The tax-free First Home Savings Account (FHSA) makes it easier for Canadians to save for a down payment on their first home.

With the new account allowing similar investments you can hold in a TFSA or RRSP, a Questrade FHSA can help you save on fees while keeping your returns tax-free.

You can use a Questrade FHSA account to hold stocks, GICs, bonds, mutual funds, and even options.

Does Questrade Offer FHSA Accounts?

Questrade made the Tax-Free First Home Savings Account available to Canadians after it was launched nationwide starting on April 1, 2023.

The Questrade FHSA can be opened by eligible residents between the ages of 18 and 71 who haven’t owned a home in Canada in the last four years.

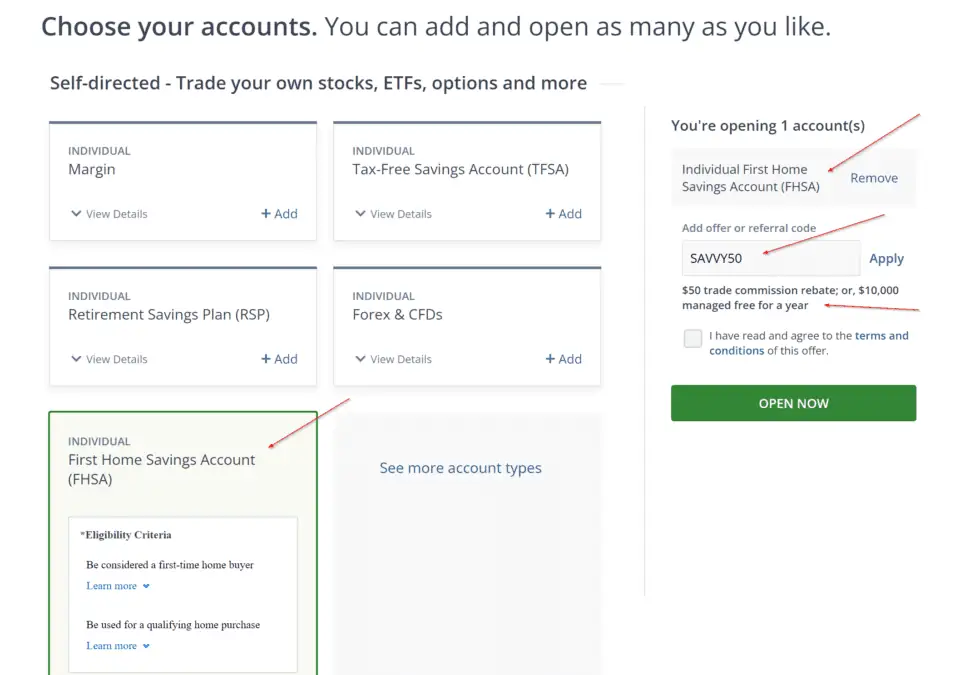

When you sign up using the promo code SAVVY50, you get a $50 trade commission rebate after depositing at least $1,000. For Questwealth accounts, you can invest up to $10,000 free for a year.

How To Invest Your FHSA on Questrade

The FHSA captures many of the great characteristics we have come to like in the TFSA and RRSP. You can invest in various assets, including stocks, bonds, Guaranteed Certificates (GICs), mutual funds, gold, and more. You can also hold cash like you would in a high-interest savings account.

When investing in your FHSA, you should consider how soon you need access to the funds.

If you are buying a home in 1-3 years, stocks may be too risky. And while GICs may offer a lower return, your principal is guaranteed.

Consider your risk tolerance, investment timeframe, and whether it makes sense to gamble on future returns or be more conservative in protecting your capital.

Stocks

Offer potentially higher returns but can be volatile. You can lower your risk exposure by investing in a globally diversified equity ETF.

To invest in stocks, you need a brokerage platform like Questrade or Wealthsimple Trade (confirm whether an FHSA is available).

Related: How To Buy Stocks on Questrade.

Exchange-Traded Funds (ETFs)

ETFs are similar to mutual funds, but they generally charge lower fees and can be traded like stocks.

You can buy ETFs comprising stocks, bonds, commodities, or a mix of these.

Because an ETF can comprise thousands of securities, it is easier to diversify your holdings and lower risk with one or a handful of ETFs.

You can buy ETFs using Questrade.

Related: Best ETFs in Canada.

Guaranteed Investment Certificates (GICs)

GICs are also referred to as term deposits. You put your cash in a GIC product for a specific length of time and earn interest that is paid monthly, annually, or on the maturity date.

GICs are protected through deposit insurance by the Canada Deposit Insurance Corporation (CDIC). They are low-risk and one of the safest ways to invest your FHSA.

Other permitted investments in an FHSA include:

- Mutual funds

- Bonds

- Options

- Cash

Questrade FHSA Fees

Questrade offers no-commission trading for ETF purchases. When you buy or sell individual stocks (or sell ETFs), you pay a $4.95 to $9.95 trading fee.

Unlike big bank brokerages, you don’t pay inactivity or maintenance fees if you have a small balance on Questrade.

Below are the trading fees to expect for a Questrade FHSA:

| Investment Product | Trading Fee |

| Stocks | 1 cent per share; $4.95 minimum and $9.95 maximum per trade |

| ETFs | Free to purchase; $4.95 to $9.95 when you sell |

| Options | $9.95 + $1 per contract |

| Mutual funds | $9.95 per trade |

| GICs | Free to buy with a $5,000 minimum purchase |

| Precious metals | $19.95 USD per trade |

Benefits of a Questrade FHSA

A Questrade FHSA offers these advantages:

Access to multiple investment products: You can invest in stocks, ETFs, GICs, mutual funds, and bonds on one platform.

Low fees: Save on investment fees with no commissions on ETF purchases and low trading fees when selling and for other assets.

Save on taxes: FHSA contributions are tax-deductible, and investment returns are tax-free.

Stay in control: A self-directed FHSA leaves you in control of your portfolio. You can decide which assets to hold and in what allocation.

Dual currencies: Questrade supports Canadian and U.S. dollar accounts.

Related: Best Mortgage Rates in Canada.

What is the First Home Savings Account?

The First Home Savings Account is a new registered account designed to help first-time homebuyers save for a down payment on a house in Canada’s expensive real estate market.

The program was introduced in the 2022 budget and is set to launch in April 2023.

This account allows eligible Canadians to contribute up to $40,000 while enjoying tax benefits peculiar to both the TFSA and RRSP.

Who is Eligible?

To open an FHSA account, you must be between the ages of 18 and 71 and not have owned a home in which you lived in the preceding four calendar years.

You must also be a tax resident of Canada.

How Much Can You Contribute To an FHSA?

You can contribute up to $8,000 to an FHSA each year and up to $40,000 during your lifetime.

Unused contribution rooms in any year can be carried forward to future years. For example, if you contribute $5,000 to your FHSA in 2023, you will be able to contribute up to $11,000 in 2024 (i.e. the $3,000 carried forward + $8,000 limit in 2024).

Annual contributions can be deducted from your taxable income, resulting in immediate tax savings.

Income earned in an FHSA (interest, dividend, and capital gains) are also tax-free.

If you over contribute to an FHSA, a 1% tax is levied on the excess amount monthly until you withdraw the over-contribution or have additional contribution room (similar to a TFSA over-contribution).

Related: How To Get a Mortgage as a First-Time Homebuyer.

Questrade FHSA vs TFSA vs RRSP

Here’s how the FHSA, TFSA, and RRSP compare:

| FHSA | RRSP | TFSA | |

| Contribution limit | $8,000/year and $40,000 lifetime | 18% earned income in the previous year up to a limit ($30,780 in 2023) | $6,500 in 2023 ($88,000 since inception) |

| Over-contribution penalty | 1% monthly penalty on excess contributions | 1% monthly penalty on excess contributions over $2,000 lifetime buffer | 1% monthly on excess contributions |

| Withdrawals | Tax-free for home purchase | Pay taxes on withdrawals | Tax-free |

| Account expiration | After 15 years | Convert at age 71 | Does not expire |

| Tax-free gains | Yes | Tax-deferred | Yes |

| Contributions tax deductible | Yes | Yes | No |

| Investments | Savings deposits, stocks, ETFs, mutual funds, options, bonds, GICs | Savings deposits, stocks, ETFs, mutual funds, options, bonds, GICs | Savings deposits, stocks, ETFs, mutual funds, options, bonds, GICs |

FHSA vs RRSP Home Buyer’s Plan (HBP)

The Home Buyer’s Plan (HBP) is a program under the Registered Retirement Savings Plan that allows you to borrow up to $35,000 from your RRSP to buy a home.

A couple can withdraw up to $70,000 (i.e. $35,000 x 2).

The HBP must be repaid to your RRSP within 15 years, whereas you don’t need to repay the FHSA following withdrawal for a home purchase.

You can use both the HBP and FHSA when buying your first home in Canada.

Related: Best Mortgage Lenders.

FAQs

The FHSA is available starting on April 1, 2023, and Questrade FHSA accounts became available on the same date.

Yes, you can open a TFSA and FHSA and use both to save for a home purchase.

Direct transfers from an FHSA to a TFSA are not allowed. However, you can withdraw and deposit TFSA funds in an FHSA without paying taxes if you have an FHSA contribution room.

You can’t transfer RRSP funds to an FHSA tax-free. When RRSP funds are withdrawn, you trigger taxes at your marginal tax rate and lose the RRSP contribution room.

You cannot open an FHSA if you currently own a home or have had a home in the last four years.

Parents can gift you money to contribute to your FHSA, and you can claim a tax deduction for these funds on your income tax return.

No, you don’t pay taxes when you withdraw from your FHSA if the funds are for a home purchase. For non-home purchases, tax at your marginal rate applies.

Your FHSA can stay open for up to 15 years, after which it must be closed. If you are not buying a home, you can transfer your FHSA balance to your RRPS or RRIF on a tax-free basis.