If you are looking to DIY your investments and become a self-directed investor, you will need access to a brokerage account.

In Canada, there are online brokerage platforms owned by the big banks (e.g. CIBC Investor’s Edge) and independent online discount brokers with no bank affiliations (e.g. Questrade and Wealthsimple Trade).

When investors choose a brokerage account, their choice often comes down to these six factors:

- Trading fees and commissions

- Platform versatility and features

- Account types offered

- Investment products available

- Customer service support, and

- Security

This CIBC Investor’s Edge review covers how the platform does with each factor and how it compares to alternative discount brokers in Canada.

CIBC Investor’s Edge Summary

CIBC Investor's Edge

-

Ease of use

-

Trading fees

-

Accounts offered

-

Investment products

-

Security

Overall

Summary

CIBC Investor’s Edge is a division of CIBC Investor Securities Inc., which is a subsidiary of the Canadian Imperial Bank of Commerce (CIBC). The CIBC Investor’s Edge app is available on both the App Store and Google Play store as the CIBC Mobile Wealth App.

It supports multiple investment products and accounts, including RRSP, TFSA, RESP, RRIF, corporate and estate accounts. Compared to other big bank brokerages, standard trading fees on this platform are well below $10 per trade. That said, annual maintenance fees still apply to smaller accounts.

Pros

- Lower trading fees compared to other big banks.

- Multiple investment account options and products.

- A mobile app is available.

- Access to free research tools, analyst reports, and educational resources

- Discounts for students and active traders.

Cons

- $100 annual account maintenance fee for smaller balances.

- Standard trading fees are not the lowest.

How CIBC Investor’s Edge Works

Below, we cover the various types of accounts you can open using CIBC Investor’s Edge, types of investment products, trading fees, platform features, benefits, downsides, and more.

CIBC Investor’s Edge Accounts and Investments

You can open all the main investment accounts using CIBC Investor’s Edge, including:

- Tax-free Savings Account (TFSA)

- Registered Retirement Savings Plan (RRSP)

- Registered Education Savings Plan (RESP)

- Registered Retirement Income Fund (RRIF)

- Locked-in RSP (LRSP)

- Locked-in Retirement Account (LIRA)

- Locked-in Retirement Income Fund (LRIF), and

- Prescribed Retirement Income Fund (PRIF)

In addition to the registered accounts above, the platform also supports non-registered accounts, such as margin and cash accounts, plus non-personal accounts, including:

- Corporate or Partnership

- Investment Club

- Formal Trust, and

- Estate accounts

Investors can access a variety of investment assets using CIBC Investor’s Edge. The choices available are stocks, ETFs, options, mutual funds, GICs, bonds, and precious metals certificates.

The commissions for trading these assets differ, and we summarize them below.

Here is a guide on how to invest in stocks.

CIBC Investor’s Edge Trading Fees

Of the brokerage platforms big banks own, CIBC Investor’s Edge’s fees are some of the most competitive.

However, you could save even more if you go with a no-commission brokerage platform, particularly with ETF trades.

| Stocks | ETF | Options | |

| Standard Trading Fee | $6.95/trade | $6.95/trade | $6.95 + $1.25 per contract |

| Student Pricing | $5.95/trade | $5.95/trade | $5.95 + $1.25 per contract |

| Active Trader Pricing | $4.95/trade | 4.95/trade | $4.95 + $1.25 per contract |

| Telephone Trades | $50 minimum commission | $50 minimum commission | $50 minimum commission |

To qualify for “Active Trader” pricing, you must place 150 or more trades per quarter.

There is no additional charge to purchase mutual funds. However, each mutual fund is subject to a management fee and other fund expenses incurred by fund companies to manage a mutual fund.

For precious metals (gold and silver) certificates, a commission up to $40 + 0.105% – 0.25% of the trade value applies.

Other CIBC Investor’s Edge Fees

Non-registered accounts with combined assets of $10,000 and below are subject to an annual maintenance fee of $100. This fee is waived if a client opens a registered retirement account.

For registered retirement accounts, this annual fee applies when your balance is $25,000 or less.

The margin rate for non-registered accounts is 4% (CAD) or 4.5% (USD). For a registered account, the margin rate is 5% (CAD) or 5.5% (USD) as of January 3, 2022 (subject to change).

Additional fees that may apply to your account include:

- Full RRSP plan withdrawal: $100

- Partial RRSP withdrawal: $50

- RRIF or LIF account closure: $25

- Investment account transfers: $135 (Transfer outs)

- Duplicate statements: $10 each

CIBC Investor’s Edge Platform and Tools

CIBC Investor’s Edge is available through a web-based platform and a mobile app (CIBC Mobile Wealth App).

You can use the platform to trade thousands of stocks, ETFs, options, and mutual funds listed on Canadian and U.S. exchanges.

Its functionality includes access to:

Trade notifications and alerts: You get email notifications when your orders have been completed. You can also set alerts for price movements, news, and more.

Market data and charting: Get access to real-time data and various types of indicators for technical analysis. It also offers screeners.

Watch lists: You can build up to 20 customized watch lists to track investments you are interested in.

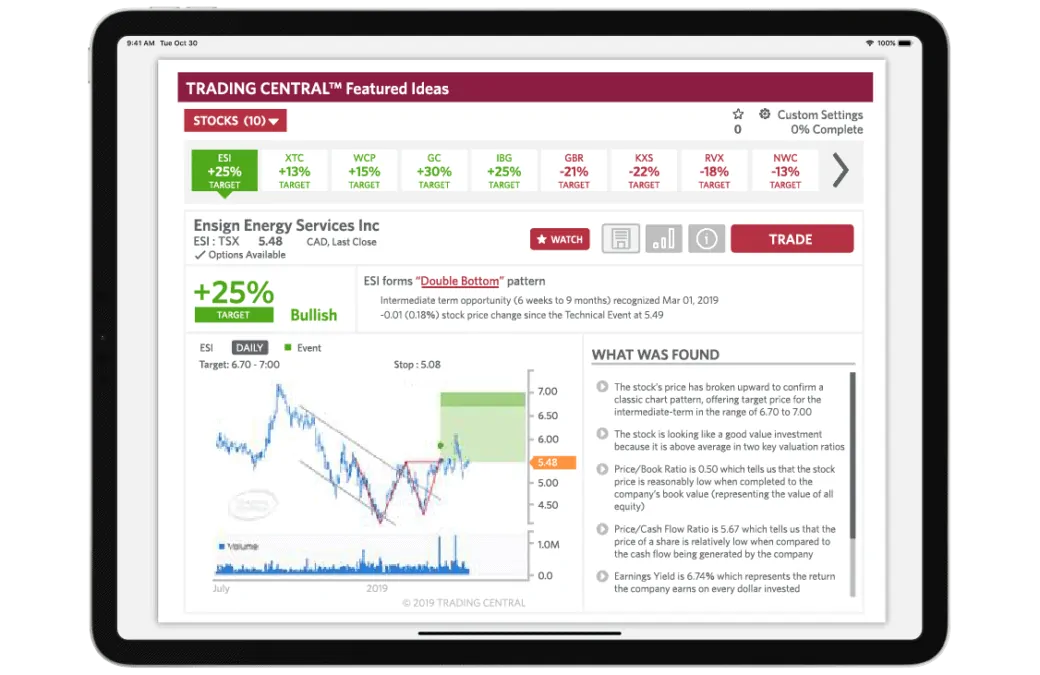

Research and investment education: You gain access to a daily newsletter from Trading Central, including trade ideas and sector-specific market information. It also includes insights from leading CIBC investment experts and other industry sources.

Clients can also get access to CIBC’s Learn, which is an educational platform that has a variety of educational content and articles across multiple topics and product categories – Equity, Options, Mutual Funds, and more written by CIBC and industry experts.

Is CIBC Investor’s Edge Safe and Legit?

CIBC is one of the largest banks in North America and a top-5 bank in Canada. CIBC Investor’s Edge is a division of CIBC Investor Services Inc., which is a subsidiary of CIBC.

CIBC Investor Services Inc. is a member of the Canadian Investor Protection Fund (CIPF) and the Investment Industry Regulatory Organization of Canada (IIROC).

CIPF membership means that your investments in certain account types are protected by up to $1 million against member firm insolvency.

CIBC customers enjoy a “Digital Banking Guarantee” with a promise that returns 100% of the money they lose due to unauthorized transactions on their account (subject to terms and conditions).

Pros of CIBC Investor’s Edge

To summarize the platform, here are some of its benefits and downsides:

- A brokerage owned by one of Canada’s largest banks

- Competitive trading fees and commissions (compared to other banks).

- Access to multiple investment accounts and products.

- Access to a mobile app on iOS and Android devices.

- Free research tools, analyst reports, and educational resources.

- Student and active trader discounts are available.

Pros of CIBC Investor’s Edge

- $100 annual account maintenance fee for accounts below $10,000/$25,000 depending on whether it is a registered or non-registered account.

- The standard trading fees are not the lowest in the industry. Wealthsimple Trade does not charge a commission on Canadian ETF and stock trades, while Questrade’s fees start at $4.95.

CIBC Investor’s Edge Promotion

**Expired** For a limited time, you can get 100 free online stock or ETF trades or up to $3,000 cashback.

| Amount transferred | Cashback |

| $5,000 to $24,999 | $100 |

| $25,000 to $99,999 | $200 |

| $100,000 to $249,999 | $500 |

| $250,000 to $499,999 | $750 |

| $500,000 to $999,999 | $1,500 |

| $1 million + | $3,000 |

CIBC Investor’s Edge vs. Alternatives

The table below shows how CIBC Investor’s Edge compares to Scotia iTrade, RBC Direct Investing, and Wealthsimple Trade.

| CIBC Investor’s Edge | Wealthsimple Trade | Scotia iTrade | RBC Direct Investing | |

| Stock trading fee | $6.95 | $0 | $9.99 | $9.95 |

| ETF fee/trade | $6.95 | $0 | $9.99 | $9.95 |

| Options fee/contract | $6.95 + $1.25 | N/A | $9.99 + $1.25 | $9.95 + $1.25 |

| Commission-free ETFs | No | All ETF trades are commission-free | A few (purchases only) | No |

| Types of accounts | RRSP, TFSA, RESP, RRIF, LRSP, LIRA, PRIF, LRIF, cash, Margin, Corporate, Formal Trust, Estate, Partnership | TFSA and RESP | TFSA, RRSP, RRIF, RESP, cash, margin, investment club, trust, corporate, partnership, non-profit organizations | TFSA, RRSP, RESP, RRIF, margin, corporate, investment club, partnership |

| Minimum investment | None | None | None | None |

| Trading commission discount | $5.95/trade students; $4.95/trade for active traders (stocks) | N/A | $4.95/trade for active traders (stocks) | $4.95/trade for active traders (stocks) |

| Maintenance fees | $100/year; waived with $10K-25K balance | None | $25 per quarter if balance is ≤ 10,000 | $25/quarter if balance is less than $15,000 |

| Platform | Web and mobile app | Web and mobile app | Web and mobile app | Web and mobile app |

| Mobile App rating | 3.3/5 on App Store | 4.7/5 on the App Store | 1.2/5 on the App Store | 4.8/5 on the App Store |

| Transfer-in fees waived? | Up to 100 free trades or $3,000 cash back | Up to $150 with transfers of $5,000+ | – | Up to $200 with transfers of $15,000+ |

| Other features | Access to advanced charting tools, market data, and investor education | $25 sign-up bonus; access to robo-advisor service; crypto-trading; SRIs, free money transfer app, and high interest savings account | Sustainable investing tools; referral program | Access to robo-advisor service via RBC Investease |

| Learn more | – | Read review | Read review | Read Review |

CIBC Investor’s Edge FAQ

You can set up cash transfers from your CIBC chequing account or link an account from a different bank. Pre-authorized debits can be set up to make recurring deposits in your investment account. You can also deposit funds in your account using a cheque.

To waive the $100 annual maintenance fee on non-registered accounts, you must maintain a balance of at least $10,000 or hold a registered retirement account. To waive the $100 annual administration fee on registered retirement accounts, you must maintain a balance of at least $25,000. Students get a $1 discount on equity and ETF trades, while active traders get a $2 discount per trade.

A margin account allows you to borrow money against the investments in your account so you can use the borrowed funds to purchase more securities. A margin account amplifies your gains or losses and increases your risk. It is similar to a line of credit, and you pay an interest rate on the amount borrowed.

Don’t let the lower trade fees suck you in. The worst customer service. Chat is always closed and you will often get “Internal error, please contact us” when you try to place a trade. Then you will wait forever on hold. On top of this, I have had market orders take over 40 minutes to get filled. If the only other option was a shifty broker running his server out of the back of his car, pick that one.

I agree with the above comment. The foreign exchange portion of their portal was taken down to fix technical issues. It has been down for a week. Had to wait for a total of 5.5 hrs over three attempts before someone answered the phone. Their application is good, their customer service is the worse.

Do you want to have your entire trading account held hostage for months? Well CIBC Investors edge is for you! They’ll keep you on hold indefinitely and won’t answer the phone for months on end! Think going to a branch will help you? Think again, they will not be able to get your money into your account. I have 10’s of thousands of dollars stuck in my US funds account and I have no way of getting it back until they finally answer the phone, I’ve easily spent over 12 hours on hold , I end up having to hang up the phone and call back every time, I’ve sat on hold for a total of 3 hours one time! No one is answering , I want to get out of CIBC Investors edge ASAP, totally unacceptable.

Agree with all the above comments. Chat never works, the customer phone service will have you waiting 3 hours for a call to be picked up. Its customer service is horrible.

Terrible phone service. Impossible to contact unless you are willing to waste hours of your time on hold while listening to an annoying assurance that “your call is important to us”.

Terrible..waited for over 2 hours on phone and finally gave up.

Support is the worst ever

Trades are lagging..

Markets closed and trade was still pending even when the limit price was set

Haven’t talked to a representative yet..

Terrible for such a large corporation..

Agree with all the negative comments. Today (Feb 1, 2021) I waited 2 hours on the phone, then it cut out. Called again, it cut out again after 2 hours. Called last Friday, cut out after 2 hours. That’s basically a whole work day waiting to do something where I have to call them. (moving positions from one account to another … ie. a joint account). I’ve also experienced slow processing of limit orders. The only positive is the $6.95 commission, but wow when your money is stuck, it’s not worth it. Questrade would be a much better option at this point.

I have been using different retrail trading program such as TD, HSBC and CIBC Investor Edge, CIBC is the worst of the three, poor user expereince, application not responsive at all, very slow to cancel or change an order, it takes one and half hours to process a market order, this application is not architured, designed and implemented by professionals, it is a shame of CIBC.

Very poor user experience, application is not responsive at all, very slow to cancel or change an order, it takes one and half hours to process a market order.

HIGHLY recommend looking at ANY other trading platform than Investor’s Edge. Like all the comments above, customer service is non-existent. If there’s any issue (and there always is) you are out of luck trying to fix it in a timely manner. Unbelievably bad.

Have used Investor’s Edge for over a decade. I am a retail investor that invests strictly on common stock.

I have never had any serious trouble with Investor’s Edge that a phone call has not fixed.

I don’t actually call that often as 99.9% of transactions I can do on line.

I will admit over the last year they have been upgrading their platform and it is going very slow. I am not happy about this, they do need to step it up.

One last thing in fees. Trades are $6.95/trade, but if the trade is on the US exchanges the fee becomes $6.95 US$/trade.

Avoid CIBC at all costs – They’re goal is only to charge fees.

Under $25,000 RRSP?

Pay $116/year.

Transfer out to a better broker?

Pay $155 AND THEN pay $116 for RRSP annual fee when you close your now empty account.

Need help?

Good luck, there is no customer service.

Their interface is garbage, their app is terrible – Charts are trash, no studies or real time data.

I just paid all the ridiculous fees to transfer MY investments and MY money to a better broker, and this made me so angry that I’m closing my bank and CC accounts.

CIBC is the worst bank and broker in Canada.

The system is slow, sometimes it takes 2-3 seconds to refresh a page. What more ridiculous part is they could put your buy order on pending for manual “review”, and results a 25 seconds of delay ! I lost hundreds of dollar in one trade just because of this. Their system is absolutely unacceptable, stay away, guys.

6 figure losses due to technical errors through CIBCs Investors Edge.

After 9 months of arbitration and internal “reviews” CIBC has declared they aren’t responsible for their own technical issues.

Even if I ignored this massive issue, the platform is beyond antiquated, the customer service is abysmal (This is true for all areas of CIBC) endless nickel and dime fees, there’s no upside to putting your money with them.

I was a customer for almost 30 years. I’m leaving now.

Do not waste your time or money.

It’s very dangerous with CIBC investor edge trader. I lost thousands US$ after I purchased few options (call and put both) in the CIBC investor edge account. Even if there are deep-in money when there are expired, no proper excise have been done as they said on their website. There are all end with nothing. This trader just suck your money and do nothing. STAY AWAY !!!

Have been trading for over 20 years and this is by far the worst customer service and trading platform I have experienced. Started with E-Trade (when there was a canadian version) went to BMO, then to iTrade. iTrade has the nicest, most convenient trading platform for active traders but their customer service went to complete shit with covid. Then jumped to CIBC, but clearly should have looked into the water before diving. How can you advertise as a vehicle for active traders with a five minute “pending” delay to get an order to the market. No level 2 quotes!! Their news service is a complete joke – I don’t care what “sentiment” TC Insites rates the news for a particular stock. Platform navigation is very slow and not at all intuitive. All kinds of little annoyances like not being able to see the current stock price when making a change in a call or put order. This platform was not designed by traders or for traders – STAY AWAY!!!!!

Agreed with most of the above. If I could do it over again, would never use investor’s edge. Too many errors/glitches that prevented tradings . Can’t cancel during market closed hours whereas another broker the cancellation is instant. Executing is also faster with another broker and I think I get better buy rates/better than limit price with the cheaper broker. Even without considering discount brokers, CIBC is not cheap among big 6! TD gives 50 free trades every year. Both TD and Scotia have some free ETF tradings. National has unlimited free trading with certain amount of investment. And some of the big 6 have paper accounts for new investors practice. If you’re considering CIBC, don’t! I used to like CIBC, not anymore. CIBC, do better!

I signed on to see what was available – I am a CIBC client for many years now, including RRSPs, line of credit, etc. Didn’t see much to make it worthwhile, so didn’t engage, really. Now, I get an email informing me that there is a $100 annual fee that I owe in a month. I have never used the app, made a trade, transfered in a dollar. Now, I have finally bothered to look through the 74 page concetn form, and sure enough, there it is, so I guess it’s on me. Now the problem has become getting in touch with anyone. CIBC is pretty bad about not providing email addresses, phone numbers are slow to answer, bots and chat support are awful. So now I’m just worried about the other fees I will owe when I try to cancel my account, and if I will be able to make that happen before the deadline and avoid any more. $100 for a demo of a feature that is not very good. Go to qtrade instead!

CIBC customer for fifty years. Recently tried to access dividends from Investor’s Edge Account. No problems doing this in the past. THIS time I am told there are no bank accounts linked to the Investor’s Edge account. After waiting on hold for over an hour, I am told by customer service that my account has been “restricted” pending their receipt of further information (which they have anyway). Have been trying to resolve this for a week. I have been with Investor’s Edge for over ten years but will be moving on when this problem is finally resolved. Arrogant, horrible customer service!