RBC’s student chequing account is referred to as the ‘RBC Advantage Banking for students.’

This student account offers free and unlimited transactions, and it can be useful for saving on bank fees while you are enrolled as a full-time student at a post-secondary institution.

Read on to learn how RBC Advantage Banking for students accounts work.

RBC Advantage Banking for Students Features

Unlimited free transactions: This account includes unlimited debit transactions and Interac e-Transfers. While there is a cap of 999 free Interac e-Transfers for the student account, you will likely not need that many transactions as a student.

Dedicated mobile app: Students can use the RBC Mobile Student Edition app to simplify their banking. This app is available to clients under the age of 22.

Access to RBC rewards: Enrol your account in the RBC Value Program and earn RBC Rewards points when you shop online and in-store. You can redeem points for flights, car rentals, gift cards, merchandise, or to pay down your credit cards or loans.

Free credit score check: Access your TransUnion credit score from your RBC dashboard for free.

Access to a student credit card: You can easily apply for an RBC Student credit card.

Get personalized financial insights: Use NOMI Insights to budget, save money automatically, set alerts, and more.

RBC Student Bank Account Benefits

RBC is one of Canada’s largest banks, and as a client, you get free access to thousands of RBC ATMs across the country.

In addition to saving on monthly bank fees, an RBC Advantage Banking Plan does not charge an RBC fee when you use another bank’s ATM in Canada.

Note that a convenience fee may be charged by the ATM operator.

Accountholders get a rebate worth up to $39 on the annual fee of an eligible RBC credit card. The two credit cards that qualify for this rebate are:

- Signature RBC Rewards Visa, and

- Westjet RBC Mastercard

You can easily use your RBC Visa Debit Card to make purchases in person and online.

If you are a newcomer, you can benefit from RBC’s international student account offers.

Lastly, RBC offers many financial products and services, making it easy to keep all your accounts in one place.

RBC Student Account Requirements

To qualify for RBC Advantage Banking for students, you must be a full-time student at a primary, secondary, or post-secondary school.

Proof of enrollment at a qualifying educational institution is required.

RBC Advantage Banking for Students Fees

While you won’t pay a monthly account fee, service charges apply to some transactions

| Service | Fee |

| Overdraft protection | $5/month + applicable overdraft interest |

| Safe deposit box | $60 to $500 per year, depending on the size |

| Cross-border debits | $1 each |

| Bank drafts | $8.50 each |

| PLUS System ATM in Canada/U.S. | $3 each |

| PLUS System ATM abroad | $5 each |

| Personalized cheques | 1st book of 50 cheques free; fees apply after |

| NSF fee | $45 (1 NSF fee rebated fee each year) |

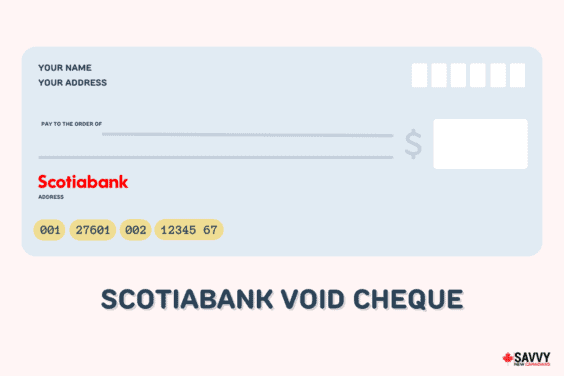

Related: RBC Void Cheque Sample.

RBC vs. Scotiabank vs. TD vs. CIBC Student Accounts

| Features | RBC Advantage Banking | Scotiabank Student Banking Advantage Plan | CIBC Smart for Students | TD Student Chequing |

| Monthly fee | $0 | $0 | $0 | $0 |

| Debit transactions | Unlimited | Unlimited | Unlimited | Unlimited |

| e-Transfer transactions | Unlimited (999 cap/month) | Unlimited | Unlimited | Unlimited |

| Non-bank ATM fee in Canada | Free (ATM operator may charge convenience fee) | $2 each | $2 (1 free each month) | $2 |

| Foreign ATM fee in U.S. | $3 each | $3 each | $3 each | $3 each |

| Foreign ATM fee (other countries) | $5 each | $5 each | $5 each | $5 each |

| Other features | Up to $39 rebate on credit card annual fee | Earn Scene+ rewards points; $75 welcome bonus | Access to a free SPC+ membership | No monthly fee on overdraft protection; earn extra Stars at some Starbucks locations |

| Review | – | Learn more | Learn more | Learn more |

RBC Advantage Banking for Students Alternatives

You can save on fees, get access to unlimited transactions, and earn rewards with these accounts.

Simplii Financial

The No Fee Simplii Chequing account offers several benefits you would normally get with a premium chequing account, including:

- Unlimited debit purchases, bill payments, and Interac e-Transfer transactions.

- Free access to thousands of CIBC ATMs across Canada.

- No monthly account fees.

- Access to free international money transfers.

- Savings interest on your balance.

- Available to both students and non-students.

For a limited time, you could also get a $400 cash bonus when you open an account.

Simplii Financial has millions of customers, and it is owned by CIBC. Learn more about its products and services.

HSBC Student Chequing Account

HSBC Bank Canada is one of Canada’s largest banks. It offers a student bank account that has no monthly fees* and offers unlimited chequing account transactions.

You also get:

- Free Interac e-Transfers®

- Free mobile cheque deposits

- Free withdrawals from your account at HSBC Bank Canada or THE EXCHANGE® Network ATMs

- Access to mobile and online banking

- Access to an HSBC credit card

There is also no minimum balance requirement to qualify for no monthly fees.

When you open a new HSBC student chequing account, you get up to a $150 cash bonus, comprising a $50 welcome reward and $100 when you open your account online.

You should deposit at least $1,000 in your account within 30 days of opening it to take advantage of these offers.

Scotiabank Student Banking Advantage Plan

This Scotiabank student account offers unlimited free transactions and no monthly fees if you are a student.

Accountholders also earn loyalty points (Scene+) when they make purchases using their Scotiabank debit card.

When you open a new Scotiabank account, you get a welcome bonus after meeting the eligibility requirements.

Related: