The new RBC ION Visa credit card from the Royal Bank of Canada covers the basics if you want a no-annual-fee card that earns competitive rewards.

Cardholders earn up to 1.5 Avion points per dollar spent on everyday purchases and get access to other perks.

This RBC ION Visa review covers its top features, benefits, and alternative credit cards.

RBC ION Visa Overview

- $0 annual fee

- $0 annual fee for additional cards

- 0.99% promotional interest rate for cash advances and balance transfers for the first 10 months (offer available until December 6, 2023)

- 19.99% regular interest rate on purchases

- 22.99% regular interest rate on cash advances and balance transfers (21.99% if you reside in Quebec)

- Earn 1.5x Avion points per $1 spent on grocery, gas, daily transit, rideshares, streaming, and digital subscriptions

- Earn 1x Avion point per $1 spent everywhere else

- 3,500 bonus Avion points on approval for a limited time

RBC ION Visa Card Benefits

For a no-annual-fee credit card, the RBC ION Visa has a comparably good earning rate.

1. Welcome bonus: New cardholders earn 3,500 bonus Avion points on approval for a limited time.

2. Earn Avion Points: You earn 1.5 Avion points per $1 spent on the following purchase categories:

- Groceries

- Gas

- Public transit, rideshare, and electric vehicle charging

- Streaming, digital gaming, and digital subscriptions

For all other purchases using your card, the earn rate is 1 Avion point per $1 spent.

3. Save at Petro-Canada: When you link the RBC ION Visa to your Petro-Points account and pay with the card, you save 3 cents per litre on gas or diesel purchases at Petro-Canada and earn 20% more Petro-Points and Avion points.

4. Complimentary DashPass Subscription: Cardholders get a 3-month complimentary DashPass subscription valued at almost $30. This subscription includes unlimited $0 delivery fees on orders of $15 or more when you pay with your RBC credit card.

5. Standard insurance coverage: This card comes with purchase security and extended warranty insurance coverage.

6. Other Perks: RBC credit card users can link a Be Well card and earn 50 Be Well points per $1 spent on eligible purchases at Rexall.

Downsides of the RBC ION Visa

The RBC ION Visa does not include comprehensive or travel insurance coverage benefits, but this is typical for entry-level credit cards.

Also, there is a minimum redemption threshold of $10 when redeeming your Avion points.

Lastly, this card requires a good credit score to qualify.

How To Redeem Avion Points

You can redeem Avion points as a statement credit to pay off your credit card balance or for merchandise and gift cards.

For gift card redemptions, the conversion rate is 1 Avion point = 0.71 cents.

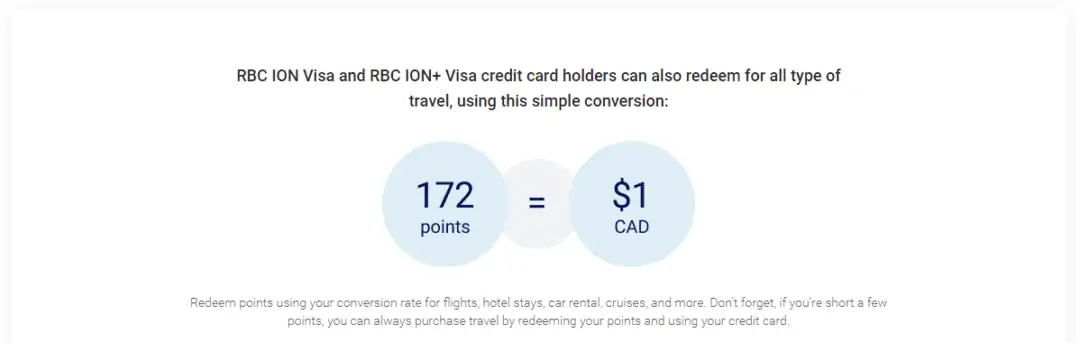

Avion points can be used to pay for travel via the Avion Rewards website with the conversion rates below.

How To Apply For The RBC ION Visa Card

You can apply for the RBC ION Visa by visiting their website (refer to the RBC page for up-to-date offer terms and conditions).

While there is no published minimum income requirement, you will need a good credit score to qualify.

RBC ION Visa Alternatives

For no-annual-fee cash back card alternatives, you can also look at the Tangerine Money-Back Credit Card and RBC Cash Back Mastercard.

Alternatively, you can pay a small monthly fee for the RBC ION+ Visa for access to additional benefits.

Tangerine Money-Back Credit Card: This Tangerine credit card has no annual fee. Cardholders earn 2% unlimited cash back in 2-3 purchase categories and 0.50% cash back on all other spending. Learn more.

Tangerine Money-Back Credit Card

Rewards: Earn up to 2% unlimited cash back in up to 3 spending categories and 0.50% on all other purchases.

Welcome offer: Get an extra 10% cash back on up to $1,000 in spending in the first 2 months ($100 value); 1.95% balance transfer rate for 6 months.

Interest rates: 19.95% for purchases, balance transfers, and cash advances.

Annual fee: $0

RBC Cash Back Mastercard: This no-annual-fee RBC credit card pays 2% cash back on groceries (on up to $6,000 spent annually), and 0.50% to 1% cash back on all other purchases. Learn more in this review.

RBC ION+ Visa: A step up from the RBC ION Visa, the RBC ION+ Visa Card has a $4 monthly fee and offers:

- 3x Avion points per $1 spent on grocery, dining, food delivery, gas, rideshares, daily public transit, EV charging, streaming, digital gaming, and digital subscriptions

- 1 Avion point per $1 spent on everything else

This card also includes mobile device insurance, purchase security, and extended warranty insurance.

Get more details in this review.

Is the RBC ION Visa For You?

If you are looking for an entry-level credit card with no annual fees and easy-to-understand rewards, the RBC ION Visa may be for you.

For a $4 monthly fee, you can earn double the points on groceries, gas, daily transit, and streaming subscriptions, by opting for the RBC ION+ Visa instead.

Alternatively, the Tangerine Money-Back Credit Card also works well for earning cash back on everyday purchases, and it does not have an annual fee.

Related: