First West Credit Union is one of the largest credit unions in Canada and the third-largest in British Columbia after Vancity and Coast Capital Savings.

This review of First West covers the various financial products and banking services offered through their divisions and the benefits available to members.

Who is First West Credit Union?

First West Credit Union was founded in 2010 after a merger between Envision Credit Union and Valley First Credit Union. The two credit unions that form today’s First West can trace their roots as far back as 1946 and 1947, respectively.

First West Credit Union is based in B.C., with almost 250,000 members and over $15 billion in assets under management.

It has multiple subsidiaries, including First West Capital, First West leasing Ltd., First Wealth Management Ltd., and First West Insurance.

The credit union delivers its core banking services through four main brands:

- Island Savings: services Vancouver Island and Southern Gulf Islands

- Valley First: caters to the Okanagan, Similkameen, and Thompson Valleys

- Enderby & District: services the North Okanagan communities

- Envision Financial: provides services in the Lower Mainland and Kitimat regions

Related: Best New Bank Account Promotions.

First West Credit Union Accounts: Personal Banking

For personal accounts, First West’s divisions generally offer chequing, savings, mortgages, personal loans, insurance, investments, and financial planning accounts and services.

Some services vary or are not available in some divisions.

- Chequing Accounts: Free chequing, low-fee chequing, US Dollar chequing, Seniors chequing, and junior chequing.

- Savings Accounts: High-interest savings, investment savings, US Dollar savings.

- Borrowing: Mortgages, car loans, personal loans, RRSP loans, lines of credit, and credit cards.

- Insurance: Home, condo, tenant, auto, boat, title, earthquake, travel, and other insurance.

- Investments: Mutual funds, GICs, stocks, responsible investing, bonds, and more in RRSP, TFSA, RESP, RDSP, and RRIF accounts.

Related: Low-Cost Investing in Canada.

First West Credit Union: Business Banking

- Chequing Accounts: Low-fee chequing, unlimited chequing, US Dollar, and non-profit organization chequing accounts.

- Savings Accounts: High-interest business savings and Agri-Invest.

- Business loans and mortgages

- Business insurance

- Investments: Mutual funds, stocks, bonds, term deposits, Group RRSP, and online investing via Qtrade Investor.

How To Open a First West Credit Union Account

Members can bank with the various divisions of First West Credit Union in person at a branch, online through their website or mobile app, and by telephone.

Envision Financial (website).

- App: Envision Financial mobile app on iOS, Android, and Blackberry.

- Phone: 1-888-597-6083; Mon-Fri (8 am to 8 pm) and Saturday )8:30 am to 4 pm).

- Mail: Envision Administration Office, 6470 201 Street, Langley, B.C. V2Y 2X4.

Valley First and Enderby (website)

- App: The Valley First mobile app is available on iOS, Android, and Blackberry.

- Phone: 1-888-597-8083; Mon-Fri (8 am to 8 pm) and Saturday (8:30 am to 4 pm).

- Mail: Valley First Administration Office, 3rd Floor, 184 Main Street, Penticton, B.C. V2A 8G7.

Island Savings (website)

- App: The Island Savings mobile banking app is available on iOS and Android.

- Phone: 1-888-597-1083; Mon-Fri (8 am to 8 pm) and Saturday (8:30 am to 4 pm).

- Mail: Island Savings Administration, 499 Canada Avenue, Duncan, B.C. V9L 1T7.

Members of First West Credit Union have access to over 4,500 free (ding-free) ATMs across Canada through The EXCHANGE and ACCULINK Networks.

Eligibility for membership includes:

- 19+ years of age

- Residency in British Columbia

- Purchase membership equity share of $5

When you refer a new member, you both receive a $50 bonus.

First West Credit Union Fees

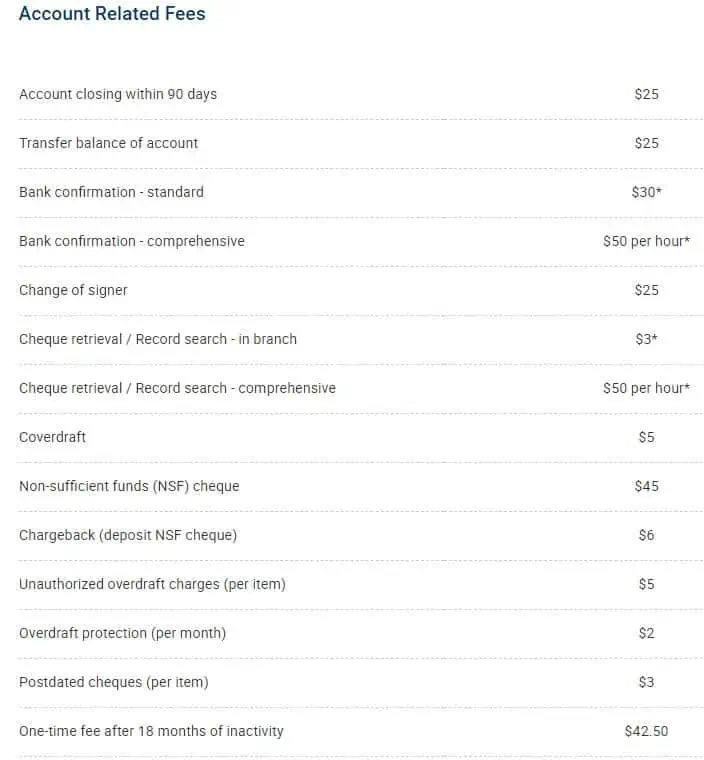

In addition to the basic account fees (where applicable), other member service fees may apply and vary across divisions.

For example, for Envision Financial, here is a partial snapshot of their fees:

For a full list of updated service fees, check the credit union’s websites.

Is First West Credit Union Safe?

When you bank with Envision Financial, First Valley, Island Savings, and Enderby and District credit unions, your deposits are protected 100% through the Credit Union Deposit Corporation (CUDIC) of British Columbia.

This includes funds in personal and business accounts in chequing, savings, term deposits, GICs, and foreign currency deposits.

CUDIC does not insure your credit union equity shares or investments such as mutual funds.

Conclusion

First West Credit Union is another member-owned financial cooperative that provides Canadians access to convenient banking, member benefits, and community development.

This First West review is part of a Canadian Credit Union series.

Related: