Although many people now use more technologically advanced methods of sending and depositing payments, it is still valuable to know how to write a cheque.

It is quite an easy process, but you must ensure you’re writing it correctly.

This article goes over everything you need to know about writing a cheque, including how to deposit a cheque, what to do if you make a mistake, how to keep cheques secure, and more.

What is a Cheque?

A cheque is a written, signed, and dated document that orders a bank to pay a certain amount of money to a person who has been issued the cheque.

The person issuing the cheque is the payor or drawer, and the person who receives the cheque is the payee.

The payor writes details on the cheque, including the monetary amount, the date, the payee’s name, and a signature.

A cheque can be cashed or deposited by presenting it to a bank, where the funds will be drawn from the payor’s account and transferred to the payee.

Related: Free Chequing Accounts in Canada

How To Write a Cheque

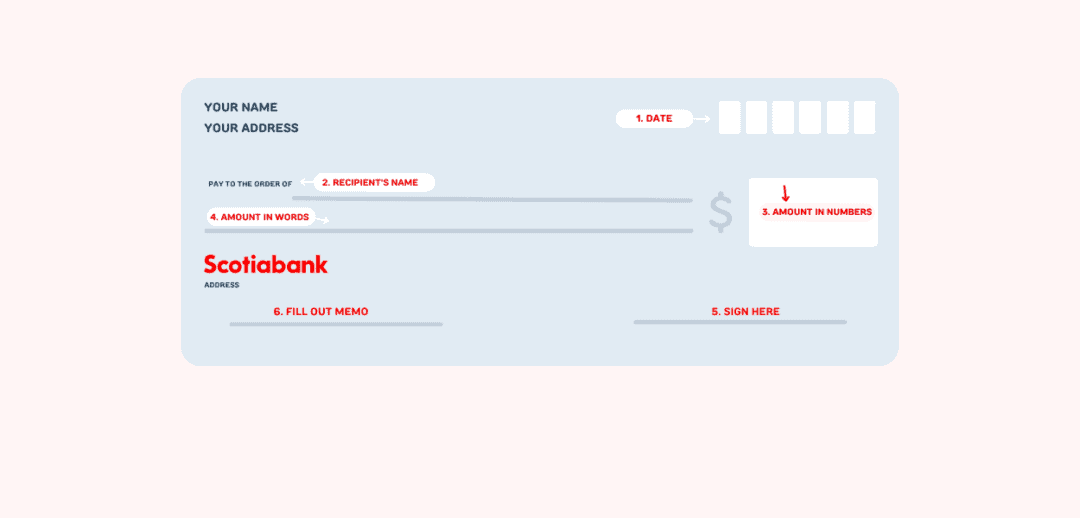

Below is a step-by-step guide to writing a cheque in Canada:

- Write the date. This is written in the top right corner, next to a box that says “Date.” Always write the same date that you filled out the cheque.

- Write the recipient or payee’s name. This is on the “Pay to the order of” line, usually the first line under the stamp with your name and information. If it’s to a person, write their first and last name. If it’s for a company, write the exact company name they use for payments. Ensure the name is spelled correctly. You can also write “cash” on this line, meaning anyone can cash the cheque.

- Write the amount (in numbers). Next to the dollar sign, write the amount you want to be taken out of your account in numbers. Include cents, and include two decimals after the period. For example, you should write “$450.20” and not “$450.2”.

- Write the amount (in words). Write the amount in words below the payee’s name. For example, if you’re paying $450.20, you should write, “Four hundred and fifty dollars and twenty cents.” Or, you can write “Four hundred and fifty dollars and 20/100”.

- Sign the cheque. Sign the cheque in the bottom right corner after filling in the details and double-checking that everything is correct. Ensure that it’s a legible signature that you use with your bank.

- Fill out the memo section. In this optional section, you can write what the cheque is for, like “rent payment.”

What If I Make a Mistake When Writing a Cheque?

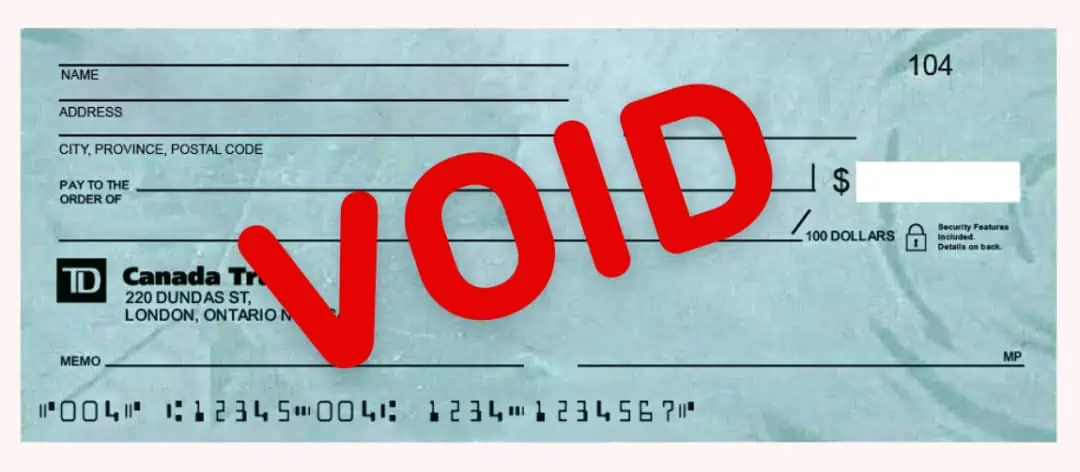

If you make a mistake when writing a cheque, it is best to void it and start a new one.

To do so, write the word “VOID” in large capital letters across the cheque, so it cannot be cashed.

If you make a small mistake, like the payee’s name or the amount written, you can draw a line through the mistake, write the correction directly above it, and add your initials.

Try not to make too many mistakes and corrections, as messy cheques are more likely to get rejected.

How To Write a Void Cheque

To write a void cheque, take one of your cheques and write “VOID” across it in large capital letters with a pen or permanent marker.

Be sure not to cover the numbers in the lower left of the cheque.

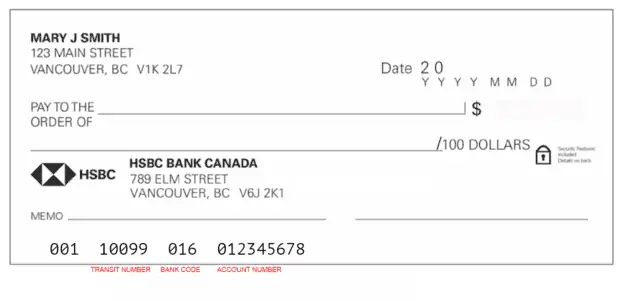

What Do the Numbers on a Cheque Mean?

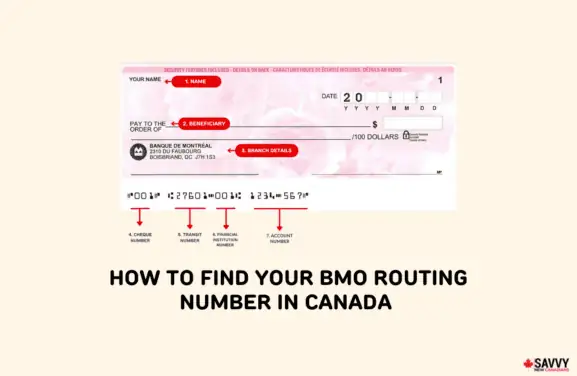

In order from left to right, the numbers on the bottom left corner of a cheque are the cheque number, transit (branch) number, financial institution number, and account number.

These numbers are important for reading and depositing a cheque.

How To Cash or Deposit a Cheque in Canada

You can deposit a cheque in one of two ways in Canada:

In-Person

If you go to a teller, give them the cheque. They will confirm your information and deposit the cheque into your account.

If you go to an automatic banking machine, select the option to deposit a cheque, select the account you want to deposit to, insert the cheque, confirm the deposit details, and select deposit.

Mobile

To deposit your cheque via your mobile device, follow your banking app’s instructions.

Commonly, you’ll have to select an option to deposit a cheque, take a photo of the front and back of the cheque, confirm your deposit details, and store the cheque until it is cleared.

How Do I Keep Cheques Secure?

To keep your cheques secure, you should:

- Record all details of cheques you’ve issued

- Ensure all cheques issued or received from others are correctly dated, completed, and signed

- Never accept post-dated cheques, and never hold a cheque until a later date

- Never accept a cheque written for another person and then signed over to you

- Don’t leave your chequebook unattended

How Long Does It Take For a Cheque to Clear?

In Canada, you get instant access to the first $100 of funds you deposit with a cheque. If the cheque is $100 or less, you will get access to all funds immediately.

If you deposit it via an ATM or mobile app, you will get access to the funds on the business day after the day of the deposit.

If you deposit more than $100, you may need to wait a certain amount of time to access the money. This is called a hold on a cheque.

Typically, holds last for about 4 to 8 days, depending on the amount of the cheque and how it was deposited. The maximum hold periods in Canada are:

$1,500 or less: 4 business days after the deposit if deposited in person, or 5 business days after the deposit if deposited via an ATM or mobile app

More than $1,500: 7 business days after the deposit if deposited in person, or 8 business days after the deposit if deposited via an ATM or mobile app

Pros and Cons of Cheques

Pros

- No convenience fees as with electronic transfers.

- A safe way to send money, as nobody but the payee can deposit it.

- A quick and easy way of proving that a payment was made.

Cons

- Cheques are not cheap when buying them in bulk and can be even more expensive if customized.

- Processing payments take longer than cash, credit, or debit transactions.

- If you accidentally miscalculate your remaining balance, you may end up overdrawing your account.

FAQs

Yes, you can write a cheque to yourself. To do so, fill it out like any other cheque, but put your own name on the “Pay to the order of” line. Writing a cheque to yourself is possible, and some people do it, but there may be easier ways to get cash, such as withdrawing money at an ATM or using a credit card.

In numeric form: Fill in the numeric section and include two decimals after the period. For example, you should write “$450.20” and not “$450.2”.

In words: Write the same amount in words with the cents included. For example, if you’re paying $450.20, you should write “Four hundred and fifty dollars and twenty cents,” or you can write “Four hundred and fifty dollars and 20/100”.

To post-date a cheque, all you need to do is write a date later than the date you are writing the cheque. For example, if the date is January 23, and you want to post-date it to the 26th, write “January 26”. The recipient will need to wait until that date to cash the cheque.

In Canada, a cheque is valid for six months. After that, it is considered “stale-dated,” and financial institutions may not cash it.

You can write a TD cheque the same way you write any other cheque in Canada. Make sure to include the date, the recipient’s name, the amount in numbers and words, and your signature.

RBC cheques are the same as all other cheques in Canada, so you can write them the same way you would write other cheques. Include the date, the recipient’s name, the amount in numbers and words, and your signature.

Conclusion

Writing a cheque in Canada is quite simple once you understand what’s required. Although it isn’t the most widely used payment method, many people still write and cash cheques, so it’s worth knowing how to use one.

Related:

I rarely write cheques anymore, but it may happen once or twice in a year or two. My bank (RBC) told me I have to “order” a minimum of cheques (50, 100, 150), and naturally I have to pay for those. But I’ll never use all of those, even the minimum. I have seen software that can print your own cheques, with the correct font and look & feel. A bank teller once told me that they use “special” ink to print cheques and a home-made one will not work. How true is that? Are home-made cheques valid? Will they be accepted by banks?

@Jackie: Here’s the information provided by Payments Canada:

“Yes, you can print your own cheques. They must meet specifications for cheques found in Standard 006. This includes printing your bank account information in magnetic ink at the bottom of your cheques.

You should present a sample of your printed cheque to avoid any potential processing problems.”