As a student, having a bank account is essential. However, you don’t want to pay $16.95 monthly for that chequing account to keep it open.

You can find student bank accounts in Canada at the Big Five banks, plus some online banking platforms that are specifically designed to waive most fees.

The best student bank accounts save you monthly maintenance fees and offer unlimited transactions and easy access to a credit card. Also, these bank accounts are great for both Canadian and international students.

What is the Best Student Bank Account in Canada?

Simplii No-Fee Chequing Account

$400 cash bonus offer

No monthly account fees

Unlimited transactions & Interac e-Transfers

Free personalized cheques

For the best free online bank for students, our recommended choice is the Simplii Financial No-Fee Chequing Account. Students get a $400 welcome bonus when they meet the requirements.

If you want an account at one of Canada’s Big Five banks, the Scotiabank Student Banking Advantage Plan is the best student account.

Best Student Chequing Accounts in Canada (Big Banks)

| Bank account | Fees/transaction limits | Eligibility | What happens after graduation? | Top features |

| Scotiabank Student Banking Advantage Plan | N/A | Must be enrolled in a full-time post-secondary institution in Canada or the US | Your account will be converted to the Preferred Package as of December 1st | Earn Scene+ points on everyday purchases, access the no-fee Scene+ Visa Credit Card, free credit score check |

| BMO Student Chequing Account | $16.95 monthly, waived as long as you are a student | Must be enrolled in a full-time program at a post-secondary university, college, or registered private vocational school | The account remains free for 1 year after graduation. After that, regular fees apply, starting in December of your program end date. | Free credit score check, access to 2 BMO student credit cards |

| CIBC Smart for Students | N/A | Must be a Canadian resident under age 25 | The account is free until you turn 25. If you graduate before then, your account will be converted into the CIBC Smart Start Account with unlimited banking benefits and no monthly fees. | Free SPC+ membership, free account until age 25 |

| RBC Advantage Banking for students | N/A | Must be a full-time student, at least 13 years old | Your account will be converted into the RBC Advantage Banking account with a monthly fee of $11.95. | Get up to $48 rebate on the annual fee of an eligible credit card, RBC Mobile Student Edition app, earn Avion points |

| TD Student Chequing Account | N/A | Must be a full-time student with proof of enrollment in full-time post-secondary education | Free until you turn 23, can be extended with proof of enrollment | Earn 50% more stars at Starbucks, free account until age 23, overdraft protection |

Scotiabank Student Bank Account

Scotiabank is one of Canada’s largest banks based on deposits and market capitalization. It was founded in 1832.

Its no-fee student bank account – the Scotiabank Student Banking Advantage Plan – comes with unlimited debit transactions and Interac e-Transfers.

You earn points (Scene+ Rewards) on everyday purchases and can redeem your points for free movies, food, travel, and more.

- Monthly fee: None

- Monthly debit transactions: Unlimited

- Monthly Interac e-Transfers: Unlimited

- Other perks: Free credit score check

New student clients get a $100 cash bonus when they meet the eligibility requirements for the chequing account.

The Scotiabank Student Advantage Banking account also provides access to the no-fee Scene+ Visa Credit Card, which is great for getting free movies and food.

In addition, you enjoy access to more than 4,000 branches and ATMs across Canada.

Get more details about Scotiabank’s chequing account offerings.

What happens when you’re no longer a student?

When your student status expires, or you cannot provide proof of enrollment confirming you’re a full-time student, your account will be converted to the Preferred Package as of December 1st that year.

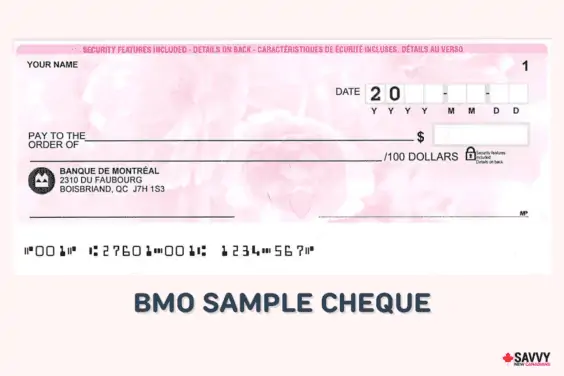

BMO Student Bank Account

The Bank of Montreal (BMO) was founded in 1817 and is one of the largest banks in Canada by market capitalization.

BMO’s student chequing account offers a $100 sign-up bonus to eligible students. The student Performance Plan account comes with unlimited monthly transactions and Interac e-Transfers.

This account normally goes for $16.95 per month; however, this fee is waived while you remain eligible as a student, plus one year after you graduate.

- Monthly fee: None

- Monthly free debit purchases: Unlimited

- Interac e-Transfers: Free

- Access to over 900 branches and thousands of ATMs across Canada

- Other perks: Check your credit score anytime

BMO student credit cards include the BMO CashBack Mastercard and BMO Air Miles Mastercard.

Learn more about BMO chequing accounts.

What happens when you’re no longer a student?

When opening the account, you’ll need to provide proof of enrollment. The student bank account is free for 4 years or until your program’s end date, with the option of extending it.

When you graduate, the account remains free for a year. After that, regular fees apply starting in December of your program end date.

CIBC Student Bank Account

CIBC was formed in 1961 through the merger of two older banks – the Canadian Bank of Commerce and the Imperial Bank of Canada.

CIBC’s student bank account has no monthly service fee and offers unlimited transactions and Interac e-Transfers.

The CIBC Smart for Students account provides a free SPC membership and access to hundreds of exclusive offers and savings from brands like Apple, Foot Locker, and Samsung.

You can keep the account open for up to 6 months after graduation.

- Monthly account fee: None

- Monthly free transactions: Unlimited

- Interac e-Transfers: Free

- Other perks: Free SPC membership (this gives you access to several student discounts at retailers)

CIBC has more than 1,100 branches and nearly 4,000 ATMs across Canada. Students get a discount on trading fees when they trade using CIBC Investor’s Edge.

Here are more details about the CIBC student account. CIBC student credit cards include the CIBC Aeroplan Visa Card for Students and the CIBC Dividend Visa Card.

What happens when you’re no longer a student?

If you graduate before turning 25, your account will be converted into the CIBC Smart Start Account with unlimited banking benefits and no monthly fees. After age 25, the account will continue as a regular CIBC Smart Account.

RBC Student Banking Account

The Royal Bank of Canada is Canada’s largest bank by market capitalization. It was founded in 1864.

Its student chequing account has no monthly fee if you are a full-time student and offers unlimited debit transactions and Interac e-Transfers.

When you open a new account, you could qualify for a cash bonus if you meet the eligibility criteria.

- Monthly account fee: None

- Monthly free debit transactions: Unlimited

- Dedicated mobile app: RBC Mobile Student Edition

- No RBC fee to use another bank’s ATM in Canada

RBC has the largest bank branch and ATM network across Canada. Here are more details about the account.

RBC student credit cards include the RBC ION Visa Card.

What happens when you’re no longer a student?

As long as you are a full-time student, you are eligible for a full waiver of the standard monthly fee. When you graduate, your account will be converted into the RBC Advantage Banking account with a monthly fee of $11.95.

Related: Best Bank Accounts for Newcomers.

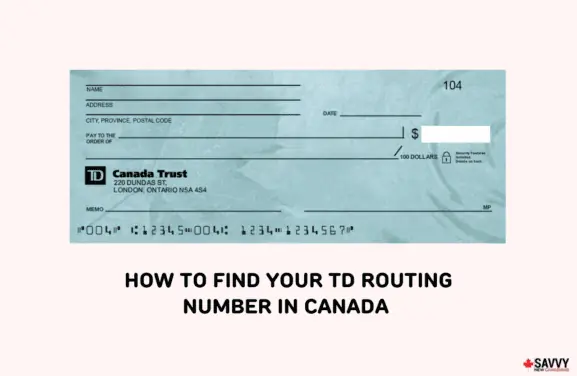

TD Student Bank Account

TD’s student chequing account has no monthly fee and offers unlimited debits and Interac e-Transfer transactions per month.

- Monthly account fee: None

- Monthly free transactions: Unlimited

- Interac e-Transfers: Free

TD Bank has over 2,300 branches and over 4,000 ATMs across North America.

TD student credit cards include the TD Rewards Visa and TD Platinum Travel Visa Card.

What happens when you’re no longer a student?

This account is free until you turn 23. After that, the fee will continue to be waived as long as you provide proof of full-time enrollment in a post-secondary program.

National Bank

National Bank has personalized offers for students, depending on their field of study. For example, if you’re studying medicine, you get these personalized benefits.

No matter your program, you get a free chequing account with no monthly fees and a Platinum Mastercard credit card.

National Bank also offers a personalized line of credit for students.

After graduation, you can switch the chequing account to one for professionals.

Best Student Online Bank Accounts in Canada

Online-only banks do not offer brick-and-mortar branches you can walk into. While this may sound like an inconvenience when you first start banking in Canada, it really isn’t.

Most transactions can be completed online these days, and an online bank’s chequing account no-fee status does not end when you graduate. You continue to enjoy access to free and unlimited transactions.

If you are unsure whether an online bank account is sufficient for you, you can open a student bank account at one of the big banks and have a supplementary online bank account elsewhere to take advantage of higher savings rates, no-fee credit cards, and other perks.

| Bank account | Fees | Transactions | Interest rate | Top features |

| Simplii No-Fee Chequing Account | N/A | Unlimited | 0.05% to 0.10% | Can be paired with a free Simplii Financial high-interest savings account, direct payroll deposit |

| Tangerine No-Fee Daily Chequing Account | N/A | Unlimited | 0.01% to 0.10% | Track and categorize your spending with the Tangerine mobile app |

| PC Money Account | N/A | Unlimited | N/A | Earn and redeem PC Optimum points, comes with a PC Optimum Mastercard, PC Financial mobile app |

| Motusbank No-Fee Chequing Account | N/A | Unlimited | 0.15% | No minimum balance, mobile app, price drop feature, earn interest on your balance |

| EQ Bank Savings Plus Account | N/A | Unlimited | 3.00% | High interest rate, free bill payments and EQ to EQ transfers |

| Neo Money Account | N/A | Unlimited | 2.25% | No minimum balance required, high interest rate |

| KOHO | Free & paid | Limited/Unlimited | Variable | Earn up to 1% cash back, comes with the KOHO Mastercard, KOHO mobile app |

Simplii No-Fee Chequing Account for Students

Simplii Financial is an online banking division of CIBC. It is one of the best digital banks in Canada, with a free chequing account that works for students and non-students alike.

Features of this account include:

- No monthly account fees

- Free and unlimited debit transactions, including bill payments and unlimited e-Transfers

- Free access to 3,400 CIBC ATMs in Canada

- Free personalized cheques

- 0.05% to 0.10% interest on your chequing account balance

- $400 sign-up bonus when you meet the eligibility requirements (link includes bonus)

- Free mobile cheque deposits

Students can also pair their chequing account with a free Simplii Financial high-interest savings account that offers a high interest rate and a Cash Back Visa Credit Card.

The Simplii Financial Cash Back Visa Card has no annual fees, and you earn 0.50% to 4% cash back on everyday purchases.

Learn more about the bank in this review.

Tangerine No-Fee Chequing Account for Students

Tangerine Bank is the online banking arm of Scotiabank and is the most popular online bank in Canada.

Its no-fee chequing account is the same for students and everyone else and comes with:

- Zero monthly account fee

- Unlimited debits, bill payments, pre-authorized payments, email money transfers, and Interac e-Transfers

- Earn interest on your chequing account balance

- Access to 3,500 free Scotiabank ATMs in Canada and 44,000 worldwide via Scotiabank’s Global ATM Alliance

- Free mobile cheque deposits

Tangerine offers a high-interest savings account that has one of the best rates available in Canada.

You can also apply for the Tangerine Money-Back Credit Card, which has no annual fees and offers unlimited 2% cash back on all purchases in up to three categories of spending.

PC Money Account

If you shop at Loblaw stores like the Real Canadian Superstore, Shoppers Drug Mart, Joe Fresh, Pharmaprix, etc., a PC Money Account can help accelerate your collection of PC Optimum points for free grocery rewards.

The PC Money Account is a spending account you can use for online and in-store transactions. It earns 10 PC Optimum points for every $1 spent (25 points per $1 at Shoppers Drug Mart).

You can redeem these points at a rate of 10,000 points = $10.

This account comes with a Mastercard you can use to take out cash for free at PC Financial ATMs located inside the company’s stores.

Motusbank No-Fee Chequing Account

The Mostusbank No-Fee Chequing Account isn’t advertised as a student-only bank, but it offers no monthly fees, no minimum balance, and free, unlimited transactions.

You also earn 0.15% interest on your balance, which is rare with most chequing accounts.

- Monthly account fee: None

- Monthly free transactions: Unlimited

- Interac e-Transfers: Free

- 0.15% interest on every dollar

When withdrawing money, you get access to over 43,000 fee-free ATMs on THE EXCHANGE Network in Canada and the Allpoint Network in the US.

Motusbank also has a Price Drop feature in their mobile app, where you can submit receipts, and if they find a better price than what you paid, you can claim your money back.

Best Student Hybrid Bank Account in Canada

A hybrid account combines the benefits of a savings and chequing account.

You earn interest on your deposits and can make unlimited free bill payments and e-Transfers. However, some do not come with a debit card, so you can only transfer money in or out using online banking.

Hybrid bank accounts are great for supplementing your existing accounts at other financial institutions.

EQ Bank Savings Plus Account

EQ Bank is a subsidiary of Equitable Bank, a Schedule 1 bank in Canada. It was launched in 2016.

This online-only bank offers a savings account that has some chequing account features. Here’s what you get in the package:

- No monthly fees

- High-interest savings account

- Unlimited bill payments and electronic fund transfers

- Unlimited Interac e-Transfers

- No minimum balance

- Free mobile cheque deposits

The EQ Bank Savings Plus Account does not offer a debit card, so you can combine it with a free chequing account elsewhere (e.g. Simplii Financial, Tangerine, or a credit union) to get the best of both worlds and access to an ATM.

Read this breakdown of EQ Bank services for more details.

Neo Financial

Neo Financial is a financial technology company that has partnerships with ATB Financial and Concentra Bank.

When you open a Neo Money Account, you get access to:

- $0 monthly fees

- Welcome bonus

- A free savings account and earn a high-interest rate on your deposits

- Unlimited free transactions online (bill payments & e-Transfers)

Neo Financial clients can apply for the Neo Credit Card, a no-fee credit card that offers up to 5% cash back on purchases at over 10,000 partner retailers.

It also offers a Neo Secured Credit Card that’s “guaranteed approval” regardless of your credit score.

In addition, this company provides mortgages and investment services through its partners.

Note that the Neo Money Account does not come with a debit card, and this account can be opened by any Canadian resident who is of the age of the majority (not only a student account).

KOHO

KOHO is another financial technology company and one of the best student accounts you can open.

This free spending and cash back rewards account comes with a reloadable prepaid card you can link with any Canadian chequing account.

When you make payments using the KOHO Prepaid Mastercard, you earn up to 5% cash back. You can spend cash back earned at any time.

A KOHO account also includes:

- Unlimited debit transactions and electronic transfers

- Access to a budgeting app

- Savings interest on your deposit

- Access to credit building (an optional paid add-on)

- $20 welcome bonus

If you are planning to open an online student banking account, you can link KOHO to it for access to ATMs and point-of-sale transaction payments.

Here is how KOHO works. It also offers paid account options.

Methodology:

The Savvy New Canadians team assessed the best bank accounts for students in Canada based on their monthly fees, transaction limits, minimum balance requirements, convenience, savings rates, promotions, and many other features. We carefully evaluated each bank account’s offerings, and our scoring methodology places more weight on each account’s overall value. Based on our research, these are some of the best bank accounts for students, but they may not be right for you. Visit the bank’s website using the links to see their updated offers before deciding.

What to Look for in the Best Student Bank Accounts

A student bank account is a chequing or savings account designed for students who are enrolled in post-secondary college, university, or CEGEP.

A student chequing account comes with a debit card and simplifies how you conduct point-of-sale transactions, deposit cheques, and receive money.

Coupled with a student savings account, you can earn interest on funds you don’t need immediately.

Here are some of the things to look for in a student chequing bank account when you are ready to open one:

No monthly fee: $0. Nada. It should not require a monthly maintenance fee for the duration of your studies.

Free Transactions: The account should offer free withdrawals, transfers, bill payments, and pre-authorized debits. While free and “unlimited” transactions should be the goal, make sure the number of free transactions included meets your needs.

Free e-Transfers: Electronic transfers make the world go round, and you want to ensure these are available for free. Again, unlimited Interac e-Transfers are the best.

ATM Access: Does the bank give you access to an ATM network that is free and convenient to access? If you routinely withdraw cash at ATMs, the fees can add up if your bank has no ATMs.

No Annual Fee Credit Cards: Access to a no-fee credit card that offers rewards when you make purchases. Here is a list of the best student credit cards in Canada.

Low or No Minimum Balance Requirement: Some bank accounts waive the monthly service fee when you keep a minimum balance, e.g. $3,000. While these offers may be tempting, the monthly fee applies if your balance dips below the minimum threshold, even for one day. No monthly fee should mean just that without any hiccups.

Promotions: A sign-up bonus or ongoing rewards program may tip the balance in favour of one account over others. Just ensure you don’t fall for ‘bait and switch’ tactics that won’t be beneficial long term.

Note that while many of these student accounts below do not have a monthly service fee, there may be fees for the use of other banks’ ATMs, paper statements, overdrafts, etc.

Best Investment Accounts for Students

It’s never a bad time to start investing…even if you have limited cash at your disposal.

Cheaper investment options for students in Canada are available through Wealthsimple and Questrade.

Wealthsimple

Wealthsimple is Canada’s most popular robo-advisor, aka online wealth manager, and the company has more than $15 billion in assets under management.

While mutual funds are still very popular as an investment tool, they can be expensive.

Robo-advisors such as Wealthsimple utilize low-cost, efficient, and diversified Exchange-Traded Funds (ETFs) in your portfolio using Nobel Prize-winning strategies.

You can invest in a non-registered investment account or a registered account (e.g. Tax-Free Savings Account – TFSA and Registered Retirement Savings Plan – RRSP) at a very low cost…0.40% to 0.50% per year.

They also offer automatic portfolio rebalancing, automatic deposits, dividend re-investing, and free financial advice. This service is entirely hands-off, and everything is done for you.

Promo: Get a $25 cash bonus when you open an account. You can also trade stocks for free using Wealthsimple Trade.

Related: Wealthsimple Invest Review

Questrade

If you are looking to buy stocks or ETFs, manage your own portfolio, and save on fees, Questrade offers one of the best stock-trading apps in Canada.

Questrade was founded in 1999 and offers trading in stocks, ETFs, options, mutual funds, precious metals, IPOs, and more.

You can open various accounts, including RRSP, TFSA, and margin accounts.

Promo: Open a Questrade account and get $50 in free trade credit.

How To Open a Student Bank Account

Opening a student bank account is generally a fast and easy process. You can open a bank account on your chosen bank’s website or visit a branch in person.

You’ll need to provide documentation that proves you’re enrolled in a full-time program at a post-secondary institution, like a timetable or proof of payment for the program.

You’ll also need to show that you’re the age of majority (if required by the bank) and prove your address.

If your student bank account is expiring and you’re still in school, you’ll need to provide updated documents that show your expected graduation date, so the bank can extend your no-fee account.

How To Choose the Best Student Bank Account

With so many student bank accounts on this list, it can be hard to choose the best one for you.

Ideally, the student bank account should have no monthly or annual fees. Check what they have for other service fees as well.

Take a look at the sign-up bonuses, transaction limits, convenience, minimum balance requirements, and eligibility criteria. Some student bank accounts allow youth as young as 13 or 14 to sign up, while others require students to be the age of majority.

You may also want to open an online-only bank like EQ Bank or Tangerine alongside a traditional bank account to take advantage of their high savings rates.

Benefits of a Student Bank Account

While you won’t have access to a student bank account forever, you can make the best use of it while you have the chance.

Typically, the bank will automatically convert your account into a paid plan after you graduate.

A student bank account allows you to access credit products, including credit cards, and you can start building your credit history and credit score.

You save on the monthly fees and enjoy free transactions with withdrawals, transfers, bill payments, and e-Transfers, usually included for free with your student banking package.

Since these bank accounts are specifically designed with students in mind, the banks may also offer fee breaks or discounts on other banking products, such as credit cards, investments, and insurance.

Lastly, using your student bank account alongside a budgeting app can help you learn the basics of money management and responsibility.

Related: Best Banks for International Students.

Downsides of a Student Bank Account

While student bank accounts offer no fees, unlimited transactions, and other perks, there are a few downsides.

When you graduate, you will need to be on the lookout as your account will be converted into one with monthly fees. Some banks will not extend their offer after you turn a certain age, even if you are still in school.

Most banks only offer student accounts for full-time students, meaning that part-time students will not qualify. The same goes for high school students, as most banks only recognize post-secondary institutions.

FAQs

International students can sign up for both CIBC and Scotiabank bank accounts. It all comes down to what offers and benefits you prefer. Scotiabank’s student account gives you access to the Scene+ Visa credit card, and new students get a cash bonus, while CIBC’s offers a free student account up to one year after graduation plus a cash bonus.

Yes, you can have 2 or more bank accounts in Canada. Be sure to take a look at the banks’ fees, limitations, and any other details to ensure they meet your needs.

All bank accounts on this list have no monthly fees for students. Here is our list of the top free chequing accounts in Canada.

Most banks on this list provide a debit card to use with the student bank account. One of the best debit cards is the Scotiabank Visa Debit card, as you can earn Scene+ points as it is linked to the Scotiabank Student Account.