Access to a small business banking account will help you separate your personal and business finances and access bank features best suited for businesses.

For example, Loop Financial, a fintech that offers one of Canada’s best small business accounts, provides business-friendly features such as lower transaction fees, the option to get a corporate card, and access to a line of credit.

This review article covers what you should know about Loop Financial, including its top features, benefits, downsides, fees, and application process.

Key Takeaways

- Loop offers global business accounts with physical and virtual cards, as well as flexible credit limits for businesses.

- Loop’s benefits include a free plan, access to cheaper international transactions, and the ability for multiple users to utilize the platform.

- When using Loop, remember that you won’t be able to visit traditional branches, and ATM withdrawals are always subject to convenience fees.

Loop: An Overview

Founded in 2015, Loop is a Toronto-based Financial Technology company that provides banking services to enterprises, startups, and brands.

Despite not being a bank, it has made its name by seamlessly helping Canadian businesses conduct international transactions through its multicurrency accounts, which have zero currency conversion fees and little to no transaction delays.

Apart from its “global banking” features, Loop also helps businesses better control their finances through a unified dashboard that shows all their payables and receivables.

Loop Financial Features

Let’s go over the main features of Loop Financial for small businesses.

Global Business Accounts

One of Loop’s main distinctive features is its global banking functionality, which allows Canadian business owners and their employees to transact internationally seamlessly.

Specifically, in addition to opening a Canadian account, Loop lets users open domiciled accounts in the U.S., EU, and UK, allowing them to avoid conversion fees and payment delays when making transactions with contractors or clients within those regions.

According to Loop, its FX rates are up to 80% cheaper than traditional banks. It converts 37 currencies instantly, making it easy to grow your business globally.

Physical and virtual cards

Loop offers virtual and physical cards that business owners and employees can use like any corporate card. These cards have no monthly or annual fees, allow multiple currency spending, and allow you to earn rewards for your USD spending.

Given their versatility, we ranked the Loop Card as one of the best business credit cards for small businesses.

Flexible Credit Limit

Through Loop’s flexible credit limits, which don’t appear on your personal credit report, businesses can easily extend their working capital.

Depending on your business’s performance over the past few months, you may eventually be eligible to access up to $50,000, but higher limits may be offered occasionally or upon request.

Since Loop directly connects to the business’s sales channels, it automatically adjusts your credit limit monthly based on your business’s growth. Loop’s monthly interest rates start at 1.2% for Invoice Financing and 1.5% for PO Financing.

Note: To access Loop’s credit line, which falls under Loop’s Capital Products, you must pay a fixed monthly fee ranging from $99 to $499.

Seamless Billing Process

Loop also lets businesses manage all their receivables with just a few clicks.

Through Loop’s Invoices dashboard, you can send unlimited payment links that let you avoid processing fees and delays and conveniently track the invoice status of all invoices you’ve sent, making it easy to ensure your business avoids payment delays.

Loop also automatically sends reminders to customers with overdue invoices on your behalf, so you don’t have to deal with awkward follow-ups personally.

Expense Management Tools

Loop lets you manage and visualize your multi-currency corporate spending in one dashboard.

To name some expense management features Loop offers, you can set custom rules and approval flows to control your employees’ spending, digitalize all receipts your business receives, and automatically integrate your business with accounting systems like Xero and Quickbooks.

Benefits of Loop

These are the benefits you can expect when using Loop for your business:

- The Basic plan is entirely free to use

- International transactions can be cheaper and faster for your business

- Loop allows spending access to employees, not just business owners

- Credit lines offered by Loop won’t affect your personal line of credit

- Loop is a one-stop platform for most of businesses’ financial needs

Downsides of Loop

Let’s go over some downsides I’ve noticed while using Loop:

- Unlike traditional banks, Loop doesn’t have physical branches

- You must pay anywhere from $99 to $499 a month to borrow monthly from Loop

- ATM withdrawals are subject to convenience fees

Loop Pricing Plans and Fees

In all of its pricing plans, Loop offers the following features:

- Free access to USD, GBP, and EUR accounts

- Free international payments

- Custom spending rules and approval controls

- Unlimited team members with accounting permission

- Automatic integration with Xero and Quickbooks

Apart from these, Loop’s features vary depending on which plan you’re subscribed to. I summarize over the differences between Loop pricing plans below.

| Basic | Loop Plus | Loop Power | |

| Price | Free | $49/month | $199/month |

| Virtual Cards | 20 | Unlimited | Unlimited |

| Maximum physical Cards | 2 | 10 | 10 |

| FX Fee | 0.50% | 0.25% | 0.1% |

| Rewards | 1X points on Card Spend | 2X points on Card Spend | 2X points on Card Spend (custom rewards) |

| Additional features | N/A | All Basic plan features + instant payment clearing | All Loop Plus features + a dedicated concierge |

How To Get Started With Loop

Getting started with Loop is as easy as visiting its website, clicking the “Open Account” button on its landing page, and filling in the necessary information to create an account.

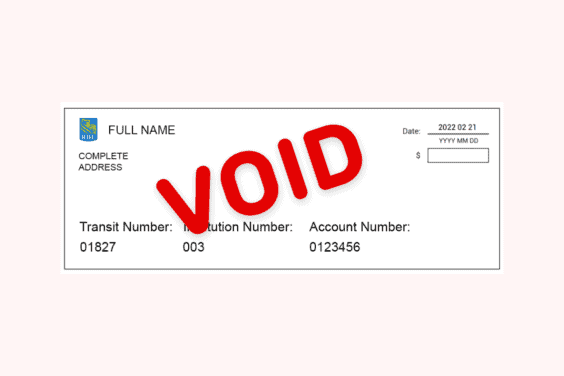

Some documents you can expect Loop to request from you during the registration process include your business registration document, proof of business address, proof of residential address, and a photo ID to confirm your identity.

Is Loop Legit?

Yes, Loop Financial is a legitimate financial platform. As per its website:

Loop operates within the requirements of the Canadian regulatory environment. Our business entities maintain the appropriate regulatory registration for the services we provide, including with OBSI, FINTRAC, and all Canadian securities regulators.

Plus, it uses industry-standard encryption and has a 24/7 fraud monitoring system to ensure your account is protected.

If you want to learn more about Loop, its team offers a free 30-minute consultation call to help you better understand whether this platform is best for your business.

Loop Alternatives

Loop Financial is one of the best small business financial accounts you can open in Canada, but it may not be for everyone. Here are the top 3 alternatives you can consider.

Float Business Card

This card combines spending, savings, and credit features that can help you manage your business finances efficiently. I personally use the free Float card to save on FX fees and earn high-interest rates on my unused USD balance.

Like Loop, Float offers various tools to automate business accounting and expense tracking.

Float Business Credit Card

Rewards: Earn 1% cash back on spending that exceeds $25,000 monthly; get access to multiple CAD and USD cards and pay no FX fees. You also earn 4% interest on your CAD and USD balance.

Welcome offer: Get $500 in cashback for becoming a Float customer and spending $25,000 within the first 90 days.

Interest rates: Not applicable (for refunded prepaid cards).

Annual fee: $0 for standard cards.

Wise Multicurrency Account

Similar to Loop, Wise is an online-based Money Service Business that many businesses use as a bank alternative.

With a Wise account, you can get local bank details for up to 9 currencies and hold a balance in over 40 Wise-support currencies, allowing you to send and receive international payments seamlessly.

It also offers a physical Wise card for daily transactions. Unfortunately, Wise doesn’t offer as many features as Loop when managing business expenses or obtaining extra capital.

RBC Digital Choice Business Account

For only $6 per month, the RBC Digital Choice Business Account offers unlimited electronic debit/credit transactions, electronic cheque deposits, and unlimited Moneris deposits, making it easy to receive payments from your clients.

It offers 10 free Interac e-Transfers per month and gives business owners access to business-relevant mentorship programs, online courses, and Payroll Solutions from over 20 partners.

Unlike Loop or Wise, this account isn’t focused on international transactions, but it’s handy if you’re already an RBC account holder and primarily want to conduct domestic transactions online.

Tangerine Business Savings Account

Tangerine, an online-only bank that is a subsidiary of Scotiabank, offers a savings account that lets businesses earn interest on funds they are not utilizing.

Unlike Loop, this account focuses on saving rather than spending, but it’s still a great option for businesses looking for an account to hold their balance.

The Tangerine Business Savings Account has zero monthly fees and allows businesses to earn interest with no minimum balance required.

Conclusion

While Loop Financial is relatively new in the market, it is fast establishing itself as one of the top one-stop banking solutions for small businesses in Canada.

If you want to try Loop, I recommend starting with its Basic plan over several weeks. Opening an account is completely free, and you can always look for alternatives if you think Loop isn’t for you.

Related: Laurentian Bank of Canada Review