Credit unions in Ontario have grown in popularity over the years. With over 70 different credit union institutions operating in Canada’s most populous Province, many people are realizing the benefits of using one instead of the Big 5 Canadian banks.

On the surface, the financial services you receive from a credit union are nearly identical to a big bank. Credit unions offer savings accounts, credit cards, and even mortgages.

Typically, the main benefit of using a credit union in Ontario is that the fees are lower, and the interest rates are higher on saving but lower on loans. This is because credit unions are not-for-profit organizations that reinvest their profits back into their customers.

If you are interested in trying out a local business rather than one of the Big 5 Banks, read our review of the ten best credit unions in Ontario for 2024.

What is a Credit Union?

A credit union is defined as a not-for-profit institution that is owned by its customers. Rather than profits being awarded to shareholders like with banks, credit unions reward their users by providing financial benefits like lower costs and higher savings interest rates.

Many credit unions are small, community branches. While being a not-for-profit organization has its tax advantages, credit unions are also instrumental in providing financial services for citizens of the local community.

The range of services offered by credit unions can pale in comparison to the big banks. This is because credit unions only need to earn enough to cover the cost of their day-to-day operations. Credit unions will also typically have fewer branches and most are regional or local, rather than nationwide.

Best Credit Unions in Ontario

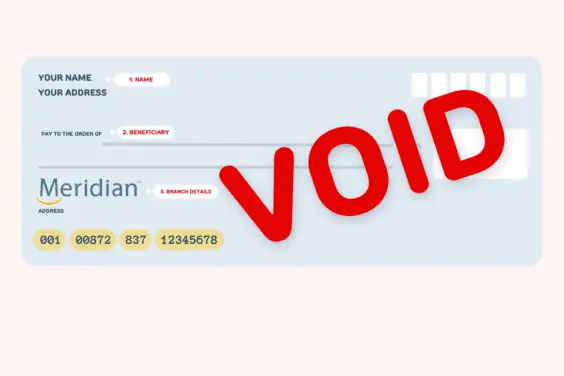

1. Meridian Credit Union

Meridian Credit Union was founded in April 2005 when the Niagra Credit Union and HEPCOE Credit Union merged. As of 2022, it is the largest credit union in Ontario and the second-largest Canadian credit union after only VanCity in British Columbia.

At the start of 2023, Meridian operated 89 branches and 15 business banking centers with over CAD 30 billion in assets under management. The company has over 2,000 employees in Ontario, including a seven-day per-week customer contact center.

Meridian offers a full portfolio of financial products and services. These include regular savings accounts, mortgages, investment accounts, credit cards, loans, and insurance.

You can learn more about Meridian Credit Union in this review.

2. Alterna Savings and Credit Union

Alterna was founded way back in 1908 in Ottawa, Ontario, as the Civil Service Savings and Loan Society. It operates more than 30 locations in Ontario with over CAD 10 billion in assets under management.

The company was Canada’s first credit union to offer a digital national bank that offers a fully digital mortgage experience. It was also the first in Canada to offer micro-loans through its Community Microfinance Program.

All of the usual financial products are available to customers, including savings and investment accounts, mortgages, loans, credit cards, and financial support for small businesses.

Related: Alterna Savings and Credit Union detailed review.

3. FirstOntario Credit Union

FirstOntario was established in 1939 as Stelco Employees Credit Union. In 1987, Stelco would officially open its doors to public members and re-branded as Avestel Credit Union. It did not adopt the FirstOntario branding until 2000.

This Ontario credit union operates 29 different locations across three regions, primarily in Southwestern Ontario. It offers many primary financial products, including savings accounts, investment accounts, loans, credit cards, and multiple different types of insurance.

4. Northern Credit Union

Northern Credit Union is an Ontario-based credit union that operates 24 locations across the northern region of the Province. It was established in 1957 and has amassed over 70,000 members in Northern Ontario with nearly $2 billion in assets under management.

This credit union offers impressive savings account features, including no monthly or annual fees and no minimum account balance. The interest rate also rises as the balance in the account grows higher.

Other financial products offered by Northern Credit Union include investment accounts, RRSPs and TFSAs, mortgages, loans, small business support, and multiple Visa credit cards.

5. DUCA Credit Union

DUCA Credit Union was established in 1954 for Dutch Immigrants entering Canada. The origins of the DUCA name are a reference to the Dutch Canadians (DUCA) for which the company was originally started. Since its inception in 1954, DUCA has expanded to 17 locations around Southern Ontario with over 75,000 members.

As for its products, DUCA offers standard savings and investment accounts for Ontario residents. It also provides both personal and business services, including mortgages, loans and lines of credit, credit cards, and insurance.

6. MOYA Financial Credit Union

MOYA Financial Credit Union, as we know it today, was established in 2016 after the merger of Krek Slovenian and Slovenia Parishes Credit Union. The name MOYA comes from the Slovenian word ‘moja’, which means ‘my.’ MOYA wanted its customers to know that it is all about individual member service.

This credit union provides plenty of financial services and products for its customers. These include regular savings and investment accounts as well as loans for personal and business, mortgages, and credit cards. MOYA even has its own blog and podcast that anyone can listen to.

7. Member Savings Credit Union

Member Savings Credit Union was founded in 1949 as the LCBO (Liquor Control Board) Credit Union in Toronto. Today, it serves 185,000 members; most are the employees or families of the OCRC, AGCO, Honeywell, MTS Allstream, or the Shell Group of Companies. As of December 2020, the company merged with Alterna Savings and Credit Union.

It offers many financial services and products, including savings and investment accounts, personal and business loans, and access to ATMs nationwide. Members Savings even offers payroll deduction options for current LCBO employees.

8. Libro Credit Union

Libro Credit Union is another institution that was established by early Dutch settlers in Canada. It was founded in 1951 by Dutch Catholic Immigrants in London, Ontario, and now operates 31 locations across Southern Ontario.

As for its financial products, Libro offers plenty for both personal and business customers. Regular savings and investment accounts, as well as mortgages, credit cards, and loans. Libro has a deep connection to the agricultural industry in Ontario and helps over 2,000 farms and agricultural businesses in the Southern region of the Province.

9. BCU Financial Credit Union

BCU, or Buduchnist Credit Union, was founded in 1952 by a group of Ukrainian immigrants who came to Canada after World War II. It is both the largest Ukrainian and largest ethnic credit union in Ontario, with 9 locations and a corporate head office.

This credit union offers all of the standard savings and investing options, including all registered and non-registered accounts for users. BCU also offers mortgages, credit cards, and personal and business loans.

10. Parama Credit Union

Parama Credit Union was established in 1952 by Lithuanian immigrants who moved to Canada following the Second World War. It operates two locations in Royal York and Roncesvalles, with over 6,000 members and over $500 million in assets under management.

Regarding its financial services, Parama Credit Union is primarily a personal banking and investment institution. It offers regular savings and investment accounts, loans, personal, and some commercial mortgages.

Parama has a full mobile app for its users and a newsletter to keep its customers informed.

Credit Unions vs Banks

This is a common comparison that is made when discussing credit unions. The primary difference is that credit unions are not-for-profit, while banks are obviously for-profit institutions that need to grow their earnings to satisfy shareholders.

Banks tend to have a more robust lineup of financial products and services, more branches, and better technology for apps and online banking. Conversely, credit unions typically have more personal customer support as their client base is smaller.

Credit unions are also much more community-based and regional. Canada is dominated by the big five banks with a national and sometimes global presence. Credit unions tend to be more involved in their own communities and give back to help support their local customers.

Are Credit Unions Safe in Ontario?

Absolutely! Despite being smaller businesses, credit unions are still regulated by the Financial Services Regulatory Authority of Ontario (FSRA). There is an argument to be made that using an Ontario credit union is even safer than using a bank.

In the Province of Ontario, the FSRA provides insurance coverage for member deposits in the oft chance that the institution fails. While banks are covered for up to $100,000 in member deposits, credit unions in Ontario are covered for up to $250,000 per member.

If you have a large amount of money with a financial institution in Ontario, you may be better off putting it into a credit union.

FAQs

Ultimately this will come down to personal preference. Some like the security that a big bank in Canada offers. Others will opt for higher interest rates on savings and lower account fees with a credit union.

Credit unions tend to have less optionality when it comes to financial products. They are also mostly regional, so if you move away, you won’t have access to a physical branch unless it is a national credit union brand.

The largest credit union in Ontario by far is Meridian Credit Union, with 89 branches and more than $30 billion in assets under management.

There are some smaller national credit unions, but most of them are regional and localized entirely within a single Province. UNI Financial Cooperation, out of New Brunswick is the largest federal credit union in Canada.

Related: Best credit unions in Alberta.

Is the TANDIA financial credit union save, to buy GIC ?

@Ewa: I am not familiar with this credit union, but it seems to be registered with the government: https://www.fsrao.ca/consumers/credit-unions-and-deposit-insurance/find-credit-union-or-caisses-populaires-ontario?combine=Tandia&field_credit_union_status_value=All

Can you still withdraw money from a general ATM machine ( ex: during travels) even of you bank at a Credit Union?

@Evelyn: The Mastercard or Visa enabled debit card should work anywhere the payment processor is accepted. ATM fees will generally apply.