadians can opt to take CPP early at age 60 in exchange for a 0.60% reduction in benefits per month, i.e. 7.2% per year or 36% at age 65.

Alternatively, you can choose to defer CPP until later, up to age 70, to enjoy an increase in benefits equivalent to 0.7% per month, i.e. 8.4% per year or 42% at age 70.

The maximum monthly CPP benefit in 2022 was $1,203.75. If you had delayed CPP until age 70, your benefit would increase by 42% to a maximum monthly CPP payment of $1,709.33 in 2022’s funds (not adjusted for inflation).

The average CPP benefit was much lower than the maximum. For example, the average monthly payment was $689.17.

Adjusting this amount for a 142% increase meant that an individual who delayed collecting CPP until 70 could receive an average of $978.62 per month in 2022 dollars.

Reasons to Defer CPP Until 70

Here are some reasons you may want to delay collecting CPP until age 70.

1. Average Life Expectancy or Better: If people in your family generally live past age 90 and you are in good health, it may make sense to delay CPP to age 70 for more benefits and to minimize your longevity risk.

2. Higher CPP Payout: An extra 42% increase in benefits for life compared to what you would otherwise receive at age 65 is nothing to scoff at. For every year after 65 that you delay, you get an 8.4% boost, which equates to 42% by the time you turn 70.

3. You Are Still Working: If you are still employed after age 65, CPP contributions become optional. However, CPP benefits are included in your taxable income and thus increase your taxes.

If you don’t need the extra income, deferring CPP income by a couple of years could result in tax savings. The same goes for OAS payments.

4. Eligibility for GIS: The Guaranteed Income Supplement is a part of OAS benefits. The maximum monthly GIS payment for the October to December quarter (2021) is $948.82 for a single, widowed, or divorced pensioner.

If you can live on your OAS/GIS benefits alongside income from your TFSA and non-registered investments, you could defer CPP until later while enjoying up to $11,385.84 in GIS money per year (i.e. $948.82 x 12 months).

5. Investment (Market and Inflation) Risks: There are lots of arguments out there for taking CPP early and keeping your investments intact as long as possible so you can maximize your returns.

Recent events show that you can’t rely on the financial markets to always deliver high returns, even more so when your investment horizon is short.

If there’s a prolonged economic downturn, your investments could suffer and provide less-than-stellar returns. The same goes for when market returns do not keep up with inflation.

On the other hand, you are ‘almost’ assured that your CPP amount will increase by 8.4% for every year you delay, and it is indexed to inflation as well. The increased CPP benefit will continue to be paid for life.

If your only reason for taking CPP early is because you are afraid that CPP funds may dry out, you can rest easy.

Recent reports by the Canada Pension Plan Investment Board (CPPIB) indicate that CPP is sustainable until at least 2090, even with the recently introduced CPP enhancements.

CPP Breakeven Point

Although you get lower CPP benefits if you start to collect at age 60, you potentially take it for longer than someone who starts at age 65.

So, what’s the breakeven point?

Based on the chart below, if you take CPP at age 65, you will benefit from the extra monthly payments (compared to the 60-year-old taker) when you reach age 74 or 73.9 years, to be precise.

And, compared to someone who started collecting CPP at age 61, you will earn more overall when you reach age 75 (or 74.9 years).

CPP Breakeven Point Chart

| Age | 60 | 61 | 62 | 63 | 64 | 65 |

| CPP income/month | $640 | $712 | $784 | $856 | $928 | $1,000 |

| CPP reduction/month | $360 | $288 | $216 | $144 | $72 | 0 |

| Total CPP income paid out before 65 | $38,400 | $34,176 | $28,224 | $20,544 | $11,136 | 0 |

| Breakeven (months) | 106.7 | 118.7 | 130.7 | 142.7 | 154.7 | – |

| Breakeven (years) | 73.9 | 74.9 | 75.9 | 76.9 | 77.9 | – |

*Based on CPP benefit entitlement of $1,000/month at age 65.

*Chart adapted from https://moneycoachescanada.ca/blog/take-cpp-age-60/

Related reading

- CPP Survivor and Death Benefits

- What Happens To CPP If You Retire Abroad

- CPP Benefits After The Death of a Spouse

- Retirement Income Guide for Canadians

- How To Withdraw RRSP Funds Tax-Free

- Pros and Cons of Taking CPP at 60

How To Apply for CPP

Note that even though you wait until age 70 to collect CPP, you will still need to apply for it. You can apply online via your My Service Canada Account or send in a paper form.

Online applications take 7-14 days to process and for paper applications, expect to wait for up to 120 days.

Hello Enoch,

I would say the breakeven point is lower than 90. From what I have read, tables, etc. it’s closer to between 78 and 82 years old.

Another reason to delay CPP to 70 is that you can save a lot of tax. With no CPP/OAS, you can drawdown RRSP/RRIFs earlier/faster and pay less tax. You don’t even need to necessarily spend that money, but getting it out of the tax-deferred accounts will help big-time.

Delaying CPP/OAS is also like creating your own defined benefit pension plan. A couple can create guaranteed income for life that is indexed to inflation – big win!

Fantastic articles, keep them up!

@Steve: Thanks for your input!

Great article and good insights into when to take CPP.

I would like to add a few considerations that I don’t usually see mentioned.

If as a retired person your income is close to the level of OAS clawback you might want to take CPP early so as not to move your income above the clawback threshold an lose $0.15 of every extra dollar you would gain by waiting.

I agree with the math behind the advantages of waiting until 70 and that it will probably improve your standard of living in retirement but for those wishing to leave an estate after they pass the additional personal funds they would use while waiting until 70 may reduce the eventual size of their estate. This of course will depend on the individuals lifespan, their portfolio, how it is invested and what returns they expect.

The third consideration would be for couples and regarding the amount of survivor benefits passed on to the surviving partner. As an example, I am about 6 years older than my wife and statistically will probably die at a younger age so there is a very good chance she will live for about 10 years after I am gone. In this case it may make sense for her to take CPP at a younger age to take better advantage of the survivor benefit. This being said, trying to make sense of the CPP survivor benefits and calculations is not easy. It would be best to consult your financial planner or experts such as Doug at drpensions.com to look into this further.

Sorry for the long post and thanks again for your article.

@David: Excellent points!

Excellent advice

Do you have any comments on an individual who has only CPP and OAS (no other pensions) and is expecting to continue operating a business after age 70 (possibly until age 88).

@Paul: I assume the decision to then take CPP early or late would depend on how much business income you expect and how it affects your tax bracket and OAS eligibility.

Very informative and easy to understand article. Thank you!

@Ali: Glad to hear you found it useful.

I think there’s a typo, “142%” should be “42%”:

“Adjusting this amount for a 142% increase meant that…”

why would CPP send an approval for me, with my retroactive amt being used to pay ‘back ‘ Social assistance’ they say they owe, so a 35,000 amt is now $22.20 is what i am getting BACK. i am 57 and on disability. Thank you for your time

Sincerely, Allie

@Allie: Hard to say. It is best to contact Service Canada directly so you can get the right awswer.