Students who are enrolled in full-time post-secondary education can save on banking fees by opening dedicated student bank accounts.

Available at all the big banks in Canada, these student accounts include unlimited free transactions and other discounts.

This TD Student Chequing account review covers how it works, its benefits, downsides, and alternatives.

TD Student Chequing Account Features

No monthly account fee: This TD student account does not have a monthly fee if you are under the age of 23 or can show proof of full-time enrollment at a post-secondary school.

Unlimited transactions: Enjoy unlimited debit, bill payments, and Interac e-Transfer® transactions.

Overdraft protection: The monthly overdraft protection fee is waived. However, overdraft interest fees apply if you use this service.

TD Access Card: Use your TD Access Card with Visa Debit to shop online and in-person wherever Visa is accepted.

Earn Starbucks rewards: You earn 50% more Stars when you pay for purchases at participating Starbucks locations using your TD credit card or Access Card with Visa Debit. You can also redeem TD points for free coffee.

Simply Save Program: This feature helps you save money every time you make a payment with your TD Access Card. It transfers $0.50 to $5.00 per transaction into your TD savings account.

TD Student Chequing Account Benefits

TD Canada Trust is one of Canada’s largest banks. With your student account, you get access to over 3,000 TD ATMs and more than 1,000 branches across Canada.

In addition to saving on monthly bank fees, a TD student chequing account also comes with overdraft protection.

If you are a newcomer to Canada, you can open a TD international student bank account.

Lastly, TD offers various financial products, including credit cards, investments, loans, insurance, and business accounts.

Downsides of a TD Student Account

If you are over 23 years of age, you must provide proof of full-time enrollment at a post-secondary school to waive the monthly fee on this account.

There is a fee for using non-TD ATMs in Canada, and service fees apply to some transactions.

TD Student Checking Account Fees

| Service | Fee |

| Non-TD ATM use in Canada | $2 each |

| Foreign ATM use (in U.S. & Mexico) | $3 each |

| Foreign ATM use (other countries) | $5 each |

| Overdraft interest rate | 21%/year |

| Use TD Access Card with Visa Debit logo abroad | 3.50% FX fee |

| Wire transfers (outgoing) | $16 – $50 |

| Wire transfers (incoming) | $17.50 |

| Non-Sufficient Funds fee | $48 |

| Safety deposit box | $60 (small); $100 (medium), $150 (large)(annual rental) |

| Paper statement by mail | $2/month |

| Bank draft | $9.95 |

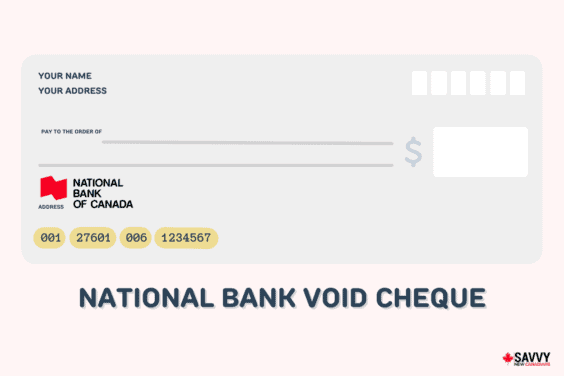

Related: TD Void Cheque Sample.

TD vs. RBC vs. CIBC Student Chequing Accounts

| Features | TD Student Chequing | RBC Advantage Banking | CIBC Smart for Students |

| Monthly fee | $0 | $0 | $0 |

| Debit transactions | Unlimited | Unlimited | Unlimited |

| e-Transfer transactions | Unlimited | Unlimited (999 cap/month) | Unlimited |

| Non-TD ATM fee in Canada | $2 | Free (ATM operator may charge convenience fee) | $2 (1 free each month) |

| Foreign ATM fee in the U.S. | $3 each | $3 each | $3 each |

| Foreign ATM fee (other countries) | $5 each | $5 each | $5 each |

| Other features | No monthly fee on overdraft protection; earn extra Stars at some Starbucks locations | Up to $39 rebate on credit card annual fee | Access to a free SPC+ membership |

| Review | – | Learn more | Learn more |

TD Student Chequing Account Alternatives

Some of the best chequing accounts for students in Canada include:

Simplii Financial

The No Fee Simplii Chequing account offers several benefits you would normally get with a premium chequing account, including:

- No monthly account fees.

- Unlimited debit purchases, bill payments, and Interac e-Transfer transactions.

- Free access to thousands of CIBC ATMs across Canada.

- Access to international money transfers.

- Interest is paid on your balance.

- Available to both students and non-students.

For a limited time, you could also get a $400 cash bonus when you open an account.

Simplii Financial has millions of customers, and it is owned by the Canadian Imperial Bank of Commerce (CIBC). Learn more about its products and services.

EQ Bank

EQ Bank is an online bank owned by Equitable Bank, one of Canada’s largest banks.

It offers a high interest savings account that beats the rates offered by many of the big banks.

The EQ Bank Personal Account also includes free and unlimited transactions, mobile cheque deposits, and access to GIC investments and global money transfers.

Learn more about what EQ Bank offers in this review.

Note: If you need paper cheques, you may want to combine an EQ Bank account with a traditional chequing account, as it does not offer them. That said, this EQ Bank account now has a payment card you can use for ATM withdrawals and in-store payments.

Related: