The Royal Bank of Canada (RBC) is one of many banks offering their clientele access to free credit score checks.

The free RBC credit score can be accessed online from your account using what is known as the “CreditView Dashboard.”

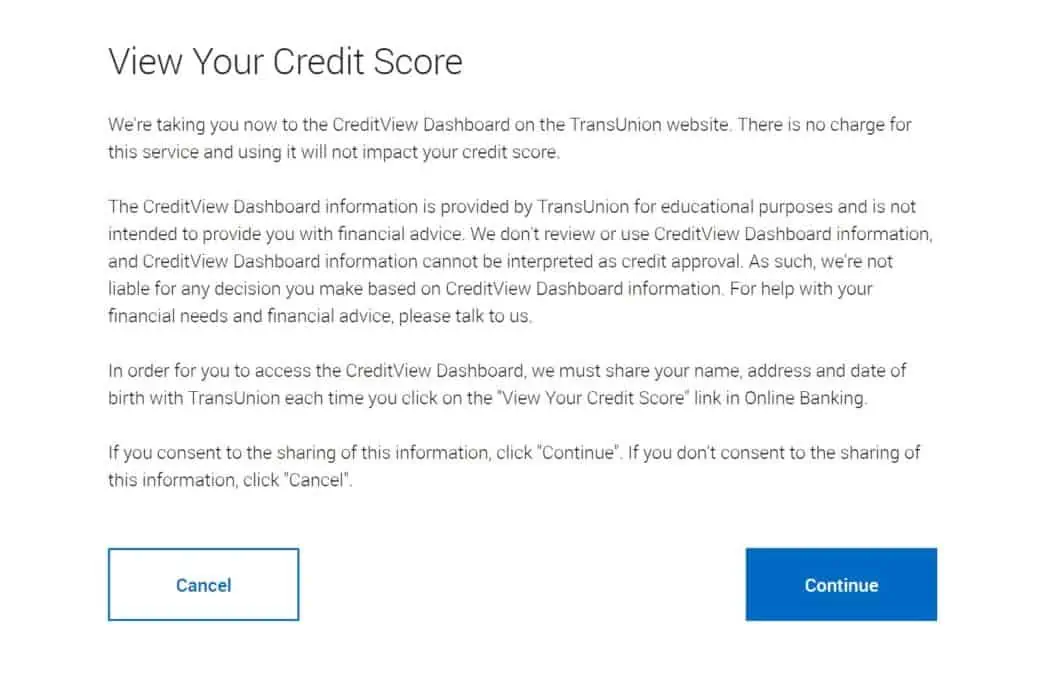

This credit score check is a “soft inquiry,” which means it will not impact your credit rating negatively.

In addition to RBC, Canadians can get updated credit scores and reports from platforms like Borrowell or Clearscore.

How To Check Your RBC Credit Score

Follow these steps to check your credit score on RBC:

1. Sign in to RBC Online Banking.

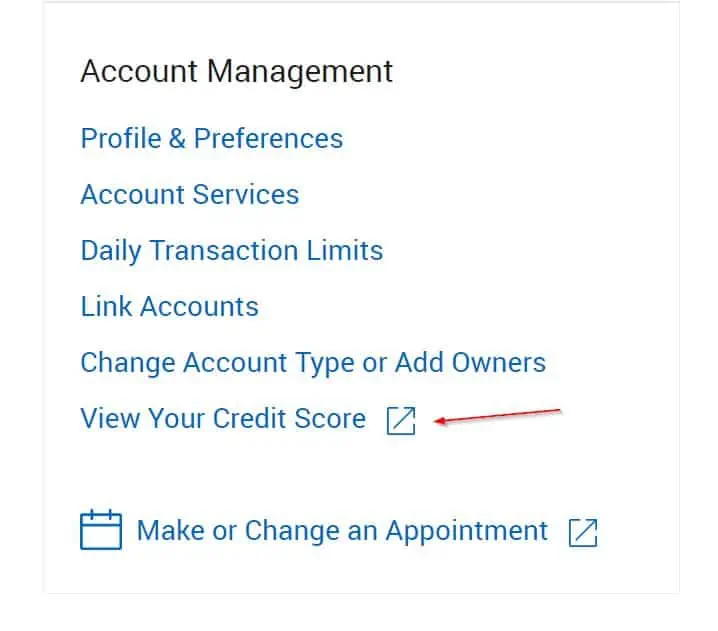

2. Scroll down to “View Your Credit Score” under “Account Management” in the menu on the right-hand side.

3. Click to open a new tab and click on “continue” to be taken to “CreditView Dashboard” on the TransUnion website.

4. You can now view your free TransUnion credit score.

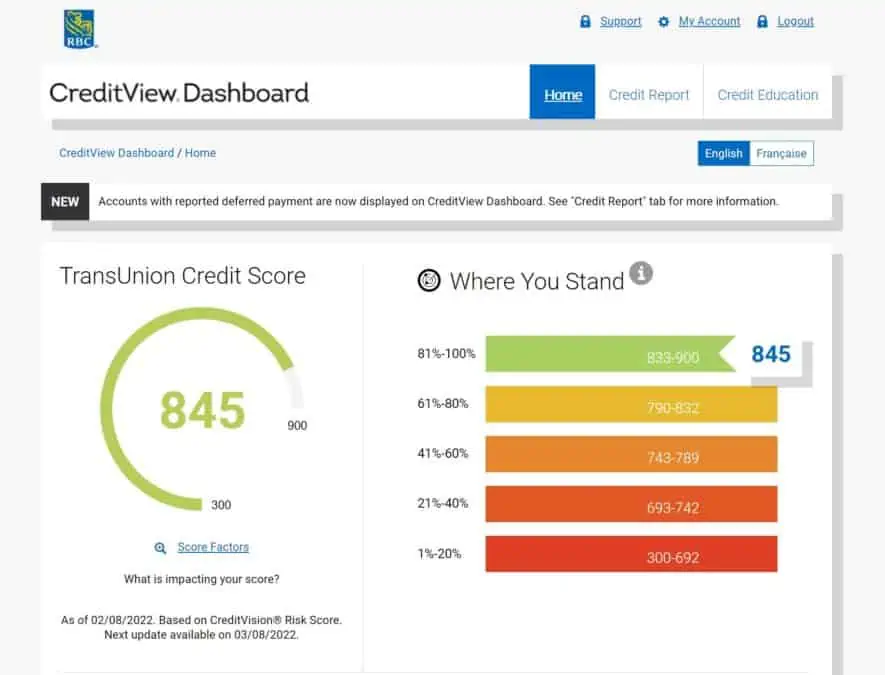

Like other credit scores in Canada, RBC’s credit score range is from 300 to 900.

The dashboard also provides information about your credit score history, how your score compares to the general population, as well as your TransUnion credit report.

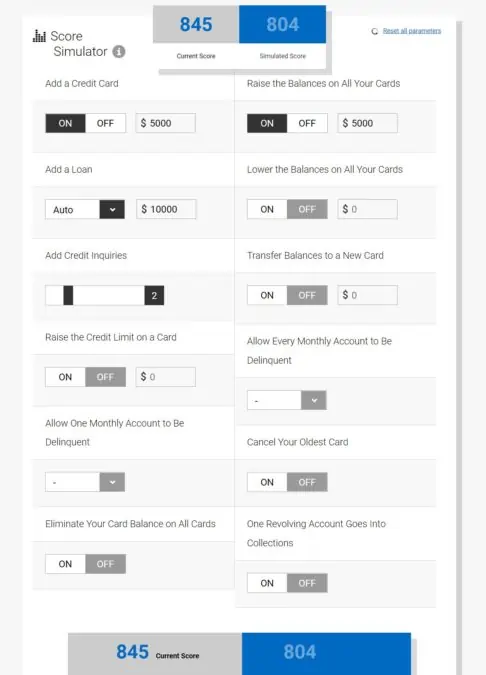

There’s also a credit score simulator that estimates how your credit score improves or declines when you take certain actions, such as:

- Add a credit card or loan

- Lower the balances on your cards

- Raise your credit limit

- Cancel your oldest card

- Miss a monthly payment, etc.

RBC Credit Score Check

Now that you have seen your credit score, what does it all mean?

A good RBC credit score range is between 743 and 789, and a credit score from 790 to 900 is excellent.

Your credit score is used by lenders to assess your creditworthiness. The higher your credit score, the better your chances of qualifying for credit e.g. personal loans, car loans, mortgages, and credit cards.

If your credit is below 660, it is considered poor or bad credit, and you will be required to pay hefty interest fees if at all your credit applications are approved.

How To Increase Your RBC Credit Score

The following factors are considered when calculating your credit score:

- Payment history

- Length of credit history

- Types and mix of credit

- Outstanding debt

You can increase your RBC credit score by taking steps to manage your credit products.

Pay bills on time: Ensure your balances are paid on time and do not miss the dates for minimum payments.

Keep a low credit utilization: Use 30% or less of your credit limit at any point in time. This is also referred to as your credit utilization rate. For example, if your credit limit is $10,000, you should not have a balance outstanding exceeding $3,000.

Limit credit applications: Don’t go on a credit application spree. If you are shopping for rates, you should keep the inquiries within a 2-week period.

Check for credit errors: Read your credit report and watch out for errors that may impact your credit rating. You can dispute credit report errors with TransUnion and Equifax.

Increase your credit limits: A higher credit limit means you can use more credit without exceeding 30% credit utilization.

Free Credit Score Checks in Canada

In addition to RBC, these financial technology companies offer free credit score checks online.

Borrowell

Borrowell has been providing free credit score checks since 2016.

As of this writing, over 2 million Canadians have used the platform to get their free Equifax credit score and report.

It makes sense to routinely check your credit score from the two major credit bureaus in Canada, and Borrowell updates your score weekly.

Sign up here or read our Borrowell review.

Credit Karma

Like RBC, Credit Karma gives clients access to their TransUnion credit score. You can also view your report, which is updated once every month.

Learn more in this review.

Loans Canada

Loans Canada offers free access to your Equifax credit score. It also helps with comparing loans across various Canadian lenders.

Learn about Loans Canada.

Free Credit Report Checks in Canada

Using the CreditView Dashboard via RBC, you can view your TransUnion credit report.

You can also contact TransUnion directly at 1-855-889-4293 to request a copy of your Consumer Disclosure (i.e. credit report).

For Equifax Canada credit reports, you can view weekly updates using Borrowell, or contact Equifax directly at 1-800-465-7166.

RBC Credit Score FAQs

No, you can’t view your credit score using the RBC mobile app. You need to sign in to Online Banking using the RBC website.

Yes, your RBC credit score is accurate and is based on TransUnion’s CreditVision Risk Score. That said, it may be different from your TransUnion score or the report lenders use when you apply for credit.

RBC pulls your TransUnion credit score report when you apply for a credit card or loan.

Yes, 800 is a good credit score, and you could qualify for credit at competitive rates.

We have detailed various strategies to improve your credit score fast in this guide.

Related: