No age is too young to start learning about money. Personal finance and understanding the value of money are valuable things that aren’t often taught in school.

When kids have conversations and learn about money early on, they are better prepared for later in life when they open a bank account, get a credit card, and get a job.

Until now, there hasn’t been an intuitive budgeting or money-saving app for kids and adults. Enter Mydoh – a smart money-saving app with a prepaid, reloadable Visa Debit card that teaches kids about money at a young age and helps them become financially literate.

This Mydoh review will cover the app, how it works, some top features, pros and cons, and more.

Mydoh Explained

Mydoh is a smart money-saving app for parents and kids. Its goal is to make it easy for kids to become savvy with their money and spending and empower them to experience financial independence.

It is owned by RBC and was launched in 2021. The app is available on iOS and Android devices across Canada (excluding Quebec).

Upon signup, kids and their parents can download the Mydoh app (the link includes a $10 bonus), and kids will receive a Visa Debit card controlled by the parent through the app.

Parents can deposit money and assign weekly tasks for their children to complete. Once they do those tasks, kids can access the money on “payday,” which is every Saturday. Parents can also set controls and limits on spending through the app.

Children can use the Mydoh Smart Cash Card for in-store and online purchases. Since it is a prepaid card, there is no risk of overspending.

How Mydoh Works

Mydoh is used through a linked parent and youth account. Here’s an overview of how both work:

Parent Account

From the Parent account, you can view and manage your children’s activities and do things such as:

- Set up weekly tasks and give your kids an allowance

- Instantly send your kids money

- Lock and unlock kids’ cards

- Track all earnings and spending

- View and react to transactions with emojis

Youth Account

Kids can learn the basics about money and saving through Play on their app. They can earn their own money through Tasks, which the parent sets up on their account.

Once they complete the tasks, kids can access and spend their money on payday, which is every Saturday. They get a Smart Cash Card, which is a Visa Debit card that can be used in-store and online.

Kids can also do the following with their account:

- Manage tasks and mark them as complete

- Use their Smart Cash Card and spend up to the limit

- Track their earnings, spending, and view their balance

- Learn about money basics, spending, and saving habits through the Play feature

The Youth account and card are controlled entirely through the Parent account.

How Tasks Work on Mydoh

Parents can create tasks for their kids to complete and check off on the app.

To create a task, you can either select an already-created task from the menu or create your own. They can be recurring tasks or one-offs. For each task, you set the due date and how much your child will earn for completing that task.

On the parent account, you can see how your kids are doing with the tasks – if they are on track, overdue, or completed.

Earnings for each completed task will add up and be sent to the child’s account on Payday. This automatically happens, and money will be moved from the parent’s account to the kid’s account.

The idea behind completing tasks for money is for kids to learn about the value of earning money and what goes into it.

How a Weekly Allowance Works

Instead of giving your kids a cash allowance, Mydoh allows parents to set up a weekly allowance that is automatically sent to their Smart Cash Card every Saturday.

Parents can set up an allowance of $10, $20, $30, $40, $50, or a customizable amount.

Depending on the kid’s age, the weekly allowance can be very different. With Mydoh, you can edit the allowance anytime.

The Mydoh Smart Cash Card

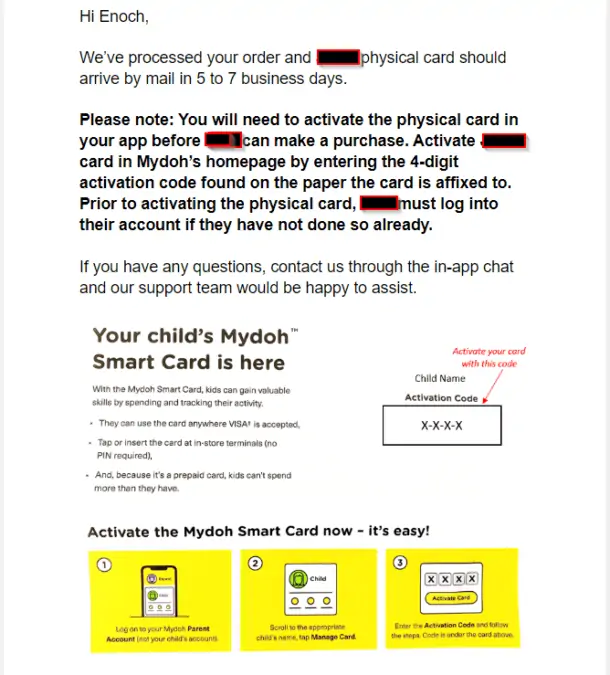

After signing up for a Mydoh account, kids will be sent a Smart Cash Card, which is a reloadable, prepaid Visa Debit card that is linked to their account.

They can either use the physical card or add it to their Apple Wallet and use it online or in stores, wherever Visa or Apple Pay is accepted.

The Mydoh Smart Cash Card is a valuable tool for kids to start developing good money habits and track their spending and earnings. As it’s a prepaid card, they can’t spend more than they have.

In addition to the physical Smart Cash Card, kids can also design and own an optional custom Smart Cash Card called “Mydoh by Me.” This customizable prepaid VISA card allows your child to express their unique personality.

The card costs $6.99, and it can be designed by uploading your child’s photo of choice or a photo from Mydoh’s gallery (plus cool stickers!). Once the design is approved, it’ll be shipped to you in 5 to 7 working days.

Mydoh Play Overview

Mydoh Play is a feature on the kid’s account that teaches them about all things finance, including loans, cost of living, and how money is made through fun facts and trivia.

Currently, nine money topics are covered, with more to come in the future:

- Budgeting

- Savings and investing

- Debt

- Taxes

- Prices

- Cost of living

- Standard of living

- The evolution of money

- The psychology of money

This feature is a great way for kids to get an early start on learning about money and becoming financially literate.

Parents can see which money lessons their kids are on and track their progress through the parent app.

How Much It Costs to Use Mydoh

When you sign up for Mydoh, you get a 30-day free trial. After that, you pay a small monthly subscription fee.

Mydoh costs $2.99/month for all users, including existing RBC clients.

You can cancel your subscription anytime.

Is Mydoh Legit?

Yes, Mydoh is a legitimate company. They are owned and operated by the Royal Bank of Canada, which keeps your funds and information safe.

Mydoh is currently ranked #13 in finance in the iOS App Store and has an average rating of 4.2 with over 1,500 ratings.

Pros and Cons of Mydoh

Below are a few pros and cons of using Mydoh:

Pros

- Teaches kids about earning, spending, and saving money at a young age

- Kids can do tasks for parents to earn money

- Kids learn about finances through fun facts and trivia with Play

- The Mydoh physical card and digital cards are free to use

Cons

- Children need access to a mobile phone or iPad to use their account

- There are a few limits to the card, including a $999.999 maximum balance, 10 purchases per day, and 30 purchases per month

Alternative Apps Like Mydoh

If you’re looking for an alternative budgeting app, these two are some of the best. However, remember that they won’t be as intuitive for kids and do not offer linked parent and youth apps.

Mydoh vs YNAB

You Need A Budget (YNAB) is a budgeting app with a four-rule method that helps you organize your finances and save money.

YNAB links to your bank account and automatically imports and categorizes your transactions.

They aim to teach you to be intentional with every dollar you have by using an envelope budgeting system.

Their four rules are:

- Every dollar has a job

- Embrace your true expenses

- Roll with the punches

- Age your money.

YNAB costs USD $14.99/month or USD $98.99/year. Read our full review.

Mydoh vs Mint

Mint is a budgeting app similar to YNAB, which syncs with your bank accounts and automatically imports and categorizes all transactions. The app is no longer available as of 2024.

It is completely free to use, and you can set budgets and view your spending habits with colourful graphs and charts.

Mint also helps you keep track of bills and recurring payments. You can opt-in to receive spending notifications on a daily, weekly, or monthly basis.

Conclusion

Mydoh is an innovative mobile app and reloadable Visa Debit card that teaches kids about earning, spending, saving, and the value of money at a young age. This can get money conversations started early, which is great, as no age is too young to learn about finances.

Kids have the independence to make their own financial decisions but cannot overspend as it is a prepaid card.

With two synced accounts, parents can view their kids’ transactions, balances, and tasks completed. They can even lock or unlock the card anytime from the app.

FAQs

Kids should be between the ages of 6 and 18 years old to use Mydoh. You can add up to 5 kids to one account.

Mydoh offers a 30-day free trial. After that, Mydoh costs $2.99 per month.

Yes, Mydoh is secure and legit. It is powered by RBC, which keeps your funds safe. They ensure all information is encrypted and a full audit trail is done whenever money moves to and from the Mydoh wallet.

No, you do not need an RBC account to use the app.

Kids can use their Mydoh card online by entering their card details. They can find the details in the app by going to the Wallet tab, clicking on the card and re-entering their password.

Yes. Mydoh allows you to add a second parent to the account. They have all the features available to the primary parent but cannot invite kids, cancel a child’s account, or order a physical card.

Related: