Routing numbers, which consist of a bank’s institution number and a transit number, serve as unique identification numbers for branches of financial institutions.

These numbers ensure funds go to the right accounts during financial transactions like loans, direct deposits, and bill payments.

In this article, you’ll learn exactly how to find your Scotiabank routing number online or on a cheque.

Key Takeaways

- If 002 is the institution number and YYYYY is the transit number, online transaction routing numbers are 0002YYYYY, and offline ones are YYYYY-002.

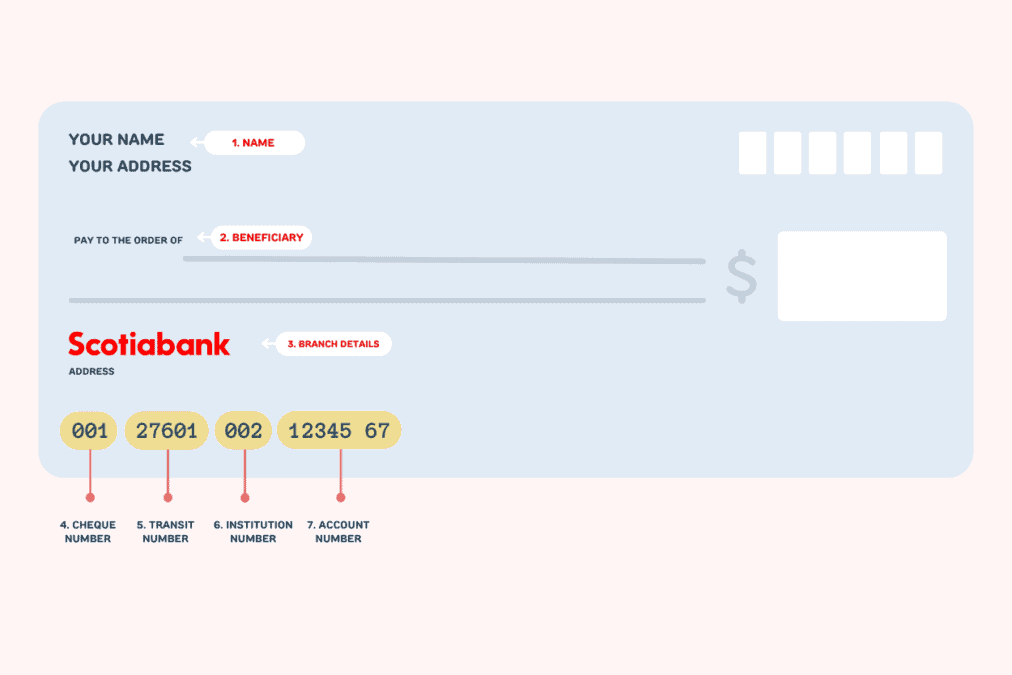

- You can find both the institution and transit number at the bottom of your Scotiabank cheque. If you don’t have a physical cheque, you can always view a copy of your void cheque through the Scotiabank app.

What is the Routing Number for Scotiabank Canada?

You can think of routing numbers as the Social Insurance Numbers (SIN) for banks in Canada. Just as every person has a unique SIN, each branch of Scotiabank has its own distinct routing number, ensuring that all funds directed to it inevitably reach their destination.

As mentioned earlier, routing numbers consist of an institution number (a code that identifies a bank) and a transit number (a 5-digit code that identifies the specific branch where you opened an account).

However, the order of these two components may differ depending on whether the financial transaction is conducted online or on paper.

If we consider XXX as the institution number and YYYYY as the transit number, the table below shows the two possible ways routing numbers can be presented:

| Type of Scotiabank Transaction | Format of Routing Number |

| Electronic | 0XXXYYYYY |

| Paper | YYYYY-XXX |

Note: Scotiabank’s institution number is 002. Ask your Scotiabank branch or check your cheque for the specific transit number to use.

How to Find a Scotiabank Routing Number Online

The easiest way to find a Scotiabank routing number online is to view a copy of your void cheque, which conveniently shows both your transit and institution numbers.

Just install the Scotiabank app if you haven’t already, and follow these simple steps:

- Open the Scotiabank application.

- Make sure you’re on the app’s home screen.

- Tap your chequing account.

- Select “Manage” near the top of your screen.

- Click the “View” button beside the “Direct deposit/void cheque info” text.

- Choose “Void cheque” from the options.

- Tap “View/print.”

Once you have the void cheque displayed on your screen, focus on the numbers located at the bottom. The 5-digit number at the bottom of the cheque represents the transit number, and the 3-digit number directly on its right side is the institution number.

When you already have both the transit and institution numbers, simply refer to the table above so you can use these numbers to form the correctly formatted routing number for your transaction.

How to Find a Scotiabank Routing Number on a Cheque

Finding a Scotiabank routing number on a cheque is very similar to doing the process on a void cheque. After you locate the 5-digit transit number and the 3-digit institution number (always 002 for Scotiabank) at the bottom of the cheque, all you need to do is stitch the numbers together.

To recap, if 002 is the institution number, and YYYYY is the transit number, the routing number is 0002YYYYY for e-transactions and YYYYY-002 for paper.

How to Find Your Scotiabank Account Number

Similar to your routing number, you can find your Scotiabank account number on a cheque or online through a void cheque.

Scotiabank personal account numbers consist of 7 digits and are typically located at the bottom of the cheque, just beside the institution number.

What Are Routing Numbers Used For?

As Scotiabank itself puts it, routing numbers represent the “route” towards your account. They ensure funds aren’t lost throughout the financial transaction, whether online or offline.

FAQs

What is the routing number for Scotiabank Halifax?

Since there are multiple Scotiabank branches in Halifax, each one will also have a unique routing number. To find the routing number of a specific branch, refer to the instructions mentioned above.

Is routing a SWIFT number?

A routing and a SWIFT number are not the same. While they both ensure funds are sent to the right institutions, a routing number is used for domestic financial transactions, and SWIFT numbers are used for international transactions.

What is the routing number in IBAN?

Canada does not use IBAN. However, it does recognize the system when processing international transactions using IBAN.

What is the SWIFT code of Scotiabank?

Scotiabank’s SWIFT code is NOSCCATT. You’ll need this code for international transactions.

Related: