Routing numbers are nine-digit bank identification numbers that serve as unique addresses for banking institutions. Formed by combining the bank and transit numbers, these codes ensure that your funds go to the right place during transactions such as wire transfers or direct deposits.

This article covers how to identify RBC routing numbers and where you can find them online or on a cheque.

Key Takeaways

- You can figure out your RBC routing number by combining your bank’s 3-digit institution number and your account’s 5-digit transit/branch number.

- With XXX being the institution number and the YYYYY being the transit/branch number, online transactions’ routing numbers are in the form of 0XXXYYYYY, while offline transactions’ routing numbers use YYYYY-XXX.

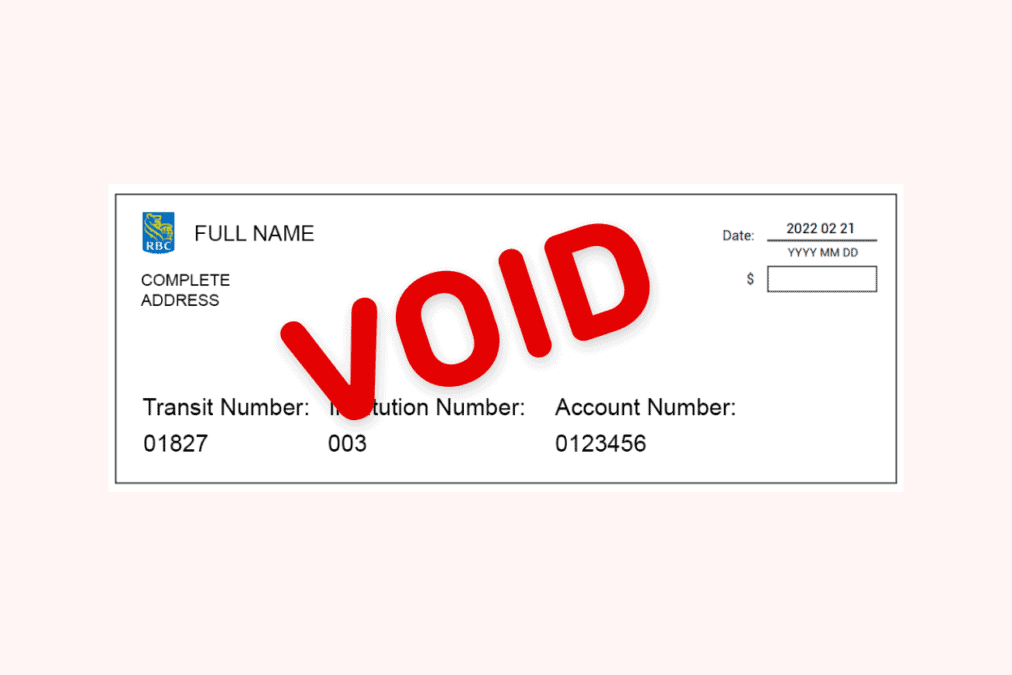

How to Find Your RBC Routing Number on a Cheque

You can locate your RBC routing number at the bottom left corner of your RBC cheque, where you’ll find the codes for your cheque, transit, institution, and account number.

To find your routing number, first, identify the branch/transit number, which is a 5-digit code, and the bank/institution number on the right side of the branch number, which consists of 3 digits.

After that, you can simply combine the bank/institution number (XXX) and the branch number (YYYYY) in the 0XXXYYYYY format to get the complete routing number for electronic transactions.

Note: RBC’s bank code is always 003. By remembering this, you can complete the routing number just by knowing the branch/transit number.

How to Find Your RBC Routing Number Online

If you don’t have immediate access to a cheque, you can also find your RBC routing number online.

To do so, simply follow these steps:

- Sign in to your RBC online banking account.

- Choose one of your chequing accounts.

- Tap “View and Print Payroll Direct Deposit Form” from the navigation.

- Ensure that you’ve chosen the right account.

- Select “View and Print.”

At this point, you’ll be presented with a customized form that already has the institution and branch number pre-filled. So, all you need to do now to know your RBC routing number is to stitch the 3-digit bank/institution number with the 5-digit branch number.

How to Find Your RBC Account Number

You can find your unique RBC account number online or at the bottom of your RBC cheque.

If you prefer finding this code online, simply go to your Online Banking’s “Bank Accounts” section. There, next to your account’s name and on the right side of the 5-digit transit number, you’ll immediately see your 7-digit Account number.

You’ll also find your RBC account number at the bottom of your RBC cheque, located on the right side of the institution number (003).

Routing Numbers in Canada Explained

Routing numbers are unique codes that distinguish individual branches of financial institutions from each other. Used both in electronic and paper transactions, these 9-digit codes ensure that every transaction is always directed to the correct bank account.

In Canada, routing numbers are shown in two different formats, depending on whether the transaction is made virtually or offline.

This table shows the two routing number formats, with XXX being the institution number and the YYYYY representing the transit number.

| Transaction Type | Format of Routing Number |

| Paper | YYYYY-XXX |

| Electronic | 0XXXYYYYY |

FAQs

The ACH (Automated Clearing House) routing number is another term for the routing numbers used for electronic transactions. However, as ACH is part of ABA routing numbers, which are only used by the U.S. banking system, they’re not used in Canada.

SWIFT codes and routing numbers have similar purposes of ensuring that transactions are sent to the correct institutions. However, SWIFT codes are specifically used for international transfers, whereas routing numbers are used for domestic transactions in Canada.

No, they’re not the same. The transit number, which specifies the bank you’ve opened your account, must be combined with your bank’s institution number to complete the routing number.

Related: