The KOHO prepaid Mastercard has been one of my go-to cards for budgeting, earning cash back, saving money, and paying with debit over the last few years.

If you are new to KOHO, my detailed KOHO review covers all that you can expect to receive when you sign up for a regular free account.

A KOHO Extra card account (previously KOHO Premium) increases your cash back rewards, eliminates foreign currency transaction fees and offers several other VIP perks you don’t want to miss out on.

This KOHO Premium review covers what the prepaid Mastercard has to offer.

What is KOHO Extra?

The basic concept behind KOHO is to help Canadians save on the ridiculous bank fees they pay every month.

When you sign up for KOHO, you get a free reloadable Mastercard and app that works like a debit card and offers rewards. You can subscribe to a paid plan (Easy, Essential or Extra) for even more perks.

The Easy account (regular KOHO) comes with zero fees, and you get:

- 1% cash back on groceries and transportation

- An automatic savings plan

- Savings interest on your entire balance

- Access to Credit Building for $10/month

Optionally, you can upgrade to the middle-tier KOHO account called Essential, for $4 per month or $48 annually. The Essential account comes with the following features:

- 1% cash back on groceries, transportation, and dining out

- 0.25% instant cash back on all other purchases

- Earn interest on your entire balance

- Access the Credit Building feature for $7/month

Both the Easy and Essential KOHO accounts include features like:

- Free joint accounts

- Apple, Google, and Samsung Pay

- 1.5% foreign transaction fee (as opposed to the 2.5% to 3% charged by your bank)

- Free e-Transfers and bill payments

- Multiple in-app offers and discounts, e.g. free credit score checks, an extra 3% cash back on Pizza Pizza or 1% on Indigo, savings on investment fees, and more

- Access to Credit Building and Instant Pay for an extra fee (get up to 50% of your daily paycheque early)

If you want to up the ante and get even more rewards and flexibility, a KOHO Extra Card account is what you are looking for.

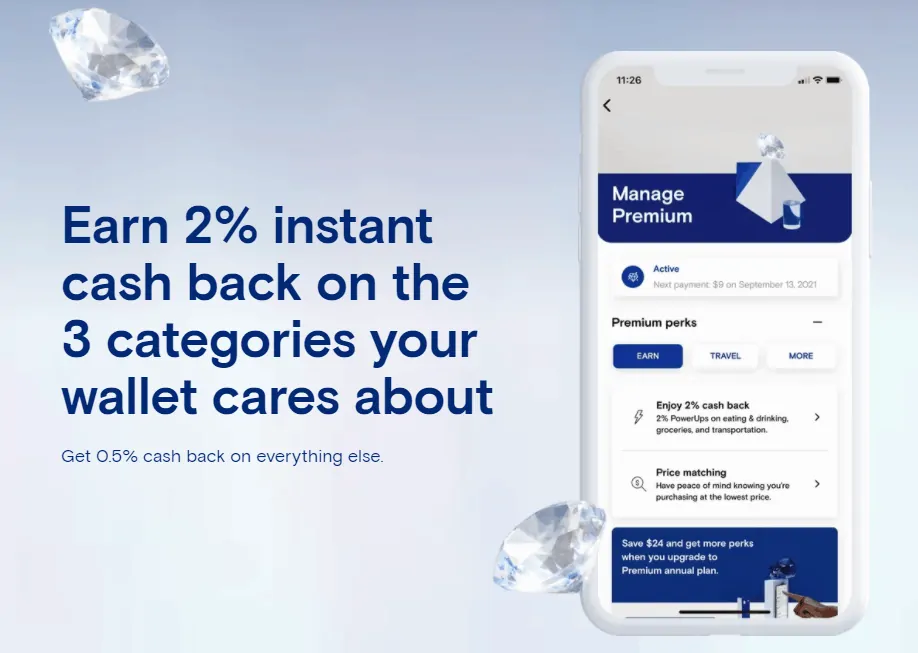

KOHO Premium (now KOHO Extra) offers the following benefits in addition to what you get with a regular KOHO account:

2% cash back: On groceries, eating and drinking, and transportation. Grocery spending includes all grocery retailers (large and small); eating and drinking include dining at restaurants, bars, coffee shops, fast-food, and food delivery services; and transportation expenses include gas, Uber, Lyft, parking, car rentals, public transport, and more.

On any other purchases not in those categories, you’ll earn 0.5% unlimited cash back. When shopping at partner stores, the cash back rate is as high as 5%.

No foreign exchange transaction fee: Generally, banks charge a 2.5% to 3% fee when you use your cards to make a purchase denominated in foreign currency. This fee is 100% waived with a KOHO Extra account, resulting in at least 2.5% savings upfront. The Free and Essential KOHO accounts charge 1.5%, which is still a significant 1% savings over your bank.

Free financial coaching: Save on financial advice when you chat with KOHO’s in-house certified financial coach. You can ask about your taxes, investments, debts, and other pressing questions you have.

Higher “velocity” limits: As a regular KOHO user, you can withdraw up to $305 at an ATM per transaction. With KOHO Extra, the limit is raised to $810 per day, and you can keep a balance of up to $50,000.

What Does KOHO Extra Cost?

How much does it cost to take advantage of these VIP perks?

KOHO Extra is free for the first 30 days and then costs $9 per month. You can save by paying for the full year upfront at $84 per year to save $24.

Is KOHO Extra Worth It?

A regular KOHO account can save you money on your daily spending, bank transactions, and foreign currency purchases.

You can take your savings a step further by opening a KOHO Extra account. That being said, whether the monthly fee makes sense for you depends on how you use your KOHO Mastercard prepaid card.

The 2% cash back covers a wide range of everyday expenses – groceries, transportation, eating, and drinking. If you spend more than $450 on these purchases every month, the $9 monthly fee or $7 (if you pay annually) is justified based on the cash back rewards alone.

If you do a lot of travelling overseas, the 2.5% saving on foreign currency transactions may more than cover your monthly fees. If your only aim is not to pay FX fees abroad, the STACK Mastercard or a credit card with no foreign currency transaction fees may be adequate.

KOHO Extra Cash Back Example

Assuming you use your KOHO card to make purchases worth $1,000 every month and $800 can be attributed to groceries, dining, and transportation.

Assuming you use your KOHO card to make purchases worth $1,000 every month and $800 can be attributed to groceries, dining, and transportation.

KOHO Easy account:

- $800 x 1% cash back = $8 savings

- $200 x 0% cash back = $0 savings

- Total savings/month: $8

Essential KOHO account:

- $800 x 1% cash back = $8 savings

- $200 x 0.25% cash back = $0.50 savings

- Total savings/month: $8.50

KOHO Extra account:

- $800 x 2% cash back: $16 savings

- $200 x 0.5% cash back: $1 savings

- Total savings/month: $17

This scenario does not consider the higher cash back rates available at KOHO partners, which can be as high as 5%.

As a KOHO Extra user, you earn up to an additional $8.50 in cash back every month after deducting fees and the savings that you would normally earn with a regular account.

Add in the price matching, free financial advice, premium new card, and in-app offers, and KOHO Extra is worth looking at.

Alternative Prepaid Credit Card

One of the top prepaid credit cards in Canada is the Neo Money card. It offers an average of 5% cash back on purchases at over 12,000 locations in Canada.

Neo Money card

Rewards: Earn an average of 5% cash back at over 12,000 retail partners and a guaranteed minimum of 0.50% (up to $50 monthly); Earn 2.25% interest on your account balance.

Welcome offer: Deposit at least $50 and complete your first purchase to receive a $20 welcome bonus, and you can earn up to 15% cash back on your first-time purchases.

Interest rate fee: 0%

Annual fee: $0 (no monthly fees)

You can also opt for the free EQ Bank Card, which waives FX fees.

EQ Bank Card

Earn up to 4%* interest on your balance

0.50% cash back on purchases

No monthly account or FX fees

Free ATM withdrawals

Hi there,

Similarly to STACKED MasterCard, does KOHO Premium provide No FX Fees when withdrawing cash at ATM when travelling abroad and within Canada.

Thanks, and lemme know.

@Jack: Yes, KOHO Premium waives the 2.5% foreign transaction fee when you spend CAD abroad.

What are the eligible retailers for the price matching feature?

@Abiola: There are tonnes of retailers on their list…probably close to 100. Some of the top retailers include Best Buy, Canadian Tire, Costco (online), Home Depot, London Drugs, Lowe’s, Staples, Walmart, etc.