Rakuten and Ibotta are free cash back rewards shopping apps.

Making a purchase online at your favourite store? You can start your shopping on either Ibotta or Rakuten and get up to 30% cash back in just a few clicks.

These two cash back rewards platforms are not the only ones you can use. Some others available in Canada or the U.S. include MyPoints, Honey, Fetch, Drop, and TopCashback.

This Ibotta Vs Rakuten comparison covers how they work, their pros and cons, and which works better.

Rakuten vs Ibotta: Summary

| Rakuten | Ibotta | |

| Best for | Online shopping | In-store shopping |

| Mobile apps | iOS and Android | iOS and Android |

| Payout threshold | $5.01 | $20 |

| Payout frequency | Quarterly | No limits |

| Payout methods | Cheque, PayPal, gift cards | Bank transfer, PayPal, gift cards |

| Participating stores | 3,500+ | 2,700+ |

| Learn more | Visit | – |

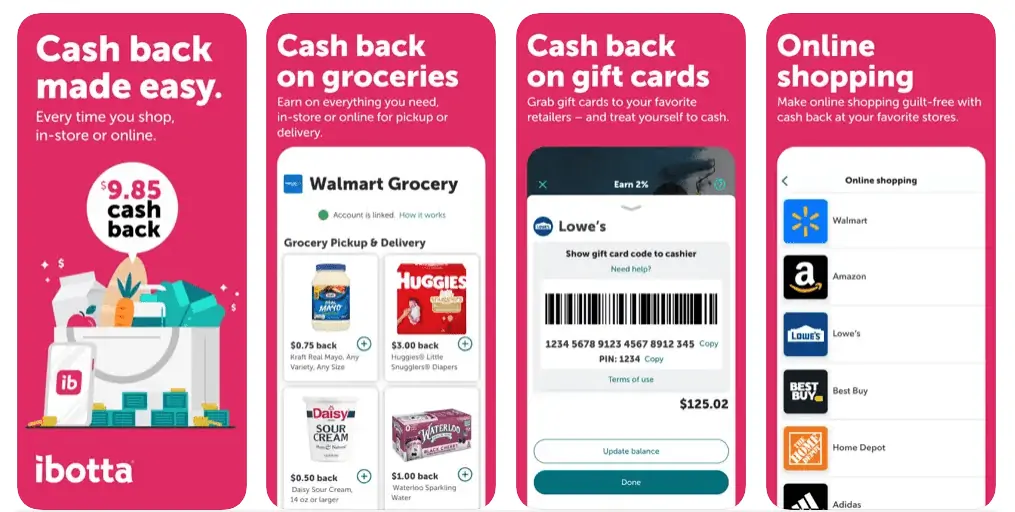

What is Ibotta?

Ibotta is a free cash back shopping app founded in 2012.

It has partnerships with more than 2,700 retailers and has millions of users in the United States.

Ibotta is available as an app on iOS and Android devices, and it also offers a browser extension for Google Chrome.

It has paid members over $1.2 billion in rewards over the years.

How Does Ibotta Work?

The Ibotta app works for both online shopping and in-store purchases.

After creating an account, you can visit any of the stores featured on the app and shop offers that cash your fancy.

If you are on a computer and have the Ibotta browser extension installed, it will pop up whenever you are on a partner website with cash back offers.

Cash back earned is automatically added to your balance.

For in-store shopping, you can link loyalty accounts from eligible retailers to Ibotta and earn cash back when you shop.

Like other receipt scanning grocery apps, Ibotta supports receipt submissions from many retailers, and cash back is credited within 24 hours.

Users can also enable “Nearby Offer Alerts” to be notified when Ibotta retailers nearby are running significant cash back offers.

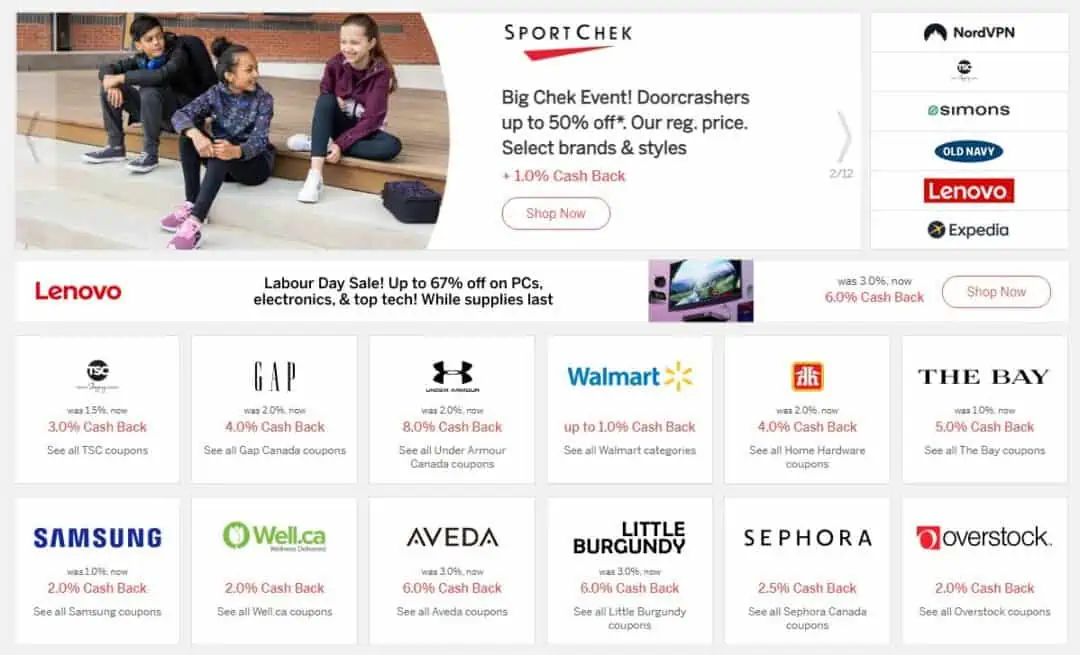

What is Rakuten?

Rakuten is the most popular cash back shopping portal in Canada and the U.S. It was founded in 1999 and was formerly known as Ebates.

The Rakuten platform has over 17 million members and has paid $3.7 billion in rewards over the years.

It has partnerships with 3,500+ stores and is available on all devices. Like Ibotta, Rakuten also has a browser extension for Google Chrome.

Rakuten

$30 sign-up bonus when you spend at least $30

Earn up to 40% cashback

Features 3,000 stores and retailers

Redeem earnings by PayPal & check

How Does Rakuten Work?

Rakuten is straightforward to use. To get started, create an account.

Start your shopping on the website, app, or via the extension, and cash back earned is paid directly to your balance.

Rakuten also has in-store cash back offers at several stores (mainly in the U.S.).

The offers and discounts on this platform can be as high as 30%.

Ibotta vs Rakuten: Participating Retailers

Ibotta is affiliated with about 2,700 stores and retailers, including the likes of Best Buy, Home Depot, Walmart, Old Navy, Kohl’s eBay, and Hotels.com.

Rakuten is affiliated with over 3,500 stores in the U.S. and 750 stores in Canada.

Popular Rakuten retailers include Walmart, The Bay, Sephora, Well.ca, Gap, Indigo, The Keg, Sportchek, Joe Fresh, Expedia, and more.

Verdict: Rakuten offers more options, and it is available in Canada.

Ibotta vs Rakuten: Available Countries

Ibotta is only available to residents of the U.S.

Rakuten is available in Canada, the United States, Japan, and France.

Verdict: Rakuten is the better choice if you live in Canada.

Ibotta vs Rakuten: Cash Back Rewards

From my observations, cash back offers on both Ibotta and Rakuten can be as high as 30%.

Both platforms also offer cash back for in-store purchases; however, Ibotta does better in this regard.

Verdict: Ibotta supports receipt scanning or uploads from in-store purchases, while Rakuten does not.

Ibotta vs Rakuten: Redemption Options

You can withdraw earnings from your Ibotta account by linking a bank account or using PayPal or gift cards.

The minimum payout threshold is $20.

For Rakuten, payments occur four times a year in February, May, August, and November.

You can cash out using PayPal, Amazon e-gift cards, or request a physical cheque. The minimum payout threshold is $5.01.

Verdict: Ibotta = Rakuten.

While Rakuten has a lower minimum payout threshold, you only get paid four times per year.

Ibotta vs Rakuten: Referral Programs

Ibotta’s referral program pays you $10 for every friend who signs up using your Ibotta referral code.

For this bonus to apply, they must place at least one order and earn cash back within 7 days of registration. They also receive a bonus.

Rakuten’s referral program pays you up to $40 for every friend who joins using your referral link.

This bonus applies after they make a purchase of at least $30 within 90 days of joining. They also receive a bonus.

Verdict: Rakuten’s referral program pays a higher bonus than Ibotta’s.

Ibotta vs Rakuten: App Ratings

Both Ibotta and Rakuten have well-rated mobile apps.

- Ibotta: Google Play (4.5/5) and App Store (4.8/5).

- Rakuten: Google Play (4.1/5) and App Store (3.9/5).

Verdict: Rakuten = Ibotta

Ibotta vs Rakuten: Security

Ibotta has a robust security framework in place to protect your account, including NIST 800-53, SSAE 18 Service, and SOC2. As per its privacy policy, it does “not sell or share your data that identifies you personally…”

Rakuten uses industry-standard encryption to protect your information.

Are they legit?

Yes, Ibotta and Rakuten are legit companies.

Ibotta has a B-rating on the Better Business Bureau, the same as Rakuten.

On Trustpilot, Ibotta has a 4.2/5 rating from over 1,000 reviews, and Rakuten has a 4.2/5 rating as well from over 20,000 reviews.

Pros and Cons of Ibotta

Pros:

- Is affiliated with thousands of popular stores

- Multiple ways to cash out earnings

- $10 sign up bonus

- Available for online and in-store shopping

- Has a browser extension that makes it easy to earn

Cons:

- $20 minimum payout threshold

- Only available in the U.S.

Pros and Cons of Rakuten

Pros:

- Has tons of cash back opportunities

- Available in Canada, the U.S., and other countries

- Low payout threshold of $5.01

- Features thousands of stores

- Browser extension comes in handy for finding deals

Cons:

- Limited in-store shopping cash back offers

- Payouts are limited to four times per year

Which is Better: Ibotta or Rakuten?

As a Canadian, Rakuten is my obvious choice, given that it operates in the country.

Also, it has more retailers and partner brands, so finding your favourite stores and earning cash back is so much easier.

I usually get an alert when shopping at a store that has Rakuten cash back because I have the browser extension installed.

U.S. residents can use Ibotta for its in-store shopping promotions and compare offers between both platforms to see which is better.

Related: