Many of the best money-saving tools today that help you earn cash back and find coupons, are available as apps on your smartphone or tablet. They are often free or come with a very low fee. These apps include Neo Money, Caddle, Checkout 51, Swagbucks and Rakuten.

With the best cash back apps for grocery shopping, you get a quick and painless way to earn cash back. While there may be several apps that can accomplish the goals below, I will be highlighting the very best apps that can save you money starting immediately!

The Best Apps To Save Money in Canada

| App | Cash Back Offer | Where to Sign Up | Minimum Payout Threshold | Cost | Best for | Cash Out Methods |

| KOHO | Up to 5% cash back (unlimited) | Get a $20 bonus when you join with CASHBACK code on signup and complete first purchase | None | $0* | High cash back rates and savings interest | Withdraw or spend directly |

| Neo Money | Up to 5% cash back (unlimited) | Get a $20 bonus when you deposit $50 and complete first purchase | None | $0 | High cash back rates | Withdraw or spend directly |

| Caddle | Various offers weekly | Sign up here and use promo code S9EL0HJGVY | $20 | Free | Earning cash back and rewards for doing simple tasks | Cheque |

| Checkout 51 | Various offers weekly | – | $20 | Free | Getting cash back on groceries and other household items | Cheque |

| Swagbucks | Up to 10% cashback | Sign up here to receive a welcome bonus of $5 | From $3 | Free | Getting cash back doing simple tasks | Gift cards, prepaid cards, and PayPal cash |

| Rakuten | Up to 40% cashback | Sign up for Rakuten and get up to a $30 bonus | $5 | Free | Earning cash back on just about everything you buy online | PayPal, cheque, or Amazon gift cards |

These cash back apps will return money to your wallet whenever you shop for groceries. They will only take a few seconds of your time and are FREE to use.

1. KOHO

KOHO is an app with a free* reloadable prepaid card that is great for budgeting and saving money. The KOHO app is versatile and easy to use, allowing you to set financial goals, save on autopilot, budget and pay fewer banking fees.

It offers up to 5% cash back on purchases and pays a 5% savings interest on your balance. You can also use your account for unlimited debits, eTransfers, direct deposits, bill payments, 0% APR cash advances, and free credit score checks.

- Rewards redemption: You can cash out your cash back whenever you want and use it to pay for purchases. There’s no minimum threshold.

- Available: Canada

- Cost: You can get a KOHO Essential account at $0* monthly

- Best for: Getting cash back on purchases and earning high interest on your balance

Open a free KOHO account here, enter the CASHBACK promo code and and complete your first purchase to get a $20 bonus.

KOHO Prepaid Mastercard

$20 welcome bonus after first purchase (use CASHBACK promo code during sign-up)

$0 monthly fee*

Earn up to 5% unlimited cash back

Get 5% savings interest on your balance

Unlimited Interac e-Transfers and debit transactions

Free budgeting app and access to credit building

2. Neo Financial

Neo Financial offers a prepaid Mastercard and an app you can use for earning cash back and managing your finances. Unlike the typical debit card, when you spend money using your Neo Money card, you earn up to 5% cash back (up to 15% cash back for first purchases).

The account also supports unlimited bill payments, Interac e-Transfers, payment wallets, online payments, Neo-to-Neo transfers, and more.

For your account balance, you earn interest, making it an excellent savings account for funds you are not spending right away.

- Rewards redemption: You can withdraw your cash back or spend it using the Neo card. Neo also has an online marketplace where you can buy items at a discount. There’s no minimum threshold.

- Available: Canada

- Cost: The standard account has no monthly or annual fees. You can also upgrade to a premium account for additional perks.

- Best for: Earning high cash back rates on all purchases

Open a Neo Money account here, deposit at least $50 and complete your first purchase to get a $20 bonus.

Neo Money Account

Unlimited 5% average cash back

No monthly fees + $20 bonus

2.25% non-promo interest rate paid on balance

Unlimited free transactions

Get a Mastercard for payments online and ATMs

Access to a no-annual-fee credit card

3. Caddle

Caddle is a grocery cash back app that is similar to Checkout 51, except that it is only available in Canada, and also pays you to answer short surveys and watch ads.

To get started with Caddle, sign up. From the app, select the offers that interest you for the week and buy them in-store. After that, take a photo of your receipt and upload it using your smartphone. Cha-ching!!

- Rewards redemption: You can cash out your cash back rewards when it reaches $20 or more. In addition to shopping cash back offers, Caddle also pays you to answer paid surveys and watch video ads weekly.

- Available: Canada

- Cost: FREE to join

- Best for: Getting cash back on groceries

You can read our detailed review of Caddle.

4. Checkout 51

The Checkout 51 app is another great app for grocery shopping.

After downloading the app, you get new discount offers every Thursday morning, and these offers stay live until the following Thursday, when new offers become available.

Pick the offers that interest you and purchase them from any store. After that, take a photo of your receipt with your smartphone and upload it through the app. That’s it, and you are on your way to earning cash back and discounts every time you shop, no coupons required.

The beauty of the Checkout 51 app (and others like it) is that if you have coupons from other sources, you can usually combine them with the offers from the app to get even more rewards.

- Rewards redemption: You can cash out your cash back balance when it reaches $20 or more.

- Available: Canada and the United States

- Cost: FREE to use

- Best for: Getting cash back on groceries and other household items

You can read my review of Checkout 51.

The Best Apps To Save on Shopping

These are some of the best apps to save money on everyday shopping, including electronics, fashion, entertainment, tools and equipment, books, drug store purchases, and everything else you buy daily.

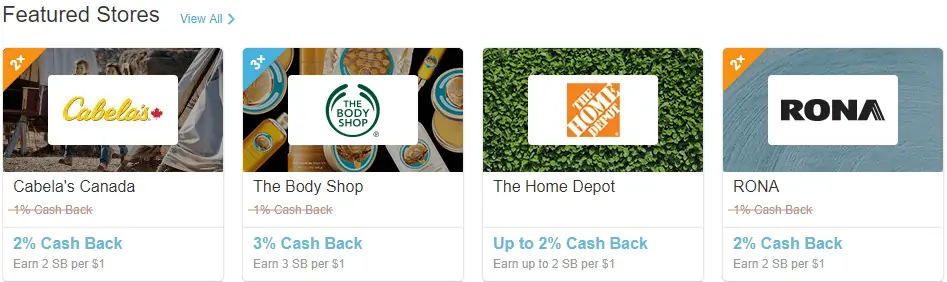

5. Swagbucks

Swagbucks is the ultimate site for earning cash when you shop online, take paid surveys, watch videos, browsing, and more.

Sign up for Swagbucks, and whenever you want to shop online, visit your favourite online store through Swagbucks. You will earn SB points for every $1 you spend.

- Rewards redemption: You can redeem your accumulated points as cash (PayPal) or gift cards. The minimum payout threshold is $3. Swagbucks has paid members over $900 million in rewards.

- Available in: Canada, the United States, and multiple other countries

- Cost: FREE to join

Bonus: Sign up here to receive a welcome bonus of $5.

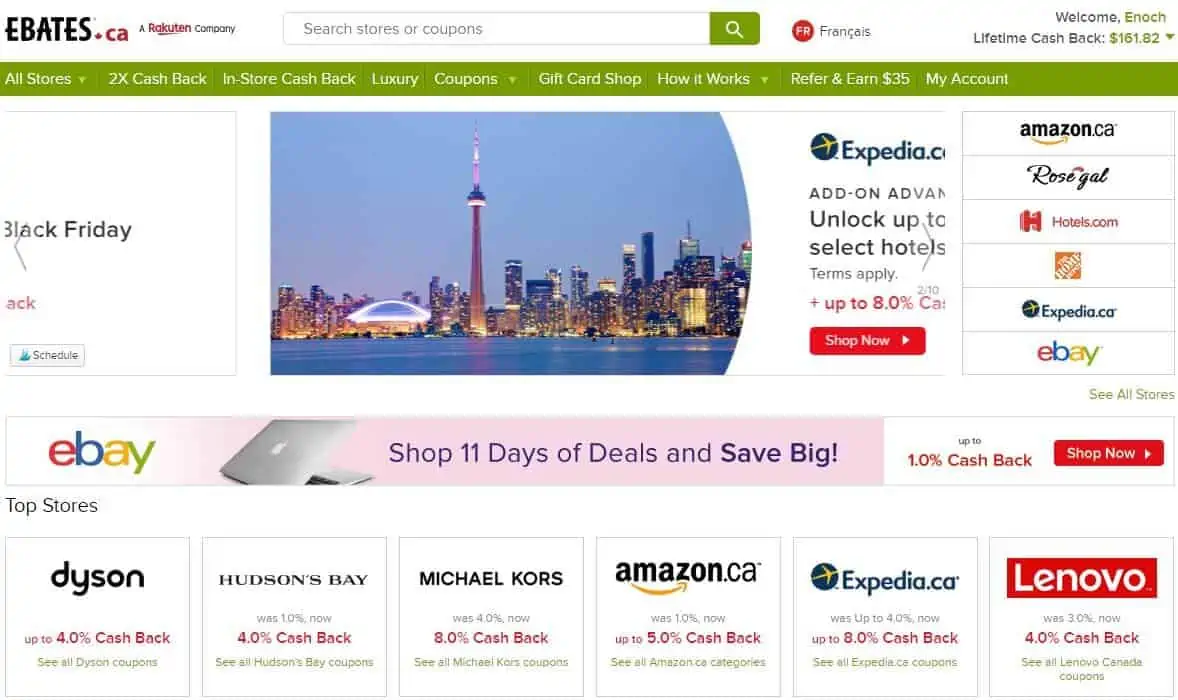

6. Rakuten (Ebates)

Rakuten is possibly the most popular cash back rewards site for your general shopping. This is how it works:

Whenever you want to shop online at your favourite stores (be it Amazon, Hudson’s Bay, eBay, Old Navy, Sephora, Home Depot, and over 2,000 other stores), proceed from the Rakuten app or website to your preferred store.

You will earn cash back effortlessly into your Rakuten account. I have seen cash back offers of 30% or more on Rakuten, which can translate into significant savings for you.

- Rewards redemption: Cash out your earnings when you reach $5 or more.

- Available: Canada, the United States, and several other countries

- Cost: FREE to use

- Best for: Earning cash back on just about everything you buy online

Sign up for Rakuten and get up to a $30 bonus. Remember to make a purchase of at least $30 through Rakuten to claim your bonus.

You can read my review of Rakuten.

7. Capital One Shopping

Capital One Shopping is an online shopping platform that rewards you with gift cards to popular brands for making eligible online purchases.

Using the browser extension for Google Chrome does not require you to be a Capital One cardholder.

When you shop online at its 30,000 partner retailers, Capital One Shopping finds coupons and promo codes for the items or services you want to buy. It instantly applies the coupons to your cart when you check out.

As you browse directly on the Capital One Shopping portal, it will inform you about the available offers and how much cash back you can earn on your purchases.

Along with getting information on your potential savings, you can also compare prices and offers from different retailers and access special cash-back offers in Capital One Shopping Rewards.

Continued use of the tool will earn you shopping credits, which you can build up and redeem for gift cards to retailers like Walmart and eBay.

- Rewards redemption: Log in to your Capital One Shopping account and go to Rewards Redemption to find a list of gift cards you can redeem.

- Available: Canada, United States

- Cost: Free

- Best for: Earning cash back through gift cards to major brands and retailers

8. Paymi

Paymi is a Canadian cash back app backed by CIBC. When you shop online or in-store at any of their participating retailers and use your linked card, you earn real cash back.

For example, you can earn cash back whenever you purchase at Lowe’s, Leons, Burger King, Gap, Sportchek, Lululemon, Aldo, Mark’s, and many other stores.

- Redemption: Cash out your earnings easily using Interac e-Transfer.

- Available: Canada

- Cost: FREE

Read this Paymi review for more information about the app.

9. TopCashback

TopCashback makes it easy to earn cash back rewards from over 4,400 retailers.

When you access your favourite retailer through the TopCashback app or website, they track your purchases and pay cash rewards into your account within 7 days. It’s that simple!

- Rewards redemption: There is no minimum threshold for withdrawing your earnings. You can cash out via PayPal or redeem for a gift card.

- Available: Multiple countries, including the United States and Canada

- Cost: FREE to sign-up

A few other apps that are worth checking out for saving on groceries include:

- SavingStar: Offers opportunities to earn money back at over 70,000 locations, including Walmart, Target, Kroger, and others. The app is only available in the U.S.

- Ibotta (the U.S. only): Cashback offers at thousands of stores and over $438 million paid out to date.

The Best Automatic Savings Apps

How many times have you set a money-saving goal but were unable to meet your goals because you forgot or were not disciplined enough?

The best money-saving apps available will help you save in ways you have never dreamed of – they save or invest your spare change so that you won’t even feel a pinch.

10. Moka

Moka is the Canadian equivalent of Digit or Acorns and is one of the best automatic investing apps available. This is how it works:

Sign up for a Moka account and link to your bank.

When you make purchases with your credit or debit card, Moka will round up your purchases to the nearest dollar and save/invest the change. For example, if you purchase a cup of coffee for $2.25, Moka will round it up to $3 and invest the $0.75 automatically.

You can set up specific savings and investing goals, and the Moka app will help you reach them. These may include saving for retirement and home down payment plans. You can reach your goals faster by making one-time lump-sum payments or multiplying your roundups.

Your funds are invested in a diversified portfolio using low-cost ETFs, and Moka helps you to save and invest on autopilot.

- Available: Canada

- Cost: $7/month

11. Wealthsimple

Wealthsimple is one of the most popular robo-advisors, making investing easier for everyday investors.

They simplify the investing process, lower your investment fees (0.50% or less), and aim to maximize your returns by diversifying your portfolio using low-cost ETFs.

The Wealthsimple app has one of the best ratings on the app store and offers a Roundup feature that helps you automate your savings.

In addition to investing, you can earn a high-interest rate on your savings through Wealthsimple Save.

Available: Canada. Read this detailed review of Wealthsimple.

Open a Wealthsimple account ($25 cash bonus).

The Best Apps For Your General Finances

One way to boost your finances is to look for easy ways to save money every day without going out of your way. These apps below do a good job of helping you budget and save money.

12. GasBuddy

GasBuddy is your secret key to finding the cheapest gas prices in your area. With real-time fuel price information at your fingertips, the Gas Buddy app can save you a significant amount of money every year.

In addition, when you Pay with GasBuddy, you save 5 cents per gallon at thousands of participating gas stations nationwide.

Available: Canada and the United States

Cost: FREE to join

13. EQ Bank

EQ Bank offers one of the best savings rates in Canada.

This rate is standard and does not disappear after a few months. The EQ Bank app is versatile, and you can deposit cheques from the comfort of your home.

Open an account or read our EQ Bank review.

Bonus FREE apps for saving money:

Other free apps/websites that can improve your finances include:

Credit Score: Canadians can also obtain their FREE credit score and report through Borrowell, while those in the U.S. should check out Credit Karma.

Hopper: Hopper is a great app for saving money on flights. With the app, you know when to book and how far into the future (up to 1 year) you need to wait to get the best deals possible. Savings of up to 40% on flights can easily be had using Hopper.

The Financial Benefits of Using the Best Cash Back Apps

If you have an average household and spend $7,203 per year on food, imagine the relief that some tangible cash back can bring. Even a “measly” 2% cashback on your purchases is equivalent to $144 and enough to clear up some of your smaller monthly bills.

If you are using the best money-saving apps for your grocery shopping, some of them offer as much as 30% in discounts, so your savings per year have the potential to be much higher.

The same goes for other areas of your finances, including savings and investing. If you find it difficult to save money towards a goal or to invest regularly, some apps automate your savings, so you do not even have to think about it.

The best apps to save money can be downloaded from the iOS and Android app stores.

Related: Best Canadian Cash Back Apps.

Thanks for the hard work in putting this together. Not sure of the relevance of the several US-only services listed here though?

@Phil: Thanks for stopping by! The U.S. apps were included for my U.S.-based audience who account for about 15-20% of this blog’s traffic. Cheers.

Hi Enoch, great post! Check out QUBER (quber.ca), been around in Canada for over a year and helping thousands of Canadians save money easily.