EQ Bank and motusbank are two of the most popular online banks in Canada. If you are tired of paying monthly fees for your chequing account or find the abysmally low interest being paid on savings offensive, an online bank could be just what you need.

Even if you used to prefer in-person service at a bank, the pandemic has shown that the average bank customer can conduct most of their transactions online without setting foot in a branch.

And when you need further assistance, you can chat with customer service by phone and have someone walk you through the process.

EQ Bank and motusbank are not the only digital banks helping Canadians save on banking fees and earn better returns on their money. Others include Tangerine, Simplii Financial, Motive Financial, and Wealthsimple.

EQ Bank Overview

EQ Bank is a subsidiary of Equitable Bank, a Schedule I bank with over 900 employees and assets of over $63 billion.

At a Glance

- High savings interest rates (up to 250x higher than other big banks)

- No monthly account fees

- No minimum account balance

- Unlimited free transactions, bill payments, and Interac e-Transfers

- Free mobile cheque deposits

- Eligible for CDIC Deposit Insurance

Ways To Bank

EQ Bank is 100% a digital bank which means that all your banking transactions are completed online.

You can access your accounts using a web interface on a laptop or desktop and smartphones using its mobile app.

EQ Bank’s customer service is available from 8am-midnight Eastern Time, seven days a week. During these times, you can either chat with a representative, email or reach them by phone.

Accounts

The financial products offered by EQ Bank include:

1. Savings Account: Referred to as the Saving Plus Account, this hybrid account functions like the combination of a savings and chequing account.

It pays one of the highest savings interest rates on general savings and TFSA/RSP savings.

This account has no monthly fees, no minimum balance, and it accepts mobile cheque deposits. It also offers unlimited free Interac e-Transfers, bill payments, and cheap international money transfers.

EQ Bank Personal Account

Up to 4.00%* interest rate

Unlimited debits and bill payments

Unlimited Interac e-Transfers

No monthly account fees

2. Guaranteed Investment Certificates (GICs): You can invest your money by purchasing a high-interest GIC and holding it in a non-registered or registered account.

GIC terms range from 3 months to 10 years. Read this EQ Bank GIC review for more details.

3. Joint Accounts: The Joint Savings Plus Account helps friends and family save together using one account.

4. US Dollar Account: This new account pays a competitive interest rate on your USD funds. It has no monthly fees, and you can link directly with Wise to make international money transfers.

Motusbank

motusbank is a newer online bank. It is owned by Meridian Credit Union, the largest credit union in Ontario.

Motusbank – At a Glance

- High interest rates on savings

- No monthly account fees

- Unlimited debit purchases and withdrawals

- Access to surcharge-free ATMs via THE EXCHANGE Network

- Eligible for CDIC deposit insurance

Ways To Bank

motusbank is an online bank, and all banking transactions are completed online using a web interface or mobile app.

You can reach its customer support service by phone or email from 8 a.m. to midnight Eastern Time, seven days a week.

Accounts

The financial products and services offered by motusbank include:

1. Savings Account: Its high interest savings account pays a competitive rate on funds in general savings, RRSP, and TFSA accounts.

motusbank savings accounts have no monthly account fees, and you get unlimited debit purchases.

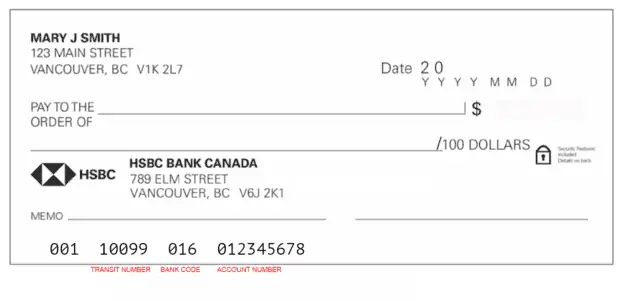

2. Chequing account: Its no-fee chequing account pays 0.15% on your balance, plus free and unlimited Interac e-Transfers and mobile cheque deposits.

3. GICs: You can invest using GICs with terms ranging from 1-5 years.

4. Mortgage: motusbank offers fixed and variable mortgage rates, as well as a home equity line of credit.

Learn more about its offerings in this review.

EQ Bank vs. Motusbank Comparison 2024

EQ Bank and motusbank are fairly similar in their core product offering, i.e. high-interest/no-fee savings and chequing account.

Let’s dig in a bit further:

A: Savings Interest: Both offer high interest rates. That said, EQ Bank’s savings rates are typically higher than motusbank by 10-50 basis points. For the most current rates, visit their websites.

B. Chequing Interest: motusbank pays 0.15% interest on your chequing account balance. Using EQ Bank’s hybrid (Savings Plus) account and Mastercard, you earn 2.50% on every dollar.

C. Convenience: Both banks offer phone and email support seven days a week from 8 am – 12:00 am EST. In addition, a motusbank chequing account gives you access to thousands of free ATMs in Canada. Neither bank offers in-person support.

D. Referral Program: EQ Bank has a referral program that pays you when new customers open an account using your referral link and deposit at least $100. motusbank does not offer a referral bonus program.

E. Safety of Funds: Funds deposited in EQ Bank and motusbank are eligible for CDIC protection up to $100,000 per insured category, per depositor.

Conclusion

Both EQ Bank and motusbank can help you save on fees. For one of the best savings rates in Canada, check what EQ Bank offers.

If you don’t have a chequing account or want one with no monthly fees, motusbank’s chequing account is worth looking at.

You can also check out this list of free chequing accounts.