Do you need a credit card, but your low salary has prevented you from applying or even qualifying for it?

While many banks require a minimum income, others provide options for people with low to no income, such as prepaid and secured credit cards.

Learn the best credit cards for low-income individuals, who offer them and the requirements to qualify for them.

Key Takeaways

- Some of Canada’s best credit cards for low-income earners include the Neo Credit Card, Scotiabank Gold Amex Card, and Tangerine Money-Back Credit Card.

- Getting a credit card with a low salary is possible through secured credit cards, prepaid credit cards, no-annual fee cards, student credit cards and joint credit cards.

- The best secured and prepaid credit cards are the Neo Secured Credit Card and Neo Money card, respectively.

Can You Get a Credit Card With a Low Salary in Canada?

Yes, you can. Some banks and lenders offer low-income earners an opportunity to get a credit card despite having a low salary.

Depending on the financial institution, you may need to provide a security deposit to get a credit card with lower income requirements.

With this card, rewards may be fewer, or there would be none. Interest and fees may also be higher.

Best Credit Cards for Low Income in Canada

| Credit Card Issuer | Minimum Income Requirement | Annual Fee | Interest rates | Features | Requirements |

| Neo Credit Card | $0 | $0 | 19.99% – 29.99% | Unlimited cashback; 5% average cashback; no hidden fees | Age of majority in your home province/territory, clear of bankruptcies over the past 7 years |

| Scotiabank Gold American Express Card | $12,000 | $120/yr | 20.99% on purchases 22.99% on cash advances | A welcome bonus worth $400 in value, no foreign transaction fees, excellent travel insurance coverage, access to special offers such as airport lounge discounts, etc. | A credit score of at least 640, must be the age of majority in your home province or territory, no bankruptcies in the past 7 years |

| Tangerine Money-Back Credit Card | $12,000 | $0 | 19.95% | Up to 2% rewards; unlimited monthly money-back rewards | Age of majority in your home province/territory, a permanent resident of Canada, clear of bankruptcies over the past 7 years |

| Scotiabank Momentum No-Fee Visa Card | $12,000 | $0 | 19.99% on purchases 22.99% on cash advances | 1% cash back on everyday purchases | Canadian citizen or permanent resident, be the age of majority in your province/territory, no declared bankruptcy in the past 7 years |

| American Express Cobalt Card | $0 | $155.88 | 20.99% on purchases 21.99% on funds advances | Earn 5x points on food and beverage, 3x points on streaming subscriptions, 2x points on travel/transit, 1x on everything else | A Canadian resident with a Canadian credit file, age of majority in the province or territory where you live |

How to Get a Credit Card With a Low Income in Canada

In summary, getting a credit card for low-income individuals can be done in several ways:

- Get a secured credit card.

- Use a prepaid credit card.

- Get a no-annual-fee credit card.

- Get a student credit card.

- Apply for a joint credit card.

Below is a more detailed take on how to apply for a credit card with low to no income.

Get a Secured Credit Card

A secured credit card requires you to put down a cash deposit (usually equal to your credit limit) when you open an account. The deposit works as collateral each time you use the card for spending.

It also minimizes the risk to the credit card provider. This is why secured credit cards are the ideal low-income credit cards in Canada. It is also available to individuals with bad or no credit.

Use a Prepaid Credit Card

A prepaid credit card works similarly to a debit card. It requires you to deposit funds onto the card before you can use it and spend only what you deposited.

What makes prepaid credit cards ideal for low-income individuals is that they do not require a credit check to apply. Prepaid credit cards also offer cash back on purchases and can be reloadable.

Get a No-Annual Fee Credit Card

As the name suggests, a no-annual-fee credit card lets you enjoy the benefits of a credit card without the yearly fee.

But, compared to a card with an annual fee, a no-fee credit card has fewer perks and rewards. It builds your credit history without paying exorbitant yearly fees.

Depending on the provider, a no-annual-fee credit card enables individuals with no earnings to get a credit card with no income requirement in Canada.

Get a Student Credit Card

Student credit cards typically come with low or no income requirements and no annual fees to help individuals establish a credit history.

Many of these cards have lower interest rates and do not provide rewards but offer opportunities to save through points or cash back. To qualify, you must be the age of majority in your province.

Apply For a Joint Credit Card

Another way to get a credit card if you have a low salary is by applying for a joint credit card. Consider this method if your spouse or partner has a higher credit score or income that meets the requirements.

Joint credit cards have several benefits, such as credit-building opportunities and simplified money management for both cardholders.

Neo Credit Card

The Neo Credit Card is another ideal credit card for low-income earners in Canada. It is a no-fee credit card with no income requirement, offers access to high-interest savings and earns a cashback rate of 5% if you make purchases at any of its 10,000 retailer partners across Canada. You can apply and get approved in minutes and earn cash back instantly.

Neo Credit

Excellent credit card for cash back

Annual fee: $0

Rewards: Earn up to 15% cash back for first purchases at eligible partners, 5% average cash back at partner stores for subsequent purchases, and 0.5% cash back on average on all purchases.

Welcome offer: $25 bonus on approval.

Interest rates: 19.99% – 22.99% for purchases.

Minimum income requirement: None

Recommended credit score:

Fair

On Neo Financial’s website

Scotiabank Gold American Express Card

The Scotiabank Gold American Express Card is among the best low-income credit cards in Canada. It requires only a $12,000 minimum income. It is ideal if you prefer a convenient and secure payment method for daily spending. Use it to build your credit by making minimum monthly payments. It also comes with an interest-free grace period on purchases.

Scotiabank Gold American Express Card

Best travel credit card in Canada

Annual fee: $120

Rewards: Earn up to 6x Scene+ points on groceries, 5x pts. on dining, food delivery, & entertainment, 3x pts. on gas, and 1x pts. on everything else.

Welcome offer: Get up to 40,000 bonus Scene+ points in the first 12 months.

Interest rates: 20.99% for purchases, 22.99% for cash advances.

Minimum income requirement: $12,000

Recommended credit score:

Good

On Scotiabank’s website

Tangerine Money-Back Credit Card

The Tangerine Money-Back Credit Card is a no-fee credit card with no minimum income requirement that lets you earn unlimited money-back rewards on daily purchases. There are no limits on the amount of money-back rewards you earn automatically and paid monthly.

Tangerine Money-Back Credit Card

Best no-fee cash back credit card

Annual fee: $0

Rewards: Earn up to 2% unlimited cash back in up to 3 spending categories and 0.50% on all other purchases.

Welcome offer: Get an extra 10% cash back on up to $1,000 in spending in the first 2 months ($100 value).

Interest rates: 19.95% for purchases, balance transfers, and cash advances.

Minimum income requirement: $12,000

Recommended credit score:

Fair to Good

On Tangerine’s website

Scotiabank Momentum No-Fee Visa Card

The Scotiabank Momentum No-Fee Visa Card offers cash back on everyday purchases with no annual fee. It is a convenient and secure way to pay for your daily spending while building your credit history through timely minimum monthly payments. It also comes with an interest-free grace period on your purchases.

Scotiabank Momentum No-Fee Visa Card

Rewards: Earn 1% cashback on gas, groceries & drugstore purchases; 0.50% cashback on everything else.

Welcome offer: Earn 5% cashback in the first 3 months on up to $2,000 spent ($100 value); introductory 0% interest on balance transfers for the first 6 months.

Interest rates: 19.99% on purchases; 22.99% on cash advances.

Annual fee: $0

American Express Cobalt Card

The American Express Cobalt Card is a rewards credit card with no credit card minimum income requirement. It lets you earn membership rewards points with every purchase. As a Cobalt card member, you receive regular perks like offers of bonus rewards and access to events. You can also transfer membership rewards points to various frequent flyer and other loyalty programs.

American Express Cobalt Card

Best for travel rewards and perks

Annual fee: $155.88 (in monthly payments of $12.99)

Rewards: Earn up to 5X points on high-spend categories.

Interest rates: 20.99% on purchases and 21.99% on cash advances.

Minimum income requirement: No minimum income or credit limit requirements.

Recommended credit score:

Good

On Amex’s website

Best Secured Credit Card in Canada

Neo Secured Credit Card

The Neo Secured Credit Card is the best credit card for low-income individuals in Canada. It requires no income and comes with no monthly or annual fees. It also lets you earn cashback of up to 15% with leading brands and a guaranteed minimum of 0.5% cashback each month. It requires no credit check, and approval is guaranteed whether you have a good, low or no credit score.

Neo Secured Credit

Best secured credit card for bad credit

Annual fee: $0

Rewards: Earn up to 15% cashback on first purchases at eligible partners, 5% cash back at partner stores, and 0.5% unlimited cashback on everything else.

Welcome offer: $25 bonus

Interest rates: 19.99%-22.99% for purchases, 22.99%-28.99% for cash advances.

Minimum income requirement: None

Recommended credit score:

None

On Neo Financial’s website

Best Prepaid Credit Card for Low Income in Canada

Neo Money card

The Neo Money Mastercard is a free spending and savings account that lets you earn up to 5% cash back and 2.25% interest on your entire balance. It is a prepaid reloadable credit card with no income requirement, no fees or interest, and no annual fees.

Neo Money Account

Monthly fee: $0

Free transactions: Unlimited debits, Interac e-Transfers, bill payments, and deposits.

Sign-up bonus: $20 welcome bonus (after funding and making your first purchase), up to 15% cash back on your first purchases at partner stores.

Interest earned on deposit: 2.25% for spending account. Earn average of 5% cash back on purchases using the Neo Money card.

On Neo Financial’s website

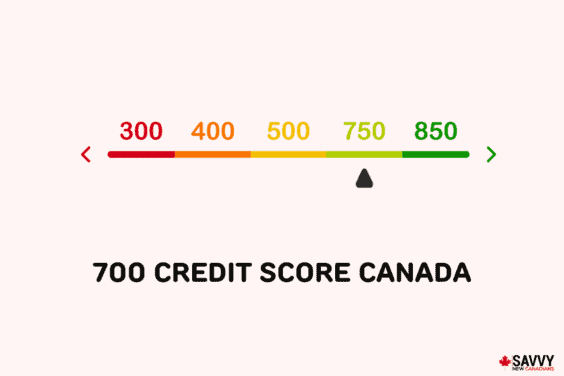

How Strict Are Credit Card Income Requirements?

Credit card minimum income requirements are stricter for premium cards, while basic credit cards come with lower income requirements, generally starting at $12,000 a year (before taxes).

Credit card companies often look at personal and household income, depending on your marital status. Some credit card issuers require no minimum income.

What Is Classified Low Income in Canada?

A household is low income in Canada if its earnings are below 50% of the median household income. In 2021, the low-income rate in the country increased to 10.6% from 9.3% in 2020.

A family is also classified as low income if it spends 20 percentage points more on essentials, including food, clothing and shelter.

In Ontario, two factors define low income:

- The individual adjusted net income for the year must be below $50,000

- The adjusted family net income for the year must be below $82,500

FAQs

A $12,000 minimum income is the lowest salary for a credit card at most banks. Others do not require a minimum salary to apply for a credit card.

Find a financial institution offering credit cards with no income requirements in Canada, such as banks or alternative lenders that accept alternative forms of income like pension payments or government assistance. You must show your capability to make timely payments to avoid late payments that can lower your credit score.

Yes, you can. If you have poor credit, a secured credit card would be one of the easiest credit cards for you to get. It requires you to make a cash deposit before you can use it. It also builds your credit because secured card issuers report it to the credit bureaus.

The Neo Secured Credit Card is the easiest to get because it requires no credit checks. It is also the best credit card for low income individuals since it has no monthly or annual fees and only needs $50 as a minimum security deposit. Plus, it rewards you with cash back at thousands of partner stores.