Paymi is a Canadian cashback app that lets you earn back money whenever you shop online or in-store at participating retailers.

Similar to the Drop Rewards app, Paymi rewards you when you sign up for a new account, link your debit and credit cards and make purchases at participating retailers. There’s no need to upload your receipt, track your spending, or clip coupons.

This Paymi review covers what you need to know about the rewards app.

Paymi Summary

Paymi Cash Back

-

Ease of Use

-

Ways to Earn

-

Payment Threshold

-

Redemption Options

Overall

Summary

Paymi is a top cashback rewards program that lets you earn cashback whenever you use your linked bank or credit card when shopping online, in-store or with Paymi partner brands. The Paymi app tracks your transactions and credits your account automatically whenever you shop. The cashback you earn through Paymi is on top of the rewards your linked card is already earning. Paymi has partnered with several brands and retailers to give you more opportunities to earn cash back. Its partners include CIBC, Burger King, Starbucks, Swiss Chalet, Old Navy, Zara, Sephora, Netflix, and Spotify.

Pros

- Free to join

- Easy to use

- Double cashback rewards

- Signup and referral bonuses

- Instant crediting of cash back earnings

Cons

- Limited cashback options

- Few partner retailers and brands

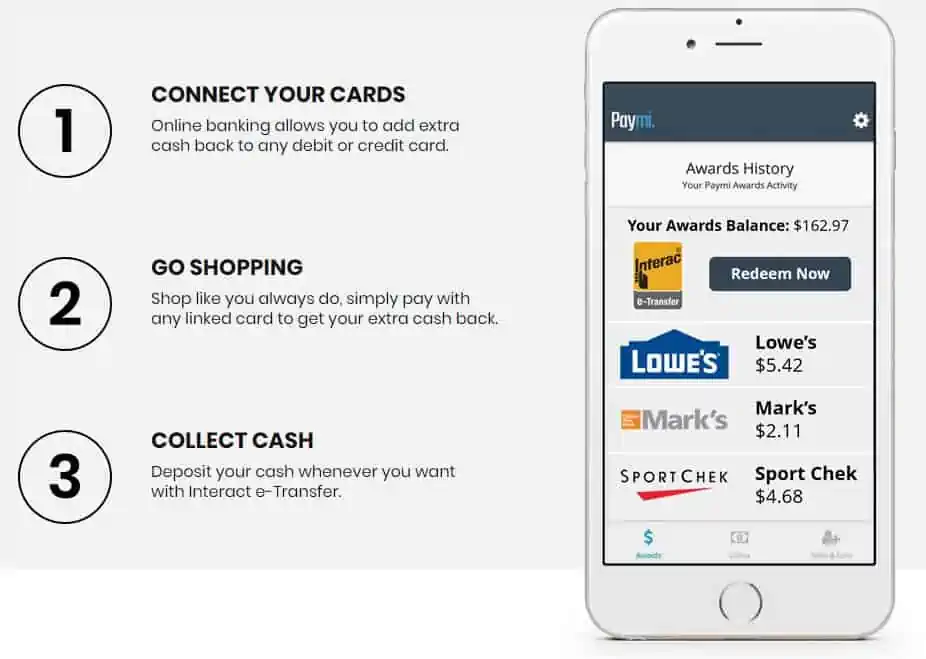

How the Paymi App Works

When you sign up, you will be asked to connect your bank cards. This process is seamless and involves signing in using your online banking details. All the main banks are supported.

The app tracks your transactions and will credit you automatically when you shop. The cash back you earn via Paymi is in addition to whatever cash back or points rewards your credit/debit card is already paying you.

Paymi Partner Brands and Retailers

Paymi has partnered with various brands and retailers so that you earn whenever you shop at these places.

CIBC: You get double the cash back when you make your purchase using a CIBC debit or credit card. CIBC’s business and U.S. dollar accounts or cards are not eligible for this offer.

Retailers: Paymi has partnered (currently or in the past) with retailers, including Burger King, Lululemon, Zara, Lowe’s, Swiss Chalet, Mark’s, Leon’s, SportChek, Aldo, Walmart, Starbucks, Sobey’s, Contiki, Lion World Travel, Insight Vacations, Milestones, Winners, Netflix, Spotify, Hudson’s Bay, Trafalgar, Ren’s Pets, Old Navy, Sephora, WineOnline.ca, Indochino, Inabuggy, etc.

How To Redeem Your Paymi Cash Back

Generally, cash back rewards appear in your account within 1-2 business days. You can withdraw funds and deposit them in your bank account using Interac e-Transfer.

For withdrawals of $25 or more, there is no fee. However, if you want to cash out before your account reaches a $25 balance, a $1.50 fee is applicable.

Is Paymi Safe?

Using CIBC as an example, when you log in to the Paymi app, they share your name, year of birth, postal code, gender, email address, and transaction history.

Your transaction history helps inform Paymi so they can send you relevant cashback offers and also award you cash back when you make an eligible purchase.

That said, Paymi does not get access to your bank account or login credentials and cannot withdraw money from your account. They also say they are committed to protecting your personal information.

I like that CIBC has a partnership with the company, which to me, means that they are a legit business. However, at the end of the day, you have to decide how comfortable you are with sharing information, how much information, and to whom.

Is Paymi Worth It?

Some of the benefits of Paymi include:

Free cash back: The app is free to join, and the 1% to 30% (Lowe’s had a 30% one recently) money back is free money on purchases you will make anyway.

Easy to use: You do not need to keep your receipts. The cash back is automatically tracked and credited.

Paymi referral code: When your friends sign up using your unique Paymi referral code or link, you receive a $5 bonus per referral.

Double up rewards: You can double up on cash back rewards by combining Paymi with another app (such as Drop and Caddle), while also earning whatever rewards are offered through your credit card loyalty program.

Downsides of Paymi

One downside of the app is that there are limited cash back options.

The participating retailers and offers change, and unless you shop the available offers, you will not earn cash back.

If you are spending cash (debit), the KOHO app pays you cash back on all purchases and is a better option.

Paymi vs. Rakuten

Rakuten (formerly eBates) automatically tracks your online purchases and credits your balance with cash back earned through offers and discounts.

It is a lot more popular than Paymi and has partnerships with more than 750 retailers in Canada and 3,000+ in the U.S.

To earn with Rakuten, sign up for a free account and visit the site before shopping at your favourite retailer’s online store.

New Rakuten users get a $30 bonus after completing their first online purchase of $30 or more via the site. Your earnings are paid out quarterly through PayPal, cheque, or Amazon gift cards.

Rakuten

$30 sign-up bonus when you spend at least $30

Earn up to 40% cashback

Features 3,000 stores and retailers

Redeem earnings by PayPal & check

Paymi vs. KOHO

Paymi and KOHO are similar in that you earn rewards automatically when you spend. And, for KOHO, cash back is up to 5%.

In addition to offering cash back, KOHO users can earn interest on their balance and get access to a free budgeting app.

Get a $20 bonus when you open a free KOHO account and make your first purchase.

KOHO Prepaid Mastercard

$20 welcome bonus after first purchase (use CASHBACK promo code during sign-up)

$0 monthly fee

Earn up to 5% unlimited cash back

Get 3% savings interest on your balance

Unlimited Interac e-Transfers and debit transactions

Free budgeting app and access to credit building

Overall, my review of the Paymi app is a positive one. If you shop regularly at the retailers featured on the app, your savings may be worthwhile.

Related Cash Back Apps in Canada

Paymi is awsome, I use it at Burger King, H&M, Zara, Staples. The cashback adds up pretty quick and then you can get an e transfer. Right now if you use this code you get double the sign up bonus (10$ instead of 5$)

Use it in the refer section:

Use this paymi code to get 10$ sign up in the refferal