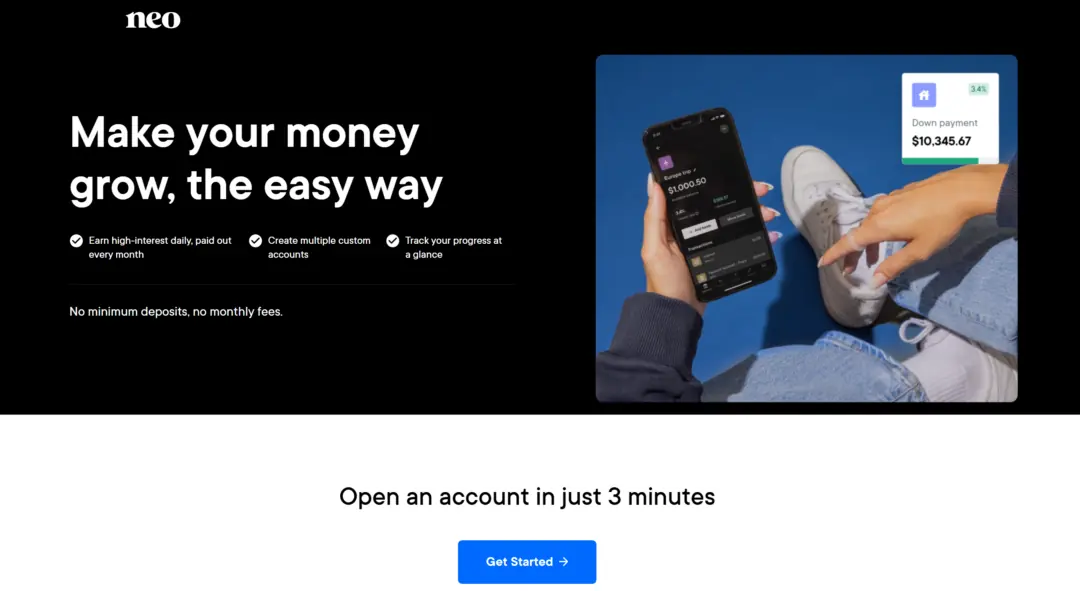

Neo Financial’s new high-interest savings account (HISA) offers Canadians an opportunity to earn competitive rates on their deposits.

Unlike the shortlived promotional rates at some banks, the Neo HISA pays a standard 4.00% interest rate on every dollar.

- Interest rate: 4.00% on every dollar.

- Minimum deposit amount: None

- Monthly fees: None

How To Sign Up For The Neo High Interest Savings Account

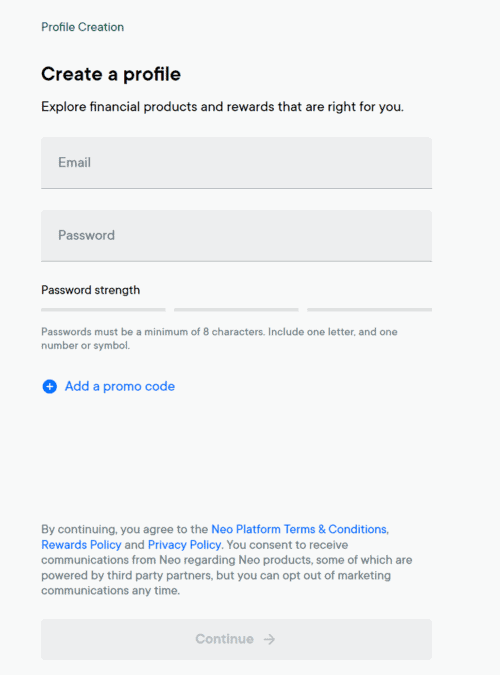

To get started, visit Neo Financial and create an account.

Click on “Open a HISA” and create your profile by entering your email and password.

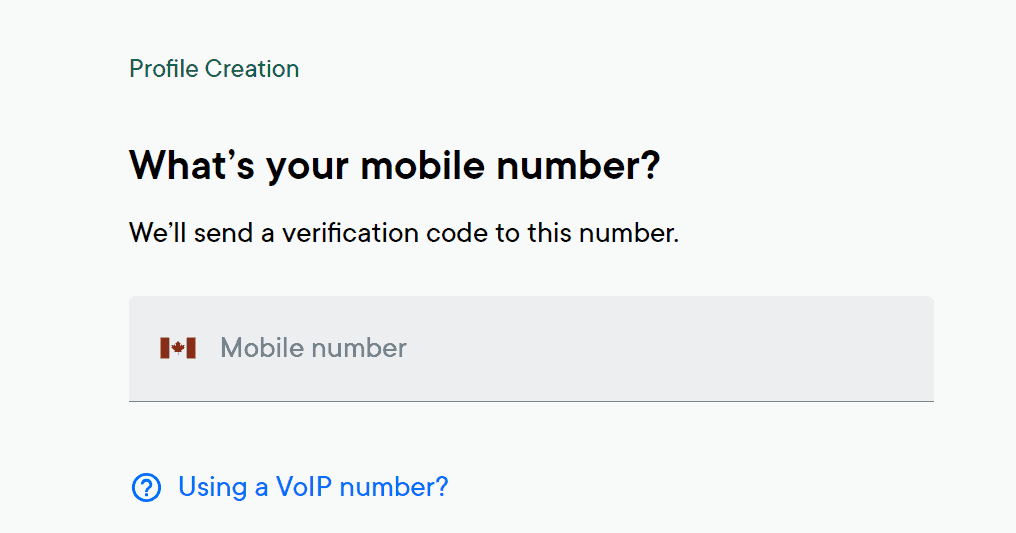

Provide your mobile number and complete your profile.

You can fund your account by linking an external Canadian bank account or transferring funds from another Neo account.

Neo HISA Benefits

Earn high interest rates. The Neo HISA pays 4.00% interest on your deposits. This is a non-promotional rate with no end date. Interest is calculated daily on your closing balance and paid monthly.

There are no monthly fees, and no minimum deposit is required to take advantage of the high rate.

You can access a mobile app to manage your Neo accounts in one place. You can also use the Neo app to set savings goals and move money around effortlessly.

Neo HISA Downside

The only downside for this account is that it is currently unavailable in Quebec but will be there soon.

Is Your Money Safe?

Neo Financial has partnered with Peoples Bank of Canada to offer its high interest savings account.

Peoples Bank is a CDIC member institution, and your savings account is eligible for CDIC deposit insurance, up to $100,000 per category, per depositor. This $100,000 threshold includes your eligible deposits at Peoples Bank of Canada.

Neo Financial Accounts

In addition to its savings account, Neo offers the following:

Neo Money Card

Neo Money card

Rewards: Earn an average of 5% cash back at over 12,000 retail partners and a guaranteed minimum of 0.50% (up to $50 monthly); Earn 2.25% interest on your account balance.

Welcome offer: Deposit at least $50 and complete your first purchase to receive a $20 welcome bonus, and you can earn up to 15% cash back on your first-time purchases.

Interest rate fee: 0%

Annual fee: $0 (no monthly fees)

This prepaid card works like a debit card on steroids. You get the convenience of a payment card you can use for online and in-person shopping, plus you earn an average of 5% cashback at 12,000 Neo partners and up to 15% cashback on first-time purchases.

The Neo Money Card also comes with a Neo Money account where your deposits earn 2.25% interest.

Neo Secured Credit

Neo Secured Credit

Rewards: Get an average of 5% cash back at 10,000+ locations.

Welcome offer: Up to 15% welcome bonus cash back on your first-time purchases; $25 cash bonus.

Interest rates: 19.99% – 29.99% for purchases; 22.99% – 31.99% for cash advances.

Annual fee: $0

The Neo Secured Credit Card offers guaranteed approval regardless of your credit score. To qualify, you will need to be the age of the majority in your province, be a resident of Canada, and have security funds of at least $50.

This Neo Card pays 1% cashback on gas and groceries and up to 5% cashback on purchases at partner retailers. And, if you want to establish or build credit, it could work for you.

Neo Credit

Neo Credit card

Rewards: Average of 5% cash back at 12,000+ partners and a guaranteed minimum of 0.50% cash back across all purchases

Welcome offer: Get up to 15% cash back on your first-time purchases, plus a $25 welcome cash bonus.

Interest rates: 19.99% – 29.99% on purchases; 22.99% – 31.99% for cash advances.

Annual fee: $0

Neo Credit is one of Canada’s top cash back credit cards. Like Neo Secured Credit, cardholders earn an average of 5% and up to 15% cashback on first-time purchases.

In addition to the physical card, you get a virtual card you can add to your Apple Wallet or Google Pay.

A regular Neo Credit card has no annual fees; however, you can upgrade your Neo Credit card with a monthly subscription to their Premium perk and earn boosted cashback and access to additional benefits.

Neo Financial HISA Alternatives

Two other online banks offering competitive high interest savings rates are KOHO and EQ Bank.

KOHO Earn Interest

5.00% savings interest on your balance

$20 sign up bonus after first purchase (use promo code CASHBACK)

Earn 1% cash back on groceries, gas, and transportation; up to 5% unlimited cash back on purchases at partners

Unlimited Interac e-Transfers and debit transactions

$0* monthly

EQ Bank Personal Account

Up to 4.00%* interest rate

Unlimited debits and bill payments

Unlimited Interac e-Transfers

No monthly account fees