If you have used the services of a financial institution to send money or perform other financial transactions, you likely have come across bank routing numbers, also called bank codes.

Every bank, including TD Canada Trust, uses a bank routing number. It typically consists of a five-digit transit number and a three-digit number exclusive to a financial institution. For TD, the code is 004.

This post will guide you on how to find your TD routing number on a cheque, online and on the TD Bank app.

How to Find the 9-Digit Routing Number for TD Bank Canada

There are only typically eight digits in routing numbers in Canada, but if a bank asks for a 9-digit number, you only need to add a 0 at the beginning of the set to complete the bank code.

Below are three ways to find the routing number for TD Bank Canada.

How to Find Your TD Routing Number on a Cheque

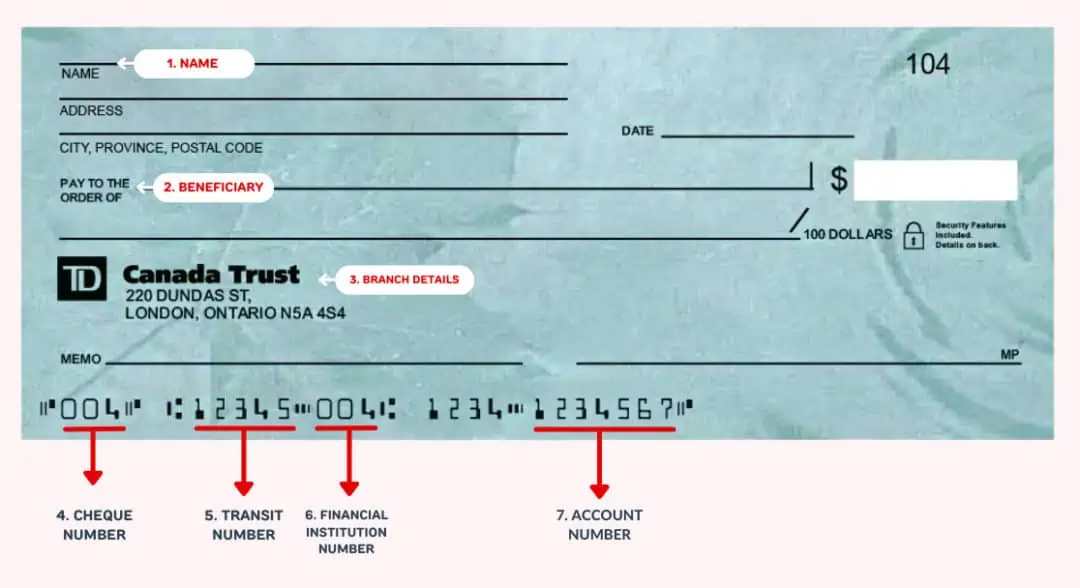

Find the routing number in a TD cheque on the lower left corner of the cheque, as seen in the image above.

How to Find Your TD Routing Number Online

Here are the simple steps to find your TD routing number online:

- Log in to your EasyWeb account.

- Find and choose the account you wish to view.

- At the right side of the page, select the “Direct deposit form (PDF)” link.

The pre-filled Direct Deposit form is pre-filled with the routing number, which consists of the 5-digit transit/branch code, the 3-digit financial institution number, and the 7-digit account number.

You can also go to the “Account Details” section of Online Banking to find the routing number.

How to Find Your TD Routing Number on the TD Bank App

Using the TD Bank app, access the pre-filled direct deposit form to find your TD routing number. Here are the steps:

- Log in to the TD Bank app.

- Find the account you want to access.

- On the “Account” screen, tap “Summary.”

- Select “Direct Deposit Information – View.”

You will then find your bank account details on screen, which will contain the transit number, institution number, and account number.

The app allows you to download a copy of the information. For convenience, you can also save the information you find on screen.

How to Find Your TD Account Number

On the cheque, you will find your TD account number on the lower left side of the check. Your account number is the 7-digit number at the end of the code.

On the app and online, locate your TD account number on the pre-filled direct deposit form or on the “Account Details” section of Online Banking.

What is a Routing Number in Canada?

As mentioned, the routing number, or bank code, in Canada is a set of numbers made up of the following:

- Branch number or transit number. It shows what branch you opened your account at. This 5-digit code ensures banks route the funds securely to a bank’s specific branch.

- Financial institution number. This 3-digit code is a unique numerical number that identifies a financial institution and allows banks to recognize a particular institution and process transactions with the said bank.

- Account number of an individual’s bank account. This number set helps in the proper transfer of funds to a designated account holder during a financial transaction.

What is a Routing Number Used For?

A routing number ensures that banks correctly and securely forward funds to the intended person at the indicated bank branch. In other words, this number denotes exactly where funds go during a bank transaction.

FAQs

No, TD Bank uses different routing numbers. Each one is meant for a particular bank transaction. The different types of bank codes TD uses include wire transfer routing numbers and ACH routing numbers.

An IBAN (International Bank Account Number) acts as a routing number that identifies your personal account in international financial transactions. IBAN is a standard international numbering system that European countries and other regions primarily use to identify overseas bank accounts.

No, it is just one part of a routing number. The transit number is the code that shows the branch location connected to a bank account. The other component of a routing number is the financial institution number, a three-digit code that identifies the bank of the account holder.

You can use the SWIFT code for financial transactions that will cross international borders. For local payments, you only need the routing number.

Related: