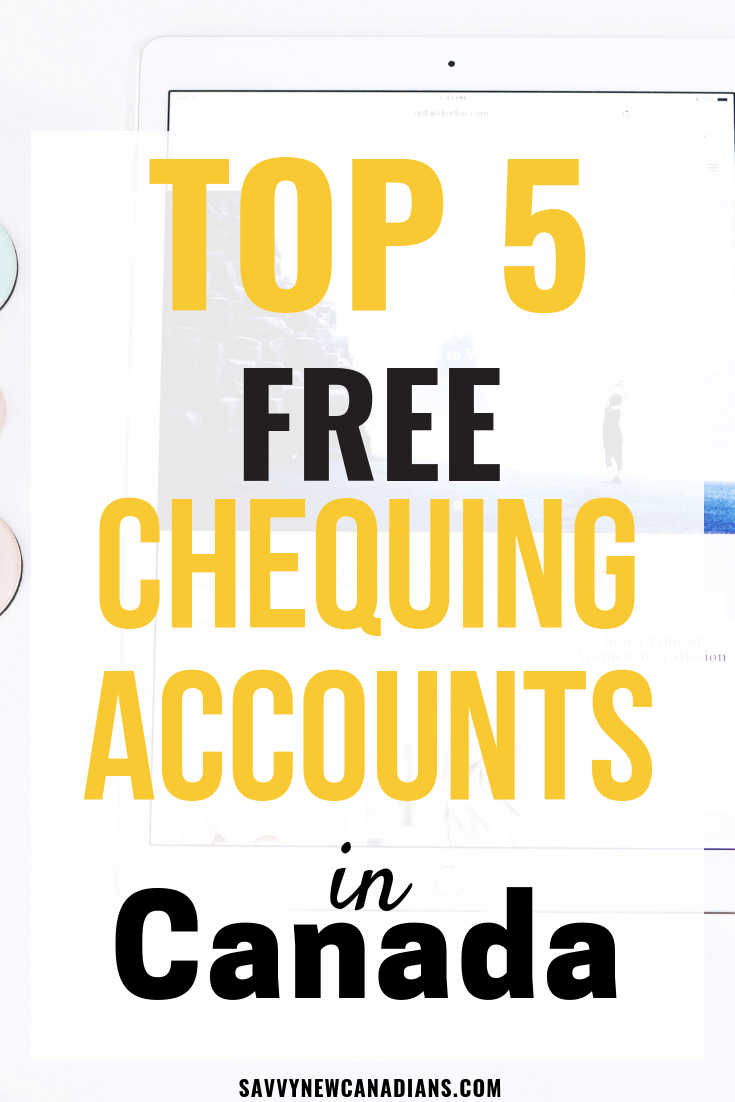

The monthly chequing fees charged by the Big Banks are largely avoidable, which is why I am discussing the best free chequing accounts currently available to Canadians.

Similar to investing fees (think mutual funds), Canadians pay some of the highest bank fees in the world. As per CBC News, Canadians pay more than $200 in annual bank fees.

Canadians do have free options when it comes to where they open their personal bank accounts – be it chequing or savings.

While loyalty may be a good virtue, you do not need to stay ‘married’ to your traditional bank, shelling out monthly bank fees month after month if there are no evident and incremental benefits.

Best Free Chequing Accounts in Canada

Here are the top four free chequing accounts you can sign up for to save on fees.

- Simplii No-Fee Chequing Account

- EQ Bank Savings Plus Account

- KOHO Earn Interest Account

- Neo Money Account

- Tangerine Chequing Account

Simplii No-Fee Chequing Account

$400 cash bonus offer

No monthly account fees

Unlimited transactions & Interac e-Transfers

Free personalized cheques

EQ Bank Personal Account

Up to 4.00%* interest rate

Unlimited debits and bill payments

Unlimited Interac e-Transfers

No monthly account fees

KOHO Earn Interest

5.00% savings interest on your balance

$20 sign up bonus after first purchase (use promo code CASHBACK)

Earn 1% cash back on groceries, gas, and transportation; up to 5% unlimited cash back on purchases at partners

Unlimited Interac e-Transfers and debit transactions

$0* monthly

Neo Money Account

Unlimited 5% average cash back

No monthly fees + $20 bonus

2.25% non-promo interest rate paid on balance

Unlimited free transactions

Get a Mastercard for payments online and ATMs

Access to a no-annual-fee credit card

Tangerine Chequing Account

No monthly account fees

Unlimited free transactions

Up to 0.10% interest on balance

Access to a no-annual-fee credit card

They are discussed in further detail below, with additional no-fee banking options from other online banks and credit unions.

The Best No-Fee Bank Accounts in Canada

These are some of the best no-fee banking available in Canada today.

1. Simplii Financial No Fee Chequing Account ($400 Bonus)

Simplii Financial (formerly known as PC Financial) is owned by CIBC. It offers a no-fee chequing account, high-interest savings, mortgages, and more.

Features of its free chequing account include:

- No monthly fees and no minimum balance

- Free unlimited transactions, including debit purchases and pre-authorized bill payments

- Free Interac e-Transfers

- Free access to 3,400+ CIBC ATMs across Canada

- Interest payments of up to 0.10% on your account balance

- Versatile app and user-friendly website

- Free cheque books

When you open a new free Simplii Chequing Account and meet the eligibility requirements, you get a $400 cash bonus.

You can also open a free Simplii savings account and earn a 6.00% interest rate for a limited time (the standard rate is 0.40% to 5.5%).

One fee to note is the $20/year inactive account fee if you do not conduct any transactions for two years or more. Other service charges may apply.

Related: Simplii Financial Review.

2. EQ Bank Personal Account

Our first pick for the best free chequing accounts in Canada is the EQ Bank Personal Account. While this account is more like a hybrid between chequing and savings, it works great if you are looking for an option to cut your banking fees.

EQ Bank is the direct banking arm of Equitable Bank, a Schedule I bank in Canada that was founded in 1970 and has more than $63 billion in assets under management.

The EQ Bank Personal Account offers the following perks and benefits:

- Zero monthly account fees

- High-interest rates (one of the highest rates you will find in Canada)

- Unlimited free transactions, including bill payments and debit transactions

- Unlimited free Interac e-Transfers

- No minimum account balance

- CDIC protection up to $100,000 per insured account category

- Versatile mobile app with free mobile cheque deposits

- International money transfer

- Mastercard debit card that waives FX and ATM fees

While this account does not offer access to cheques, you can complete all your online bill payments, preauthorized debits, and Interac e-Transfers for free. You can also deposit mobile cheques.

The interest you earn on your balance is calculated daily on the total closing balance and paid out monthly.

Clients can also open a TFSA or RSP account and invest using Guaranteed Investment Certificates or save cash.

For more details about EQ Bank and its offerings, read our detailed EQ Bank Account review.

3. KOHO Account

KOHO is not a typical bank account. This hybrid account combines the features of savings and chequing in one place and comes with a prepaid (or debit) card you can use for payments online and in person.

The top features of KOHO are:

- $0* monthly

- Earn up to 5% cash back on purchases

- Earn 5% interest on your balance

- Access to a mobile app with budgeting capabilities

- Free credit score checks

- Access to a paid credit building service (optional)

- $20 bonus when you sign up using our offer code CASHBACK and complete your first purchase

KOHO does not have its own ATMs and does not issue cheques. While it’s not a bank, it has a partnership with Peoples Trust Company, where your deposits are held.

Fees to note: There are service tiers, and you can pay a monthly fee to earn higher cash back rates on purchases and interest on your balance. Credit building also comes with a monthly fee.

4. Neo Money Account

Neo Money is a spending and savings account that earns you interest on your account balance.

Top features include:

- No monthly fees

- No minimum deposit or balance

- Unlimited free transactions

- Get access to a Neo card where you get up to 5% cash back on everyday purchases

- Earn high interest on every dollar

- $20 bonus when you fund your account with $50 or more

To fund your account, you can send an Interac e-Transfer, link your existing accounts, or set up direct deposit to your Neo Money account. You can also open a Neo HISA or get one of their no-annual-fee cash back credit cards ($25 bonus).

While it has no fees for everyday banking, a $5 fee applies when you request a paper statement.

5. Tangerine No-Fee Chequing Account

Tangerine (formerly known as ING Direct) is an online-only bank owned by Scotiabank. They offer a free chequing account and access to a high-interest savings account.

Tangerine’s free chequing account offers:

- No monthly account fees

- Access to 3,500 Scotiabank ATMs within Canada and 44,000 worldwide

- 24/7 phone support

- Interest payments of up to 0.10% on your account balance

- Free unlimited email money transfers

- Your first chequebook is free (50 cheques)

- Free unlimited Interac e-Transfers

One fee to note is their $10/year inactive account fee. An account is considered ‘inactive’ if you do not make a single transaction for 12 months.

Related: Tangerine 2% Money-Back Credit Card Review.

6. Motusbank No Fee Chequing Account

motusbank is Canada’s newest online-only bank. They are owned by the popular Meridian Credit Union and offer a no-fee chequing account, high-interest savings account, mortgages, personal loans, investments, and more.

Features of motusbank’s free chequing account are:

- $0 monthly account fees

- Up to 0.15% interest payments on your account balance

- Free and unlimited Interac e-Transfers

- Unlimited number of transactions, including debit purchases, withdrawals, and bill payments

- First chequebook is free (25 cheques)

- Mobile app with easy mobile cheque deposits

- Free access to more than 3,700 ATMs across Canada

A fee to note is their $30 inactive account fee if you don’t use your account in 12 months.

Read my complete motusbank review.

7. Motive Financial

Motive Financial (formerly known as Canadian Direct Financial) is a division of the Canadian Western Bank. They offer two free chequing accounts (Motive Chequing and Motive Cha-Ching Chequing), savings accounts, investments, and more.

Motive Chequing account offers:

- Zero fees and unlimited transactions, including pre-authorized debits and e-Transfers

- Free access to the second-largest ATM network in Canada

- Up to 0.25% interest is paid on your account balance

- Mobile app

- First cheque book (of 50 cheques) is free

The fees to note include a $1 fee per Interac e-Transfer and a $20 inactive account charge that kicks in after two years of no transactions.

8. Wealthsimple Cash Account

When you combine Wealthsimple’s Cash Account with its Save Account, you enjoy savings and chequing account benefits and pay no monthly fees.

Features of Wealthsimple Cash include:

- No monthly account fee

- No minimum account balance

- Unlimited transactions

- 1% cash back on purchases

A Save Account pays 1.50% interest on your balance.

In addition to its Cash and Save accounts, Wealthsimple also offers an online investment service worth checking out.

Read my detailed Wealthsimple Save review.

9. Manulife Advantage Account

This Manulife account combines the features of a chequing and savings account and offers:

- Free unlimited transactions (including Interac e-Transfers) with a minimum $1,000 account balance

- High-interest rates on your account balance

- Free access to over 3,000 ATMs across Canada

- A mobile app that supports cheque deposits, e-Transfers, and more

- 24/7 customer support

Note that an inactivity fee of $20 may apply after two years of no transactions.

10. Alterna Bank No-Fee eChequing Account

Alterna Bank is owned by Alterna Savings and Credit Union Limited. This online bank’s no-fee chequing account includes unlimited debit and e-Transfer transactions, with access to over 3,300 ATMs in THE EXCHANGE® Network in Canada.

Other features to note are:

- 0.05% interest on deposits

- CDIC insurance

Fees to note: Overdraft protection costs $2.50 monthly and $20-$40 inactivity fee starting in year 2. Other service charges may apply.

Bonus: PC Money Account

The PC Money Account is an everyday spending account that earns you PC Optimum points on all purchases. With no monthly fees, you earn:

- 10 points per $1 spent at participating grocery stores

- Up to 25 points per $1 spent at Shoppers Drug Mart

- 10 points per $1 spent everywhere else

- Up to 5,000 points per month on bill payments

To use the PC Money account, fund it using free Interac e-Transfer services and use it anywhere in-store and online. There is no charge to open an account, no minimum balance required, and you get free unlimited everyday transactions.

The PC Money Account does not issue cheques, but you get a debit card.

Free Credit Union Chequing Accounts

Several credit unions offer an excellent chequing account package for free. Your deposits with them are also protected by provincial deposit insurance.

Valley First Credit Union

This credit union is based in British Columbia. Their no-fee chequing account (Simply Free Account) offers unlimited transactions, unlimited Interac e-Transfers, a no-minimum balance requirement, and free access to thousands of ATMs across Canada.

Cambrian Credit Union

They are based in Manitoba and offer a free chequing account (The Unfee Account) when you set up at least one recurring direct deposit (e.g. payroll) to your account.

Steinbach Credit Union

Also based in Manitoba, this credit union offers a free chequing account (Standard Pack Chequing), and you get one free debit per month per $500 balance.

Methodology:

Savvy New Canadians rates the best free chequing accounts in Canada based on their monthly and service fees, transaction limits, minimum balance requirements, convenience, savings rates, promotions, mobile apps, branch and ATM coverage, personal experience, and many other features. Based on our research, these are some of the best bank accounts. Visit each bank’s website to learn more about their services.

Chequing Accounts Explained

A chequing account is a bank account designed for conducting everyday transactions, including bill payments, pre-authorized debits, electronic fund transfers, wire transfers, and making deposits.

Your chequing account provides access to a debit card and cheques, which makes it easy to access your money on demand. Chequing accounts are also known as transactional or demand accounts. In the U.S., the account is spelled as “checking.”

There are various types of chequing accounts, including student, senior, youth, business, joint, premium, basic, and US dollar accounts.

What to look for in a free Chequing Account

The best no-fee bank account for you will depend on what your needs are. In general, you will want to ensure access to an account with:

- Zero monthly fees

- Unlimited free transactions, including debits, POS payments, pre-authorized bill payments, transfers, and more

- No minimum balance

- Easy access to free ATMs (national and international)

- Excellent customer support

- Versatile mobile app with the ability to make mobile cheque deposits and a user-friendly website for online banking

- Easy and free money transfers

- CDIC insurance – up to $100,000 per category of deposit

- Free electronic statement

- Bonus: Interest earnings on your account balance. Yes, you can earn interest on your chequing account!

- Bonus: Free chequebooks

If you noticed, I did not mention access to in-person banking because this is either unavailable or limited when you go with a no-fee bank account.

Free chequing accounts are made possible when banks save on the operational costs needed to maintain brick-and-mortar branches by functioning as online-only or keeping only a few branches.

How to get a free Chequing Account with the Big Banks

My top picks for the best no-fee bank accounts in Canada do not include any of the biggest banks – popularly referred to as the “Big Five.” This is no surprise. With monthly fees ranging from around $5 to $35, these banks make a lot of money for their shareholders, as they should.

That being said, there are some ways to operate a free or ‘cheaper’ chequing account with the big banks if you would rather not close your account with them. These include:

1. Maintaining a minimum balance in your account – anywhere from $1,000 to $6,000. This can be tricky because if you dip below this balance at any point during the month, the fee becomes applicable. Also, note that your account balance is not earning interest while your money is just sitting there.

You can waive the fees on your Scotiabank chequing account by keeping a minimum balance and earn up to a $350 cash bonus when you open one of these accounts below:

Scotiabank Preferred Package

Scotiabank’s Preferred Package is its most popular chequing account. This account is free as long as you keep a minimum daily closing balance of $4,000 in the account. Otherwise, you pay $16.95 per month. Top features include:

- Unlimited debit transactions

- Unlimited Interac e-Transfer transactions

- Send money globally with Scotia International Money Transfer (for $1.99)

- Earn an additional 0.05% interest on your Momentum Plus Savings Account

- No fees on one non-Scotiabank ABM withdrawal per month

- Get access to the Scene+ program

With the Scotiabank Preferred Package, you earn Scene+ points on every purchase. Get 1 Scene+ point for every $5 spent on everyday purchases and 1 Scene+ point for every $1 spent at Cineplex.

2. Opening multiple accounts, e.g. when you have credit cards, mortgages, investments, and more with the same bank. I do not like this option either because if your bank does not offer you the best mortgage rate, for instance, why would you obtain your mortgage from them?

3. Opening a student bank account. If you are a post-secondary student, you can open a chequing account at a big bank and pay no monthly fees while you are in college.

FAQs

What is the best free bank account?

Your best bank option would depend on your banking needs. For example, do you send a lot of Interac e-Transfers? Many online banks offer them for free in Canada (e.g. EQ Bank and Simplii Financial).

Or do you need to walk into a bank branch to deposit cash or get a draft? In this case, your best option is to choose a traditional brick-and-mortar bank, such as Scotiabank.

Do chequing accounts pay interest?

Chequing accounts are designed to manage your day-to-day cash flows and rarely pay interest on your balance. Accounts with online banks and some credit unions earn interest. If you want to make a reasonable interest rate on your money, you should consider using a high-interest savings account.

What banks offer free chequing accounts?

The popular online banks in Canada offer free chequing accounts with unlimited transactions. While most chequing accounts provided by the big banks have a monthly fee, you may be able to waive the fee by maintaining a minimum daily closing balance.

Read this extensive list of no-fee bank options for examples of other big banks where you can access free chequing accounts.

Wrapping Up

There are many options to choose from if you want to stop paying monthly bank fees.

Online-only banks have a few downsides and may not be attractive to individuals who prefer face-to-face transactions, or who conduct a lot of atypical or business transactions, such as bank drafts or international bank transfers.

However, for most people, these are not going to be daily banking needs.

If you are anything like the average Canadian, a no-fee bank account means you could save $200+ every year!

This is good money you could put towards other endeavours. My top pick for the best no-fee bank account is the Simplii Chequing account followed by the EQ Bank Personal Account.

Wow! 60% interest at Motive? Sign me up quick! 🙂

Or was that meant to be 0.60%? Drat…

Ooops! Thanks for pointing out the typo – now updated. 🙂

Coast Capital in BC has free chequing as well

FYI Coast Capital will make you pay a $5 Member fee for deposit n will only be return to you when you want to close your account with them.

wow! $5! That’s evil. I would rather pay that amount every month to a bank and never see it again 😉

Tangerine now has free Interac e-transfers! 🙂 We’ve been with them since 2005ish! Love them!

But looking forward to wealthsimple’s new cash acct and tungsten card!

The promotion listed for Tangerine was only valid until May 30, 2019. Given this article was posted July 17, I’m not sure how that was missed.

@Rose: Thanks for pointing out. I missed that in my last update to the post.

Hello. I am trying to avoid banks altogether, as I am living a life off grid, and want to keep things simple as possible.

Is there a method in which I can send and receive money internationally, without having to subscribe to a bank account?

I want a free account in order for depositing payments from selling my e books on Amazon in the US. Amazon does not accept Coast Capital as it is not a bank!

@Gail: You can try Tangerine Bank for a free chequing account. It is owned by Scotiabank.

https://www.savvynewcanadians.com/tangerine-bank-review-no-fee-daily-banking/

But Tangerine doesnt have good customer service, its not easy to reach them. Long waiting on the phone!!

@MJ: That seems to be the case for most customer support services (online bank or otherwise) in the age of COVID-19. Even my internet provider now takes several minutes to hours to reach by phone now.

You forgot to mention any cheque deposit in MOTUS will be held until they feel free to release your funds to you.

Do you know a free account that you can receive wire ? Tangerine does not offer wire transfers.

I have a unlimited checking account with TD,i have to maintain $5000 to my account to avoid$29 fee, Just wonder as a personal account that only my paycheks and mortgage and pay off my credit card at end of a month are my account activities, does it really worth to have thus account? I have Tangerine account as a substitute as well.

@MJ: It boils down to whether you often need to visit a bank branch to complete transactions. $5000 is a lot of money to keep in an account without earning interest. That said, if you find it convenient, the lost interest may be counterbalanced by the convenience you are getting from being able to access a branch for quick support. In general, big 5 bank accounts are overrated these days.

No affiliation, but you forgot about Alterna Bank’s eChequing (0.05%) and eSavings (1.2% interest -> better than all on your list except EQ) accounts which can both be used as a no-fee chequing account. The only restriction on the eSavings account is that you can’t use the debit card to make purchases at stores, although you can use it to take out money at an ATM. There are no fees for either account generally speaking. It’s available in Quebec, and has the values of a credit union since it’s owned by one. On the other hand, some others you mentioned: Motive, EQ, and Simplii aren’t available in Quebec.

Looking for the best online checking bank account that I can open immediately

thes are fine options and i thank you for presenting them. many friends and myself are outraged at the fees being charged as of jan 1 and are also on fixed incomes..these charges are equal to a weeks food for us..but question..if you lose your bank card where do you go to replace it in the online banks?

@Gary: You can replace your bank card by contacting the bank’s customer service via phone, email, or chat in-app.

thes are fine options and i thank you for presenting them. many friends and myself are outraged at the fees being charged as of jan 1 and are also on fixed incomes..these charges are equal to a weeks food for us..but question..if you lose your bank card where do you go to replace it in the online banks?

ok i just readcfurter into your reviews and if i understand correctly these banks dont offer like visa debit cards or anything for say amazon payments at all so we would have to use the brick bank and the online bank and manage the transfer fees between the two? this saves how?

@Gary: Some of the banks offer debit cards. Since you get unlimited transactions with most online banks, you save on the transaction fees you’d otherwise have to pay for your brick bank account. Even if you still need an external account at another bank, you can go for their lowest cost/free chequing account offering.

Have had a Simplii chequing account for years, but recent security changes have made it arduous to use.

I’m a Snowbird. For several months every year, I must access my Simplii accounts from the U.S.

THE PROBLEM: Most banks nowadays require you to enter an unique security code in order to access your account. This code is usually forwarded to you by way of the email address or one of the phone numbers they have on file for you.

Not Simplii. The bureaucrats at that company allow you only one method of receiving their security code. Unless you want to change your telephone number every time you go to the U.S. or return to Canada — which itself can be difficult and time-consuming — you are forced to use an email address. But not just any email address. It must be a ProtonMail email address, which evidently is especially secure. (ProtonMail is based somewhere in Europe.)

In practical terms, here’s what that means. First, you must set up your new ProtonMail account. Then, when you want to access your Simplii account using your username and password, a box appears that lets you choose that the security code be sent to you by way of your ProtonMail account — and in the Snowbird situation, it’s the ONLY choice. Without exiting the Simplii website, you must then open your ProtonMail account. An email should be awaiting you, and from it you copy your unique code. Returning to the Simplii website, you then plug in that code, at which point you will then gain access to your Simplii accounts.

Suppose you have made an error and wish to return to your Simplii account 30 seconds after you closed the connection. Believe it or not, you are required to go through the entire ProtonMail process all over again!

I wrote to Simplii complaining about this ridiculously complicated process. They responded with some boilerplate about security blah blah blah. They completely misunderstood the reason for my frustration.

I will definitely be switching to one of the other choices on your list.

@Brandon: Thanks for stopping by!

Tangerine has been great unless you need to contact them. I’ve been with them for several years but I’m actually cancelling all of my accounts and credit card with them because I can’t deal with the literal lack of customer service. They never answer the phone. Just an FYI to people. I found this article while searching for another bank to switch to! EQ has been great (only downfall is there are no debit cards or ATMs, however great otherwise).

Alterna Bank has a “No-Fee eChequing Account”.