If you have been a Simplii Financial Bank client for a while, then you know that they previously operated as PC Financial before re-branding to Simplii Financial, the direct banking arm of CIBC, on November 1, 2017. Since then, several changes have occurred with the bank, and they now have their own credit card – the Simplii Financial Cash Back Visa Card.

As an ardent user of the PC Financial World Elite Mastercard, one of the best no-fee credit cards in Canada, I was interested in seeing what Simplii Financial’s credit card had to offer and if it was comparable or better than the 3% cash back offer I get on the PC Financial World Elite MC when I shop at the Real Canadian Superstore (or the Loblaws chain of stores in general).

This Simplii Financial credit card review covers its features and how the Visa Card stacks up against other popular no-fee cash back cards in Canada.

Simplii Financial Cash Back Visa Benefits and Features

Simplii Financial Cash Back Visa Card

Rewards: Earn 4% cash back at restaurants; 1.5% on gas & groceries, and 0.5% elsewhere (category spending limits apply).

Welcome offer: Earn up to $150 of value in your first 4 months on eligible purchases.

Interest rates: 20.99% on purchases and 22.99% on cash advances.

Annual fee: $0

Visit the link to learn more about the full terms and conditions.

1. No annual fee: There is no annual fee, including your primary card and up to three additional cards for authorized users.

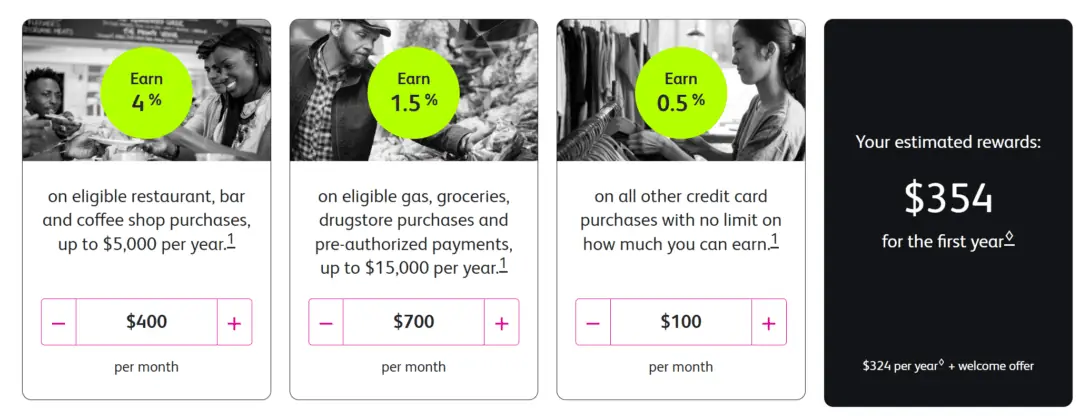

2. Cash back rewards: For a no-annual-fee card, it has some compelling cash back offers:

- 4% on your restaurant spending up to $5,000 per year.

- 1.50% on gas, groceries, drugstore purchases, and pre-authorized payments up to $15,000 per year.

- 0.50% on all other purchases with no limit on how much you can earn.

As a welcome gift, you can earn up to $150 of value in your first four months on eligible purchases. This works out as follows (offer until February 29, 2024):

- $50 statement credit after your first qualifying purchase by March 31 with your new card.†

- $50 statement credit when you spend $2,000 or more within your first 3 months or a $25 statement credit when you spend at least $1,000 within your first 3 months.†

- 10% cash back on eligible restaurants, bars and takeout for your first 4 months. Available on up to a $500 spend.†

Terms and conditions apply. This offer is not available for residents of Quebec.

3. Purchase security and extended warranty: You get free purchase security insurance of up to 90 days from the date of purchase and an extended warranty that doubles the manufacturer’s warranty by up to 1 year.

4. Easy qualification: The annual household income threshold required to qualify for this card is very low, at $15,000. This makes for easy qualification if you are a student.

5. Global Money Transfer: You earn up to $300 when you send your first Global Money Transfer. You also get 0.5% cash back when you use your Simplii Financial Cash Back Visa Card to send money abroad and use the code: GMTEVENT. Here are more details on how the Simplii Global Money Transfer service works.

6. Excellent for newcomers: For our 2024 credit card rankings, this card topped the list of the best credit cards for newcomers. You can get up to a $10,000 credit limit when you apply for the card through Simplii’s New to Canada Banking Program.

Downsides of the Simplii Financial Cash Back Visa

Some of the downsides of this card that should be taken into consideration are:

Cashback accumulates through the year and is reflected in your account as a one-time credit on your December statement. This may be less attractive than getting access to your cash back monthly.

The Simplii credit card is not available to residents of Quebec.

Is The Simplii Financial Visa For You?

The cash back offered by the Simplii Financial Cash Back Visa Card is excellent for a no-fee card.

For example, if every month you spend $400 on restaurants, $700 on groceries, gas, and bill payments, and $100 on your other purchases, your total annual cash back would be $354 (not including the welcome offer). This is not bad at all!

If you dine out a lot, the Simplii Financial Cash Back Visa is attractive, as it pays you up to $200 per year on this spending category alone, i.e. $5,000 x 4%. For restaurant/bar/coffee and takeout spending exceeding the $5,000 cap, you earn 0.5% in cash back.

Newcomers looking for a starter credit card will find it easy to qualify for it under Simplii’s program for new immigrants. The requirement to have a long credit history is waived if you qualify under the program and you get up to a $10,000 limit.

While the 1.5% offer on groceries is good, the PC Financial World Elite Mastercard does better, paying you up to 4.5% cash back on your spending at Shoppers Drug Mart and 3% at their popular Superstores…if this is where you usually shop.

For grocery shopping outside of Loblaw banner stores, the Simplii Financial Cash Back Visa is excellent.

The bottom line is if you are in the market for a cash-back card with no annual fee, the Simplii Financial Cash Back Visa card is worth checking out.

Simplii Financial Cash Back Visa Alternatives

Some alternatives you can consider in addition to this Simplii Visa card are as follows:

Featured Offers

Tangerine Money Back Credit Card

On Tangerine’s website

Welcome Bonus

$100

Annual Fee

$0

Regular APR

19.95%

Credit Score

600

Neo Financial Mastercard

On Neo Financial

Welcome Bonus

$25

Annual Fee

$0

Regular APR

19.99%

Credit Score

600

KOHO Prepaid Card

On KOHO’s website

Welcome Bonus

$20

Annual Fee

$0

Regular APR

0% (n/a)

Credit Score

n/a

Related Posts:

- Scotia Momentum Visa Infinite Card Review

- Tangerine 2% Money-Back Credit Card Review

- Best Travel Credit Cards in Canada

Simplii Financial Cash Back Visa Review

-

Cash back rewards

-

Annual fee

-

Insurance benefits

-

Eligibility requirements

-

Redeem rewards

Overall

Summary

The Simplii Financial Cash Back Visa Card is Simplii’s first credit card offering. This review highlights its cash back offers and benefits as well as the downsides associated with the card.

Pros

- No annual fee credit card

- Earn up to 4% cash back

- Low income requirement

- Can be used for international money transfers

Cons

- Not available in Quebec

- The higher cash back rates have annual spending thresholds

- Cash back earned can be redeemed once a year

i have fighting to try a simpli finnanacial cash back visa card

on Ontario diability check would that be wrong for me to do

I think it just can’t be over your exempt asset amount. I had a card when I got approved for odsp and they had no issues. They might feel different if you go into high debt on it right away for long term, but I’m always very careful never to spend more than I know I’ll be able to pay off in full. Worth a try. The stereotype is that nobody on disability can possibly avoid long term debt. I guess I enjoy proving the stereotype wrong

FYI: the 10% cashback offer is deceitful in the sense that a potential applicant might understand that the cashback rebate is up to $500, like I understood, however, it is up to $500 in spending at restaurants, which is nothing. Most people spend that in 2-3 weeks and will not go up to the 4 months they offer. If it was an “up to $500 cashback offer”, I can see how it might take $500 to attain, plus, it would’ve been more enticing. Very disappointing and gimmicky marketing.

@Tudor: True! Which is why it’s important to read the fine print thoroughly before applying for a credit card and also to read reviews like this one. 😉

I rarely eat out & need a credit card for balance transfers as well as purchases without being charged 27% (or higher). Any recommendations?

@Liv: There are a few options on this list below:

https://www.savvynewcanadians.com/best-credit-cards-canada/

Look a gift horse in the mouth on this one. The visa card never paid me the money it said I’d accumulated. There was a tiny note on the statement that I had to refer to the “message centre “ although there is no message centre on Simplii‘s site. Then the January statement showed my earned dollars balance as $0. They haven’t answered my email so I guess I’ll have to waste time on the phone with them.

“the PC Financial Mastercard does better, paying you up to 4% cash back on your grocery spending at Loblaw stores, including their popular Superstores!”

I never heard of this 4% cash back at Superstores/Loblaws, Not only that, Superstore is the only place where I don’t earn points. I tried 3 times to get an answer without one coming.

@ukerry: The PC Financial World Elite pays 45 points per $1 at Shoppers Drug Mart and 30 points per $1 at Superstore and other Loblaw grocery stores. I will update that line to read “PC Financial World Elite” as opposed to just the line of PC Financial Mastercards.

With regards to earning points at Superstore, that sounds weird. I use a PC Financial MC and I earn points on all purchases.

My husband the primary card holder passed away so I lost my secondary card. Can I get a PC master card in my own name that will. register my PC points.?

@SL Clarke: Sorry to hear. Yes, you should be able to apply directly for your own card.

Honestly, during the pandemic I pulled in 290 cashback. Its a great card, and pays off Christmas debt.

With simplii having a limited spending limit on daily debit, the visa makes up for this. I consistently add more directly and instantly from my debit account to surpass the credit limit of 500 and spend more. This allows for easier cash flow and more cashback. For low income, so long as you don’t ever spend more than you make, this works amazingly.

I know it’s not advised, but I have no choice but to take a small cash advance. Anyone know the fee with Simplii Visa?