The best business credit cards can turn your business’ finances around for the better.

They make paying for purchases easier, free up your cash flows, provide short-term financing, offer insurance coverage, help you track your expenses, and give you rewards.

Among the numerous business credit cards out there, here are some top-rated ones for small businesses and sole proprietors alike.

The Best Business Credit Cards in Canada

This list includes no-fee business credit cards and premium cards with an annual fee.

1. The Loop Corporate Credit Card

Loop Corporate Card

Rewards: Earn cash back on purchases, can hold multiple currencies (GBP, CAD, EUR, and USD), variable credit limit of up to $1 million, 55 days to make a payment; applying won’t affect your credit score.

Welcome offer: N/A

Cards: Free account gets up to 20 virtual cards and 2 physical cards; extra physical cards for $5 each.

Annual fee: $0 (Free plan). For additional premium features, you can get the Loop Plus for $49 CAD/month or $199 CAD/month for Loop Power.

The Loop Corporate credit card is one of the best for businesses that frequently conduct international financial transactions. It is also the best small business credit card in Canada overall.

Apart from providing redeemable points that most business credit cards offer, this credit card also helps you eliminate FX fees, makes receiving international payments easier, and provides accessible funds for your entire team to spend.

This card can hold amounts not just in CAD but also in USD, GBP, and EUR. So, you won’t be charged with FX fees that traditional banks charge when you spend in or send money to the United States, United Kingdom, and Europe.

To determine your starting credit limit, the Loop Corporate credit card assesses your revenue and business performance. Credit limits automatically scale monthly, with a maximum cap of $1 million.

Unlike business credit cards that limit who can use funds, the Loop corporate credit card allows you to give your team members controlled access to your credit limit through free virtual cards.

You can fully customize your internal policies and set spending and freezing rules when letting your team access virtual cards. All transactions can be automatically integrated with Quickbooks and Xero, facilitating a seamless reconciliation of your business accounting activities.

Businesses can receive 2 Loop Corporate credit cards for free when signing up for a no-fee Loop Basic account. You can purchase additional cards for $5 each if you need extra. Alternatively, you can upgrade your Loop account to Loop Plus for $49/month or Loop Power, which costs $199 monthly, as they come with at least 10 free physical cards, and multiple other perks.

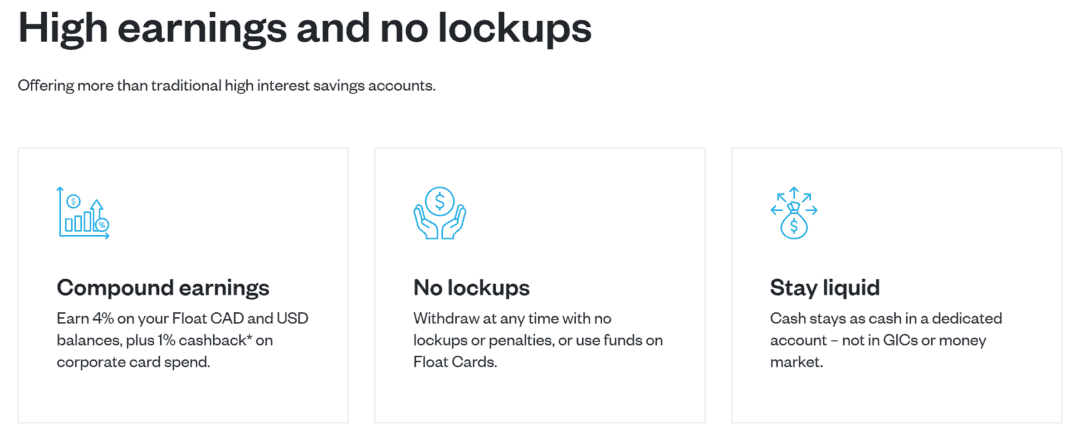

2. Float Card

Float Business Credit Card

Rewards: Earn 1% cash back on spending that exceeds $25,000 monthly; get access to multiple CAD and USD cards and pay no FX fees. You also earn 4% interest on your CAD and USD balance.

Welcome offer: Get $500 in cashback for becoming a Float customer and spending $25,000 within the first 90 days.

Interest rates: Not applicable (for refunded prepaid cards).

Annual fee: $0 for standard cards.

Float offers one of the best corporate cards you can get for your small business. Unlike traditional business credit cards, it allows you to create multiple physical and virtual cards customized for yourself, employees, and vendors.

Float cards are set up with a dashboard that makes it easy to track spending, set limits, and reconcile transactions automatically by syncing with your accounting software, e.g., Xero and Quickbooks.

You earn 1% cash back on spending exceeding $25,000 monthly, and the cash back earned is paid out monthly and added to your Float balance.

Even better (and unlike most business credit cards), Float users earn 4% interest on their business balances, with rates up to 2.7x those of Canadian banks. This is like a savings account rolled up with a business credit card!

A standard Float account is free and comes with up to 5 physical cards, unlimited virtual cards, automated receipt capture and matching, and integration with QuickBooks and Xero.

If you are a large-sized business and need unlimited physical cards, multi-level workflows, NetSuite integration, etc., you can sign up for Float Professionals at $99 monthly.

The Float Card is available with CAD and USD balances, so you can avoid foreign transaction fees when making payments in a foreign currency.

Since it is a prepaid card, you can pre-fund each card directly using your CAD or USD bank account. You can also apply for up to $500,000 of unsecured 30-day credit terms and pay it down throughout the month.

Users can access up to $175,000 in member perks and discounts from partner brands, such as HubSpot, Amazon Web Services, Notion, Carta, Xero, Dropbox, Retool, and Intercom.

Even better, when you sign up using our referral link or referral code enocho2287, you get a $500 bonus cash back after spending at least $25,000 within the first 90 days.

3. American Express Business Edge Card

American Express Business Edge Card

Rewards: Earn 3x the points per $1 spent on office supplies, gas, food, & electronics; 1x points everywhere else.

Welcome offer: NA

Interest rates: 20.99% on purchases and 21.99% on cash advances.

Annual fee: $99

The American Express Business Edge Card is a great credit card option for small businesses. Using this card, you can earn 3x points per $1 spent on business-related purchases like office supplies and gas and 1 point on everything else.

The annual fee is not too high, and the card comes with additional business solutions like account management tools. You can also get up to 99 supplementary cards for employees.

Other Perks:

- Car rental insurance

- Employee Card Misuse Protection

- Purchase protection and extended warranty

4. Marriott Bonvoy Business American Express

Marriott Bonvoy Business American Express Card

Rewards: Earn 5 pts/$1 spent at Marriott Bonvoy; 3 pts/$1 on travel, gas, & dining; 2 pts/$1 everywhere else; 1 free night each year; Elite Night credits.

Welcome offer: NA

Interest rates: 20.99% on purchases and 21.99% on cash advances.

Annual fee: $150

The Marriott Bonvoy Business AMEX card offers business owners many premium benefits.

Generally, you’ll earn 3 points per $1 spent on gas, dining and travel; 5 points per $1 spent at Marriott Bonvoy properties, and 2 points per $1 spent on everything else.

You can easily redeem your points for nights at more than 7,000 hotels and resorts worldwide.

Other Perks:

- Comprehensive travel insurance benefits (includes 7 insurance coverages)

- Purchase protection and extended warranty

- Employee card misuse protection

- Earn one free night at each annual anniversary

- American Express Invites

5. Business Platinum Card from American Express

Business Platinum Card from American Express

Rewards: Earn 1.25x pts per $1 spent on all purchases.

Welcome offer: NA

Interest rates: N/A. Check card details for penalty APRs.

Annual fee: $799

This card comes with a high annual fee, but it offers a solid way to earn points you can redeem for travel and other purchases. It offers 1.25x points on every $1 you spend.

The Business Platinum Card from Amex includes flexible payment options, travel perks like airport lounge access, and useful account management tools.

You can also get up to 55 interest-free days.

For small business owners who travel frequently, this card is one of the best business travel credit cards you can get.

Other Perks:

- Comprehensive travel insurance

- Complimentary access to the premium airport lounges

- Access to VIP hotel programs

- Special benefits at Toronto Pearson International Airport

- Over $1,000* in value every year with Amex Offers

- Employee Card Misuse Protection

- $100 CAD credit for NEXUS every 4 years

- $200 Annual Travel Credit each year

6. Caary Business Mastercard

Caary Business Mastercard

Rewards and Features: Earn 1% cash back on all purchases, access to physical and virtual credit cards, no FX fees, no personal credit checks, easy integration with accounting software, receipt capture, and more.

Interest rates: Applicable after 21 day grace period.

Annual fee: $0.

The Caary Business Mastercard is a business credit card that offers unlimited 1.5% real cash back on purchases.

There are no credit checks, and it has no impact on your credit score. It also has quick online approval, no FX charges, and you can get both physical and virtual cards (unlimited cards).

To qualify for the Caary Business Mastercard, you will need to have a corporation registered in Canada (not yet in Quebec), a $35,000+ average account balance in a business account, and a $25,000+ annual spend on a credit card.

In addition to having no annual fees, it waives foreign transaction fees. Your account simplifies expense management by allowing you to capture receipts and automatically match them using 150 data points, set spending limits, integrate with QuickBooks and Xero, etc.

7. BMO Cash Back Business Mastercard

- Annual Fee: $0

- Purchase APR: 19.99%

- Rewards: Yes

Business owners who are averse to paying annual fees on a credit card would love the features of the BMO Cash Back Business Mastercard.

You earn 1.5% cash back on gas, office supplies, cellphone, and internet spending. Also, the card pays 1.75% in cash back on purchases made at Shell stations and 0.75% cash back on all other purchases.

Finally, you get a liability waiver program that protects against employee card abuse, offers extended warranty and purchase protection, and a 25-day grace period.

8. RBC Avion Visa Infinite Business

- Annual fee: $175

- Purchase APR: 19.99%

- Rewards: 1.25 RBC Rewards points per $1 spent

With the RBC Avion Visa Infinite Business card, you can earn 1.25 points for every $1 spent up to $75,000 per year.

You can use points on any flight and airline and redeem points for hotels, tech products and more.

It also comes with travel and mobile device insurance coverage, among other perks.

9. Amex Aeroplan Business Reserve Card

- Annual fee: $599

- Purchase APR: 19.99%

- Rewards: Earn 1.25x-3x Aeroplan points

Amex Aeroplan Business Reserve Card is a good option to earn Aeroplan points for business travel.

The card has an expensive annual fee, but the lower interest rate is tempting. It also has good earning rates and comes with additional travel benefits.

10. TD Aeroplan Visa Business Card

- Annual fee: $149

- Purchase APR: 14.99%

- Rewards: Earn 1x-2x Aeroplan points

With the TD Aeroplan Business Card, you can earn 2 points for every $1 spent on Air Canada purchases.

You can also earn 1.5 points for travel and business categories like internet and shipping and 1 point on all other purchases.

The low interest rate of 14.99% is useful if you carry a balance. In addition, this card includes travel perks like free first checked bags on Air Canada flights and insurance coverage.

11. BMO Air Miles No-Fee Business Mastercard

- Annual fee: $0

- Purchase APR: 19.99%

- Rewards: Yes

The BMO Air Miles Business Mastercard is great for earning Air Miles rewards.

Generally, you earn 1 Air Mile per $20 spent and 1.25 Air Miles per $20 spent at Shell locations in Canada.

You also enjoy extended warranty and purchase protection coverage and can easily redeem your miles for travel or merchandise.

12. BMO Air Miles Business Mastercard

- Annual fee: $120 (waived in the first year)

- Purchase APR: 19.99%

- Rewards: Yes

The BMO Air Miles Business Mastercard offers a great way to earn Air Miles quickly.

Generally, you will earn 1 mile per $12 spent and 1.25 miles for purchases at Shell stations in Canada.

Additional perks of this card are:

- Comprehensive travel insurance

- Extended warranty and purchase protection

The $120 annual fee is waived for the first year.

13. Scotia Momentum for Business Visa

- Annual fee: $79

- Purchase APR: 19.99%

- Rewards: Yes

The Scotia Momentum for Business Visa Credit Card is all about cash back rewards where it counts.

You earn 3% cash back on spending at gas stations, restaurants, office supplies, and recurring bill payments on up to $50,000 in purchases (1% cash back after the limit is reached); 1% cash back on all other business purchases.

Other perks of the Scotia Momentum for Business Visa include:

- Travel emergency medical insurance

- Rental car collision/loss damage insurance

- Purchase security and extended warranty

14. American Express AIR MILES Gold Business Card

- Annual fee: $0

- Purchase APR: 19.99%

- Rewards: Yes

This no-fee business card comes with a surprising combination of features and rewards.

With the AMEX Air Miles Gold Business Card, you get 150 bonus Air Miles after spending $1,000 within the first 3 months. You also earn 1 mile per $15 in spending at participating locations and 1 mile per $20 spent on everything else.

This card provides a $100,000 travel accident insurance and American Express Invites.

15. CIBC Aeroplan Visa Business Card

- Annual fee: $180 (waived in year one)

- Purchase APR: 12.99% to 18.99%

- Rewards: Yes

- Income requirement: $35,000 minimum annual income

Want to earn Aeroplan points for travel benefits? The CIBC Aeroplan Visa Business Card offers a quick way to rack up miles.

In general, you earn 1.5 points per $1 spent on shipping, internet, cable, phone services, travel, and dining; 2 points per $1 spent with Air Canada; and 1 point per $1 spent on all other purchases.

Also, you get:

- Comprehensive travel insurance

- Purchase security and extended warranty

- Auto rental collision and loss damage insurance

- Air Canada benefits include priority check-in and boarding and complimentary access to an Air Canada Maple Leaf lounge

Methodology:

The Savvy New Canadians team uses a range of factors to determine the best business credit cards in Canada. These include interest rates, rewards, premium perks, annual fees, eligibility requirements and more. By assessing all of these factors, we have been able to determine which are, in our opinion, the best credit cards for businesses in Canada.

What Is a Business Credit Card?

A business credit card is a card that is intended for business use. These make it easier to separate your business and personal expenses.

They are useful if you need to borrow money for business expenses, whether you are self-employed, run a small business with employees, or run a large corporation.

How to Choose a Business Credit Card

There are several important considerations when you are choosing the right business credit card in Canada:

Annual Fees

Do you want to pay an annual fee to use your card? Compare the costs of the card while considering its benefits to decide whether it makes sense to pay for it.

Rewards

Many business credit cards come with rewards. You should explore the types of rewards available and choose the card that offers the rewards most useful for your business.

You may earn cash back on certain purchases like gas or travel, which could be useful for your business.

You may prefer to choose several cards, all offering different rewards, and then decide when to use each card to get the best rewards.

Welcome Bonuses

Look for welcome bonuses too. These change regularly, so always consider the offers when applying for your card.

Perks

Business credit cards in Canada often come with perks like travel insurance coverage, hotel discounts, and savings on purchases that make sense for businesses.

Credit Limit

A higher limit may be useful for your business, depending on how much you intend to borrow.

Interest Rates

If you carry a balance, it’s better to use a business credit card with a lower interest rate. However, if you pay back your balance in full every month, this may not be an important factor.

Benefits of a Business Credit Card

While business credit cards come in various colours and stripes, they are similar to personal credit cards and offer business owners access to financing, convenience, security, improved cash flow, and rewards.

Here are some of the benefits of having a company card:

Separate Business and Personal Transactions: Use your business cards for business-specific purchases and your personal credit cards for personal transactions. This helps to simplify your record-keeping and is invaluable at tax time.

Also, by separating business and personal expenses, you can protect your company’s limited liability status.

Establish a Business Credit History: Your business builds its own credit history, which can be useful if you need a loan to facilitate business operations in the future.

Earn Rewards: Some cards offer perks and rewards, which translate into free money. Examples include cash back, Air Miles, and discounts on qualifying business purchases.

Get Protection and Security: Premium business cards may offer various insurance coverages such as travel insurance, mobile device protection, purchase security, extended warranty, credit card controls, and more.

Get a Free Line of Credit: When you pay off your credit card balance within the grace period, you essentially get a free loan or revolving line of credit.

Downsides of Business Credit Cards

There are a few potential downsides to be aware of with business credit cards:

- They often have higher interest rates on the credit card balance compared to traditional business loans.

- The annual fees can be high and add up, which can have an even bigger impact if you have several cards.

- If you manage your business credit card badly, this may have an impact on your personal credit score.

How to Apply for a Business Credit Card in Canada

If you want a business credit card in Canada, start by exploring the available cards. Use the credit cards in this guide to get started, which are some of Canada’s best business credit cards.

When you find a card that looks suitable for your business, you must consider the requirements.

Unlike with a personal credit card, you will need to be able to show that you have a business. Even if you are self-employed, you will need some evidence of this.

You will often need to provide some photo identification, like a passport.

If you are a sole proprietor, you will typically need to provide documentation like a Notice of Assessment, previous tax returns, your trade name registration certificate, and other financial statements for your business.

For new businesses, you may need to provide additional information, like a cash flow statement.

If you have a partnership, you may need to provide information about the other people involved in the business.

You’ll often need to present the Articles of Incorporation if you run a corporation.

All credit card issuers will have slightly different requirements, but you should be prepared to present the above information when you apply for a business credit card in Canada.

Once you have gathered the necessary information, you can apply for your chosen business credit card.

You might be able to apply for your chosen credit card online. However, you may need to make an appointment at your local bank branch and present the information in person.

If your application is approved, you will receive your new business credit card shortly afterwards.

Business vs Personal Credit Card

Business credit cards are similar to personal credit cards in many ways, but they have some important differences:

- Rewards are typically more suitable for businesses, with rewards related to office supplies, travel, gas and bills.

- Premium perks often include useful accounting tools and other perks targeted at businesses.

- Credit limits are often higher due to the higher cost of business expenses.

- Interest-free grace periods may be longer.

- You can usually apply for a large number of supplementary cards so your employees can use the cards to make business purchases.

Why Should I Get a Business Credit Card?

There are several reasons to get a business credit card. One of the main reasons is to keep your personal and business accounts separate.

You may just want to use your personal credit card if you are self-employed. But when you file your tax return, it is much quicker and easier when you have completely separated your accounts.

You can also deduct your business expenses related to the credit card, like the interest and fees. This is a lot easier to do when you have a separate card for your business.

You can also enjoy rewards, cash back and premium perks on things more related to your business, like gas and office supplies. Some cards also come with account management tools.

Conclusion

Note that while your business credit card is owned by your company, you may still bear personal responsibility for any debts incurred. This is because you likely assented to providing a “personal guarantee” when you applied for the card.

What this means is that you should ensure bills are paid on time and all of the time, as you would with your personal credit cards.

Frequently Asked Questions

There are several excellent business credit cards in Canada. In our opinion, the best is the Loop Corporate Credit Card.

We recommend the Loop Corporate Credit Card as Canada’s best no-fee business credit card, followed by the BMO CashBack Business Mastercard.

While you could use your personal credit card to cover business expenses, separating your accounts is more difficult, which can prove problematic when filing your tax return.

You will typically need a good credit score of over 660 to apply for a business credit card in Canada.

Yes, credit card fees and interest are deductible for businesses in Canada.

Related: