While paper cheques are not as common as they once were, and you are now more likely to send someone money using electronic alternatives like Interac e-Transfers and email money transfers, you may still need to write a cheque every now and then.

Sample cheques come in handy when you need to set up direct deposit with your employer or clients or you need to set up pre-authorized debits for periodic billing purposes.

This guide details how BMO sample cheques work, how to read a BMO cheque, and how to print a BMO void cheque online.

How To Get a BMO Sample or Void Cheque

You can get a BMO void cheque by writing “VOID” on an existing BMO cheque using a dark pen or permanent marker.

If you don’t have a BMO chequebook or want to save your paper cheques for better use, you can download a BMO void cheque sample through your online banking account.

Follow these steps to get a BMO void cheque online:

- Sign in to your BMO Online Account

- Select the bank account you need a void cheque for under “My Accounts”

- Select the “Void Cheque” link

- You can now view and download your void cheque

You can also download a BMO void cheque in PDF using the BMO Mobile Banking app.

BMO’s void cheque/direct deposit form contains all the information that would normally be on a cheque (i.e. transit number, institution number, and account number).

You can provide a copy of this to your employer or anyone looking to set up direct deposit or pre-authorized debit to and from your bank account.

Void cheques are not available for download on Small Business accounts. For this, you will need to order cheques and void one of them to use.

Related: Best BMO Savings Accounts in Canada

How To Read a BMO Sample Cheque

A sample cheque is often required when you need to set up direct deposits to your bank account or pre-authorized debits (such as loan repayments, rent, mortgage, insurance, or childcare).

Canadian cheques are similar in the information they contain, and you can follow the same steps to write a cheque for BMO, TD, RBC, CIBC, and other banks.

A BMO Bank sample cheque is also referred to as a BMO “specimen” or “void” cheque.

So, what information does a BMO sample cheque contain?

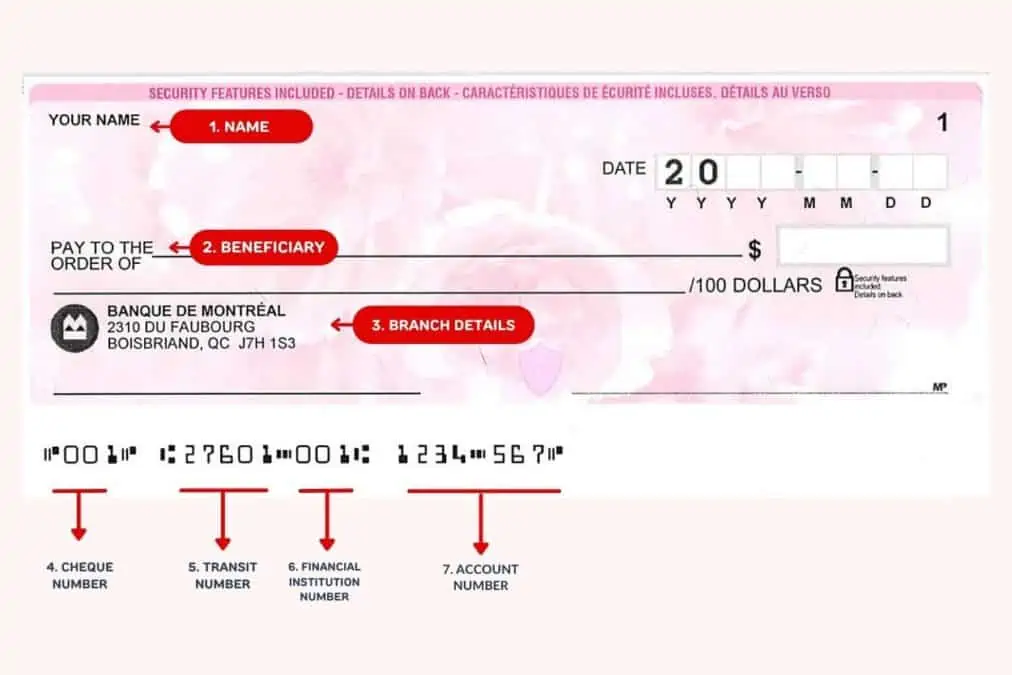

1. Name: Your name is printed at the top of the cheque. This indicates you (the “drawer”) who owns the bank account from which funds are being withdrawn. Your home address is also printed under your name.

2. Beneficiary (payee): This section is where you write the name of the individual or organization to whom you are making a payment. For a void or sample BMO cheque, this section is left blank.

3. Bank account and branch details: This section includes the bank name and the address of the bank branch where your account is held.

4. Cheque number: This 3-digit number is what the bank uses to identify the cheque transaction in your bank statement. On your BMO cheque, it is shown at the far left bottom in the MICR (Magnetic Image Character Recognition) encoding line as well as on the top right corner of the cheque.

5. Transit (branch) number: This 5-digit number refers to the specific bank branch where you initially opened your bank account.

6. Financial institution number: This 3-digit number is also referred to as the bank code. The Bank of Montreal’s institution code is 001. This institution number stays the same regardless of which BMO branch you use.

7. Account number: This 7-12 digit number identifies your bank account. BMO bank account numbers are 7-digit long and include a dash.

When you combine BMO’s institution number and transit number and add a leading zero “0”, you get your routing number.

For example, using the BMO sample cheque above, your BMO routing number is 00011234567.

Related: TD Savings Account Review.

How To Write a BMO Cheque

You can easily write a BMO cheque by following these steps:

- Write the date in the upper right corner of the cheque.

- Write the name of the payee (beneficiary) on the line where it says “Pay to the order of”.

- Write the amount of money you are paying. If the sum includes cents, you can add them in the “ /100” area. For example, $100.50 can be written as “One hundred dollars and 50/100”. You should also fill out the box where you have the “$” sign with the amount in figures.

- Fill out the “Memo” section with the reason for the payment. For example, “February rent”.

- Sign the cheque at the bottom left corner to make it official.

BMO Sample Void Cheque FAQ

You can print off a BMO specimen or void cheque from your online banking account.

You can order BMO cheques online for a fee. While you can print your own cheques, they will need to meet certain requirements, including ensuring that your bank account information is written in magnetic ink.

Related: